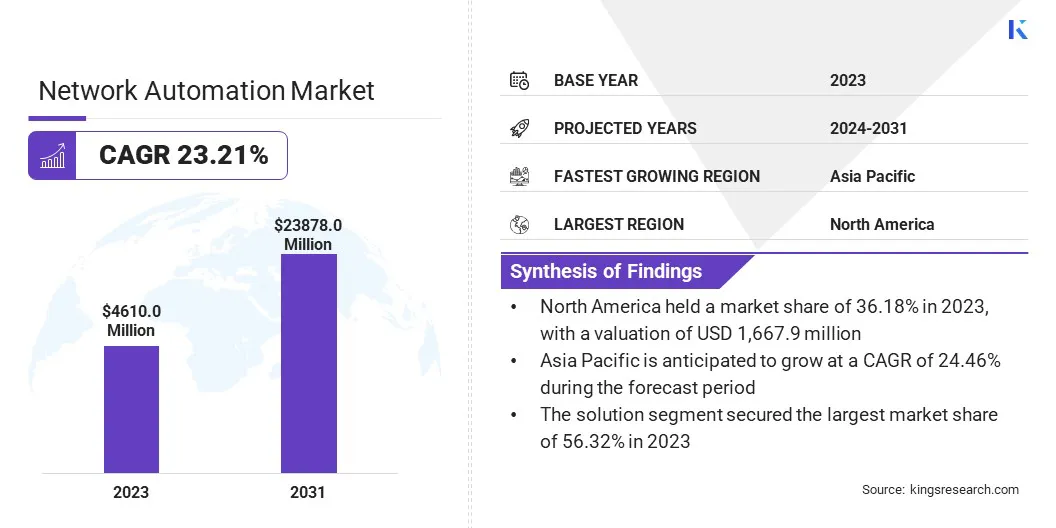

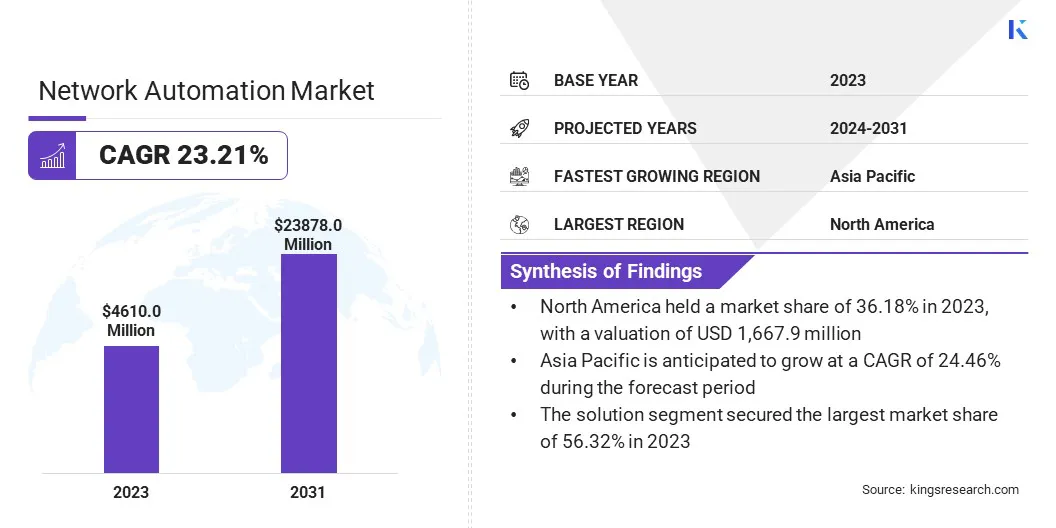

Network Automation Market Size

Global Network Automation Market size was valued at USD 4,610.0 million in 2023 and is projected to grow from USD 5539.9 million in 2024 to USD 23,878.0 million by 2031, exhibiting a CAGR of 23.21% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as BMC Software, Inc., Cisco Systems, Inc., IBM Corporation, Juniper Networks, Inc., Open Text, SolarWinds Worldwide, LLC, NetBrain Technologies Inc., VMware, Inc., FUJITSU, Broadcom and others. Growing adoption of cloud-based network automation solutions and rapid growth of data traffic are driving market growth.

