Market Definition

The market encompasses the development, production, and distribution of drugs and treatments aimed at managing narcolepsy, a chronic sleep disorder. This market includes medications for controlling Excessive Daytime Sleepiness (EDS), cataplexy, and other related symptoms of narcolepsy.

It involves pharmaceutical companies, healthcare providers, and research organizations focused on advancing therapies and improving the quality of life for individuals with narcolepsy. The report outlines the major factors driving the market, along with key drivers and the competitive landscape shaping the growth trajectory over the forecast period.

Narcolepsy Therapeutics Market Overview

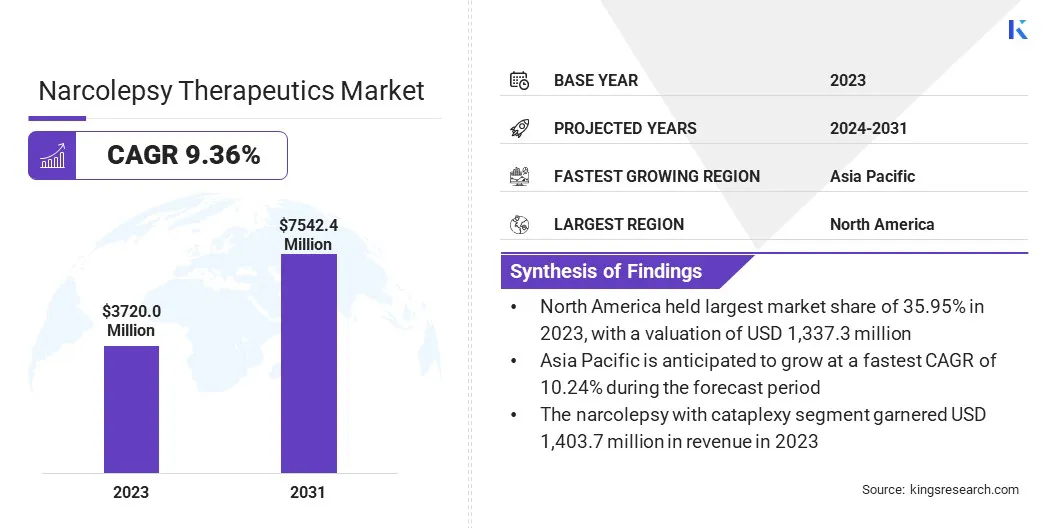

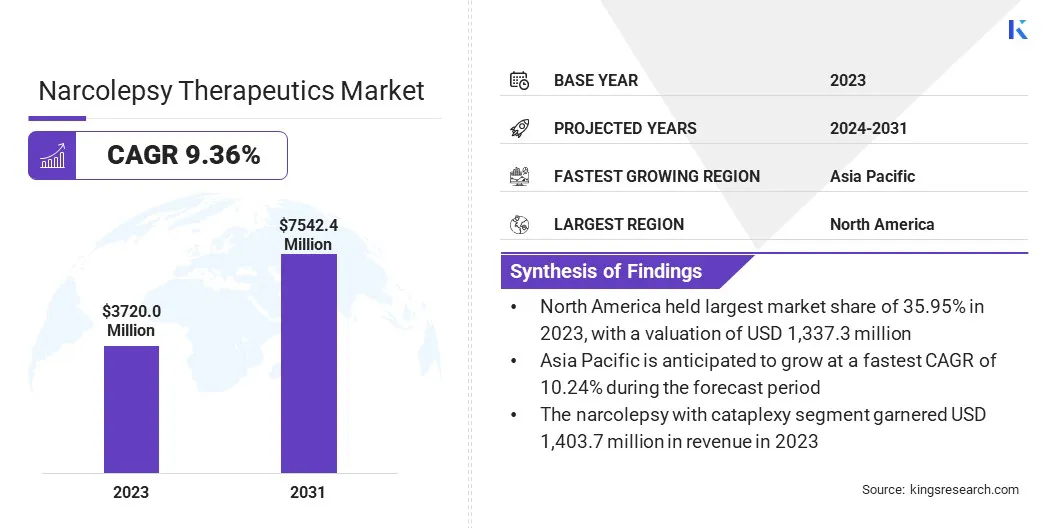

The global narcolepsy therapeutics market size was valued at USD 3,720.0 million in 2023 and is projected to grow from USD 4,032.1 million in 2024 to USD 7,542.4 million by 2031, exhibiting a CAGR of 9.36% during the forecast period.

