Market Definition

The market encompasses the global development, manufacturing, and distribution of audio mixing consoles used in professional applications such as live sound reinforcement, studio recording, broadcasting, and post-production.

It comprises a diverse range of analog and digital consoles serving audio engineers, studios, broadcasters, and production companies. The report examines critical market drivers, industry trends, and regional analysis, along with the regulatory frameworks influencing the market over the forecast period.

Mixing Console Market Overview

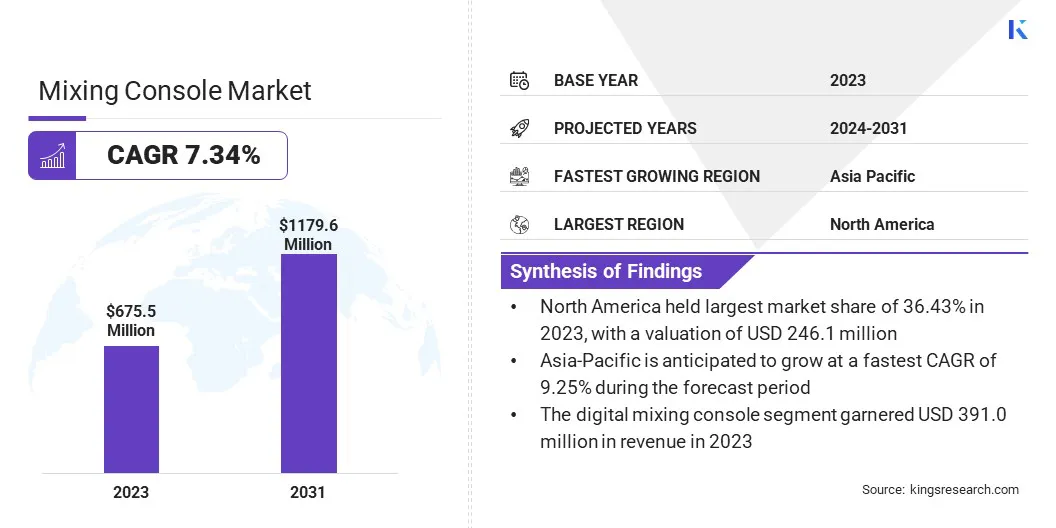

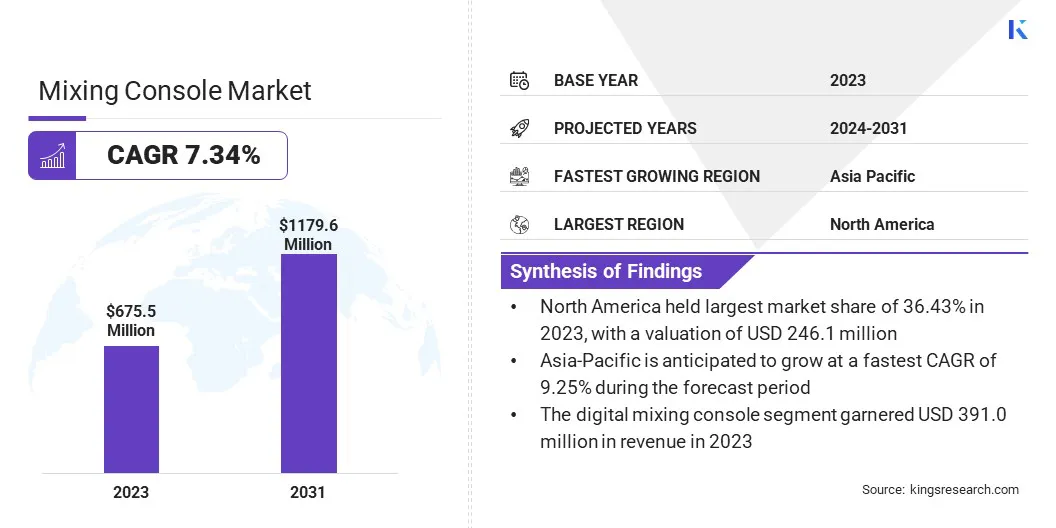

The global mixing console market size was valued at USD 675.5 million in 2023 and is projected to grow from USD 718.6 million in 2024 to USD 1,179.6 million by 2031, exhibiting a CAGR of 7.34% during the forecast period.

Market growth is driven by increasing demand for high-quality audio production across various industries, including music recording, live sound reinforcement, broadcasting, and film post-production. Technological advancements, such as the integration of digital signal processing (DSP), automation, and networked audio solutions, are further enhancing the capabilities and efficiency of modern mixing consoles.

Major companies operating in the mixing console industry are Yamaha Corporation., PreSonus Audio Electronics, Inc., RCF S.p.A., HARMAN International., Avid Technology, Inc., Loud Audio, LLC, STAGETEC, Roland Corporation, DiGiCo, LAWO, Solid State Logic, TEAC Corporation, Allen & Heath Limited, AEQ, and Music Tribe HQ FZE.

