Market Definition

The mining remanufacturing components market involves refurbishing and restoring used mining equipment components to their original performance standards. This process involves disassembly, inspection, repair, and replacement of worn parts to extend the lifespan of machinery while reducing operational costs and environmental impact.

Key components include engines, hydraulic systems, transmissions, and electrical systems. The market serves mining operators seeking reliable, cost-effective alternatives to new parts without compromising performance or safety.

Mining Remanufacturing Components Market Overview

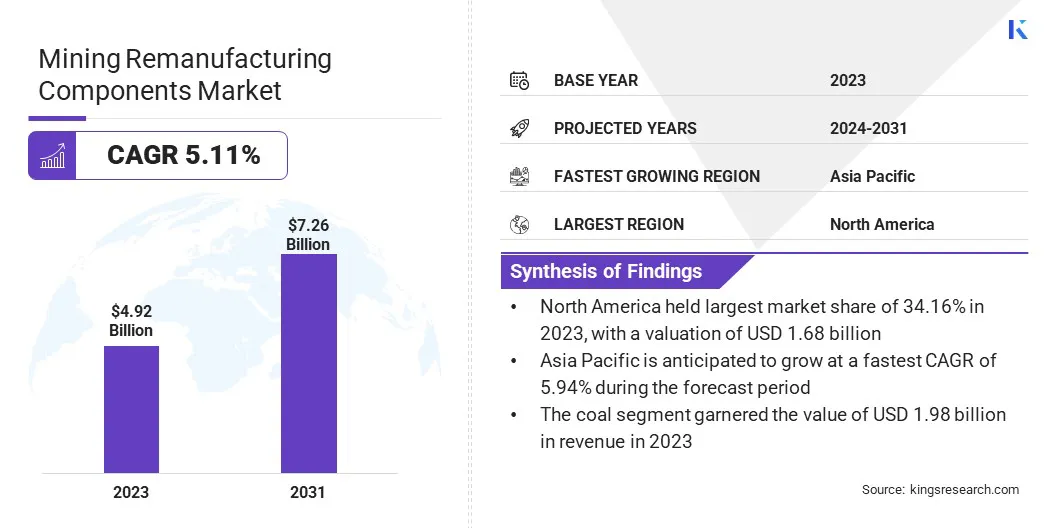

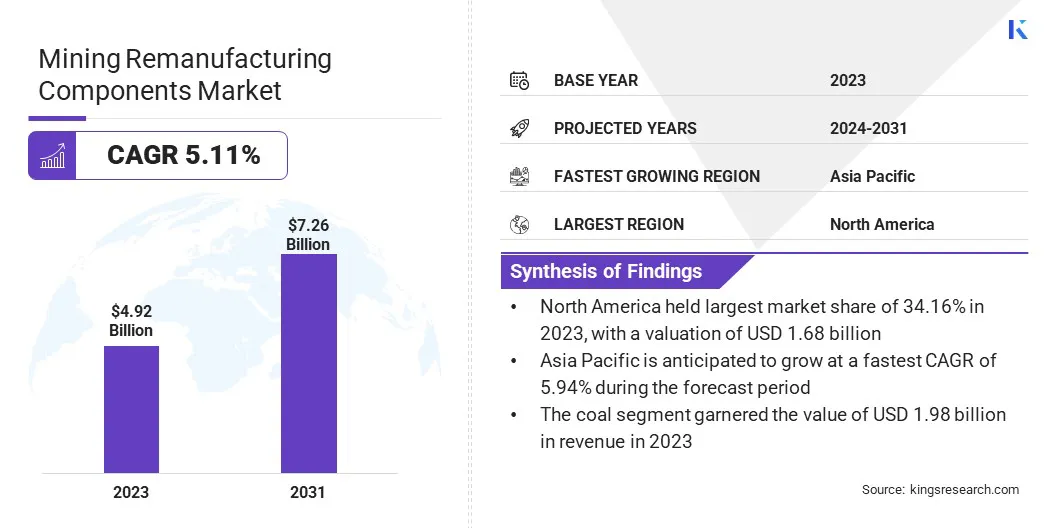

The global mining remanufacturing components market size was valued at USD 4.92 billion in 2023 and is projected to grow from USD 5.13 billion in 2024 to USD 7.26 billion by 2031, exhibiting a CAGR of 5.11% during the forecast period.

