Market Definition

A network switch is a hardware device that connects multiple devices within a local area network and forwards data to specific devices based on MAC addresses. The market includes a broad range of products that support various operational needs across industries. It covers fixed configuration switches, Power over Ethernet (PoE) switches, modular switches, and smart switches.

The market is segmented by switching port speed, including 100 Mbps Ethernet & 1 Gigabit Ethernet, and other variants designed for specific bandwidth requirements. The market serves multiple end-use sectors such as data centers, telecommunication providers, enterprises, industrial operations, government bodies, public sector entities, and healthcare facilities.

Network Switches Market Overview

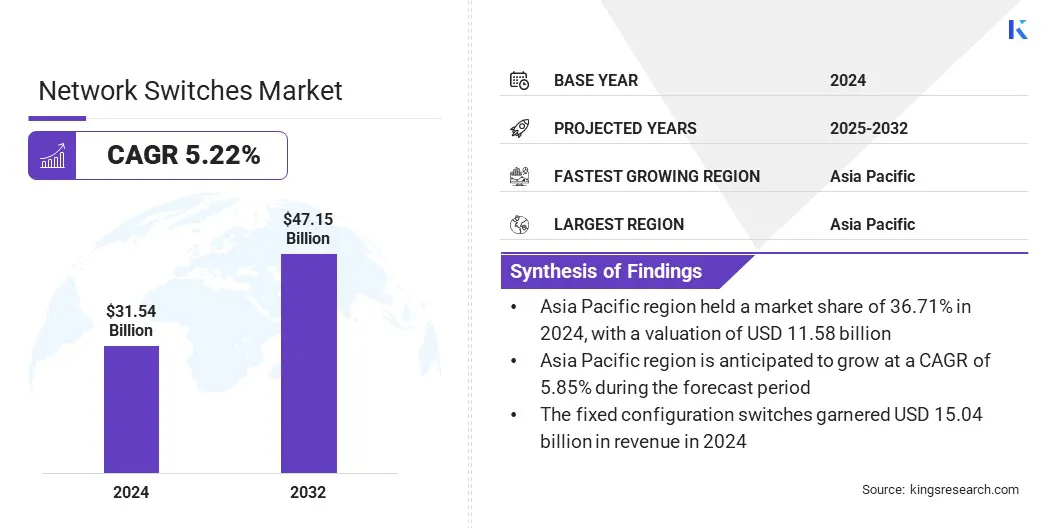

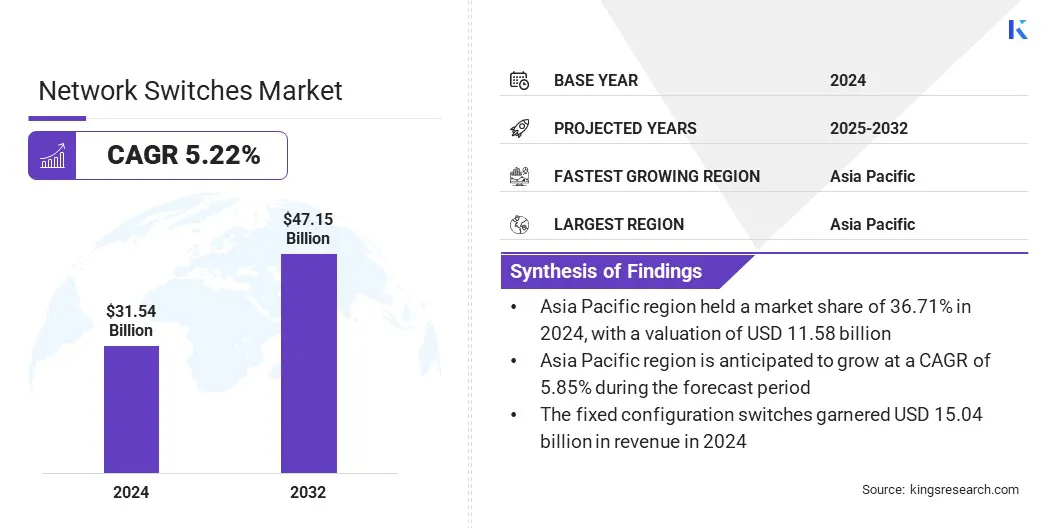

The global network switches market size was valued at USD 31.54 billion in 2024 and is projected to grow from USD 33.02 billion in 2025 to USD 47.15 billion by 2032, exhibiting a CAGR of 5.22% during the forecast period. The growth is driven by a growing demand for more resilient and efficient network solutions that support expanding data traffic, cloud adoption, and real-time applications across enterprise and service provider environments.

The market is shifting toward high-performance switches that provide increased throughput, lower latency, and improved traffic management to support the demands of high-density and data-intensive network environments.

