Market Definition

The market refers to devices and systems designed with interchangeable and customizable components. These instruments can be adapted for various applications, allowing users to configure and reconfigure their systems based on their specific needs.

The report provides a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to influence the growth dynamics throughout the forecast period.

Modular Instruments Market Overview

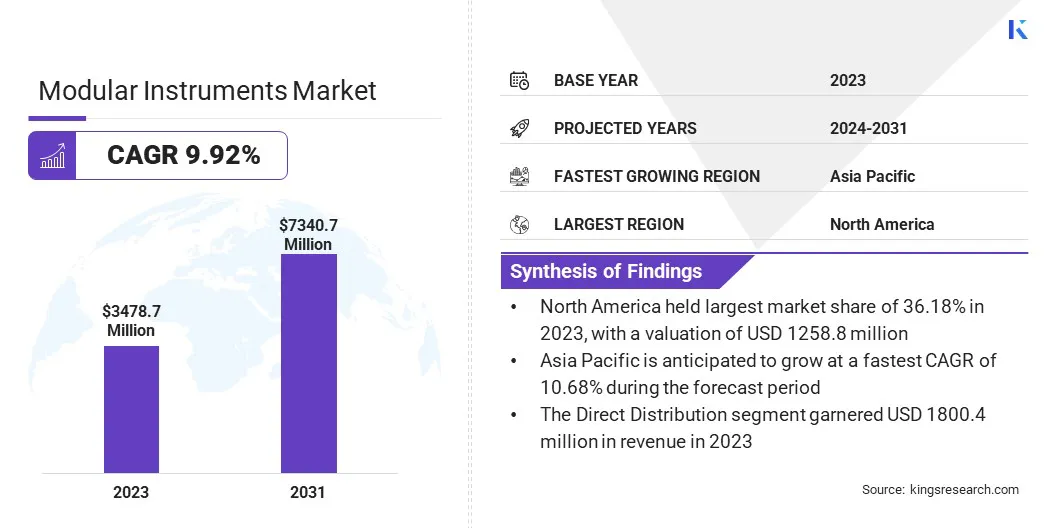

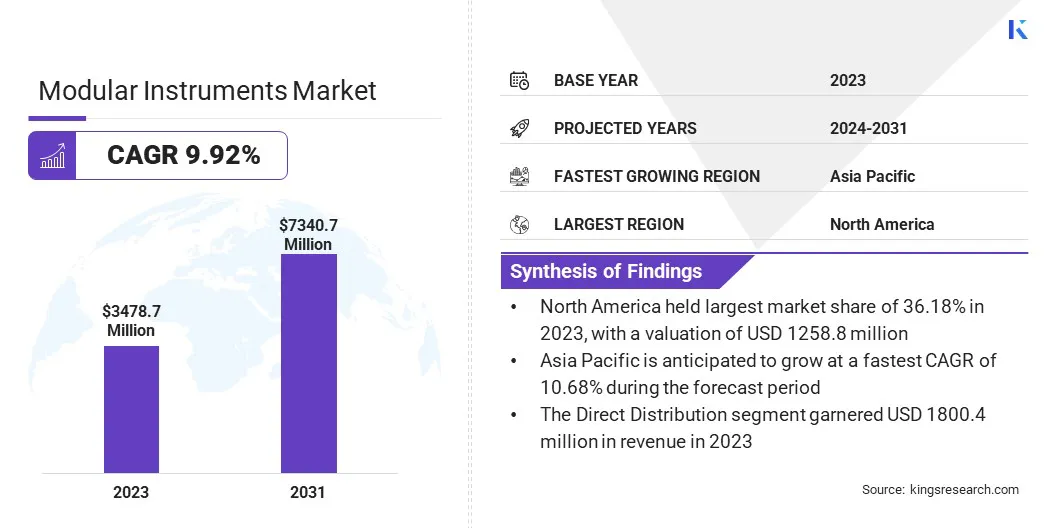

Global modular instruments market size was valued at USD 3478.7 million in 2023, which is estimated to be valued at USD 3787.3 million in 2024 and reach USD 7340.7 million by 2031, growing at a CAGR of 9.92% from 2024 to 2031.