The market is driven by the increasing demand for cost-effective and sustainable solutions in the mining industry. Remanufacturing mining components, including engines, transmissions, hydraulic systems, and electrical components, helps extend equipment lifespan, reduce operational costs, and minimize environmental impact.

Major companies operating in the global mining remanufacturing components Industry are Caterpillar, Komatsu, Atlas Copco Group, AB Volvo, PT SANGGAR SARANA BAJA, J C Bamford Excavators Ltd., Cardinal Mining, Hitachi Construction Machinery Co., Ltd., Kymera International., SRC HOLDINGS CORPORATION, Liebherr-International Deutschland GmbH, Swanson Industries, Sandvik AB, Epiroc, and Deere & Company.

Rising commodity demand and increasing mining activities in developing regions are further fueling the market. Additionally, advancements in remanufacturing technologies, such as automation and AI-driven diagnostics, are improving the efficiency and reliability of refurbished components.

Key Highlights:

- The global mining remanufacturing components market size was valued at USD 4.92 billion in 2023.

- The market is projected to grow at a CAGR of 5.11% from 2024 to 2031.

- North America held a market share of 34.16% in 2023, with a valuation of USD 1.68 billion.

- The engine segment garnered USD 1.24 billion in revenue in 2023.

- The mine/haul truck segment is expected to reach USD 1.66 billion in 2023.

- The coal segment is expected to reach USD 3.04 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.94% during the forecast period.

Market Driver

"Increasing Focus On Cost Optimization and Sustainability Initiatives"

The mining remanufacturing components market is driven by the increasing focus on cost optimization and equipment lifecycle extension in the mining industry. Mining companies operate in highly capital-intensive environments, where purchasing new machinery and components can significantly impact operational budgets.

Remanufacturing offers a cost-effective alternative by restoring used components, such as engines, hydraulic systems, and transmissions, to new condition at a fraction of the cost. This approach reduces capital expenditure which improves asset utilization and operational efficiency.

Adopting remanufactured components helps mining companies contribute to circular economy practices, reducing raw material consumption and energy usage. Additionally, sustainability initiatives are pushing the industry toward remanufacturing solutions. Governments and regulatory bodies are enforcing stringent environmental policies to curb waste generation and carbon emissions.

Market Challenge

"Maintaining The Quality and Reliability of Remanufactured Components"

The mining remanufacturing components market faces a significant challenge in maintaining the quality and reliability of remanufactured components. Mining operations involve extreme conditions, including heavy loads, abrasive materials, and harsh environmental factors.

As a result, ensuring that remanufactured components meet original equipment manufacturer (OEM) standards is critical. Industry players are investing in advanced testing, certification processes, and OEM partnerships.

Remanufacturers can ensure that components meet or exceed OEM specifications by implementing rigorous quality control measures, including non-destructive testing (NDT), precision machining, and AI-driven defect detection.

Market Trend

"Adoption of AI-powered Diagnostics and 3D Printing for Component Reconstruction"

The adoption of automation and AI-driven diagnostics in the remanufacturing of mining components is on the rise, marking a significant trend. Companies are leveraging advanced technologies to enhance component refurbishment, reduce downtime, and improve operational sustainability as the demand for precision and efficiency increases.

AI-driven diagnostics are enabling predictive maintenance, allowing mining operators to assess component conditions in real time. Additionally, automation in remanufacturing, such as robotic disassembly, precision welding, and 3D printing for component reconstruction, is improving production efficiency and reducing costs. These advancements streamline the refurbishment process, ensuring higher consistency and quality control while minimizing material wastage.

- In May 2024, Spee3D’s Expeditionary Manufacturing Unit (EMU) introduced a cutting-edge mobile additive manufacturing solution, enabling rapid, on-site production of critical remanufactured mining components. This innovation minimizes downtime, reduces supply chain dependency, and enhances operational efficiency, positioning EMU as a game-changer for maintenance and repair needs in the mining sector.

Mining Remanufacturing Components Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Engine, Hydraulic Cylinder, Axle, Differential, Transmission, Others

|

|

By Equipment

|

Hydraulic Excavator, Mine/Haul Truck, Wheel Loader, Crawler Dozers, Others

|

|

By Industry

|

Coal, Metal, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Engine, Hydraulic Cylinder, Axle, Differential, Transmission, and Others): The engine segment earned USD 1.24 billion in 2023, due to high replacement demand, engine wear from extreme mining conditions, and increased adoption of remanufactured engines for cost efficiency and sustainability.

