Market Definition

The market focuses on the development and deployment of automated technologies and systems in mining operations. This includes robotics, autonomous vehicles, drones, automated drilling and hauling equipment, and advanced software solutions such as artificial intelligence, machine learning, and Internet of Things.

These technologies aim to improve safety, productivity, and efficiency in mining activities. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry growth.

Mining Automation Market Overview

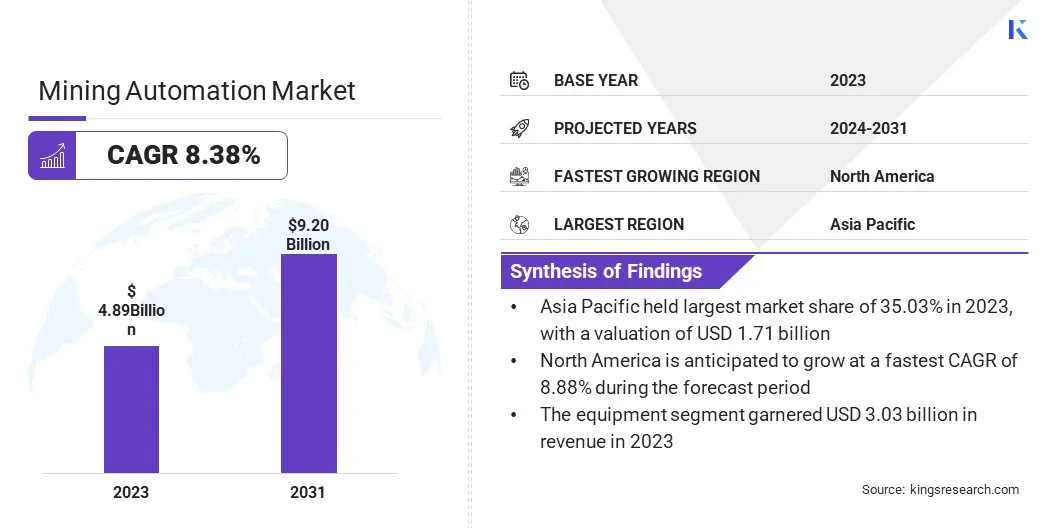

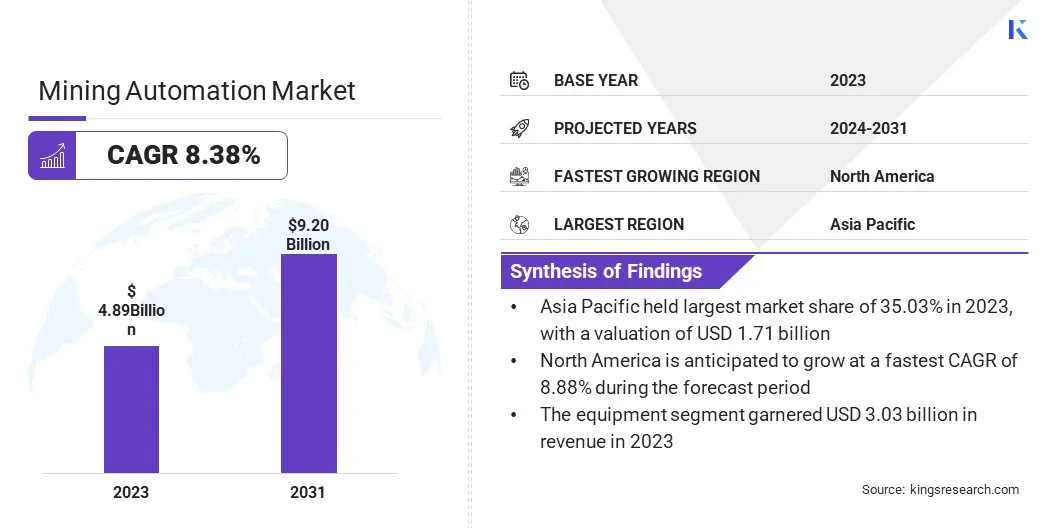

The global mining automation market size was valued at USD 4.89 billion in 2023 and is projected to grow from USD 5.24 billion in 2024 to USD 9.20 billion by 2031, exhibiting a CAGR of 8.38% during the forecast period. Market growth is driven by the growing need for enhanced productivity, operational efficiency, and worker safety.

As global demand for critical minerals such as lithium, cobalt, and rare earth elements rises, mining companies face increasing pressure to scale operations efficiently and sustainably. Automation reduces dependence on manual labor, particularly in hazardous or remote locations, while improving precision and consistency. Technological advancements in AI, robotics, and autonomous vehicles further accelerate the adoption of automation in modern mining operations.

Key Market Highlights:

- The mining automation industry size was recorded at USD 4.89 billion in 2023.

- The market is projected to grow at a CAGR of 8.38% from 2024 to 2031.

- Asia Pacific held a market share of 35.03% in 2023, with a valuation of USD 1.71 billion.

- The underground segment garnered USD 1.96 billion in revenue in 2023.

