Market Definition

The market encompasses solutions for real-time video monitoring and recording in mobile environments. It includes imtegrated cameras, storage devices, wireless communication technologies, and monitoring software used across sectors law enforcement, transportation, emergency services, and commercial fleets.

The report provides insights into the key factors of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Mobile Video Surveillance Market Overview

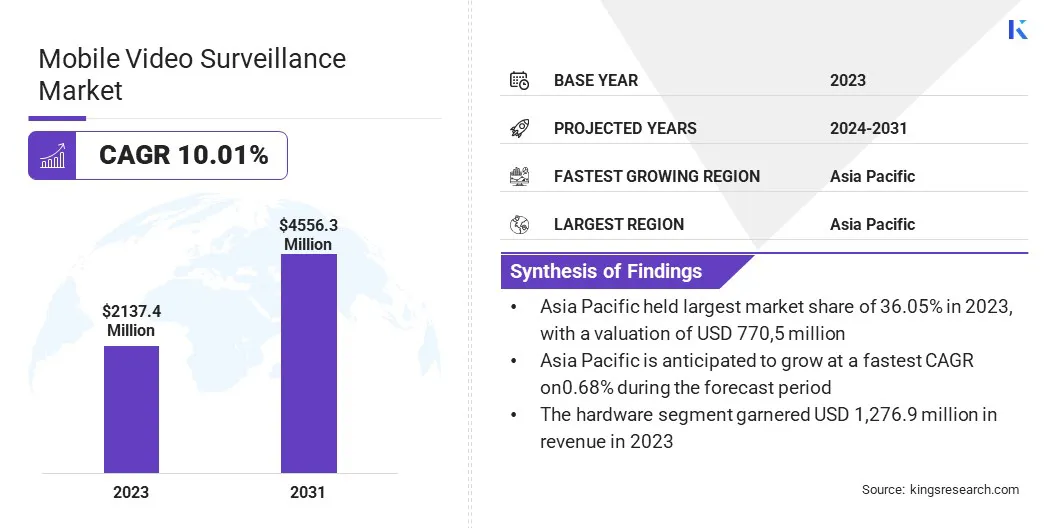

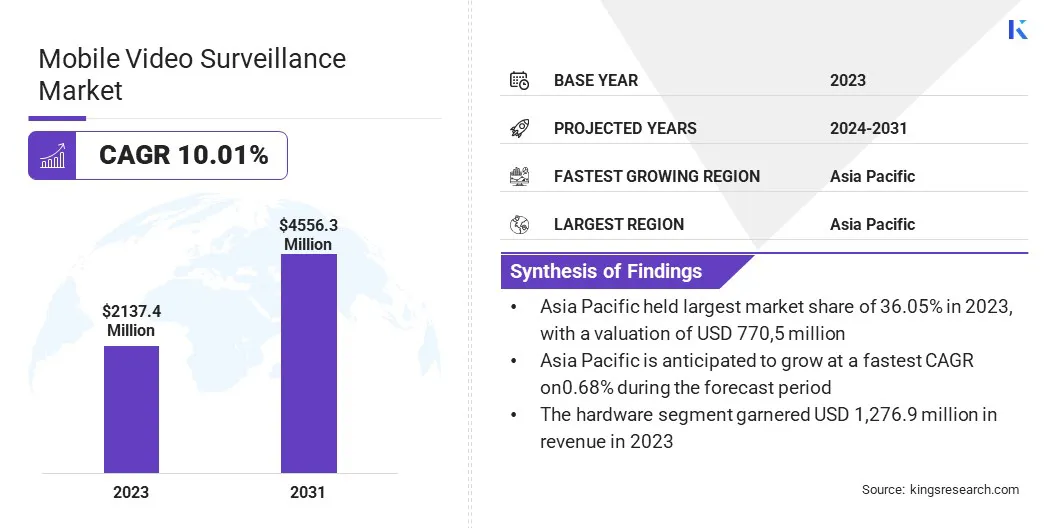

The global mobile video surveillance market size was valued at USD 2,137.4 million in 2023 and is projected to grow from USD 2,337.1 million in 2024 to USD 4,556.3 million by 2031, exhibiting a CAGR of 10.01% during the forecast period.

This growth is fueled by the rising demand for advanced security and real-time situational awareness across mobile and remote environments. The widespread deployment of high speed mobile networks, including 4G LTE and 5G, is facilitating seamless video transmission and remote monitoring capabilities.

Major companies operating in the mobile video surveillance industry are Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd, Honeywell International Inc., Axis Communications AB, Robert Bosch GmbH, Panasonic Holdings Corporation, Hanwha Group, Verkada Inc., Motorola Solutions, Inc., Eagle Eye Networks, Milestone Systems A/S, Rhombus Systems, Verint Systems Inc., Videoloft, and Genetec Inc.