This market is registering significant growth driven by the increasing prevalence of narcolepsy globally, rising awareness about the disorder, and advancements in treatment options. Growing research investments are leading to the development of novel drugs targeting the core symptoms of narcolepsy, such as EDS and cataplexy.

Additionally, the expansion of healthcare infrastructure and improved access to healthcare services are contributing to the market's expansion. The approval of new, more effective medications and therapies is also boosting the market.

Major companies operating in the narcolepsy therapeutics industry are Jazz Pharmaceuticals, Inc., Eisai Inc., Harmony Biosciences, Avadel, Axsome Therapeutics, Inc., Novartis AG, Merck KGaA, Amneal Pharmaceuticals LLC., XWPharma Ltd., Suven Life Sciences Limited, Centessa Pharmaceuticals plc, Zevra Therapeutics, Inc., Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd, and NLS Pharmaceutics.

Furthermore, the rise in clinical trials and collaborations between pharmaceutical companies and research organizations is accelerating the introduction of drugs, providing more targeted and personalized treatment options. Rising awareness and diagnosis rates are further anticipated to boost the market, with a focus on enhancing patient outcomes and quality of life.

- In June 2024, Harmony Biosciences announced the U.S. Food and Drug Administration (FDA) approval of WAKIX (pitolisant) for the treatment of EDS in pediatric patients aged 6 years and older with narcolepsy. This makes WAKIX the first and only non-scheduled treatment option for pediatric narcolepsy patients.

Key Highlights

- The narcolepsy therapeutics industry size was valued at USD 3,720.0 million in 2023.

- The market is projected to grow at a CAGR of 9.36% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 1,337.3 million.

- The narcolepsy with cataplexy segment garnered USD 1,403.7 million in revenue in 2023.

- The central nervous system stimulants segment is expected to reach USD 2,156.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.24% during the forecast period.

Market Driver

"Increasing Prevalence of Narcolepsy and Adoption of Digital Health Tools"

The narcolepsy therapeutics market is registering significant growth, due to the rising prevalence of narcolepsy, a chronic neurological disorder. The rising awareness of the condition is encouraging people to seek medical attention for its symptoms like EDS and cataplexy.

This growing awareness has driven the demand for effective treatments, as patients and healthcare providers are looking for therapies that can manage symptoms and improve quality of life. In addition, the adoption of digital health tools is playing a crucial role in the management of narcolepsy.

Wearable devices, mobile apps, and remote monitoring technologies are being increasingly utilized to track sleep patterns, alertness levels, and overall well-being of patients in real time.

These digital tools provide valuable data that can aid in treatment decisions, allowing for more personalized and precise management of the disorder. Digital health tools are enhancing patient outcomes and contributing to the market growth by improving diagnostic accuracy and treatment adherence.

- In April 2024, Aculys Pharma, Inc. and Four H, Inc. announced their research collaboration to explore the use of wearable devices for assessing narcolepsy and EDS associated with Obstructive Sleep Apnea Syndrome (OSAS) in Japan. The partnership aims to develop digital biomarkers by collecting data on patients' sleep, activities, and heart rate, for improving the understanding and treatment of sleep disorders.

Market Challenge

"Challenges in Diagnosing Narcolepsy and Developing Effective Treatments"

A significant challenge in the narcolepsy therapeutics market is the lack of comprehensive understanding of the underlying causes and mechanisms of narcolepsy. Narcolepsy is primarily caused by the loss of orexin-producing neurons in the brain; however, the exact triggers and processes behind this neuronal loss are still not fully understood.

This lack of clarity has slowed the development of targeted treatments that could address the root cause of the disorder, rather than just managing the symptoms. As a result, current treatment options mainly focus on alleviating EDS and cataplexy, but they do not restore the lost orexin function or prevent the progression of the disease.

