Market Definition

The market involves technologies and systems designed to detect, monitor, and neutralize unauthorized drones. It serves sectors such as defense, critical infrastructure, and public safety.

Solutions include radar, radio frequency disruption, laser systems, and AI-based tools, driven by growing drone threats, regulatory compliance, and the global expansion of drone usage. The report outlines primary market growth drivers, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Anti-Drone Market Overview

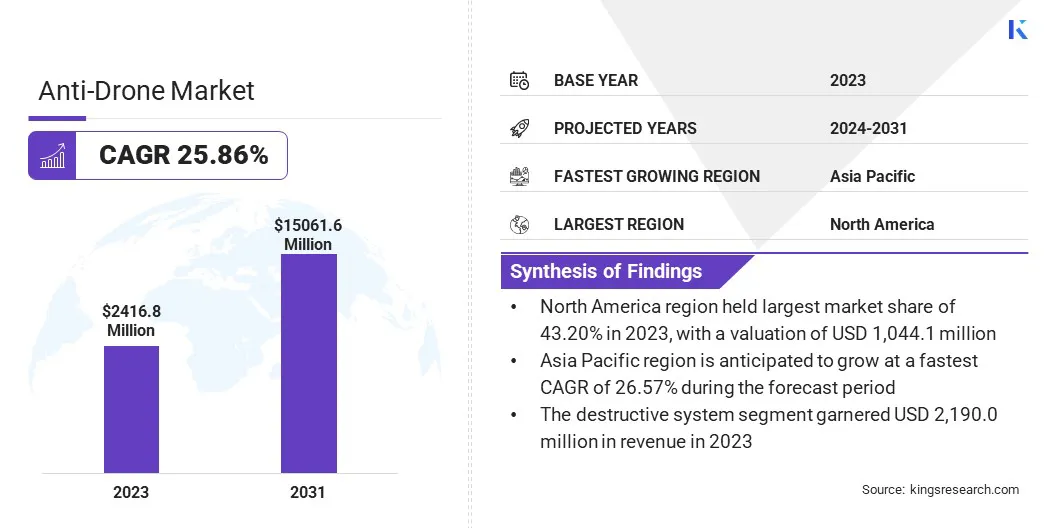

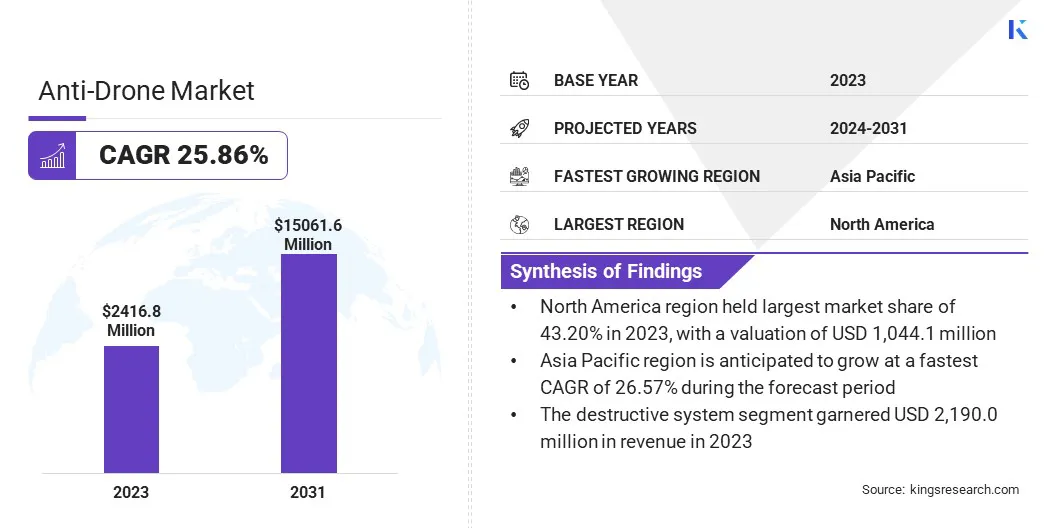

The global anti-drone market size was valued at USD 2,416.8 million in 2023 and is projected to grow from USD 3,010.4 million in 2024 to USD 15,061.6 million by 2031, exhibiting a CAGR of 25.86% during the forecast period.

Rising security threats from malicious drone activities and high-profile incursions are leading to increased demand for counter unmanned aerial systems (UAS) solutions. Additionally, increased defense investments and evolving warfare strategies are accelerating the global deployment of advanced anti-drone technologies.

Major companies operating in the anti-drone industry are RTX, Leonardo S.p.A., RAFAEL Advanced Defense Systems Ltd., DroneShield Ltd, Moog Inc., MBDA, Saab AB, Lockheed Martin Corporation. Thales, Dedrone, ASELSAN A.Ş., Detect Inc., Accipiter Radar., IAI, QinetiQ, and others.

