Butadiene Market Size

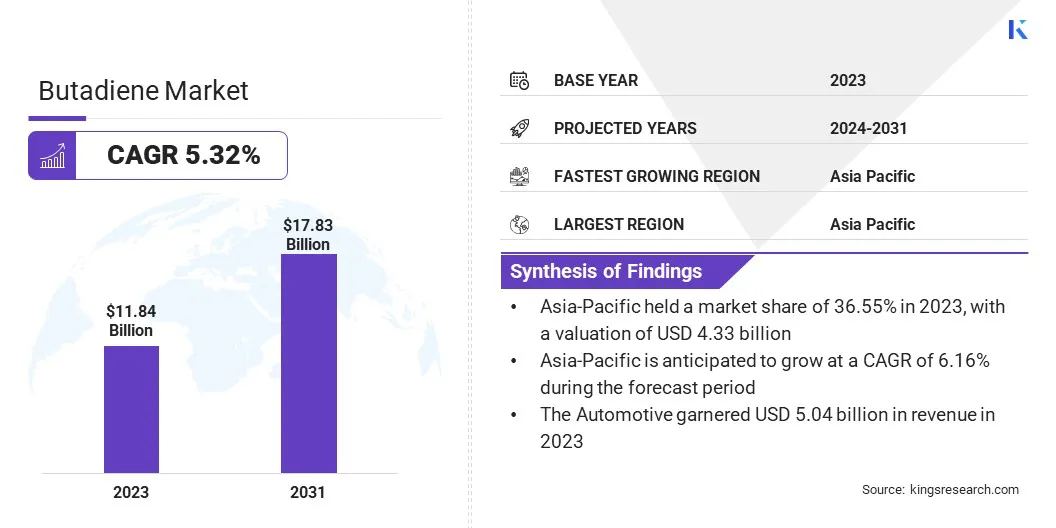

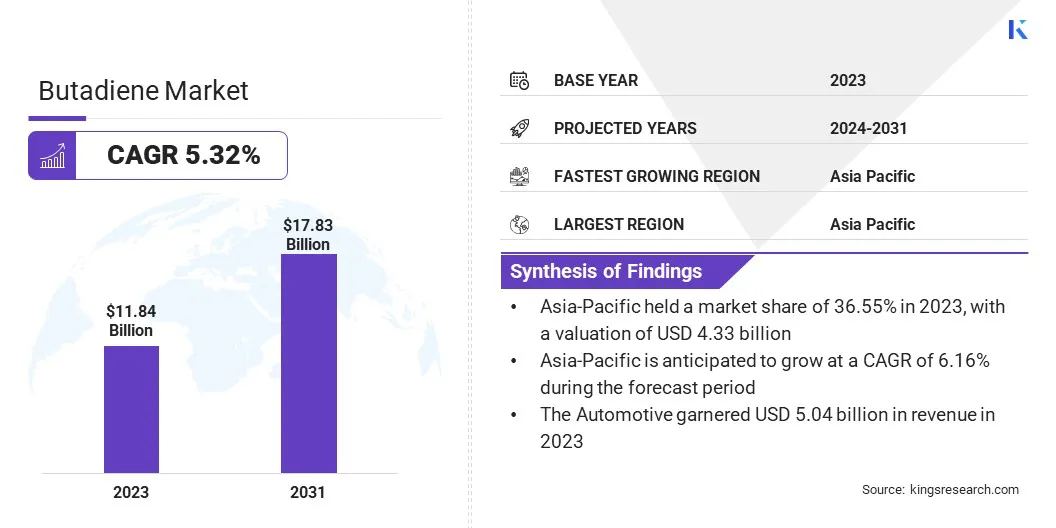

The Global Butadiene Market size was valued at USD 11.84 billion in 2023 and is projected to grow from USD 12.40 billion in 2024 to USD 17.83 billion by 2031, growing at a CAGR of 5.32% during the forecast period.

The expansion of the automotive industry in emerging economies is driving the demand for synthetic rubber and plastics used in tires, automotive parts, and components, thus boosting the usage of butadiene.

In the scope of work, the report includes products offered by companies such as LyondellBasell Industries Holdings B.V., TPC Group, Exxon Mobil Corporation, Shell International B.V., Evonik Industries AG, LOTTE Chemical CORPORATION, Repsol, CNPC, Zeon Chemicals L.P, Reliance Industries Limited, and others.

Butadiene is used to produce synthetic rubbers, plastics, and chemicals. It is a critical raw material in the automotive, chemicals, and consumer goods industries, where it enhances the flexibility, durability, and impact resistance properties of materials. Its versatility allows it to be used in various applications, including tire manufacturing, plastic production, and industrial goods.