Offering customizable and scalable network automation solutions presents a significant opportunity for the network automation market. Businesses increasingly seek tailored automation frameworks that can adapt to their specific operational needs and scale alongside their growth. Customization allows organizations to align automation tools with unique network infrastructures and business processes, enhancing efficiency and agility.

Scalability, on the other hand, addresses the capability of these solutions to expand seamlessly as network demands evolve, whether due to technological advancements like 5G and IoT or business expansions. This opportunity spans across various sectors, from telecommunications and finance to healthcare and manufacturing, where diverse network architectures require adaptable automation strategies.

Companies that excel in offering customizable and scalable solutions can differentiate themselves by providing flexibility in deployment models—cloud-based, on-premises, or hybrid and by integrating advanced features such as AI-driven analytics for proactive network management. Ultimately, such solutions empower businesses to streamline operations, optimize resource allocation, and improve service delivery while maintaining cost-effectiveness and compliance with industry regulations.

Network automation refers to the use of software and technologies to automate the management, provisioning, configuration, and operation of network devices and services. It aims to reduce manual intervention, minimize errors, and improve operational efficiency in managing complex network infrastructures. Deploying network automation involves implementing tools and platforms that can orchestrate tasks such as device configuration, network monitoring, performance optimization, and troubleshooting. These solutions leverage APIs, scripting languages, and sometimes AI and ML algorithms to execute tasks autonomously based on predefined policies or real-time analytics.

Industries that benefit from network automation range from telecommunications and IT services to healthcare, where reliable and secure network operations are critical for patient care and data management. As networks evolve with technologies such as SDN (Software-Defined Networking) and NFV (Network Functions Virtualization), the scope of automation is expanding to encompass dynamic network provisioning and agile service delivery. Successful deployment of these solutions requires a strategic approach to align automation goals with business objectives, ensuring seamless integration with existing IT ecosystems and adherence to industry standards for security and compliance.

Analyst’s Review

Key players are strategically focusing on expanding their product offerings and enhancing their technological capabilities to meet evolving customer demands. Companies are prioritizing the development of AI-driven automation tools that enable predictive maintenance, proactive network management, and real-time analytics.

- For instance, in 2024, according to Cisco's report, over the next two years, 60% of IT leaders and professionals anticipate implementing AI-driven predictive network automation across all sectors of NetOps. Furthermore, 75% of firms surveyed plan to adopt solutions providing comprehensive visibility across diverse network domains, from campus and branch to WAN, data center, internet, public clouds, and industrial networks, through a unified console.

Rising significant investments in cloud-native solutions and hybrid network automation platforms, catering to the increasing adoption of multi-cloud environments and edge computing. Imperatives for key players include fostering strategic partnerships with cloud service providers and telecom operators to broaden market reach and enhance solution scalability. Moreover, efforts are directed toward addressing integration complexities across diverse IT infrastructures and ensuring interoperability with legacy systems. Regulatory compliance and data security remain paramount, prompting investments in advanced cybersecurity measures and regulatory frameworks.

Network Automation Market Growth Factors

The rise of cloud-based network automation solutions marks a pivotal driver transforming network automation market. Cloud-based solutions offer scalability, flexibility, and cost-efficiency by leveraging cloud infrastructure to automate network provisioning, monitoring, and management tasks. This shift allows businesses to dynamically adjust their network resources based on demand, optimizing performance and reducing operational overhead. Cloud-based automation also facilitates rapid deployment of new services and applications, enabling organizations to innovate and respond swiftly to market changes.

Moreover, these solutions support centralized management and visibility across distributed network environments, enhancing operational efficiency and simplifying compliance with regulatory requirements. As businesses increasingly migrate towards hybrid and multi-cloud architectures, cloud-based network automation becomes essential in ensuring seamless integration and consistent performance across diverse IT landscapes. This driver underscores the strategic imperative for network automation providers to enhance cloud-native capabilities, integrate AI-driven analytics, and collaborate with cloud service providers to deliver scalable, resilient, and future-ready solutions.

Integration with legacy systems presents a significant challenge for the network automation market. Legacy systems often use proprietary protocols and architectures that are incompatible with modern automation tools and standards. This challenge requires organizations to bridge the gap between legacy and modern IT infrastructures, ensuring interoperability and continuity of operations during the automation deployment process. Complex integration processes can lead to increased project timelines, resource allocation, and potential disruptions to ongoing business operations.