The limited understanding of the disease's pathophysiology also presents challenges for early diagnosis, making it difficult to detect narcolepsy at an early stage, particularly before the onset of severe symptoms. As a result, many patients are diagnosed later in the course of the disease, which may impact treatment efficacy and overall quality of life.

Increased research into the molecular and genetic underpinnings of narcolepsy is essential to overcome this challenge. Advancing knowledge about the disease mechanisms can lead to the development of more precise, disease-modifying therapies.

Market Trend

"Personalized Medicine and Combination Therapies"

The narcolepsy therapeutics market is registering notable trends that influence its treatment. One of the key trends is the shift toward personalized medicine, which focuses on tailoring treatments to the specific needs of individual patients.

This approach considers various factors, including genetic makeup, comorbidities, and the severity of symptoms, to optimize treatment effectiveness and minimize adverse effects. Personalized medicine aims to enhance treatment outcomes by offering more precise and targeted therapies for narcolepsy patients.

Another significant trend is the increased focus on combination therapies. Narcolepsy is a complex disorder with multiple symptoms. Combination therapies aim to address various aspects of the condition simultaneously.

Such therapies can provide aid in the management of the disorder by using multiple treament strategies, improving overall symptom control and quality of life for patients. This trend reflects the need for more holistic approaches to treating narcolepsy and ensuring long-term management of the disorder.

- In April 2024, Beacon Biosignals and Takeda announced their strategic collaboration to advance neurobiomarkers and endpoints for sleep disorders. The partnership focused on utilizing Beacon’s FDA-cleared Dreem 3S EEG headband and AI-powered analytics to support clinical trials for sleep disorders, including narcolepsy, and improve the diagnostic journey for patients.

Narcolepsy Therapeutics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Treatment

|

Narcolepsy with cataplexy, Narcolepsy without cataplexy, Secondary narcolepsy

|

|

By Product

|

Central nervous system stimulants, Selective serotonin reuptake inhibitor , Tricyclic antidepressants, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Treatment (Narcolepsy with cataplexy, Narcolepsy without cataplexy, Secondary narcolepsy): The narcolepsy with cataplexy segment earned USD 1,403.7 million in 2023, due to the high demand for treatments that manage both EDS and cataplexy symptoms effectively.

- By Product (Central nervous system stimulants, Sodium Oxybate, Selective serotonin reuptake inhibitor, Tricyclic antidepressants, Others): The central nervous system stimulants segment held 28.47% share of the market in 2023, due to their widespread use in managing daytime sleepiness and improving alertness in narcolepsy patients.