Moreover, the increasing prevalence of live streaming, podcasting, and home studio configurations has broadened the consumer base, propelling market expansion. The rapid growth of digital entertainment platforms, combined with rising investments in professional audio technology, is anticipated to boost the global demand for mixing consoles.

- In January 2025,TASCAM introduced the IF-ST2110 Expansion Card for its Sonicview 16XP/24XP digital mixing consoles, enhancing SMPTE ST 2110 AV network support for professional broadcast and production environments. The update enables low-latency IP-based workflows, improved auto mixer functions, and third-party protocol integration.

Key Highlights

- The mixing console industry size was recorded at USD 675.5 million in 2023.

- The market is projected to grow at a CAGR of 7.34% from 2024 to 2031.

- North America held a share of 36.43% in 2023, valued at USD 246.1 million.

- The digital mixing console segment garnered USD 391.0 million in revenue in 2023.

- The compact mixers segment is expected to reach USD 607.5 million by 2031.

- The live sound segment is anticipated to witness the fastest CAGR of 8.76% over the forecast period.

- The direct sales segment garnered USD 388.5 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 9.25% theough the projection period.

Market Driver

Increasing Demand for Live Sound Reinforcement

The increasing demand for live sound reinforcement is fueling the growth of the mixing console market, supported by the resurgence of concerts, music festivals, corporate events, and large-scale public gatherings. Rising demand for high-fidelity audio is highlighting the need advanced consoles that can precisely manage complex, multi-channel setups.

Growth in touring productions, large venues, and investments in cutting-edge sound systems further support this trend. Additionally, innovations such as networked audio, remote mixing, and AI-driven automation are enhancing efficiency and sound quality, reinforcing the importance of modern mixing consoles in live events.

- In October 2024, Waves Audio Ltd. introduced the eMotion LV1 Classic, a fully integrated live mixing console that combines the LV1 mix engine with a hardware workflow optimized for live sound engineers. Featuring stereo channels, 44 buses, and Waves’ Double Precision 32-bit floating point mixer engine, it delivers exceptional audio quality.

Market Challenge

High Initial Investment and Maintenance Costs

The high initial investment and maintenance costs associated with mixing consoles present a significant barrier to market growth, particularly for small studios, independent creators, and emerging professionals. Premium models with advanced DSP, automation, and networked audio features require substantial capital expenditure.

Ongoing costs, including software updates, firmware upgrades, and maintenance, further increase ownership expenses. Additionally, repairs and component replacements, particularly for digital consoles, can be costly and require specialized expertise, limiting accessibility and adoption.

To address this challenge, manufacturers are offering flexible financing options, leasing programs, and subscription-based models to make high-end mixing consoles more accessible.

Providing comprehensive training resources and user-friendly interfaces can reduce operational complexity, minimizing the need for costly technical support. Manufacturers can enhance product durability and offer extended warranty programs to reduce long-term maintenance expenses.

Market Trend

Shift Toward Digital and Networked Consoles

The shift toward digital and networked consoles is influencing the market, reflecting the need for greater flexibility, efficiency, and seamless integration. Digital consoles provide advanced features such as automation, digital signal processing (DSP), and direct compatibility with digital audio workstations (DAWs), enabling precise control and streamlined workflows.

Networked audio protocols such as Dante, AVB, and AES67 enable low-latency communication over IP networks, reducing cabling complexity and allowing remote control. This transition reduces reliance on complex analog cabling while enabling remote control and collaboration, allowing engineers to manage audio from virtually any location.

- In November 2023, TASCAM introduced the Sonicview digital recording and mixing consoles, featuring multi-environment touch screens. These consoles integrate modern digital processing with a flexible interface designed for professional audio applications. The Sonicview series aims to enhance workflow efficiency, offering seamless control and high-fidelity sound for live and studio settings.

Mixing Console Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Analog Mixing Consoles, Digital Mixing Console

|

|

By Console Size

|

Compact Mixers, Rack-Mountable Mixers, Full-Sized Consoles

|

|

By Application

|

Live Sound, Studio Recording, Broadcast, DJing

|

|

By Sales Channel

|

Direct Sales, Indirect Sales (retailers, distributors, online marketplaces)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Analog Mixing Consoles and Digital Mixing Console): The digital mixing console segment earned USD 391.0 million in 2023 due to advanced features, seamless integration, and increasing demand for high-quality audio production.

- By Console Size (Compact Mixers, Rack-Mountable Mixers, and Full-Sized Consoles): The compact mixers held a share of 48.52% in 2023, attributed to their portability, affordability, and growing use in home studios, live streaming, and small-scale productions.

- By Application (Live Sound, Studio Recording, Broadcast, and DJing): The live sound segment is projected to reach USD 546.2 million by 2031, fueled by the rising number of concerts, festivals, corporate events, and advancements in live audio technology.

