Market Definition

Neonatal ventilators are advanced medical devices engineered to provide critical respiratory support to newborns, including premature and critically ill infants who cannot breathe independently. These systems deliver precisely controlled airflow, oxygen, and pressure to maintain optimal oxygenation and carbon dioxide balance.

Neonatal ventilators are specifically designed to accommodate the delicate lung physiology of neonates. They provide precise control over parameters such as tidal volume, pressure, and breathing rate, which ensures safe and effective ventilation.

Neonatal Ventilators Market Overview

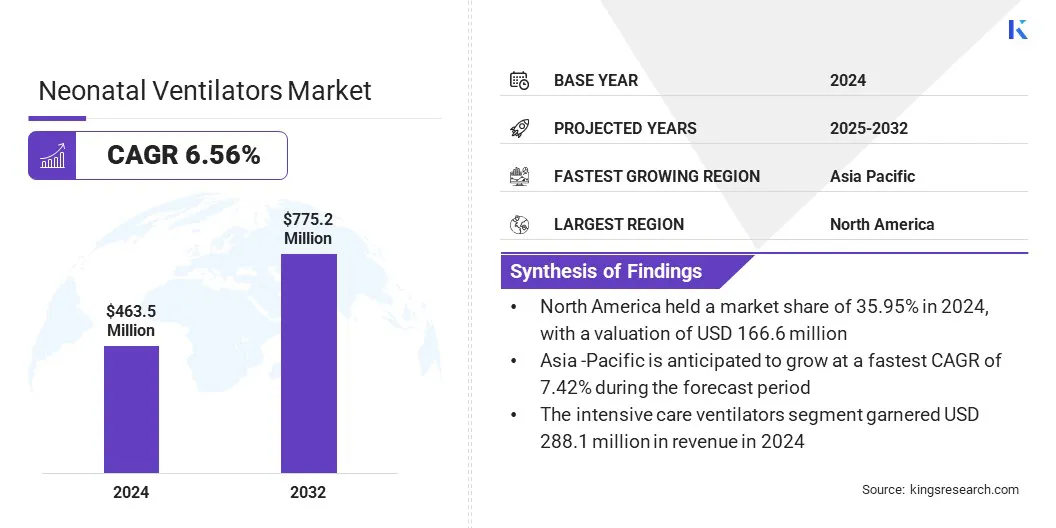

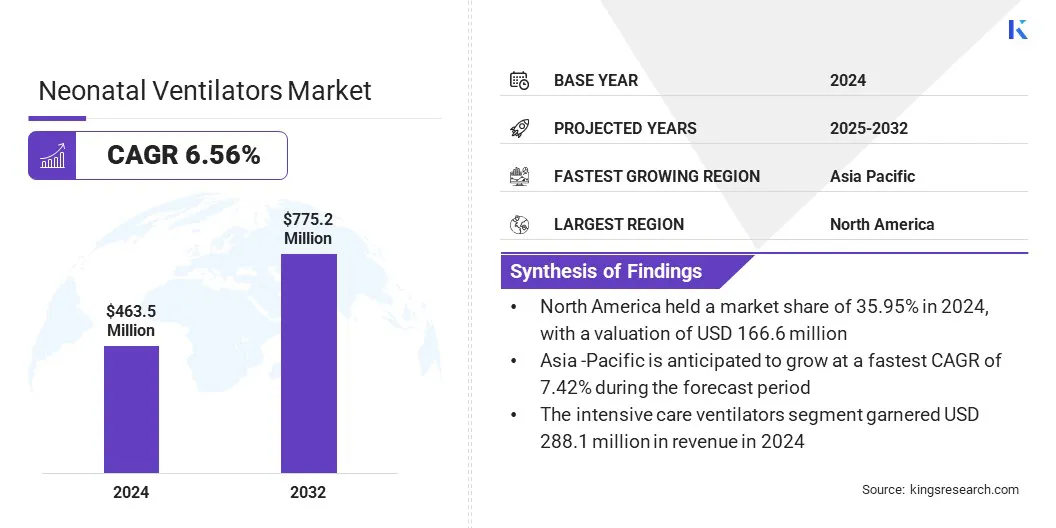

The global neonatal ventilators market size was valued at USD 463.5 million in 2024 and is projected to grow from USD 492.4 million in 2025 to USD 775.2 million by 2032, exhibiting a CAGR of 6.56% over the forecast period.

The market is driven by the rising incidence of premature births and neonatal respiratory disorders, which is increasing the demand for ventilator support. Growing awareness of advanced neonatal care and expanding hospital infrastructure in emerging economies are boosting the adoption of advanced neonatal ventilators.

Key Highlights:

- The neonatal ventilators industry size was recorded at USD 463.5 million in 2024.

- The market is projected to grow at a CAGR of 6.56% from 2025 to 2032.

- North America held a market of 35.95% in 2024, with a valuation of USD 166.6 million.

- The invasive ventilation segment garnered USD 249.5 million in revenue in 2024.

- The intensive care ventilators segment is expected to reach USD 477.2 million by 2032.