Narcolepsy Therapeutics Market Regional Analysis

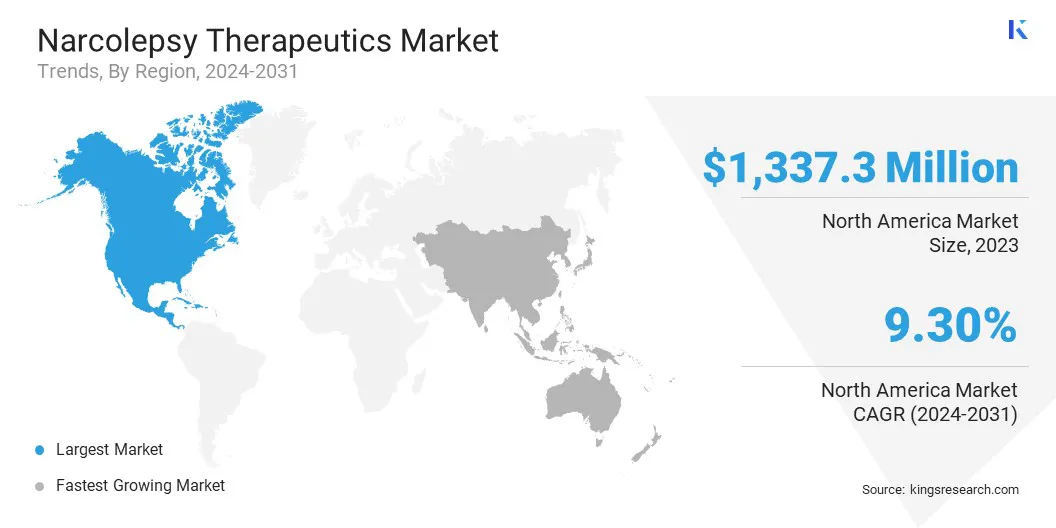

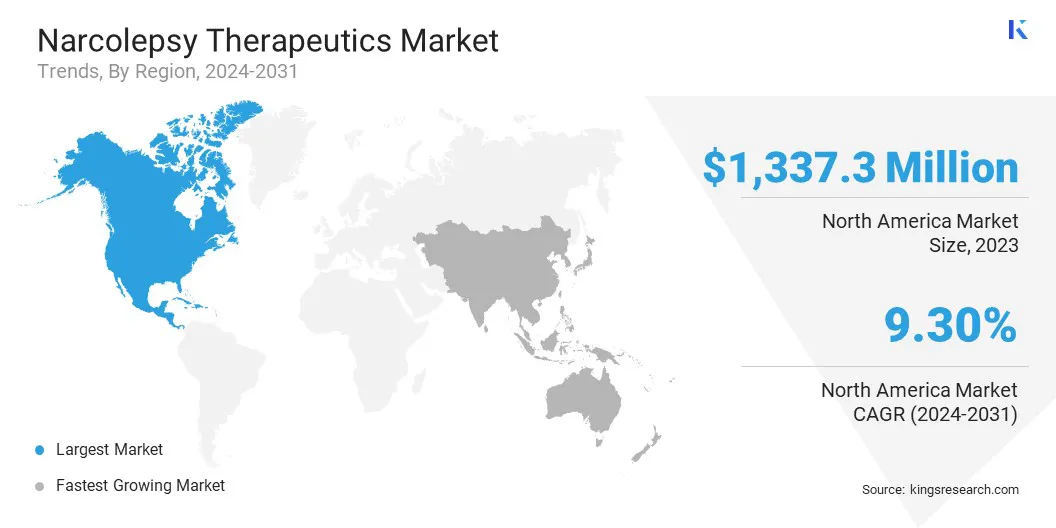

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America narcolepsy therapeutics market share stood around 35.95% in 2023, with a valuation of USD 1,337.3 million. This dominance can be attributed to the high awareness and early diagnosis of narcolepsy, leading to increased demand for effective treatments.

The dominant market share of the region is largely attributed to the U.S., where a well-established healthcare system, widespread insurance coverage, and strong support for neurological research significantly contribute to the market growth.

Approval of advanced treatments like sodium oxybate and CNS stimulants by the U.S. Food and Drug Administration (FDA) has enhanced the accessibility and acceptance of these therapies.

Additionally, public awareness campaigns and patient advocacy groups in North America have raised awareness, resulting in improved diagnosis rates and timely treatment. The robust presence of pharmaceutical giants in the region also facilitates the development and distribution of innovative narcolepsy therapies.

- In June 2023, Avadel Pharmaceuticals announced the U.S. commercial launch of LUMRYZ (sodium oxybate), the first and only once-at-bedtime oxybate for the treatment of cataplexy and EDS in adults living with narcolepsy.

Asia Pacific narcolepsy therapeutics industry is expected to register the fastest growth in the market, with a projected CAGR of 10.24% over the forecast period. The market is driven by rising healthcare investments, improved access to medical treatments, and a growing focus on neurological disorders in emerging economies.

In countries like China, Japan, and India, the increasing prevalence of narcolepsy, combined with improvements in diagnostics and patient access to therapies, is driving the market. The region’s growing middle-class population, with higher disposable income and healthcare spending, is also creating a larger patient base for narcolepsy treatments.

Furthermore, the market in Asia Pacific benefits from the rapid adoption of advanced technologies in the healthcare sector, leading to enhanced treatment options and better disease management.

A key factor contributing to the growth is the rising number of clinical trials and partnerships between global & local pharmaceutical companies, which are accelerating the development of more targeted and innovative therapies for narcolepsy.