The increasing demand for customizable test setups is driving growth in the market. Industries like electronics, automotive, and telecommunications rely on flexible solutions to meet specific testing needs, including adapting to new technologies and evolving standards.

Major companies operating in the modular instruments industry are Keysight Technologies, NATIONAL INSTRUMENTS CORP., VIAVI Solutions Inc., Astronics Corporation, AMETEK Magnetrol USA, LLC., Pickering Interfaces Ltd, Test Evolution, Chrome ATE Inc., Marvin Test Solutions, Inc., and Signal Craft Technologies.

The market is expanding rapidly, driven by the need for flexible, scalable, and customizable testing solutions across various industries, particularly in the automotive industry.

With the growth of the electric vehicle (EV) market, there is an increasing demand for testing complex systems such as battery management, powertrains, and autonomous vehicle technologies.

- According to the International Energy Agency (IEA), electric vehicle (EV) sales reached nearly 14 million units in 2023. As a result, the share of electric cars in total vehicle sales has increased significantly, accounting for approximately 18.5% of global sales in 2023.

Modular instruments offer significant advantages in meeting these testing requirements. They provide adaptable solutions that support automation and integration with AI and IoT. These features enable efficient, high-performance testing in industries focused on innovation and technological advancements.

Key Highlights:

- The modular instruments industry size was recorded at USD 3478.7 million in 2023.

- The market is projected to grow at a CAGR of 9.92% from 2024 to 2031.

- North America held a market share of 36.18% in 2023, with a valuation of USD 1258.8 million.

- The PXI and PXIE segment garnered USD 1549.8 million in revenue in 2023.

- The direct distribution segment is expected to reach USD 3895.7 million by 2031.

- The telecommunications segment is anticipated to witness fastest CAGR of 10.63% during the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 10.68% during the forecast period.

Market Driver

"Demand for Customization"

Customization is a key growth driver for the modular instruments market, as industries like electronics, automotive, and telecommunications increasingly require tailored testing solutions. Modular instruments offer flexibility, enabling businesses to design test setups that cater to specific requirements.

This adaptability is particularly crucial in automotive, where testing complex systems such as powertrains, battery management, and autonomous driving technologies demands specialized equipment. As these industries advance, the demand for customizable solutions is expected to further drive the growth of the market.

- In July 2024, Microair launched the T3000 skySuite, a customizable modular avionics system. T3000 skySuite is designed for light sports and general aviation and offers flexible configurations with integrated components, highlighting the growing demand for personalized, adaptable solutions in the market.

Market Challenge

"Compatibility Issues"

One of the key challenges in the modular instruments market is ensuring compatibility between modules from different vendors. This can result in integration issues, requiring additional time and effort to achieve seamless communication and performance.

To address this, manufacturers are increasingly adopting standardized platforms, such as PXI and LXI to promote interoperability. Additionally, offering detailed documentation, software integration tools, and modular ecosystems can help users address compatibility concerns, ensuring efficient testing setup across products from various vendors.

Market Trend

"Integration with Software Tools"

A prominent trend in the modular instruments market is the integration of systems with advanced software tools, which enhance automation, data analysis, and system control. This integration streamlines testing processes, enhance accuracy, and improve overall efficiency.

By combining hardware flexibility with powerful software platforms, manufacturers are able to create customized test setups. This enables the automation of complex tasks and real-time analysis of large datasets, driving advancements in testing processes across industries.

- In May 2023, NI launched its Software-Defined Battery Lab solution, a significant development in the market. This innovative solution improves battery validation by offering customizable, scalable testing systems. It integrates both software and hardware to accelerate the testing and development processes for EV manufacturers.