- The equipment segment is expected to reach USD 5.62 billion by 2031.

- North America is anticipated to grow at a CAGR of 8.38% over the forecast period.

Major companies operating in the mining automation market are Caterpillar Inc, Komatsu, Sandvik AB, Atlas Copco AB, Hexagon AB, ABB, Hitachi Construction Machinery Co, Epiroc Mining India Limited, Trimble Inc., Siemens, Rockwell Automation, Autonomous Solutions, Inc, Rio Tinto, TAKRAF GmbH, and Micromine.

Mining companies are increasingly shifting toward proactive service models to enhance asset reliability and operational efficiency. This transition aligns with the industry's growing focus on performance-based maintenance strategies, aiming to reduce downtime and enhance long-term performance outcomes.

- In September 2024, ABB launched an expanded suite of service offerings under its ABB Care program, introducing ABB Care for Mining Automation and ABB Care for Hoisting. This strategic extension supports mining customers in transitioning from traditional reactive maintenance to proactive, performance-focused solutions, improving asset reliability, reducing downtime, and optimizing operational efficiency.

The growing demand for minerals and metals is fueling the expansion of the market. The growth of industries such as electric vehicles, renewable energy, and electronics has led to increased demand for resources such as lithium, cobalt, copper, and rare earth elements.

To meet this demand, mining companies are adopting automation to increase efficiency, scale operations, and maintain competitiveness. Automated systems enable continous operations, improve ore recovery, and reduce reliance on manual labor, particularly in remote or hazardous environments.

- According to the International Energy Agency, demand for critical minerals experienced strong growth in 2023. Lithium consumption rose by 30%, while demand for nickel, cobalt, graphite, and rare earth elements increased by 8% to 15%.

High Initial Capital Investment

High initial capital investment present a major challenge to the expansion of the mining automation market. Implementing advanced technologies such as autonomous vehicles, robotic drilling systems, and real-time monitoring infrastructure requires substantial upfront costs.

These expenses include equipment, software integration, workforce training, and system maintenance. For several mining companies, such as small and mid-sized operators, these challenges delay or limit the adoption of automation despite its long-term efficiency benefits.

To address this challenge, companies are exploring phased automation strategies, leasing models, and partnerships with technology providers to reduce upfront costs. Government incentives and funding programs are also helping offset capital expenditures in regions prioritizing sustainable and high-tech mining.

Additionally, modular and scalable automation solutions are enabling miners to implement technology gradually, allowing for cost control while improving operational efficiency over time.

Integration of AI and Analytics

The integration of AI-powered digital assistants into mining operations reflects a growing adoption of expert systems for equipment maintenance. These tools deliver real-time, context-specific insights, enabling informed decision-making and proactive machinery management. This trend reduces unplanned downtime, enhances operational efficiency, and supports predictive maintenance strategies, aiding the growth of the market.

- In March 2025, ABB introduced GMD Copilot, an AI-powered digital assistant designed to optimize the operation and maintenance of gearless mill drives (GMDs), which play a vital role in mineral extraction. By providing real-time, context-specific insights, GMD Copilot enhances decision-making, boosts efficiency, and supports more reliable performance of grinding mills' critical components in the process of crushing ore to extract valuable minerals in mining operations.

Mining Automation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technique

|

Underground, Surface

|

|

By Component

|

Equipment (Autonomous Trucks, Remote Control Equipment, Underground LHD Loaders, Pumping Stations, Tunneling Equipment, Others), Software (Workforce Management, Proximity Detection, Fleet Management, Data Management, Others)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technique (Underground and Surface): The underground segment earned USD 1.96 billion in 2023 due to increasing adoption of automation technologies to enhance safety and efficiency in complex and hazardous underground environments.

- By Component (Equipment (Autonomous Trucks, Remote Control Equipment, Underground LHD Loaders, Pumping Stations, Tunneling Equipment, and Others) and Software (Workforce Management, Proximity Detection, Fleet Management, Data Management, and Others) ): The equipment segment held a share of 62.05% in 2023, fueled by the rising demand for autonomous machinery and robotic systems that improve operational productivity and reduce human intervention.

Mining Automation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific mining automation market accounted for a share of around 35.03% in 2023, valued at USD 1.71 billion. This dominance is reinforced by rapid industrialization, increasing mining activities, and the rising adoption of automation technologies across key economies such as China, India, and Australia.

Additionally, established players in the mining automation sector are actively innovating their product offerings to align with local industry needs and regulatory goals.

- In March 2024, Rockwell Automation launched its CUBIC product line across the Asia Pacific, expanding access to IEC-61439 compliant modular enclosure systems for electrical and power panel construction. Previously limited to select markets, CUBIC will now support high-growth sectors such as renewable energy, mining, data centers and infrastructure, reinforcing Rockwell’s commitment to industrial automation and digital transformation.

The North America mining automation industry is set to grow at a CAGR of 8.88% over the forecast period. This growth is fostered by the increasing demand for advanced mining technologies, characterized by the need for improved operational efficiency, worker safety, and environmental sustainability.

