Market Definition

The market encompasses hardware and software solutions that simulate real-world network conditions for testing and optimization. Covering SD-WAN, IoT, cloud, and other technologies, it serves industries such as telecommunications, BFSI, government & defense to enhance network reliability, security, and performance in evolving digital infrastructures.

Network Emulator Market Overview

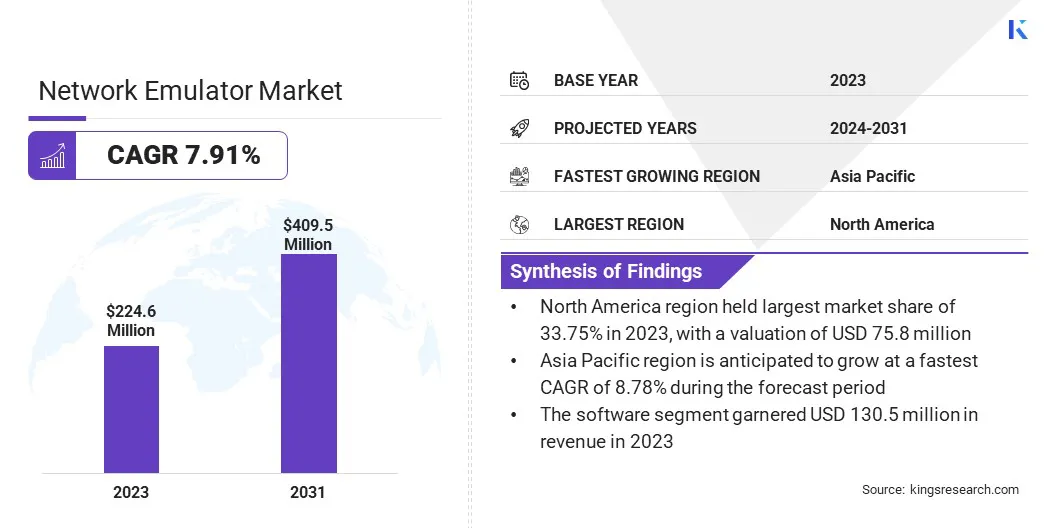

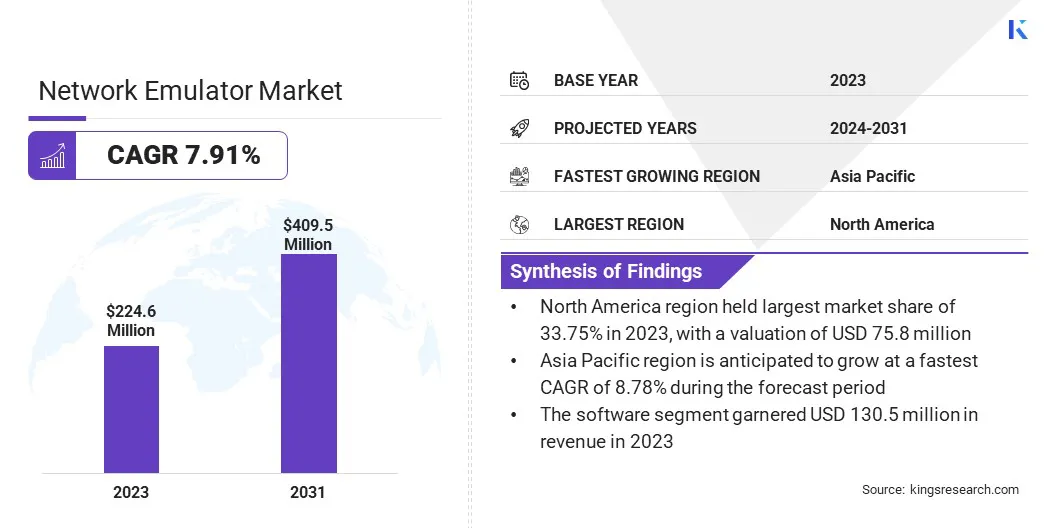

The global network emulator market size was valued at USD 224.6 million in 2023 and is projected to grow from USD 240.3 million in 2024 to USD 409.5 million by 2031, exhibiting a CAGR of 7.91% during the forecast period.

