Market Definition

Military vetronics comprises integrated electronic systems designed to enhance the performance, safety, and situational awareness of military vehicles. It includes sensors, communication modules, control units, and display technologies that support operational efficiency and mission effectiveness.

Applications cover real-time battlefield data sharing, command and control, navigation, and surveillance, ensuring coordinated operations and strategic advantage. Defense forces deploy these systems across armored vehicles, tanks, combat support vehicles, and unmanned ground vehicles to improve combat readiness, vehicle functionality, and crew protection.

Military Vetronics Market Overview

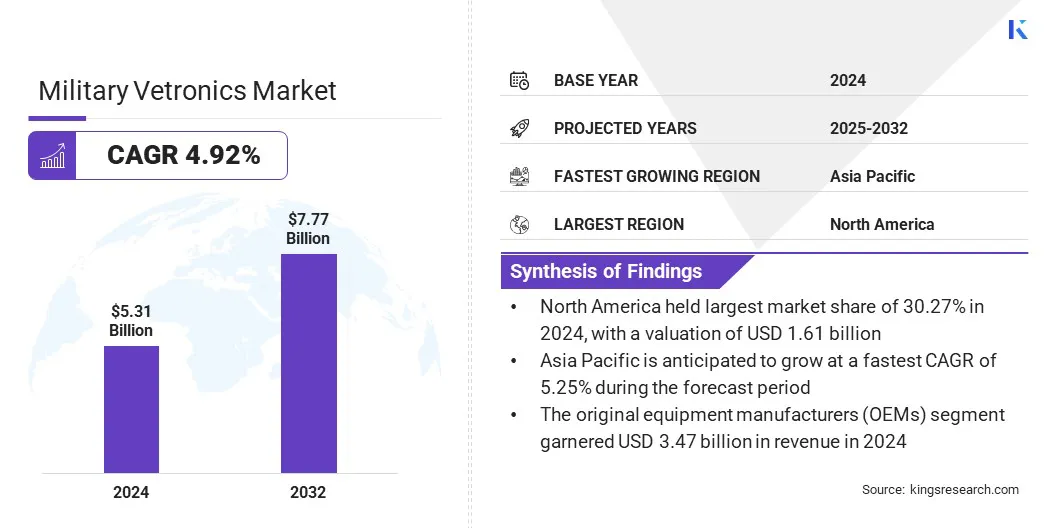

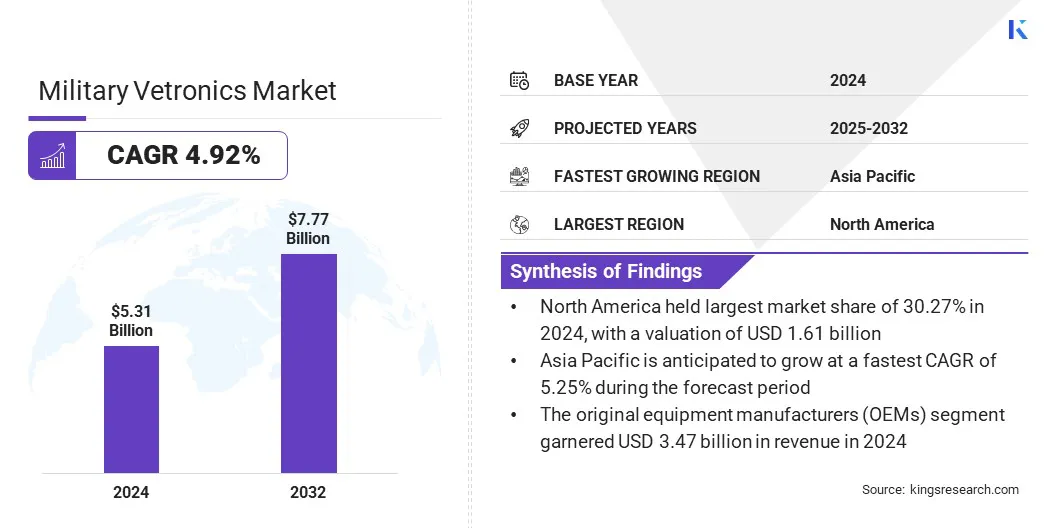

The global military vetronics market size was valued at USD 5.32 billion in 2024 and is projected to grow from USD 5.55 billion in 2025 to USD 7.77 billion by 2032, exhibiting a CAGR of 4.92% over the forecast period.

This growth is attributed to the rising demand for advanced electronic systems to enhance situational awareness, vehicle performance, and crew safety in military operations. Expanding adoption of integrated sensors, communication modules, and control units is enabling real-time data sharing, command and control, and battlefield management, thereby driving market expansion.

Key Highlights

- The military vetronics industry size was valued at USD 5.32 billion in 2024.

- The market is projected to grow at a CAGR of 4.92% from 2025 to 2032.