Additionally, this growth is supported by major investments in automation technologies aimed at modernizing mining operations and enhancing productivity. The rising demand for minerals and metals essential for sectors such as construction, electronics, and renewable energy is highlighting the need for more efficient, tech-enabled extraction methods across the region.

- In September 2024, Epiroc inaugurated its new Surface Mining Automation Center (SMAC) in Providence, Utah, to advance autonomous haulage solutions. This expansion follows the expansion of the former ASI Mining team and marks a significant investment in OEM-agnostic automation, reinforcing Epiroc’s commitment to next-generation mining technologies.

Regulatory Framework

- In the U.S., the National Institute for Occupational Safety and Health (NIOSH) conducts research and tools for improving safety in automated mining operations.

- In Europe, the European Union Mining Waste Directive and Machinery Directive ensure that automation technologies used in mining operations are safe for workers and compliant with environmental standards.

- In India, the Mines and Minerals Development and Regulation (MMDRA) establishes a national framework for the development and regulation of mines and minerals, guiding state-level actions.

Competitive Landscape

The mining automation industry comprises several established, globally recognized players with a strong industry presencey. Companies are forming strategic collaborations to integrate automation, electrification, and digital solutions, aiming to accelerate decarbonization across the mining sector.

By combining expertise in equipment manufacturing with advanced energy and control technologies, they are developing interoperable platforms that support fully electrified operations. These collaborations align with evolving industry standards while positioning players to transition to cleaner and smarter mining operations.

- In August 2024, Komatsu and ABB entered into a strategic collaboration agreement to jointly develop integrated solutions aimed at advancing net-zero emissions in heavy industrial machinery. This global partnership combines Komatsu’s leadership in construction and mining equipment with ABB’s expertise in automation and electrification, creating an open platform that promotes interoperability from renewable energy generation to fully electrified mining operations, while accelerating decarbonization and enhancing energy efficiency across the mining industry.

Key Companies in Mining Automation Market:

- Caterpillar Inc

- Komatsu

- Sandvik AB

- Atlas Copco AB

- Hexagon AB

- ABB

- Hitachi Construction Machinery Co

- Epiroc Mining India Limited

- Trimble Inc.

- Siemens

- Rockwell Automation

- Autonomous Solutions, Inc

- Rio Tinto

- TAKRAF GmbH

- Micromine

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, US-based mining startup KoBold Metals raised USD 537 million in a funding round co-led by Durable Capital Partners LP and T. Rowe Price, bringing its valuation to USD 2.96 billion. The funding aims to support KoBold’s use AI and advanced exploration techniques to identify critical battery metals essential for the clean energy transition.

- In November 2024, Hexagon acquired indurad, a global leader in radar and real-time location systems (RTLS), along with its autonomous haulage subsidiary, xtonomy. This sacquisition strengthens Hexagon’s capabilities in mine safety, productivity, and autonomy by integrating indurad’s advanced radar-based collision avoidance systems, real-time ore tracking, and OEM-agnostic automation platform.

- In January 2024, Epiroc introduced three new electric drill rigs, including Pit Viper 271 XC E, Pit Viper 275 XC E, and Pit Viper 291 E, as part of its Smart and Green Series. These high performance, zero-emission drills reduce fuel consumption and carbon footprint, while offering enhanced automation, safety, and bit load capacities up to 42.5 tonnes.

- In December 2023, Epiroc launched a new suite of digital solutions tailored for surface mining, including Blast Support for safer blasting operations and an upgraded Situational Awareness system featuring Zone-based Messages for real-time alert and risk zones.

- In July 2023, Hexagon AB acquired HARD-LINE, a global leader in mine automation, remote-control technology, and production optimization. This strategic acquisition strengthens Hexagon’s life-of-mine technology portfolio by integrating HARD-LINE’s scalable remote operation and by-wire technologies with Hexagon’s existing platforms, including HxGN Underground Mining, HxGN Autonomous Mining, and HxGN MineProtect. The combined expertise will drive the advancement of OEM-independent, interoperable automation solutions, supporting increased safety, productivity, and autonomy across the mining sector.

- In May 2023, ABB partnered with carbon reduction company First Mode to supply BORDLINE lithium-ion energy storage systems for a fleet of zero-emission mining haulage trucks, supporting decarbonization of heavy-duty transport in the mining sector.

- In April 2023, Sandvik Mining and Rock Solutions launched AutoMine for Underground Drills, a tele-remote solution that enables operators to remotely and simultaneously control multiple automated Sandvik underground drills. This advanced technology enhances productivity, safety, and operational efficiency by allowing centralized supervision of drilling activities in underground mining environments.

- In April 2023, XCMG Machinery introduced three new mining equipment models: the XE690DK mining excavator, the XDR80TE-AT autonomous electric dump truck, and the XDE240 mining dump truck. The XE690DK, launched in Indonesia, features a powerful, efficient, and environmentally friendly design suitable for diverse construction environments.