Rising global defense spending, coupled with the integration of Artificial Intelligence (AI), is accelerating demand for advanced anti-drone technologies. Governments are prioritizing AI-enabled detection and interception systems to enhance threat response capabilities, driving innovation in scalable and adaptive counter-drone solutions. This reflects a strategic shift toward modernizing military operations amid evolving aerial threats.

- In March 2025, the American Society for Industrial Security (ASIS) published a report highlighting the growing threat of unauthorized drones to critical infrastructure. The report emphasized the need for advanced counter-UAS technologies and outlined best practices to mitigate drone-related security risks across various sectors.

Key Highlights:

- The anti-drone market size was recorded at USD 2,416.8 million in 2023.

- The market is projected to grow at a CAGR of 25.86% from 2024 to 2031.

- North America held a market share of 43.20% in 2023, valued at USD 1,044.1 million.

- The destructive system segment garnered USD 2,190.0 million in revenue in 2023.

- The drone detection and disruption system segment is expected to reach USD 9,356.3 million by 2031.

- The radar-based detection segment secured the largest revenue share of 34.21% in 2023.

- The kinetic system segment is set to grow at a robust CAGR of 23.69% through the forecast period.

- The military and defense segment garnered USD 1,285.3 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 26.57% over the forecast period.

Market Driver

Growing Military Investments

The expansion of the market is fueled by rising military investments, as governments integrate anti-drone technologies into defense modernization strategies. Increasing defense budgets enabling the deployment of advanced systems for drone detection, interception, and neutralization, reflecting the global demand for improved security in modern warfare.

- In May 2024, the Association for Uncrewed Vehicle Systems International (AUVSI) highlighted the growing demand for secure drone systems and effective procurement practices. Sentrycs secured strategic agreements to deploy its counter unmanned aerial system (C-UAS) technology across European military bases. This underscores the increasing government investment in the anti-drone solutions to strengthen security at critical sites.

Market Challenge

High Costs of Development and Deployment

The high costs associated with developing and deploying advanced counter unmanned aerial systems (C-UAS) pose a major challenge to the expansion of the anti-drone market. Significant investments in research, technology, and infrastructure create financial constraints, particularly for cost-sensitive sectors, limiting widespread adoption.

To overcome this barrier, industry players are focusing on scalable, cost-effective modular solutions and leveraging public-private partnerships to reduce development expenses and enhance market accessibility.

Market Trend

Integration of Artificial Intelligence (AI)

The global market is being significantly influenced by the integration of artificial intelligence (AI). AI enhances counter-drone systems by enabling real-time data analysis, autonomous tracking, and precise neutralization of threats. This trend is fostering the development of more efficient, scalable, and adaptive solutions, allowing security forces to better respond to the growing drone threat.

- In February 2025, Airobotics, a subsidiary of Ondas, initiated a global demonstration tour of its Iron Drone Raider system, highlighting its AI-powered capabilities for real-time interception and neutralization of hostile drones. Proven in military applications, the system addresses rising demand for efficient and cost-effective counter-drone solutions.

Anti-Drone Market Report Snapshot

|

Segmentation

|

Details

|

|

By Mitigation Type

|

Non-destructive System, Destructive System (Laser System, Missile Effector, Electronic Countermeasure)

|

|

By Defense Type

|

Drone Detection System, Drone Detection and Disruption System

|

|

By Type

|

Radar-Based Detection, Radio-Frequency (RF), Electro-Optical (EO), Infrared Radiation (IR), Others

|

|

By Technology

|

Electronic System, Laser System, Kinetic System

|

|

By Platform

|

Ground-based, Handheld, UAV-based

|

|

By End User

|

Commercial, Military and Defense, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Mitigation Type (Non-destructive System and Destructive System): The destructive system segment earned USD 2,190.0 million in 2023 due to its high effectiveness in neutralizing immediate threats, particularly in military and critical infrastructure applications where rapid and decisive action is essential for security.

- By Defense Type (Drone Detection System and Drone Detection and Disruption System): The drone detection and disruption system segment held a share of 63.53% in 2023, attributed to its comprehensive approach in identifying, tracking, and neutralizing unauthorized drones, making it highly suitable for both civilian and military applications where proactive threat mitigation is critical.

- By Type (Radar-Based Detection, Radio-Frequency (RF), Electro-Optical (EO), Infrared Radiation (IR), and Others): The radar-based detection segment is projected to reach USD 5,205.3 million by 2031, fueled by its ability to provide long-range, all-weather, and real-time tracking of drones, making it a reliable and scalable solution for securing large and sensitive areas across various sectors.

- By Technology (Electronic System, Laser System, and Kinetic System): The electronic system segment is set to grow at a CAGR of 26.26% through the forecast period, attributed to its precision, versatility, and cost-effectiveness in disrupting drone operations without physical contact, making it ideal for protecting both civilian and military assets in complex and dynamic threat environments.