Major companies operating in the network switches industry are CommScope, Inc., Weidmüller, Hewlett Packard Enterprise Development LP, Moxa Inc., Rockwell Automation, Cisco Systems, Inc., Phoenix Contact, Hangzhou Hikvision Digital Technology Co., Ltd., NETGEAR, Arista Networks, Inc., Advantech Co., Ltd., Allied Telesis, Inc., Juniper Networks, Inc., and TPIN, Dell Inc.

Manufacturers are developing automotive-grade Ethernet switches to support scalable in-vehicle networks capable of handling increasing data loads from sensors, cameras, and electronic control units. These switches enable high-speed, low-latency communication across advanced driver assistance systems (ADAS), infotainment, and autonomous driving platforms.

Automakers are adopting these solutions to future-proof vehicle networks and meet evolving data and safety requirements.

- In October 2024, NXP Semiconductors N.V. launched its new S32J family of high-performance network controllers and Ethernet switches. The S32J devices are designed to support scalable vehicle networks and are part of the NXP CoreRide platform. The switches share a common switch core with NXP’s S32 microcontrollers and processors, enabling seamless integration and maximizing software reuse.

Key Highlights:

- The network switches industry size was recorded at USD 31.54 billion in 2024.

- The market is projected to grow at a CAGR of 5.85% from 2025 to 2032.

- Asia Pacific held a market share of 36.71% in 2024, with a valuation of USD 11.58 billion.

- The fixed configuration switches segment garnered USD 15.04 billion in revenue in 2024.

- The 100 Mbps Ethernet & 1 Gigabit Ethernet segment is expected to reach USD 20.12 billion by 2032.

- The data centers segment is expected to reach USD 18.86 billion by 2032.

- North America is anticipated to grow at a CAGR of 5.51% during the forecast period.

Market Driver

Growing Demand for More Resilient and Efficient Network Solutions

The network switches market is driven by the increasing demand for resilient and efficient network solutions. Enterprises and service providers require reliable infrastructure to support mission-critical applications, real-time communication, and uninterrupted data flow. This has led to a focus on switches that offer high availability, automated failover, and advanced traffic management capabilities.

Manufacturers are developing products that meet strict performance and uptime requirements while optimizing energy use and network stability. These systems are critical in data centers, industrial networks, and enterprise IT environments, driving widespread adoption of high-reliability switching technologies.

- In December 2024, FS launched its PicOS enterprise switches designed to deliver high performance, flexibility, and unified management for campus networks. The new switch portfolio integrates PicOS switch software and the AmpCon-Campus management platform to support scalable and resilient network infrastructure.

Market Challenge

High Power Consumption and Excessive Heat Generation

A major challenge in the network switches market is the high power consumption and excessive heat generation of advanced switching devices. These factors reduce operational efficiency and drive up energy costs, especially in large-scale data centers and enterprise networks that require continuous, high-speed data processing.

The increased demand for higher bandwidth and faster switching speeds often results in greater energy use, creating difficulties in managing cooling requirements and operational expenses.

Manufacturers are addressing this challenge, by investing in the development of energy-efficient switch designs that incorporate advanced cooling technologies and low-power components. Additionally, companies are adopting intelligent power management systems that dynamically adjust energy consumption based on network traffic.

Market Trend

Shift Toward High-Performance Switches

The network switches market is undergoing a shift toward high-performance switches to support the growing complexity and scale of modern network environments. These switches provide higher throughput, lower latency, and enhanced data handling to support growing traffic from virtualization, cloud computing, and real-time applications.

Enterprises and data centers are adopting them to manage increasing traffic from virtualization, cloud computing, and real-time applications. Rising performance requirements in next-generation network systems, along with the need to support data-intensive, latency-sensitive workloads across distributed environments, are accelerating the adoption of high-performance switches.

- In April 2025, Zyxel Networks launched the CX4800-56F, a 48-port 10G/25G L3 fiber aggregation switch with eight 100G uplinks, targeting medium-sized businesses, enterprises, and service providers. The switch is designed to meet rising bandwidth demands driven by AR, AI, and VR technologies. It delivers up to 4 Terabits of switching capacity and includes dual power and four fan modules for enhanced redundancy.

Network Switches Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Fixed Configuration Switches, PoE (Power over Ethernet) Switches, Modular Switches, Smart Switches

|

|

By Switching Port Speed

|

100 Mbps Ethernet & 1 Gigabit Ethernet, 2.5 Gigabit Ethernet & 5 Gigabit Ethernet, 10 Gigabit Ethernet, Others

|

|

By End User

|

Data Centers, Telecommunication Providers, Enterprise and Industrial Use, Government and Public Sector, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Fixed Configuration Switches, PoE (Power over Ethernet) Switches, Modular Switches, and Smart Switches): The fixed configuration switches segment earned USD 15.04 billion in 2024 due to their ease of deployment, cost efficiency, and widespread use in enterprise and campus networks.