Modular Instruments Market Report Snapshot

|

Segmentation

|

Details

|

|

By Platform

|

PXI and PXIE, Benchtop, 19 Inch, VXI

|

|

By Distribution Channel

|

Direct Distribution, Indirect Distribution, Others

|

|

By End Use

|

Telecommunications, Aerospace & Defense, Automotive, Transportation, Electronics, Semiconductor, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Platform (PXI and PXIE, Benchtop, 19 Inch, VXI): The PXI and PXIE segment earned USD 1549.8 million in 2023 due to increased demand for high-performance modular instruments in testing and automation across various industries.

- By Distribution Channel (Direct Distribution, Indirect Distribution, Others): The direct distribution segment held 51.75% of the market in 2023, due to its streamlined access to modular instruments and its ability to meet customer needs for flexibility and cost-efficiency.

- By End Use (Telecommunications, Aerospace & Defense, Automotive, Transportation, Electronics, Semiconductor, Others): The telecommunications segment is projected to reach USD 2008.9 million by 2031, owing to the growing demand for modular instruments in 5G infrastructure expansion, network testing, and high-speed data applications.

Modular Instruments Market Regional Analysis

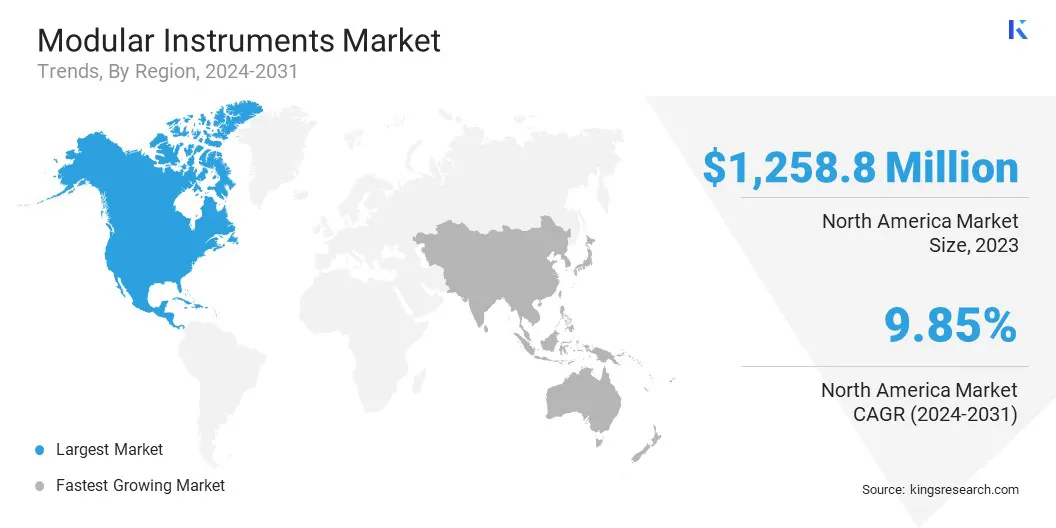

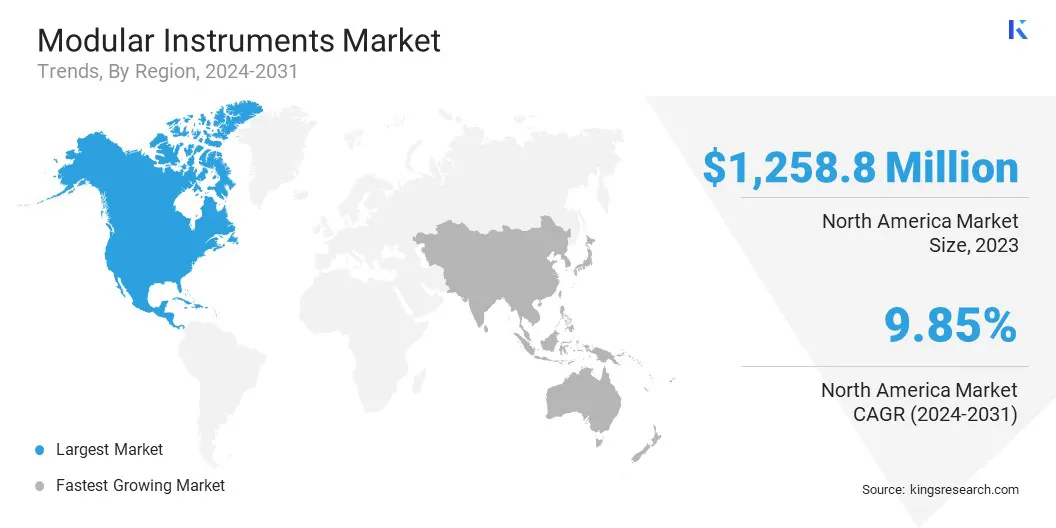

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America modular instruments market share stood around 36.18% in 2023 in the global market, with a valuation of USD 1258.8 million. This dominance is attributed to the region’s advanced industrial ecosystem, widespread adoption of automation, and a strong presence of key players driving innovation in testing technologies.

Sectors such as aerospace, defense, and automotive are increasingly adopting automated and high-performance testing solutions, further boosting the demand in this region. Additionally, significant investments in R&D and the integration of AI and IoT into testing processes continue to strengthen North America’s leadership in the global market.

Asia Pacific Modular Instruments industry is poised for significant growth at a robust CAGR of 10.68% over the forecast period. Countries like China, India, and Japan are rapidly expanding their manufacturing capabilities, boosting growth in sectors like telecommunications, electronics, and automotive.