This growth is driven by the increasing adoption of 5G networks, IoT, AI-driven applications, and cloud computing, requiring advanced network testing and validation solutions. Additionally, the shift toward cloud-based and virtualized network emulation solutions is accelerating, offering scalability, cost-efficiency, and real-time simulation capabilities.

Major companies operating in the network emulator industry are Spirent Communications, PacketStorm Communications, Inc., VIAVI Solutions Inc., Valid8.com Inc., Aukua Systems Inc., Keysight Technologies, SIMNOVUS, Marben Products, SolarWinds Worldwide, LLC., EVE-NG Ltd, Apposite Technologies, NextGig Systems, Inc., GigaNet Systems Inc., Rohde & Schwarz Finland Oy, GL Communications Inc, and others.

As enterprises and telecom providers prioritize network reliability, performance, and security, network emulation remains essential for testing and validation in evolving digital ecosystems.

The rise of 5G, AI-driven workloads, cloud computing, and IoT is boosting the demand for scalable, high-performance network emulators. Industries such as telecommunications, BFSI, healthcare, and defense are increasingly investing in network emulation solutions to ensure seamless connectivity, optimize latency, and mitigate cybersecurity risks.

Key Highlights:

- The network emulator industry size was recorded at USD 224.6 million in 2023.

- The market is projected to grow at a CAGR of 7.91% from 2024 to 2031.

- North America held a market share of 33.75% in 2023, with a valuation of USD 75.8 million.

- The software segment garnered USD 130.5 million in revenue in 2023.

- The IoT segment is expected to reach USD 129.9 million by 2031.

- The telecommunication segment is expected to reach USD 109.7 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 8.78% during the forecast period.

Market Driver

"Growing Demand for 5G Network Testing"

The network emulator market is experiencing significant growth due to the rapid deployment of 5G networks worldwide. With telecom operators and enterprises investing heavily in 5G infrastructure, the need for advanced testing solutions has surged.

Network emulators enable real-time testing of 5G applications, devices, and services in controlled environments, ensuring seamless performance before commercial deployment. With the rapid adoption of 5G, network emulators are likley to remain essential for optimizing latency, throughput, and resilience.

Market Challenge

"High Costs of Network Emulation Solutions"

The high cost of advanced testing solutions presents a key challenge to the progress of the network emulator market, particularly for small and mid-sized enterprises. Sophisticated hardware, software, and ongoing maintenance drive up expenses.

This challenge can be addressed through the development of cloud-based network emulation platforms. Cloud-based solutions offer flexible, scalable, and cost-effective alternatives, enabling businesses to access testing environments without significant capital investment. By leveraging virtualization and pay-as-you-go models, companies can reduce costs while ensuring testing efficiency.

Market Trend

"Growing Demand for Network Emulators in AI Infrastructure Deployment"

The network emulator market is experiencing significant growth as organizations optimize AI infrastructure for high-performance computing and deep learning. These workloads require high-bandwidth low-latency networks for efficient data processing and model training.

Network emulators enable real-world simulation, ensuring AI performance across distributed data centers, cloud environments, and edge environments. As AI applications scale, enterprises require reliable network emulation to assess the impact of bandwidth, latency, and packet loss on AI-driven workloads.

This is crucial for industries deploying AI in real-time applications such as autonomous systems, financial analytics, and healthcare diagnostics. Integrating network emulation into AI infrastructure development enahnces performance, minimizes downtime, and enhances system efficiency.

- In June 2024, Calnex Solutions launched the SNE-X 400G, the first network emulator with 400GbE interfaces, designed for AI infrastructure and high-performance computing networks. The solution enables enterprises to test and optimize Ultra Ethernet deployments, enhancing network reliability and accelerating job completion in AI-driven environments.