- The mechanical ventilators segment is anticipated to witness the fastest CAGR of 6.80% over the forecast period.

- The pressure mode ventilation segment held a market share of 33.24% in 2024

- The hospitals segment garnered USD 167.9 million in revenue in 2024

- Asia Pacific is anticipated to grow at a CAGR of 7.42% over the forecast period.

Major companies operating in the neonatal ventilators market are AVI Healthcare Private Limited, Medtronic, Drägerwerk AG & Co. KGaA, GINEVRI, Getinge, ZOLL Medical Corporation, Fisher & Paykel Healthcare Limited, ResMed Private Limited, Inspiration Healthcare Group plc, Air Liquide Medical Systems, ICU Medical, Inc, Shenzhen Mindray Bio-Medical Electronics Co., Ltd, SIARE ENGINEERING INTERNATIONAL GROUP S.p.A, Breas Medical AB and aXcent medical GmbH.

Rising healthcare expenditure and broader insurance coverage are driving demand for advanced neonatal care solutions, including ventilators. Hospitals are prioritizing modern respiratory support technologies to improve survival outcomes for premature and critically ill infants.

- In June 2024, the U.S. Centers for Medicare & Medicaid Services (CMS) projected that National Health Expenditure (NHE) will grow 5.8% annually through 2033, enabling greater hospital investment in neonatal care equipment.

Market Driver

Rising Incidence of Severe Respiratory Syncytial Virus (RSV) Infections

A key driver in the neonatal ventilators market is the rising incidence of severe respiratory syncytial virus (RSV) infections in infants. RSV is a major cause of acute respiratory illness, often resulting in hospitalizations and the need for critical respiratory support.

This growing burden is prompting healthcare providers to strengthen neonatal intensive care units with advanced ventilators capable of precise and safe respiratory management. The increasing prevalence of RSV is also accelerating investments in neonatal respiratory devices to improve survival rates and patient outcomes.

- In 2024, the U.S. Centers for Disease Control and Prevention (CDC) highlighted that respiratory syncytial virus (RSV) causes an estimated 58,000–80,000 hospitalizations annually among children under five in the U.S., driving demand for neonatal ventilators to manage severe respiratory complications in infants.

Market Challenge

High Cost of Neonatal Ventilators

A key challenge in the neonatal ventilators market is the high cost of acquiring and maintaining advanced ventilator systems. These devices require specialized engineering, precision components, and integration of safety features tailored for newborns, which significantly increase production expenses. Hospitals face additional costs for servicing, consumables, and staff training, making widespread adoption difficult in resource-limited settings.

High capital investment for neonatal ventilators can restrict accessibility for smaller healthcare facilities, requiring careful budget planning and often limiting the availability of critical respiratory support for neonates.

To address this challenge, market players are focusing on developing cost-effective and scalable neonatal ventilators without compromising safety or performance. Companies are introducing portable and modular designs that reduce manufacturing and maintenance expenses of the devices.

Additionally, manufacturers are offering comprehensive service packages, training programs, and leasing models to ease the financial burden on healthcare providers and improve adoption of neonatal ventilators across hospitals and neonatal care unit.

Market Trend

Development of Versatile and Multi-Patient Ventilators

A key trend in the neonatal ventilators market is the development of versatile, multi-patient ventilators that cater to a wide range of patient needs, from premature newborns to adults. These devices enable hospitals to provide personalized respiratory care while optimizing space, costs, and equipment utilization.

Manufacturers are integrating advanced features such as invasive leakage compensation, automated monitoring, and compliance with international safety standards to enhance treatment efficiency and improve patient outcomes. These innovations are also supporting broader adoption of neonatal ventilators across healthcare facilities.

- In June 2025, Getinge launched a neonatal option for its Servo-c ventilator, enabling support for premature newborns while maintaining versatility for all patient categories. The update enhances personalized respiratory care, complies with international safety standards, and strengthens hospital adoption of advanced neonatal ventilators.

Neonatal Ventilators Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Invasive Ventilation, Non-invasive Ventilation

|

|

By Mobility

|

Intensive Care Ventilators, Portable Ventilators

|

|

By Technology

|

Mechanical Ventilators, High Frequency Ventilators, Volume Targeted Ventilators, Hybrid Ventilators

|

|

By Mode

|

Pressure Mode Ventilation, Combined Mode Ventilation, Volume Mode Ventilation, Others

|

|

By End Use

|

Hospitals, Clinics, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Invasive Ventilation and Non-invasive Ventilation): The invasive ventilation segment earned USD 249.5 million in 2024 due to its widespread use in managing severe neonatal respiratory distress and critical care cases.

- By Mobility (Intensive Care Ventilators and Portable Ventilators): The intensive care ventilators segment held 62.15% of the market in 2024, due to high adoption in NICUs for continuous monitoring and advanced respiratory support.

- By Technology (Mechanical Ventilators, High Frequency Ventilators, Volume Targeted Ventilators, and Hybrid Ventilators): The high frequency ventilators segment is projected to reach USD 276.1 million by 2032, owing to their effectiveness in treating preterm infants with delicate lungs.

