Market Definition

The market encompasses the design, development, manufacturing, and distribution of integrated circuits that combine both analog and digital functionalities on a single chip. The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to determine the growth dynamics throughout the forecast period.

Mixed Signal IC Market Overview

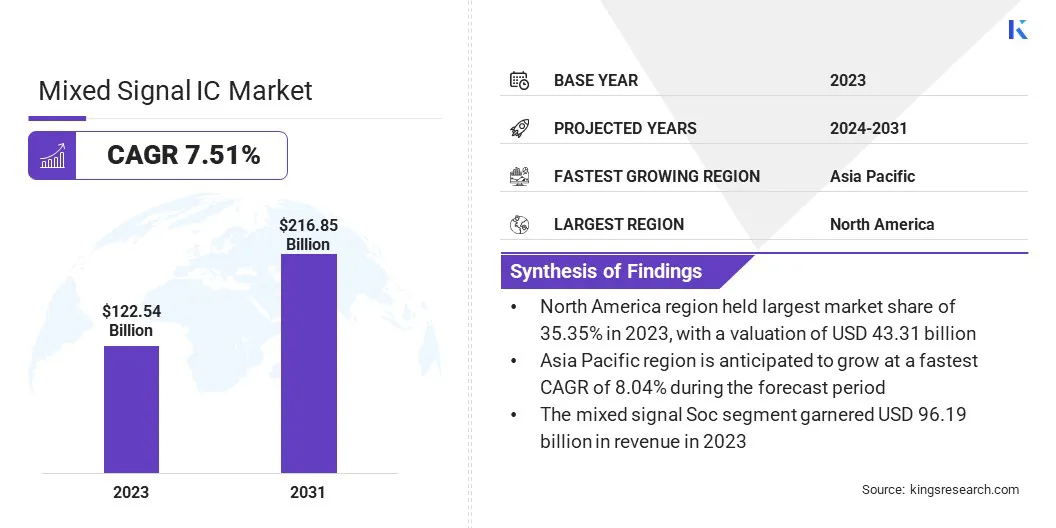

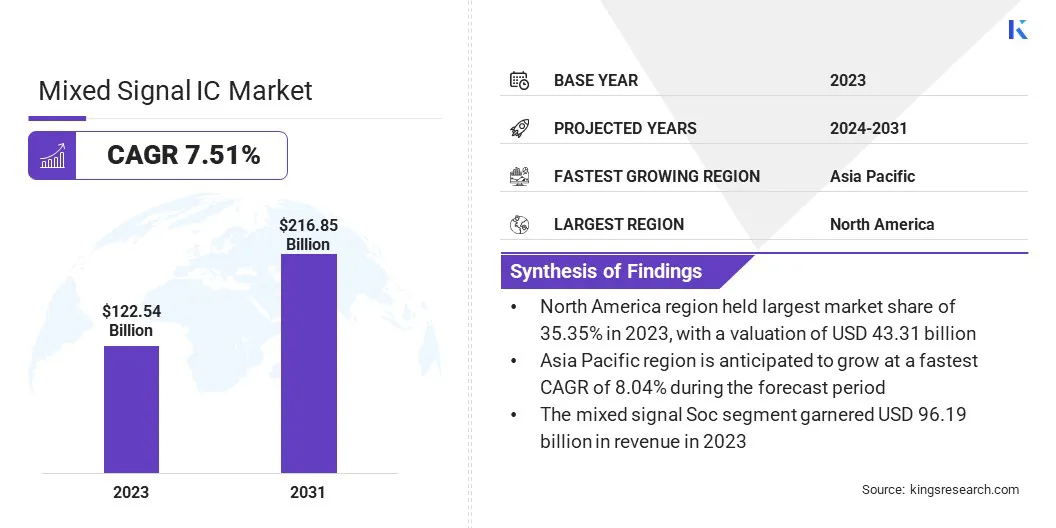

The global mixed signal IC market size was valued at USD 122.54 billion in 2023 and is projected to grow from USD 130.65 billion in 2024 to USD 216.85 billion by 2031, exhibiting a CAGR of 7.51% during the forecast period.

The rising integration of ADAS, infotainment systems, and battery management solutions in modern vehicles has significantly propelled the demand for high-efficiency mixed-signal ICs, enabling seamless interaction between analog sensor inputs and digital processors.

Additionally, the accelerating transition toward electric and hybrid vehicles has heightened the need for energy-efficient mixed-signal ICs that enhance battery performance and optimize power usage.