The region is expected to continue its upward trajectory in the market, due to the improving healthcare infrastructure and an expanding pool of healthcare professionals trained to diagnose and manage sleep disorders.

Regulatory Frameworks

- In the U.S., narcolepsy therapeutics are regulated by the FDA, which ensures that all medications for narcolepsy, including wakefulness-promoting agents and other treatment options, meet safety and efficacy standards. The Center for Drug Evaluation and Research (CDER) is responsible for evaluating new treatments for narcolepsy, while the Orphan Drug Act provides incentives for the development of treatments for rare diseases like narcolepsy.

- In the European Union, narcolepsy therapeutics is regulated under the European Medicines Agency (EMA), which evaluates and approves medications for narcolepsy across EU member states. The European Union Clinical Trials Regulation ensures that clinical trials for new narcolepsy treatments comply with safety and ethical standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the approval and regulation of drugs used in the treatment of narcolepsy, ensuring they adhere to Japanese healthcare standards.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates pharmaceutical products, including those for narcolepsy, and ensures that all drugs are safe, effective, and available in the market.

Competitive Landscape

The narcolepsy therapeutics industry is characterized by key players focusing on strategic initiatives such as product innovation, strategic partnerships, and expanding their product portfolios to maintain market leadership.

Several companies are investing heavily in Research and Development (R&D) to create more targeted and effective therapies, with a focus on improving the safety and efficacy of existing treatments. Collaboration with research institutions, universities, and healthcare providers is a common strategy to enhance the development and delivery of innovative therapeutics.

In addition to R&D, companies are increasingly pursuing mergers and acquisitions to broaden their market presence and access new technologies. Expanding into emerging markets is another key approach, as companies look to tap into regions with growing demand for narcolepsy treatments.

Some market players are also focusing on expanding their distribution networks and improving patient access to therapies through enhanced support services and educational initiatives to strengthen their market positions.

- In April 2024, Teijin Pharma Limited and Bioprojet announced their exclusive global licensing agreement. The partnership focused on developing a new orexin receptor 2 agonist investigational candidates for the treatment of narcolepsy. This candidate, discovered by Teijin Pharma, is designed to address the orexin deficiency associated with narcolepsy, which causes EDS and cataplexy. Bioprojet, known for its success in developing narcolepsy treatments, will have global rights to research, develop, manufacture, and commercialize the candidate.

List of Key Companies in Narcolepsy Therapeutics Market:

- Jazz Pharmaceuticals, Inc.

- Eisai Inc.

- Harmony Biosciences

- Avadel

- Axsome Therapeutics, Inc.

- Novartis AG

- Merck KGaA

- Amneal Pharmaceuticals LLC.

- XWPharma Ltd.

- Suven Life Sciences Limited

- Centessa Pharmaceuticals plc

- Zevra Therapeutics, Inc.

- Hikma Pharmaceuticals PLC

- Teva Pharmaceutical Industries Ltd

- NLS Pharmaceutics

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In October 2024, Avadel Pharmaceuticals announced the FDA approval of LUMRYZ (sodium oxybate) extended-release oral suspension for the treatment of cataplexy or EDS in pediatric patients aged 7 years and older with narcolepsy. The approval includes Orphan Drug Exclusivity, marking a significant expansion of LUMRYZ into the pediatric narcolepsy population.

- In August 2024, Avadel Pharmaceuticals plc announced the publication of post-hoc analysis data from the pivotal Phase 3 REST-ON clinical trial, demonstrating that LUMRYZ (sodium oxybate) extended-release oral suspension resulted in greater weight loss in patients with narcolepsy compared to placebo. The study highlighted a significant reduction in Body Mass Index (BMI) and weight among participants treated with LUMRYZ, with nearly one in five experiencing clinically meaningful weight loss.

- In June 2024, Takeda presented positive results from its Phase 2b trial of TAK-861 for narcolepsy type 1 (NT1) at SLEEP 2024. The trial demonstrated statistically significant and clinically meaningful improvements in EDS and cataplexy, with TAK-861 being well tolerated. Takeda plans to initiate Phase 3 trials in the first half of fiscal year 2024, following the FDA’s Breakthrough Therapy designation for TAK-861.