The butadiene market is characterized by significant interdependencies with petrochemical and refining industries, with a global reach across developed and emerging economies.

- As per the US. Energy Information Administration (EIA), the global oil production for 2023 was 101.81 million barrels per day. This high level of oil production ensures a steady supply of by-products, thereby supporting themarket. Butadiene is primarily produced during the refining process of crude oil and natural gas, hence, the increased global oil output leads to greater availability of butadiene.

The market involves the production, distribution, and consumption of butadiene, a highly reactive hydrocarbon used in the manufacturing of synthetic rubber, plastics, and various chemicals.

Butadiene is primarily produced through steam cracking, where hydrocarbons like naphtha (a type of crude oil) are heated to high temperatures, or through dehydrogenation, where butanes (a type of natural gas liquid) are heated to remove hydrogen.

It is a by-product of the refining process of crude oil and natural gas and is used in the production of key materials for the automotive, chemicals, and consumer goods industries.

It is essential in creating products such as tires, plastic components, and industrial rubber goods. The market is segmented into by type and by end-use industry, with each segment catering to specific applications across various sectors.

Analyst’s Review

The butadiene market is competitive, with manufacturers focusing on optimizing production processes to ensure a steady supply. Companies are increasingly investing in advanced extraction techniques and improving operational efficiencies to meet demand from key industries like automotive and chemicals.

Strategic collaborations and technological innovations are central to improving product quality and reducing costs. Manufacturers are also exploring sustainable practices and expanding into emerging markets to diversify their portfolios. Overall, the market is dynamic, with companies adapting to evolving industrial needs.

- In October 2024, Bridgestone Americas announced that it had received a grant from the U.S. Department of Energy's Industrial Efficiency and Decarbonization Office. The company plans to design, build, and operate a pilot plant aimed at developing a more sustainable and cost-effective method for obtaining butadiene from ethanol. The project will assess the economic feasibility, commercial potential, and carbon footprint of converting ethanol into butadiene. The butadiene produced will be used for further research into its potential application as a feedstock for raw materials in Bridgestone tires.

Butadiene Market Growth Factors

The key growth factors driving the market are the expansion of the automotive industry and the rising demand for synthetic rubber. The growth of the automotive industry leads to the increased demand for synthetic rubber in tires and automotive parts, which, in turn, boosts the consumption of butadiene.

Simultaneously, the rising need for durable, high-performance materials across the construction and footwear industries further accelerates the demand for butadiene-based synthetic rubbers. As these industries grow, the butadiene market benefits from the increasing requirement for synthetic rubber and related materials, driving significant consumption and market expansion.

The fluctuating price of butadiene poses a significant challenge for manufacturers, as it is closely tied to the volatile prices of crude oil and natural gas. These price variations make it difficult for companies to predict production costs, plan budgets, and maintain consistent pricing for their products.

To address this challenge, companies can adopt hedging strategies to lock in prices and mitigate risk. Additionally, investing in diversified feedstocks and alternative production methods, such as bio-based butadiene or renewable sources, can help reduce dependence on oil & gas, stabilizing production costs and improving financial predictability.

Butadiene Industry Trends

A significant trend in the butadiene market is the shift toward sustainable production, driven by growing environmental concerns and stricter carbon emission regulations. Companies are increasingly focusing on producing bio-based butadiene and utilizing renewable feedstocks to reduce their environmental footprint.

This trend is not only helping meet regulatory demands but also positioning the market for future sustainability. By adopting greener production methods, companies can ensure long-term viability while aligning with global efforts to combat climate change and reduce reliance on fossil fuels.

- In January 2024, Michelin, IFPEN, and Axens inaugurated the first industrial-scale demonstrator plant for producing bio-based butadiene at Michelin’s site in Bassens, near Bordeaux, France. The demonstrator was built as part of the BioButterfly project, a collaboration between the three partners and supported by ADEME (French Agency for Environment and Energy Management). This project aims to develop and commercialize butadiene derived from ethanol produced from biomass, offering a sustainable alternative to traditional petrochemical-based butadiene.

Another prominent trend in the butadiene market is the integration of advanced technologies to enhance production efficiency and sustainability. Companies are adopting carbon capture techniques and energy-efficient processes to reduce emissions and minimize the environmental impact of butadiene production.

These technologies not only help meet stricter environmental regulations but also optimize operational costs. By embracing innovations in extraction and refining, manufacturers are able to produce butadiene more efficiently while contributing to global efforts to reduce carbon footprints and promote sustainability in the market.