- North America held a market share of 30.27% in 2024, valued at USD 1.61 billion.

- The command, control, communications, and computers (C4) systems segment garnered USD 1.52 billion in revenue in 2024.

- The main battle tanks (MBTs) segment is expected to reach USD 2.08 billion by 2032.

- The original equipment manufacturers (OEMs) segment is anticipated to witness the fastest CAGR of 4.97% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.25% through the projection period.

Major companies operating in the military vetronics market are Boeing, Lockheed Martin Corporation, General Dynamics Corporation, Elbit Systems Ltd., Rheinmetall AG, Saab, BAE Systems, Curtiss-Wright, Safran SA, Thales, Oshkosh Defense, LLC, TE Connectivity, Collins Aerospace, Northrop Grumman, and RTX.

The increasing focus of defense agencies on modernization, operational efficiency, and strategic readiness is driving the integration of military vetronics into armored vehicles, tanks, combat support vehicles, and unmanned ground vehicles. Additionally, ongoing technological advancements by solution providers, along with defense procurement initiatives and modernization programs, are accelerating market growth.

- In March 2023, the U.S. Department of Defense allocated USD 271 million to modernize the Army’s next-generation combat vehicles. The funding is intended to improve silent watch capabilities, mobility, operational endurance, and onboard electrical power, supporting broader modernization initiatives in the military vetronics sector.

Market Driver

Rising Global Defense Expenditure

The growth of the military vetronics market is fueled by rising global defense expenditure and governments’ focus on modernizing armed forces. These systems integrate advanced sensors, communication modules, navigation tools, and control units to enhance vehicle performance, situational awareness, and crew safety.

Defense agencies are increasingly deploying these solutions to improve operational efficiency, battlefield management, and mission effectiveness. According to the United Nations, global military spending reached a record high in 2024, with expenditures exceeding USD 2.7 trillion. This increase underscores the growing emphasis on defense capabilities worldwide.

Market Challenge

Complex System Integration

Complex system integration creates a significant barrier to the growth of the military vetronics market. Modern combat vehicles require seamless coordination of sensors, communication units, navigation modules, and control systems, which are developed by different suppliers and based on varying technical standards.

Integrating these subsystems requires custom engineering, rigorous testing, and specialized expertise, which extend development timelines and increase overall costs.

Older military vehicles that lack built-in support for modern electronics present further challenges, as retrofitting advanced electronics into older platforms requires major modifications. The shortage of skilled engineers and technicians capable of managing complex integration further complicates large-scale deployment.

To address these challenges, defense agencies and contractors are increasingly adopting standardized architectures, modular designs, and advanced simulation tools. These approaches aim to improve compatibility, reduce integration risks, and accelerate the deployment of advanced vetronics solutions across diverse vehicle fleets.

Market Trend

Adoption of Modular and Open Systems Architectures

The military vetronics market is experiencing a strong shift toward modular and open systems architecture, driven by the need for flexible, interoperable, and upgradeable electronic systems.

This approach allows seamless integration of sensors, communication modules, navigation tools, and control units, reducing compatibility challenges and supporting faster technology updates. These architectures are particularly valuable for defense agencies managing diverse vehicle fleets, where modernization and lifecycle extension are critical.

Organizations are increasingly implementing modular designs to simplify upgrades, enhance system interoperability, and accelerate deployment of advanced capabilities. Standardized and open architectures reduce development complexity, lower costs, and enable rapid incorporation of emerging technologies.

- In March 2023, a study published by the University of Belgrade highlights the adoption of modular and open systems architectures in military vetronics. The study emphasizes that these architectures enhance interoperability, simplify the integration of new technologies, improve cost-effectiveness, and boost the operational efficiency of military vetronics.

Military Vetronics Market Report Snapshot

|

Segmentation

|

Details

|

|

By System

|

Communication & Navigation Systems, Command, Control, Communications, and Computers (C4) Systems, Weapon Control Systems, Power & Control Systems, Display & Interface Systems, Vehicle Protection Systems, and Others

|

|

By Platform

|

Main Battle Tanks (MBTs), Light Armored Vehicles (LAVs), Infantry Fighting Vehicles (IFVs), Armored Personnel Carriers (APCs), Mine-Resistant Ambush Protected (MRAP) Vehicles, Unmanned Ground Vehicles (UGVs), Amphibious Vehicles, Logistics & Support Vehicles, and Others

|

|

By End User

|

Original Equipment Manufacturers (OEMs), and Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By System (Communication & Navigation Systems, Command, Control, Communications, and Computers (C4) Systems, Weapon Control Systems, Power & Control Systems, Display & Interface Systems, Vehicle Protection Systems, and Others): The command, control, communications, and computers (C4) systems segment earned USD 1.52 billion in 2024 primarily due to rising demand for enhanced battlefield management and real-time operational coordination.