- By Equipment (Hydraulic Excavator, Mine/Haul Truck, Wheel Loader, Crawler Dozers, and Others): The mine/haul truck segment held 33.65% share of the market in 2023, due to its heavy usage in large-scale mining operations, high maintenance requirements, and cost advantages of remanufactured components over new parts.

- By Industry (Coal, Metal, Others): The coal segment is projected to reach USD 3.04 billion by 2031, owing to the rising global energy demand, extensive use of heavy machinery in coal extraction, and the need for cost-effective component replacement solutions in high-volume operations.

Mining Remanufacturing Components Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a mining remanufacturing components market share of around 34.16% in 2023, with a valuation of USD 1.68 billion. This dominance is driven by the presence of major mining companies, advanced remanufacturing infrastructure, and stringent environmental regulations promoting sustainable practices.

The region has a well-established mining sector, particularly in the U.S. and Canada, where the demand for cost-effective and durable component solutions is high. The increasing adoption of remanufactured components in mining trucks and excavators continues to drive revenue in the region.

- In October 2024, according to the U.S. Geological Survey, there are over 11,000 operational mining sites, encompassing a diverse range of operations from sand and gravel extraction to coal and gold mining. Additionally, thousands of inactive mines are distributed across the U.S.

The mining remanufacturing components Industry in Asia Pacific is poised to grow at a significant CAGR of 5.94% over the forecast period, driven by rapid industrialization, increasing mining activities, and the rising demand for raw materials in countries such as China, India, and Australia.

The region's expanding mining sector, fueled by infrastructure development and urbanization, is creating a strong demand for cost-effective and sustainable mining solutions. Additionally, government initiatives promoting circular economy practices and reduced carbon emissions are encouraging the adoption of remanufactured components.

Regulatory Frameworks

- In the U.S., the Mine Safety and Health Administration (MSHA) regulates safety standards for mining equipment, including remanufactured components, It ensures compliance with safety protocols, minimizes operational hazards, and enforces rigorous inspections to enhance worker protection and equipment reliability in the mining industry.

- In Europe, the European Union (EU) regulates the mining remanufacturing components market through directives like the Circular Economy. These ensure sustainability, safety, and compliance, promoting remanufacturing, waste reduction, and resource efficiency in the mining sector.

- In India, the Ministry of Mines & Central Pollution Control Board (CPCB) regulates mining activities and sustainability practices, while the Bureau of Indian Standards (BIS) ensures component quality and remanufacturing standards.

Competitive Landscape:

The global mining remanufacturing components market is characterized by a large number of participants, including established corporations and rising organizations. Key players in the market are actively investing in innovation and technological advancements to enhance their market presence.

With applications across mining equipment such as haul trucks, excavators, and loaders, companies are continuously improving their remanufacturing processes to meet industry-specific performance and sustainability demands.

Businesses are focusing on strengthening their regional footprint by tailoring solutions to local mining regulations and operational challenges while simultaneously scaling their global reach to capitalize on the increasing demand for cost-effective and durable remanufactured components.

- For instance, in November 2024, AWTEC, an AISIN company specializing in transmission remanufacturing, merged with AISIN World Corp. of America's (AWA) aftermarket division to strengthen AISIN’s presence in the market. This strategic move enhances product availability, streamlines supply chains, and expands service capabilities, ensuring optimized solutions for heavy equipment and industrial operations.

List of Key Companies in Mining Remanufacturing Components Market:

- Caterpillar

- Komatsu

- Atlas Copco Group

- AB Volvo

- PT SANGGAR SARANA BAJA

- J C Bamford Excavators Ltd.

- Cardinal Mining

- Hitachi Construction Machinery Co., Ltd.

- Kymera International.

- SRC HOLDINGS CORPORATION

- Liebherr-International Deutschland GmbH

- Swanson Industries

- Sandvik AB

- Epiroc

- Deere & Company

Recent Developments (M&A)

- In July 2024, Komatsu acquired GHH Group to expand its underground mining equipment and remanufacturing capabilities, enhancing global reach, aftermarket support, and innovation in mining components.