Moreover, legacy systems may lack the scalability and agility needed to support advanced automation functionalities such as dynamic network provisioning and real-time analytics. Addressing these integration challenges requires strategic planning, investment in interoperability solutions, and expertise in legacy system migration and modernization. Successful integration efforts enable organizations to leverage existing IT investments while unlocking the benefits of automation, including improved efficiency, reduced costs, and enhanced service delivery. Overcoming integration complexities remains a critical focus area for businesses and automation providers alike, emphasizing the need for standardized protocols, robust migration strategies, and comprehensive testing to ensure seamless transition and operational continuity.

Network Automation Market Trends

The growing adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) is aiding network automation market growth. SDN decouples the network control and data forwarding functions, allowing centralized programmable management and automation of network infrastructure. NFV, on the other hand, virtualizes network functions traditionally performed by dedicated hardware appliances, enabling flexible deployment and scaling of network services. Together, SDN and NFV empower organizations to achieve greater agility, scalability, and cost-efficiency in managing their networks.

By abstracting network services from the underlying hardware, businesses can automate provisioning, configuration, and orchestration processes, reducing manual intervention and accelerating service delivery. Adoption of SDN and NFV enables enterprises to optimize resource utilization, enhance network performance, and rapidly innovate through programmable network architectures. As organizations embrace digital transformation initiatives, SDN and NFV have become pivotal in modernizing network infrastructures to meet evolving business requirements and customer expectations for agility and responsiveness.

Segmentation Analysis

The global market is segmented based on component, organization size, deployment, network type, vertical, and geography.

By Component

Based on component, the market is segmented into solution and services. The solution segment secured the largest network automation market share of 56.32% in 2023, driven primarily by the increasing adoption of advanced automation technologies across industries. The solution segment is further classified into SD-WAN & network virtualization solutions, intent-based networking platforms, configuration management tools, and others. Businesses are increasingly investing in comprehensive network automation solutions to streamline operations, enhance efficiency, and reduce operational costs.

These solutions offer capabilities such as AI-driven analytics, real-time monitoring, and automated configuration management, catering to the growing complexity and scale of modern network infrastructures. Moreover, the rising demand for scalable and customizable automation platforms capable of integrating with diverse IT environments is bolstering segment expansion.

By Deployment

Based on deployment, the market is categorized into cloud-based, on-premises, and hybrid. The cloud-based segment within the network automation market is expected to record a remarkable CAGR of 24.11% through the forecast period. This growth is driven by the surging adoption of cloud-native network automation solutions across enterprises globally. Cloud-based solutions offer significant advantages such as scalability, flexibility, and cost-efficiency, allowing organizations to leverage cloud infrastructure for automating network management and operation tasks.

The shift toward hybrid and multi-cloud environments is further accelerating the adoption of cloud-based automation for enabling seamless integration with existing IT ecosystems and supporting dynamic workload requirements. Moreover, advancements in AI and machine learning capabilities embedded within cloud-based automation platforms enhance predictive analytics, autonomous operations, and proactive network monitoring, which is propelling segment growth.

By Vertical

Based on vertical, the market is classified into BFSI, IT & telecommunications, manufacturing & retail, healthcare, and others. The IT & telecommunications segment accrued the highest revenue of USD 1,688.3 million in 2023 within the network automation market. The sector's inherent reliance on robust and efficient network infrastructure to support mission-critical operations and customer services is fueling significant investments in network automation technologies. Automation solutions in this sector enable telecommunications providers and IT enterprises to enhance service delivery, optimize network performance, and manage operational costs effectively.

The rapid deployment of 5G networks and the proliferation of IoT devices require advanced automation capabilities to handle increased data traffic and ensure seamless connectivity, which is fueling product uptake in the industry. The adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) within IT and telecommunications is boosting the demand for agile, scalable automation solutions that can dynamically adapt to evolving network demands, facilitating segment development.