- By Platform (Main Battle Tanks (MBTs), Light Armored Vehicles (LAVs), Infantry Fighting Vehicles (IFVs), Armored Personnel Carriers (APCs), Mine-Resistant Ambush Protected (MRAP) Vehicles, Unmanned Ground Vehicles (UGVs), Amphibious Vehicles, Logistics & Support Vehicles, and Others): The main battle tanks (MBTs) held a share of 26.48% of the market in 2024, due to their extensive deployment in modernization programs and the integration of advanced vetronics for enhanced combat performance.

- By End User (Original Equipment Manufacturers (OEMs), and Aftermarket): The original equipment manufacturers (OEMs) segment is projected to reach USD 5.09 billion by 2032, owing to increasing demand for new military vehicles equipped with advanced vetronics systems and modernization of existing fleets.

Military Vetronics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America military vetronics market share stood at 30.27% in 2024, valued at USD 1.61 billion. This dominance is reinforced by substantial defense budgets, ongoing modernization programs, and the presence of advanced manufacturing and R&D capabilities.

The region benefits from the integration of cutting-edge vetronics technologies, including sensors, communication modules, and command and control systems, which are enhancing operational readiness and vehicle performance.

Supportive government procurement policies, collaborations between defense agencies and contractors, and continuous investment in autonomous and networked battlefield solutions are further driving market growth.

- In September 2025, U.S.-based EnerSys launched the Hawker ARMASAFE iON-X 24-volt lithium-ion batteries for military vehicle applications. They are engineered for high-current vehicle starting and to support onboard electronic systems. These batteries are available in 105 Ah and 162 Ah models and deliver long cycle life and comply with MIL-PRF-32565C standards.

Asia Pacific military vetronics industry is set to grow at a CAGR of 5.25% over the forecast period. This growth is fueled by increasing investments by government defense agencies and domestic defense manufacturers in vehicle modernization programs and the expansion of local defense production capabilities across Asia Pacific.

The growing focus on unmanned ground vehicles, autonomous platforms, and integrated battlefield management solutions is driving a strong demand for advanced vetronics systems. Rapid adoption of cutting-edge sensors, secure communication networks, and modular architectures is driving innovation in military vetronics.

Regulatory Frameworks

- In the U.S., MIL-STD-1275, a U.S. Department of Defense standard, regulates electrical characteristics for 28 VDC power systems in military vehicles. It ensures compatibility and protection against voltage transients, supporting reliable operation of vetronics systems.

- In Japan, the Japanese Industrial Standards JIS C 60068 regulate environmental testing methods for electronic equipment, including military applications. It ensures that military vetronics systems maintain functionality and resilience under diverse environmental conditions.

- Globally, the International Organization for Standardization (ISO) 26262 regulates the functional safety of electrical and electronic systems in road vehicles. It applies to military vehicles using automotive-grade electronics, ensuring reliable and safe operation of military vetronics components.

Competitive Landscape

Companies operating in the military vetronics industry are maintaining competitiveness through investments in advanced sensors, communication modules, navigation systems, and modular system architectures. They are developing vetronics solutions for real-time battlefield management, command and control, and vehicle performance optimization to support operations across main battle tanks (MBTs), armored personnel carriers, and unmanned ground vehicles.

Market players are expanding their offerings with autonomous system integration, cybersecurity features, and advanced data analytics to meet evolving defense requirements. Moreover, they are establishing technical support centers and collaborating with defense agencies and technology partners to facilitate deployment and improve system interoperability.

Additionally, companies are providing training programs, maintenance services, and simulation-based testing to enhance operational reliability and sustain competitive positioning.

- In May 2024, Textron Systems and Kodiak Robotics announced a collaboration to develop an uncrewed military vehicle for operations in complex terrain. The vehicle will incorporate Kodiak’s autonomous driving system and utilize modular DefensePods for sensor deployment. The program is scheduled to demonstrate driverless capabilities later and assess potential applications with the U.S. Department of Defense and allied forces.

Top Key Companies in Military Vetronics Market:

- Boeing

- Lockheed Martin Corporation

- General Dynamics Corporation

- Elbit Systems Ltd.

- Rheinmetall AG

- Saab

- BAE Systems

- Curtiss-Wright

- Safran SA

- Thales

- Oshkosh Defense, LLC

- TE Connectivity

- Collins Aerospace

- Northrop Grumman

- RTX

Recent Developments (Partnerships)

- In September 2025, Nordic Air Defence and Volvo Defense announced a partnership to integrate anti-drone technology into Volvo's VIPRO Protection Systems for military vehicles. The collaboration aims to develop a compact and cost-effective counter-unmanned aircraft system (C-UAS) pod designed to launch drone-intercepting projectiles from vehicles. This integration will enhance vehicle protection against drone threats, improving operational effectiveness and mission success.