The region’s focus on advancing technologies, such as 5G and IoT, increases demand for modular testing solutions. Furthermore, the ongoing industrialization, drives the market in Asia Pacific.

Regulatory Frameworks

- In the US, the Environmental Protection Agency (EPA) protects public health and the environment by enforcing regulations on emissions, recycling, waste disposal, and conducting research to mitigate environmental risks.

- In the EU, modular instruments must comply with CE marking requirements, indicating they meet high safety, health, and environmental protection standards for products traded in the European Economic Area (EEA).

Competitive Landscape

In the modular instruments industry, companies are increasingly focusing on enhancing product performance, scalability, and flexibility. They are developing high-performance controllers, expanding connectivity options, and integrating advanced software solutions to meet the growing demands of industries like aerospace, defense, telecommunications, and automotive.

These advancements are designed to optimize test and measurement applications, offering cost-effective and future-proof solutions that meet the evolving technological requirements of various sectors.

- In Nov 2024, Pickering Interfaces unveiled a next-generation single-slot PXIe embedded controller at Electronica 2024 in Munich, Germany. This controller offers 2x performance improvements, making it ideal for high-bandwidth T&M applications and supporting demanding future-ready PCIe Gen4 interconnectivity.

List of Key Companies in Modular Instruments Market:

- Keysight Technologies

- NATIONAL INSTRUMENTS CORP.

- VIAVI Solutions Inc.

- Astronics Corporation

- AMETEK Magnetrol USA, LLC.

- Pickering Interfaces Ltd

- Test Evolution

- Chrome ATE Inc.

- Marvin Test Solutions, Inc.

- Signal Craft Technologies

Recent Developments (M&A/New Product Launch)

- In July 2024, Agilent Technologies acquired Sigsense, an AI-driven startup, enhancing its CrossLab Connect platform. This acquisition aims to optimize lab operations by improving the monitoring and performance of scientific instruments, including modular test and measurement solutions.

- In November 2023, EDGE launched the X RANGE, a multi-domain testing facility in the UAE, offering advanced modular testing capabilities for defence, aerospace, and commercial products. It aims to enhance testing for diverse military and security applications.