- By Sales Channel (Direct Sales and Indirect Sales (retailers, distributors, and online marketplaces)): The indirect sales segment is anticipated to witness a fastest CAGR of 7.56% over the forecast period due to the expanding reach of online marketplaces, distributor networks, and retail channels, enhancing product accessibility and customer convenience.

Mixing Console Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America mixing console market share stood at around 36.43% in 2023, valued at USD 389.9 million. This dominance is reinforced by the strong presence of leading audio equipment manufacturers, well-established entertainment and media industries, and high adoption of advanced audio technologies.

The increasing demand for professional-grade audio solutions in live events, broadcasting, and studio recording is accelerating the adoption of mixing consoles. The rising popularity of home studios, podcasting, and live streaming has expanded the consumer base.

Government and corporate investments in high-quality audio infrastructure for events, conferences, and education sectors further bolster regional market expansion.

- In March 2025, Telos Alliance unveiled the Axia Altus SE, a cloud-ready virtual mixing console designed for professional broadcast applications. The new system offers enhanced flexibility, scalability, and seamless integration with IP-based workflows, making it ideal for remote production and distributed audio environments.

Asia-Pacific mixing console industry is set to grow at a robust CAGR of 9.25% over the forecast period. This expansion is supported by the growth of the entertainment and music industries, rising investments in live events, and increasing adoption of digital audio technologies.

The expanding network of recording studios, concert venues, and broadcasting stations is propelling demand for advanced mixing consoles. The rise of independent music production, podcasting, and digital content creation is further boosting regional market expansion.

Government initiatives to enhance media and entertainment infrastructure, along with the growing presence of global audio equipment manufacturers, are expected to further accelerate domestic market growth.

Regulatory Frameworks

- In the EU, the Electromagnetic Compatibility (EMC) Directive (2014/30/EU) requires that electrical and electronic equipment comply with regulations to prevent electromagnetic interference and ensure safe operation. The Waste Electrical and Electronic Equipment (WEEE) Directive mandates proper collection, treatment, and recycling of electronic waste to support a circular economy.

- In Japan, the Electrical Appliances and Materials Safety Act (PSE Law) regulates the safety of electrical equipment. It requires manufacturers and importers to meet strict conformity assessments and labeling requirements before market entry.

- In Australia and New Zealand, the Regulatory Compliance Mark (RCM) certifies that electrical equipment complies with safety and electromagnetic compatibility (EMC) standards under the Electrical Equipment Safety System (EESS) and Australian Communications and Media Authority (ACMA) regulations.

Competitive Landscape

The mixing console industry exhibits a highly competitive landscape, with key players prioritizing innovation, technological advancements, and strategic alliances to strengthen their market position. Manufacturers are investing in R&D to integrate AI-driven automation, enhance digital processing capabilities, and expand connectivity options.

Additionally, companies are diversifying their distribution networks, leveraging e-commerce platforms, and forming collaborations with recording studios, broadcasters, and live event organizers.

- In September 2024, RØDE introduced the RØDECaster Video, an all-in-one production console designed for professional audio and video workflows. Featuring integrated audio mixing, video switching, and effects, it streamlines content creation for live streaming, podcasting, and video production.

List of Key Companies in Mixing Console Market:

- Yamaha Corporation.

- PreSonus Audio Electronics, Inc.

- RCF S.p.A.

- HARMAN International.

- Avid Technology, Inc.

- Loud Audio, LLC

- STAGETEC

- Roland Corporation

- DiGiCo

- LAWO

- Solid State Logic

- TEAC Corporation

- Allen & Heath Limited

- AEQ

- Music Tribe HQ FZE.

Recent Developments (M&A/New Product Launch)

- In March 2025, Universal Audio Inc. acquired Studio Electronics Corp historic tube mixing console originally built for Caesars Palace in 1966. The acquisition highlights UA’s commitment to preserving its legacy while continuing to fostering innovation in music and audio production.

- In December 2024, Axios HQ acquired Mixing Board, a network of communications and marketing professionals, to enhance its internal communications platform, through enhanced knowledge sharing and AI-driven messaging.

- In September 2024, DiGiCo introduced the Quantum326, a compact dual-screen, 26-fader mixing console, at PLASA 2024. Retaining the power of the Quantum338, it features 128 input channels, 64 buses, a 24×24 matrix, and advanced FPGA processing.

- In June 2024, Cadac Consoles launched its CM-Series integrated mix system in the US at InfoComm 2024. It features the CM-J50 mixing console, offering advanced software features, and the CM-SR remote audio stage racks, designed for high I/O capacity and flexibility.

- In April 2023, Yamaha Corporation introduced the DM3 Series of compact digital mixing consoles, designed for applications including live sound, streaming, recording, and installations. Key features include 96 kHz sound quality, Dante and non-Dante models, a 9-inch touchscreen, and DAW Remote support.