Technological innovation in high resolution imaging, AI driven video analytics, and edge computing is enabling more intelligent, responsive, and autonomous surveillance systems. Furthermore, growing investments in smart city infrastructure and mobility modernization initiatives are boosting the adoption of mobile surveillance technologies for applications such as urban traffic management, crowd monitoring, and incident response.

- In March 2025, Johnson Controls introduced upgraded enterprise access control and video surveillance solutions at ISC West 2025, including the C CURE IQ 3.10 platform with enhanced mapping, advanced video management, and edge AI analytics.

Key Highlights

- The mobile video surveillance market size was valued at USD 2,137.4 million in 2023.

- The market is projected to grow at a CAGR of 10.01% from 2024 to 2031.

- Asia Pacific held a market share of 10.68% in 2023, with a valuation of USD 770.5 million.

- The hardware segment garnered USD 1,276.9 million in revenue in 2023.

- The transport vehicles segment is expected to reach USD 1,735.9 million by 2031.

- The transportation segment is projected to generate a revenue of USD 1,837.5 million by 2031.

- North America is anticipated to grow at a CAGR of 10.03% over the forecast period.

Market Driver

Growing Need for Remote Monitoring and Security

The growth of the market is fueled by the increasing need for remote monitoring and enhanced security across industries, particularly in transportation and logistics. As businesses seek to improve operational efficiency and ensure safety, the demand for real-time surveillance solutions has surged.

Remote monitoring capabilities enable industries to track vehicles, assets, and personnel in real-time, reducing the risk of theft, accidents, and operational disruptions. This growing reliance on mobile video surveillance for secure, on-the-go monitoring is transforming security management by offering a more efficient and scalable solution for monitoring large, dispersed operations.

- In December 2024, Nokia launched the world’s first 5G-enabled 360° camera for industrial use. The camera is designed for harsh industrial environments and offers 8K streaming with low-latency 360° video and spatial audio over 5G, Wi-Fi, and Ethernet. It also integrates with Nokia's Real-time eXtended Reality Multimedia software, providing a complete solution for real-time remote monitoring, situational awareness, and teleoperation.

Market Challenge

Data Privacy and Security Concerns

A major challenge hindering the expansion of the mobile video surveillance market is the growing concern over data privacy and security. As surveillance systems collect and transmit large volumes of sensitive video data, there is an increased risk of unauthorized access, data breaches, and misuse of personal information.

This is particularly concerning in sectors such as transportation, where monitoring vehicles and passengers involves handling sensitive footage.

To address these concerns, companies are focusing on implementing robust encryption methods, secure cloud storage, and advanced authentication protocols to ensure the safety and privacy of video data. Additionally, integrating AI-based analytics allows for data processing at the edge, reducing the need to transmit sensitive footage and further enhancing security.

Market Trend

Integration of AI-Powered Video Analytics

The market is experiencing a major trend toward the integration of AI-powered video analytics, enhancing real-time video processing and decision-making. By incorporating artificial intelligence, these surveillance systems can automatically analyze video feeds to detect anomalies, recognize patterns, and generate actionable insights in real time.

This technology improves the speed and accuracy of threat detection, reduces the need for manual monitoring, and enables faster responses to incidents. The shift toward AI-driven solutions is increasing the efficiency of video surveillance systems and providing industries with smarter, more effective security solutions.

- In September 2024, Hanwha Vision unveiled a range of AI-powered, cloud-connected video surveillance solutions at GSX 2024. The launch featured multi-directional AI cameras, an AI PTRZ camera built on the NVIDIA Jetson platform, and an AI Box enabling real-time analytics for non-AI cameras. Cloud platforms such as OnCloud, DMPro, and SightMind were also introduced to support remote surveillance management and data-driven decision-making.

Mobile Video Surveillance Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Hardware, Service

|

|

By Application

|

Transport Vehicles, Trains and Trams, Buses, Others

|

|

By Vertical

|

Military and Defense, Transportation, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software, Hardware, and Service): The hardware segment earned USD 1,276.9 million in 2023 due to the high demand for cameras, storage devices, and mobile recording units used in surveillance systems.

- By Application (Transport Vehicles, Trains and Trams, Buses, and Others): The transport vehicles segment held 38.91% of the market in 2023, propelled by the growing use of video surveillance in police cars, ambulances, and commercial fleets for safety and monitoring.

- By Vertical (Military and Defense, Transportation, Industrial, and Others): The transportation segment is projected to reach USD 1,837.5 million by 2031, fostered by increasing investments in smart transport systems and the need for real-time monitoring in public transit.

Mobile Video Surveillance Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific mobile video surveillance market accounted for a substantial share of 36.05% in 2023, valued at USD 770.5 million. This dominance is primarily attributed to rapid urbanization, large-scale investments in transportation infrastructure, and the increasing deployment of surveillance systems across densely populated cities.