Network Automation Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America network automation market share accounted for 36.18% and was valued at USD 1,667.9 million in 2023. The region's leadership in the market can be attributed to its early adoption of advanced technologies and robust infrastructure investments across various industries. Key factors driving market dominance include the widespread deployment of Software-Defined Networking (SDN), Network Functions Virtualization (NFV), and cloud-based automation solutions.

Additionally, stringent regulatory requirements and the need for stringent cybersecurity measures are increasing the adoption of network automation in sectors such as telecommunications, IT services, and banking. North American enterprises prioritize operational efficiency, scalability, and agility, which is fostering a conducive environment for the growth of network automation solutions. Furthermore, strategic initiatives by major players in the region to innovate and expand their product offerings are contributing significantly to North America's substantial market share and leadership position in the global network automation landscape.

The Asia-Pacific network automation market is poised to grow at the highest CAGR of 24.46% between 2024 and 2031. This growth is propelled by rapid digital transformation initiatives, increasing adoption of cloud technologies, and the expansion of 5G networks across the region. Countries like China, Japan, India, and South Korea are at the forefront of deploying advanced network automation solutions to support the burgeoning demand for seamless connectivity, IoT integration, and digital services.

Moreover, government initiatives promoting smart city development and industrial automation are fueling market growth in Asia-Pacific. Enterprises in the region are adopting automation to enhance operational efficiency, reduce costs, and accelerate innovation in network management and service delivery. Furthermore, the growing emphasis on cybersecurity measures and regulatory compliance is driving the adoption of robust automation solutions, which is supporting regional market progress.

Competitive Landscape

The global network automation market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Network Automation Market

- BMC Software, Inc.

- Cisco Systems, Inc.

- IBM Corporation

- Juniper Networks, Inc.

- Open Text

- SolarWinds Worldwide, LLC

- NetBrain Technologies Inc.

- VMware, Inc.

- FUJITSU

- Broadcom

Key Industry Developments

- June 2024 (Launch): Cisco unveiled a pioneering AI cluster solution developed in collaboration with NVIDIA for data centers. This innovation revolutionizes infrastructure and software management, offering customers advanced capabilities to build, manage, and optimize their operations more effectively.

- May 2024 (Launch): Samsung Electronics and O2 Telefónica launched their inaugural virtualized RAN (vRAN) and Open RAN commercial site in Germany. This marked the debut of Samsung’s 5G vRAN solution in the country's commercial network, offering robust and dependable 4G and 5G services to customers.

- March 2024 (Acquisition): IBM acquired Pliant, a premier provider of network and IT infrastructure automation solutions. This acquisition enhanced IBM's capabilities in automating network and IT tasks, abstracting these functions to the application layer, and allowing applications and developers to efficiently manage infrastructure directly within their applications.

- May 2023 (Collaboration): Juniper Networks and ServiceNow partnered to deliver comprehensive automation solutions for managed service providers (MSPs) and enterprises, enhancing network deployment and operational efficiency while reducing costs.

- April 2023 (Launch): BMC unveiled solutions designed to enable enterprise customers to utilize AI via its Helix Control-M platform, Control-M solution, AMI offerings, and Helix Operations Management platform. BMC Helix is available on Google Cloud Marketplace and ensures seamless data orchestration across mainframe and cloud systems, enhancing user experiences.

- February 2023 (Collaboration): Cisco partnered with NEC Corporation to strengthen their collaboration by integrating system solutions and exploring opportunities in 5G xHaul and private 5G. This strategic initiative aims to help customers modernize their infrastructure and enhance connectivity for a broader user base and diverse devices.

- February 2023 (Acquisition): IBM announced its plans to acquire NS1, a top provider of SaaS solutions for network automation. NS1’s advanced technology helps businesses streamline content, service, and application delivery, enhancing performance, security, reliability, and cost efficiency. This acquisition supported IBM’s strategic goal of delivering comprehensive digital-age solutions for businesses.

The global network automation market is segmented as:

By Component

- Solution

- SD-WAN & Network Virtualization Solutions

- Intent-Based Networking Platforms

- Configuration Management Tools

- Others

- Services

- Managed Service

- Professional Service

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Deployment

- Cloud-based

- On-premises

- Hybrid

By Network Type

- Physical Network

- Virtual Network

- Hybrid Network

By Vertical

- BFSI

- IT & Telecommunications

- Manufacturing & Retail

- Healthcare

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America