- By Switching Port Speed (100 Mbps Ethernet & 1 Gigabit Ethernet, 2.5 Gigabit Ethernet & 5 Gigabit Ethernet, 10 Gigabit Ethernet, and Others): The 100 Mbps Ethernet & 1 Gigabit Ethernet segment held 45.12% of the market in 2024, due to continued demand from small and medium-sized networks that require reliable and affordable connectivity solutions.

- By End User (Data Centers, Telecommunication Providers, Enterprise and Industrial Use, Government and Public Sector, Healthcare, and Others): The data centers segment is projected to reach USD 18.86 billion by 2032, owing to rising demand for high-speed, low-latency switching infrastructure to support increasing data traffic and cloud computing workloads.

Network Switches Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific network switches industry share stood at 36.71% in 2024 in the global market, with a valuation of USD 11.58 billion. The dominance is due to increasing demand for high-performance switches that support Wi-Fi 6, Wi-Fi 6E, and emerging Wi-Fi 7 access points. These switches are essential for managing traffic from power-intensive edge devices and complex hybrid enterprise networks.

Rapid adoption of cloud services, growth in data center construction, and large-scale 5G infrastructure investments is further accelerating deployment across commercial, industrial, and public sectors. Countries such as China, India, South Korea, and Japan are increasingly investing in advanced network infrastructure, thereby contributing to sustained growth of the market.

- In April 2025, Edgecore Networks launched the ECS5500-12P and ECS5500-12T, compact 10G Layer 2+/Lite L3 multi-Gigabit switches designed for Wi-Fi 6/6E/7 access points, edge devices, and hybrid enterprise networks. The ECS5500-12P offers up to 60W of power per port with a total PoE++ budget of 480W, supporting high-power devices such as AI-enabled surveillance cameras and smart building terminals.

North America Network Switches Market is poised to grow at a CAGR of 5.51% over the forecast period. The growth is driven by a high volume of new product launches tailored to meet evolving needs in consumer and industrial networking applications. Manufacturers in the region are focusing on innovation and expanding product portfolios to support higher speeds, better energy efficiency, and improved management capabilities.

Moreover, the presence of a mature IT ecosystem, early adoption of advanced technologies, and demand from sectors such as manufacturing, healthcare, and cloud computing are supporting consistent market expansion across this region.

- In May 2024, MaxLinear, Inc. launched a new family of 2.5G Ethernet switches and octal-port PHYs designed for consumer and industrial applications. The product line includes 7-port and 10-port single-chip switches and 8-port 2.5GBASE-T PHYs, offering low power consumption and a broad feature set. These solutions support wire-speed switching, IGMPv3, LACP, PTP, SyncE, and MACsec, with uplink options including 10G SERDES.

Regulatory Frameworks

- In the U.S., network switches must comply with regulations set by the Federal Communications Commission (FCC) under Title 47 of the Code of Federal Regulations, which governs electromagnetic interference and radio frequency emissions. Manufacturers are required to meet FCC Part 15 standards for unintentional radiators to ensure safe and interference-free operation in public and private networks.

- In Europe, network switches fall under the Radio Equipment Directive (RED) 2014/53/EU, which sets essential requirements for electromagnetic compatibility, radio spectrum usage, and safety. Products in the Europe network switches market must carry the CE marking to demonstrate compliance with applicable EU directives before commercialization.

Competitive Landscape

Key players in the network switches industry are focusing on technological advancements to enhance switching performance and scalability. A major strategy involves the development of smart switches that double network scale and performance while reducing power consumption and operational complexity.

Companies are forming strategic partnerships with cloud providers and edge computing platforms to align switch capabilities with shifting data traffic demands. Additionally, several companies are adopting open networking standards to improve interoperability and drive faster deployment cycles across diverse IT environments.

- In May 2025, Hewlett Packard Enterprise enhanced its HPE Aruba Networking portfolio with the launch of new CX 6300M campus switches and the CX 10040 distributed services switch. The CX 10040, a next-generation smart switch, features AMD Pensando programmable DPUs that offload security and network functions, delivering twice the performance of the earlier CX 10000 model.

List of Key Companies in Network Switches Market:

- CommScope, Inc.

- Weidmüller

- Hewlett Packard Enterprise Development LP

- Moxa Inc.

- Rockwell Automation

- Cisco Systems, Inc.

- Phoenix Contact

- Hangzhou Hikvision Digital Technology Co., Ltd.

- NETGEAR

- Arista Networks, Inc.

- Advantech Co., Ltd.

- Allied Telesis, Inc.

- Juniper Networks, Inc.

- TPIN

- Dell Inc.

Recent Developments (Product Launch)

- In February 2025, Cisco launched the N9300 Series Smart Switches with embedded AMD Pensando DPUs to support AI-driven data center transformation. These smart switches combine networking and security services into a single platform, enhancing scalability and efficiency. The switches integrate Cisco Silicon One E100 and offer Cisco Hypershield as the first built-in service, enabling real-time security at the network layer.

.