- In June 2024, Shell announced the Final Investment Decision (FID) for the Polaris carbon capture project at its Scotford refinery in Alberta, Canada. This project, designed to capture significant CO2 emissions, reflects the growing adoption of carbon capture technologies in the chemical and refining sectors, including the butadiene industry, to enhance sustainability and meet environmental regulations.

Segmentation Analysis

The global market is segmented based on type, end-use industry, and geography.

By Type

Based on application, the market has been segmented into Styrene-butadiene rubber (SBR), Polybutadiene rubber (PBR), acrylonitrile butadiene rubber, styrene butadiene latex, and others. The SBR segment led the butadiene market in 2023, reaching the valuation of USD 4.18 billion. The expansion of SBR is supported by several key factors.

SBR's versatility, durability, and cost-effectiveness make it ideal for applications across the automotive, footwear, and construction industries. The growing demand for tires, especially in emerging markets, boosts the need for SBR due to its excellent performance in tire manufacturing.

Additionally, advancements in synthetic rubber production technologies and the increasing focus on sustainability are enhancing SBR production efficiency while meeting environmental regulations. As the automotive sector grows and urbanization continues globally, the demand for SBR in high-performance applications remains strong, further driving market expansion.

By End-use industry

Based on end-use industry, the market has been classified into automotive, construction, consumer goods, and others. The automotive segment is poised for significant growth at a CAGR of 6.03% through the forecast period. The growing demand for synthetic rubber used in tires, seals, and gaskets is driving the automotive segment, as it relies heavily on butadiene for production.

As the automotive industry continues to grow, particularly in emerging markets, the need for high-performance and durable components increases, further fueling the demand for butadiene. Additionally, the rising focus on fuel efficiency, safety standards, and eco-friendly materials in automotive manufacturing encourages the use of butadiene-based synthetic rubbers, boosting the segment.

- According to the European Automobile Manufacturers Association (ACEA), the global car production reached 76 million units in 2023. This significant increase in automotive manufacturing directly impacts themarket, as butadiene is a key raw material for producing synthetic rubber, which is essential formanufacturing tires and various automotive components.

Butadiene Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.55% share of the butadiene market in 2023, with a valuation of USD 4.33 billion. This dominance can be attributed to its rapid industrialization and the strong growth of key sectors such as automotive, construction, and chemicals.

Countries like China, India, and Japan are major consumers of butadiene, due to the rising demand for synthetic rubber in tires and automotive components in the region. The region's expanding manufacturing capabilities and demand for consumer goods further increase the need for butadiene-based products.

Additionally, the automotive industry's growth in emerging economies, coupled with the establishment of advanced manufacturing technologies and infrastructure, strengthens Asia Pacific's position as the dominant market for butadiene globally.

The butadiene market in Europe is poised for significant growth over the forecast period at a CAGR of 5.88%. The strong automotive industry in the region, particularly in countries like Germany and France, drives the demand for butadiene in synthetic rubber production for tires and automotive parts.

Additionally, Europe is focusing on sustainable manufacturing processes and environmental regulations, which encourage the adoption of cleaner, more efficient technologies in butadiene production. The growing demand for advanced materials in the automotive and consumer goods industries further supports butadiene consumption.

With strong infrastructure and increasing investment in research and development (R&D), Europe is positioned for robust market growth.

Competitive Landscape

The global butadiene market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic efforts such as increased investments in R&D, establishment of new manufacturing facilities, and improvements in supply chain efficiency are expected to create opportunities for growth in the market. These initiatives will help enhance production capabilities, drive innovation, and ensure a more streamlined and cost-effective supply chain, fostering the market’s expansion.

List of Key Companies in Butadiene Market

- LyondellBasell Industries Holdings B.V.

- TPC Group

- Exxon Mobil Corporation

- Shell International B.V.

- Evonik Industries AG

- LOTTE Chemical CORPORATION

- Repsol

- CNPC

- Zeon Chemicals L.P

- Reliance Industries Limited

Key Industry Developments

- January 2024 (Expansion): Evonik is increasing its production capacity for hydroxyl-terminated polybutadienes (HTPB), marketed under the POLYVEST brand, at its plant in Marl, Germany. This expansion strengthens Evonik’s position in the polybutadiene market, supporting the demand for butadiene-based products used in adhesives and sealants, including specialized applications in aerospace. The production of butadiene at the Marl site ensures a reliable and efficient supply of raw materials.

The global butadiene market is segmented as:

By Type

- Styrene-butadiene rubber (SBR)

- Polybutadiene rubber (PBR)

- Acrylonitrile Butadiene Rubber

- Styrene Butadiene Latex

- Others

By End-use Industry

- Automotive

- Construction

- Consumer Goods

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America