Major companies operating in the mixed signal IC industry are Tower Semiconductor, Melexis, Silicon Labs, Semiconductor Components Industries, LLC, Cirrus Logic, Inc., Microchip Technology Inc., Mouser Electronics, Inc., Texas Instruments Incorporated, Broadcom, STMicroelectronics, Intel Corporation, Cirrus Logic, Inc., Analog Devices, Inc., Renesas Electronics Corporation, and NXP Semiconductors.

Advancements in semiconductor manufacturing, particularly the shift to smaller process nodes, are driving the development of high-speed, low-power mixed signal ICs. These technological improvements are strengthening the integration of analog and digital functionalities, making them indispensable for applications in telecommunications, industrial automation, and healthcare.

- In June 2024, Magnachip Semiconductor Corporation introduced two innovative products aimed at enhancing display panel performance in IT devices: a multi-functional Power Management Integrated Circuit (PMIC) and a multi-channel level shifter.

Key Highlights:

- The mixed signal IC industry size was valued at USD 122.54 billion in 2023.

- The market is projected to grow at a CAGR of 7.51% from 2024 to 2031.

- North America held a market share of 35.35% in 2023, with a valuation of USD 43.31 billion.

- The mixed signal SoC segment garnered USD 96.19 billion in revenue in 2023.

- The consumer electronics segment is expected to reach USD 110.07 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.04% during the forecast period.

Market Driver

Growing Adoption of Automotive Electronics and EVs

The market is registering significant growth, driven by the rapid expansion of automotive electronics and EVs. The integration of ADAS (Advanced Driver-Assistance Systems), infotainment systems, and battery management solutions in modern vehicles has increased the demand for high-performance mixed signal ICs.

These ICs enable seamless communication between analog sensor inputs and digital processing units, ensuring precise real-time data handling for safety and efficiency.

Additionally, the shift toward EVs and hybrid vehicles has intensified the need for power-efficient mixed-signal ICs, which optimize energy consumption, enhance battery life, and improve overall vehicle performance. Thus, the demand for these specialized ICs will remain strong, shaping the future of the market.

- In 2023, according to the International Energy Agency (IEA), global electric car registrations reached nearly 14 million, totaling the number of EVs on the road to 40 million. This represented a 35% year-on-year growth, with sales surpassing 3.5 million more than in 2022.

Market Challenge

Design Complexity and Integration Challenges

A major challenge in the mixed signal IC market is the complexity of design and integration, due to the need for seamless interaction between analog and digital components. Unlike purely digital ICs, mixed-signal ICs require precise signal conversion and noise management, making their design process highly intricate and time-consuming.

This complexity increases development costs and extends time-to-market for new products. A potential solution to this challenge is the adoption of advanced Electronic Design Automation (EDA) tools and AI-driven simulation software, which can streamline the design process, optimize performance, and reduce errors.

Market Trend

Advancements in Semiconductor Manufacturing

The market is registering significant advancements driven by continuous improvements in semiconductor manufacturing technologies. The transition to smaller process nodes is enabling the development of high-performance, low-power mixed-signal ICs.

These innovations enhance the efficiency, speed, and integration of analog and digital components, making them ideal for next-generation applications in telecommunications, industrial automation, and healthcare.

Manufacturers are focusing on optimizing chip architectures to support high-speed data processing, lower energy consumption, and improved signal integrity as the demand for compact and power-efficient devices grows.

- In November 2024, Renesas Electronics Corporation launched new AnalogPAK ICs, including low-power and automotive-qualified variants, along with the industry’s first programmable 14-bit SAR ADC. The newly introduced SLG47011 AnalogPAK device features a programmable multichannel 14-bit SAR ADC with a Programmable Gain Amplifier (PGA) and adaptable power-saving modes, allowing for optimized energy efficiency.

Mixed Signal IC Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Mixed Signal SoC, Microcontroller, Data Converter

|

|

By End Use

|

Consumer Electronics, Medical & Healthcare, Telecommunication, Automotive, Military & Defense

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Mixed Signal SoC, Microcontroller, Data Converter): The mixed signal SoC segment earned USD 96.19 billion in 2023, due to the growing demand for high-performance, power-efficient integrated solutions in advanced consumer electronics and automotive applications.