- By Mode (Pressure Mode Ventilation, Combined Mode Ventilation, Volume Mode Ventilation, and Others): The combined mode ventilation segment is anticipated to witness the fastest CAGR of 6.86% over the forecast period, due to its flexibility in adjusting ventilation strategies for diverse neonatal conditions.

- By End Use (Hospitals, Clinics, Ambulatory Surgical Centers, and Others): The hospitals segment garnered USD 167.9 million in revenue in 2024, due to the concentration of NICUs and higher adoption of advanced neonatal ventilators in clinical settings.

Neonatal Ventilators Market Regional Analysis

Based on region, the Market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America neonatal ventilators market share stood at around 35.95% in 2024, with a valuation of USD 166.6 million. This dominance is attributed to the rising incidence of premature births and respiratory complications in newborns, which is increasing the demand for advanced respiratory support in neonatal intensive care units.

Technological advancements, including portable, modular, and AI-enabled ventilators, are enhancing treatment efficiency and patient outcomes. Expanding hospital infrastructure and investments by key players in neonatal care are further supporting adoption of advanced neonatal ventilators across healthcare facilities.

Additionally, strategic expansions by key players are strengthening distribution channels and facilitating broader availability of advanced neonatal ventilators, thereby contributing to the market growth.

- In January 2024, UK-based medical technology company Inspiration Healthcare Group PLC launched its U.S. platform through the strategic acquisition of Airon Corp., a Florida-based specialist respiratory device company, providing an established channel to support the upcoming launch of its SLE6000 neonatal ventilator in the U.S. market.

Asia Pacific neonatal ventilators industry is set to grow at a robust CAGR of 7.42% over the forecast period. This growth is attributed to the rising prevalence of premature births and neonatal respiratory complications in emerging economies such as China and India. Rapid modernization of healthcare infrastructure and government initiatives to improve neonatal care are facilitating wider adoption of advanced ventilators.

Growing awareness of family-centered care and postnatal support is prompting hospitals to invest in integrated neonatal care solutions. Increasing affordability of medical devices and local manufacturing efforts by key players are further supporting market growth across the region. Additionally, integrated neonatal care solutions combining ventilation and advanced postnatal support are enhancing patient care and driving market growth in the region.

- In October 2024, Dräger India launched the BabyRoo TN300 open warmer, designed for delivery rooms and neonatal intensive care units, offering advanced thermoregulation, automated respiratory support, and family-centered care, and integrating with the Dräger Babylog neonatal ventilator to enhance postnatal and neonatal care.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates neonatal ventilators as medical devices through its Center for Devices and Radiological Health (CDRH). It oversees device safety, efficacy, labeling, manufacturing quality, clinical evaluations, and post-market surveillance to ensure respiratory support systems are safe and effective for newborns.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) regulates neonatal ventilators to ensure safety, efficacy, and quality. It oversees device approvals, clinical evaluation, manufacturing compliance, and post-market monitoring while investigating incidents and enforcing recalls to maintain safe hospital use of neonatal respiratory devices.

- In China, the National Medical Products Administration (NMPA) regulates neonatal ventilators, ensuring compliance with safety, performance, and quality standards. It reviews clinical trials, technical documentation, and manufacturing practices, oversees device registration, and monitors post-market adverse events to promote safe adoption of neonatal respiratory technologies.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates neonatal ventilators under the Ministry of Health & Family Welfare. It oversees device approval, quality compliance, clinical testing, import licensing, and post-market surveillance to ensure ventilators are safe, effective, and suitable for hospital use.

Competitive Landscape

Major players operating in the neonatal ventilators industry are expanding their product portfolios through strategic acquisitions of established ventilator lines to strengthen their presence in respiratory care.

They are focusing on broadening their range of ventilators to address diverse neonatal needs, from basic respiratory support to advanced and high-frequency ventilation. Additionally, they are leveraging acquisitions to enhance distribution networks, improve market reach and provide a more comprehensive set of respiratory solutions.

- In February 2024, the Karnataka Health Department of India launched a dedicated neonatal ambulance service equipped with advanced life support systems, including ventilators and incubators, to ensure safe transportation of premature and critically ill infants to specialized healthcare facilities.

Key Companies in Neonatal Ventilators Market:

- AVI Healthcare Private Limited

- Medtronic

- Drägerwerk AG & Co. KGaA

- GINEVRI

- Getinge

- ZOLL Medical Corporation

- Fisher & Paykel Healthcare Limited

- ResMed Private Limited

- Inspiration Healthcare Group plc

- Air Liquide Medical Systems

- ICU Medical, Inc

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- SIARE ENGINEERING INTERNATIONAL GROUP S.p.A

- Breas Medical AB

- aXcent medical GmbH

Recent Developments (Product Launch)

- In October 2024, Dräger India launched the BabyRoo TN300 open warmer, designed for delivery rooms and neonatal intensive care units, offering advanced thermoregulation, automated respiratory support, and family-centered care, and integrating with the Dräger Babylog neonatal ventilator to enhance postnatal and neonatal care.

In October 2024,