Network Emulator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Technology

|

SD-WAN, IoT, Cloud, Others

|

|

By Vertical

|

Telecommunication, BFSI, Government & Defense, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware and Software): The software segment earned USD 130.5 million in 2023 due to the increasing adoption of virtualized and cloud-based network emulation solutions.

- By Technology (SD-WAN, IoT, Cloud, and Others): The IoT segment held a share of 31.86% in 2023, fueled by the growing need for network performance validation in IoT ecosystems.

- By Vertical (Telecommunication, BFSI, Government & Defense, Healthcare, and Others): The telecommunication segment is projected to reach USD 109.7 million by 2031, propelled by the expanding deployment of 5G networks and the rising demand for advanced network testing solutions.

Network Emulator Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America network emulator market share stood at around 33.75% in 2023, valued at USD 75.8 million. This dominance is reinforced by the the rapid adoption of advanced networking technologies, including 5G, cloud computing, and IoT.

With the presence of leading telecommunications, IT, and cloud service providers, there is a strong demand for network emulation solutions to test and optimize network performance.

The regional market further benefits from supportive government initiatives promoting digital transformation and cybersecurity, leading to increased investments in network testing and security validation. With the growing reliance on virtualized and cloud-based network emulation solutions, North America is expected to maintain its leading market position.

Asia Pacific network emulator industry is poised to grow at a CAGR of 8.78% over the forecast period. This growth is primarily stimulated by rapid digital transformation, increasing 5G deployments, and rising adoption of IoT and AI-driven infrastructure across key economies such as China, India, Japan, and South Korea.

With governments and enterprises investing heavily in next-generation network technologies, the demand for network emulation solutions is accelerating.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates network communication standards, spectrum allocation, and compliance for wireless and telecommunications infrastructure. Its oversight ensures network emulator solutions adhere to regulatory guidelines for signal integrity, interference management, and connectivity reliability across industries such as telecommunications, defense, and IoT applications.

- In Europe, the Body of European Regulators for Electronic Communications (BEREC) oversees telecommunications policies, competition, and network performance standards, influencing adoption. The European Telecommunications Standards Institute (ETSI) develops technical standards for network testing, 5G, IoT, and SD-WAN, ensuring compliance and interoperability for network emulation solutions.

Competitive Landscape

Key players operating in the network emulator industry are focusing on technological advancements, product innovation, and strategic partnerships to strengthen their market presence and gain a competitive edge.

Leading companies are investing in cloud-based and virtualized network emulation solutions to cater to the growing demand for 5G, IoT, AI-driven network testing, and edge computing applications.

The companies are expanding their product portfolios by integrating AI-powered analytics, automation, and real-time network performance monitoring into their emulation solutions. Additionally, they are strengthening their offerings through mergers, acquisitions, and collaborations with telecom operators and enterprises.

Increasing investments in software-defined networking (SDN), cybersecurity testing, and high-speed networking are projected to intesify competition in the market, fostering innovation and scalability.

- In February 2024, Keysight Technologies launched the E7515W UXM Wireless Test Platform, the first integrated test solution for non-terrestrial networks (NTN). This platform enables telecom providers and device manufacturers to validate 5G NTN performance, ensuring seamless connectivity between terrestrial and satellite networks for next-generation wireless communication.

List of Key Companies in Network Emulator Market:

- Spirent Communications

- PacketStorm Communications, Inc.

- VIAVI Solutions Inc.

- Valid8.com Inc.

- Aukua Systems Inc.

- Keysight Technologies

- SIMNOVUS

- Marben Products

- SolarWinds Worldwide, LLC.

- EVE-NG Ltd

- Apposite Technologies

- NextGig Systems, Inc.

- GigaNet Systems Inc.

- Rohde & Schwarz Finland Oy

- GL Communications Inc

Recent Developments (New Product Launch)

- In March 2025, DTI Publishing launched LabHub Network Emulator v1.0, an interactive and visual network emulation solution for educators. Designed to simulate real-world network conditions, it facilitates hands-on learning, enhancing expertise in security, troubleshooting, and network performance.