- By End Use (Consumer Electronics, Medical & Healthcare, Telecommunication, and Automotive): The consumer electronics segment held 49.53% share of the market in 2023, due to the widespread adoption of smartphones, wearables, and smart home devices requiring efficient signal processing and power management.

Mixed Signal IC Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 35.35% share of the mixed signal IC market in 2023, with a valuation of USD 43.31 billion. The region’s dominance is driven by strong demand from industries such as consumer electronics, automotive, and telecommunications.

The region's leadership in semiconductor innovation, backed by major players investing in Research and Development (R&D), has significantly contributed to market growth.

The presence of leading technology firms, a well-established industrial automation sector, and increasing adoption of EVs and 5G infrastructure have further fueled the demand for mixed-signal ICs. Additionally, government initiatives supporting semiconductor manufacturing and chip design advancements have strengthened the region’s market position.

The market in Asia Pacific is poised to grow at a significant CAGR of 8.04% over the forecast period, driven by rapid industrialization, rising consumer electronics demand, and expanding automotive production. Countries like China, Japan, South Korea, and Taiwan play a key role in the global semiconductor supply chain, with strong manufacturing capabilities and high investments in chip fabrication.

The increasing deployment of 5G networks, growing adoption of IoT devices, and rising focus on electric and autonomous vehicles are boosting the demand for mixed-signal ICs across the region. Furthermore, government support for domestic semiconductor production and the presence of major contract chip manufacturers contribute to the strong growth trajectory in the market.

- In November 2024, the India Brand Equity Foundation (IBEF) reported a 20.88% rise in EV sales in India, reaching 1.39 million units. This growth supports the country’s ambitious plans to expand EV adoption across different vehicle categories. India aims for 30% EV sales in private cars, 70% in commercial vehicles, and 80% in three-wheelers and two-wheelers by 2030, with a goal of having 80 million EVs on its roads.

Regulatory Frameworks

- In the U.S., the FCC regulates mixed-signal ICs by enforcing RF emission and EMI standards. Additionally, the CHIPS and Science Act provides funding and incentives to boost domestic semiconductor manufacturing, research, and innovation, strengthening the supply chain and reducing reliance on foreign chip production.

- In Europe, the market operates under the European Chips Act, which aims to enhance semiconductor production and innovation across the EU. Mixed-signal ICs must also comply with RoHS (Restriction of Hazardous Substances) Directive and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) Regulation, ensuring environmental safety and limiting hazardous materials in electronic components.

Competitive Landscape:

The global mixed signal IC market is characterized by intense competition, with key market players focusing on innovation, strategic partnerships, and technological advancements to strengthen their market position. Companies are investing heavily in R&D to enhance IC performance, power efficiency, and integration capabilities, catering to the growing demand for compact and multifunctional electronic components.

Many firms are expanding their manufacturing capacity, either through in-house fabrication or collaborations with leading semiconductor foundries, to ensure a stable supply chain and meet rising demand. Strategic mergers and acquisitions are being pursued to broaden product portfolios and gain access to advanced design capabilities.

Additionally, firms are forming alliances with consumer electronics, automotive, and telecommunications companies to co-develop specialized mixed-signal solutions tailored for applications such as 5G, IoT, and automotive electronics. Companies are also focusing on process node advancements to stay competitive, integrating mixed-signal functionality with AI and ML capabilities, and optimizing chip architectures for enhanced performance in power-sensitive applications.

- In November 2024, onsemi unveiled the Treo Platform, a mixed-signal solution and an advanced analog built on 65nm Bipolar-CMOS-DMOS (BCD) process technology. This platform features a modular architecture designed to accelerate the development of intelligent power management, sensor interface, and communication solutions across industries such as automotive, medical, industrial, and AI data centers.

List of Key Companies in Mixed Signal IC Market:

- Tower Semiconductor

- Melexis

- Silicon Labs

- Semiconductor Components Industries, LLC

- Cirrus Logic, Inc.

- Microchip Technology Inc.

- Mouser Electronics, Inc.

- Texas Instruments Incorporated

- Broadcom

- STMicroelectronics

- Intel Corporation

- Cirrus Logic, Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- NXP Semiconductors

Recent Developments (Product Launch)

- In March 2025, Pragmatic Semiconductor Ltd. launched its FlexIC Platform Gen 3, a next-generation mixed-signal flexible ASIC design platform. The platform delivers a tenfold reduction in digital power consumption and a threefold decrease in digital area, streamlining rapid custom ASIC development for applications such as RFID and sensor interfaces.