- By Platform (Ground-based, Handheld, and UAV-based): The ground-based segment earned USD 1,406.2 million in 2023 due to its ease of deployment, scalability, and ability to integrate advanced detection and mitigation technologies, making it a preferred choice for securing fixed infrastructure and high-value assets across civilian and defense sectors.

- By End User (Commercial, Military and defense, Government, and Others): The military and defense segment held a share of 53.18% in 2023, propelled by rising security threats from hostile drones, increased defense budgets, and the critical need for advanced counter-UAS systems to protect strategic assets and maintain operational superiority in conflict-prone environments.

Anti-Drone Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America anti-drone market share stood at around 43.20% in 2023, valued at USD 1,044.1 million. The dominance is attributed to high defense spending and continuous military modernization in the region. The U.S. Department of Defense, as the largest global military spender, invests heavily in advanced drone and counter-drone technologies, enabling large-scale deployment and innovation that reinforce the region’s leadership in counter-UAS capabilities.

- In October 2024, the U.S. Department of Defense published its annual defense spending report, highlighting a total expenditure of USD 609 billion across states. This significant investment continues to foster the development of advanced counter unmanned aircraft system (UAS) technologies and support industrial growth.

Asia Pacific anti-drone industry is likely to grow at a robust CAGR of 26.57% over the forecast period. This growth is stimulated by significant defense investments. Nations are prioritizing the development and deployment of advanced counter-drone technologies to enhance security. This focus on strengthening defense capabilities, along with growing security concerns, accelerates regional market expansion.

- In January 2025, India tested its indigenously developed Bhargavastra micro-missile system to address rising swarm drone threats. Featuring long-range detection and precision strike capabilities, the mobile and terrain-adaptable system highlights India’s commitment to cost-effective innovation and operational efficiency in strengthening its counter-drone defense infrastructure.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) regulates airspace management and influences the deployment of counter-drone systems. It enforces rules on drone operations and restricts the use of counter-drone technologies, such as jamming systems, to prevent interference with authorized Unmanned Aircraft Systems (UAS) operations and ensure safe airspace usage.

- In Europe, the European Union Aviation Safety Agency (EASA) sets comprehensive regulations for drone operations. It establishes safety standards for drones and imposes restrictions on counter-drone technologies such as jamming systems to prevent airspace disruption. EASA aims to integrate drones into European airspace while ensuring safe coexistence with manned aircraft.

- In Asia Pacific, the Civil Aviation Authority of Singapore (CAAS) oversees drone operations in Singapore to ensure their safe integration into the airspace. CAAS regulates counter drone systems to prevent disruptions to authorized drone activities and implements security measures to safeguard critical infrastructure. These regulations ensure a balanced approach to operational safety and security.

Competitive Landscape

The anti-drone market is evolving rapidly as companies introduce advanced counter unmanned aerial systems (UAS) solutions. Key industry players are prioritizing innovations such as vehicle mounted systems, AI-powered detection technologies, and automated neutralization capabilities to strengthen their market positions and address growing security demands across defense, critical infrastructure, and public safety sectors.

- In March 2025, DroneShield launched its Unmanned Aerial System (UAS) Incident platform to provide global insights into drone-related incidents. The platform aggregates open-source data and offers real-time intelligence on drone activities and security breaches. It enables customers to track, assess and respond to risks effectively using an updated repository for trend analysis specific to their security needs.

List of Key Companies in Anti-Drone Market:

- RTX

- Leonardo S.p.A.

- RAFAEL Advanced Defense Systems Ltd.

- DroneShield Ltd

- Moog Inc.

- MBDA

- Saab AB

- Lockheed Martin Corporation.

- Thales

- Dedrone

- ASELSAN A.Ş.

- Detect Inc.

- Accipiter Radar.

- IAI

- QinetiQ

Recent Developments (Partnerships/New Product Launch)

- In February 2025, Adani Defence & Aerospace, in partnership with the Defence Research and Development Organisation (DRDO), introduced a Vehicle-Mounted Counter-Drone System at Aero India. Designed to bolster India's defense readiness, the system delivers long-range protection with high agility and precision, featuring automated drone detection, classification, and neutralization. This underscores the nation’s focus on indigenous technological advancement in counter-UAS capabilities.

- In September 2024, Honeywell introduced its SAMURAI (Stationary and Mobile UAS Reveal and Intercept) system, aimed at countering drone swarms and protecting critical assets in contested airspace. The system integrates beyond-visual-line-of-sight communication with advanced command-and-control capabilities, enabling the detection, tracking, and neutralization of drone swarms on both mobile and fixed platforms.

- In June 2024, Dedrone, in collaboration with leading defense partners, launched DedroneOnTheMove (DedroneOTM)—a cutting-edge airspace security solution designed for expeditionary forces operating in high-risk environments. It features Dedrone’s award-winning sensor-fusion platform and DedroneTracker.AI, delivering 360-degree drone detection with 95% accuracy for effective counter-drone operations.