Countries such as China, India, and Japan are actively implementing mobile surveillance in public transit systems, metro networks, and high-traffic urban zones to enhance safety and operational control. Additionally, the expansion of smart city initiatives and rising security concerns in industrial zones and logistics corridors are fueling demand for mobile surveillance solutions.

- In July 2023, D-Link launched Indigenous Series, a Made in India range of surveillance solutions,. This new range includes IP-based cameras and network video recorders designed and manufactured locally. The Indigenous Series offers feature-rich surveillance solutions tailored to meet the unique security needs of the Indian market, offering features such as two-way audio, night vision, and integration with the D-Link VISION App for seamless monitoring.

North America mobile video surveillance industry is expected to register the fastest CAGR of 10.03% over the forecast period. This growth is largely attributed to the high adoption of advanced surveillance technologies across law enforcement agencies, emergency response units, and commercial fleets.

The United States, in particular, is investing heavily in AI-powered surveillance, real-time video analytics, and fleet monitoring platforms to support public safety and logistics efficiency. The widespread deployment of 4G and 5G networks supports mobile video applications, while strong demand from school transportation, urban policing, and cross-border vehicle monitoring continues to bolster regional market expansion.

Regulatory Frameworks

- In the United States, mobile video surveillance systems are regulated by the Video Privacy Protection Act (VPPA), which governs the sharing of video footage, along with state-level privacy laws such as the California Consumer Privacy Act (CCPA).

- In the European Union, mobile video surveillance systems are regulated by the General Data Protection Regulation (GDPR), which establishes rules for data collection, retention, and consent regarding video footage.

- In China, mobile video surveillance systems are regulated by the Cybersecurity Law of the People's Republic of China, which specifies requirements for data storage, security, and access protocols.

- In Japan, mobile video surveillance systems are regulated by the Act on the Protection of Personal Information (APPI), which governs the collection, storage, and use of personal data captured by surveillance systems.

Competitive Landscape

The mobile video surveillance market is characterized by key players focusing on innovation, strategic partnerships, and portfolio expansion to strengthen their market presence. Leading companies are heavily investing in research and development to integrate advanced features such as AI-driven video analytics, real-time alerts, and cloud-based monitoring into their offerings.

Many are expanding their product lines to include compact, ruggedized hardware suitable for mobile environments, and modular systems that support flexible deployment across various vehicle types. Strategic collaborations with telecom providers, fleet operators, and security service firms are being formed to enhance system integration and expand market reach.

Additionally, firms are emphasizing geographic expansion through joint ventures and distribution agreements, particularly in emerging markets with growing demand for mobile surveillance solutions. Mergers and acquisitions are being employed to gain access to niche technologies, expand customer bases, and accelerate go-to-market timelines.

Subscription-based service models and video surveillance-as-a-service (VSaaS) are gaining traction as companies seek to generate recurring revenue and offer scalable solutions tailored to customer needs.

- In December 2024, Security 101 acquired Eos Business Surveillance Solutions. The acquisition aims to enhance Security 101’s capabilities in mobile surveillance solutions, particularly mobile surveillance trailers, and integrate Eos’s expertise in video surveillance and access control.

List of Key Companies in Mobile Video Surveillance Market:

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd

- Honeywell International Inc.

- Axis Communications AB

- Robert Bosch GmbH

- Panasonic Holdings Corporation

- Hanwha Group

- Verkada Inc.

- Motorola Solutions, Inc.

- Eagle Eye Networks

- Milestone Systems A/S

- Rhombus Systems

- Verint Systems Inc.

- Videoloft

- Genetec Inc.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, Neurotechnology launched updated versions of its SentiVeillance Cluster 10.0 and SentiVeillance SDK 10.0. The upgrades enhance biometric and object recognition video analytics, including support for Automated License Plate Recognition (ALPR), face recognition, and human/vehicle object tracking, targeting law enforcement and large-scale surveillance.

- In October 2024, i-PRO Co. Ltd. launched 19 new heavy-duty Aero PTZ camera models designed for extreme weather. These cameras feature edge AI analytics, 4K resolution, and advanced auto-tracking, making them suitable for mission-critical and mobile surveillance applications. Built to operate in extreme temperatures and harsh environments, the cameras also include cybersecurity features and support for multiple AI applications, enhancing their adaptability and reliability in demanding field conditions.

- In October 2024, GardaWorld Security Corporation signed a binding agreement to acquire Stealth Monitoring. T The acquisition combines proprietary technologies and complementary capabilities, enhancing the value and range of customer offerings.

- In August 2024, OMNIVISION introduced the OV50M40 image sensor, a 50-megapixel CMOS sensor for smartphones.It offers advanced video HDR capabilities, excellent low-light performance, and high-quality telephoto crop-zoom, making it suitable for front, main, ultra-wide, and telephoto camera applications in smartphones.