Market Definition

Military radars are electronic systems that use radio waves to detect, track, identify, and monitor aircraft, missiles, ships, vehicles, and personnel. They are essential for situational awareness, surveillance, targeting, and navigation in military operations.

The market focuses on the development, production, and sale of radar systems for military applications. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Military Radars Market Overview

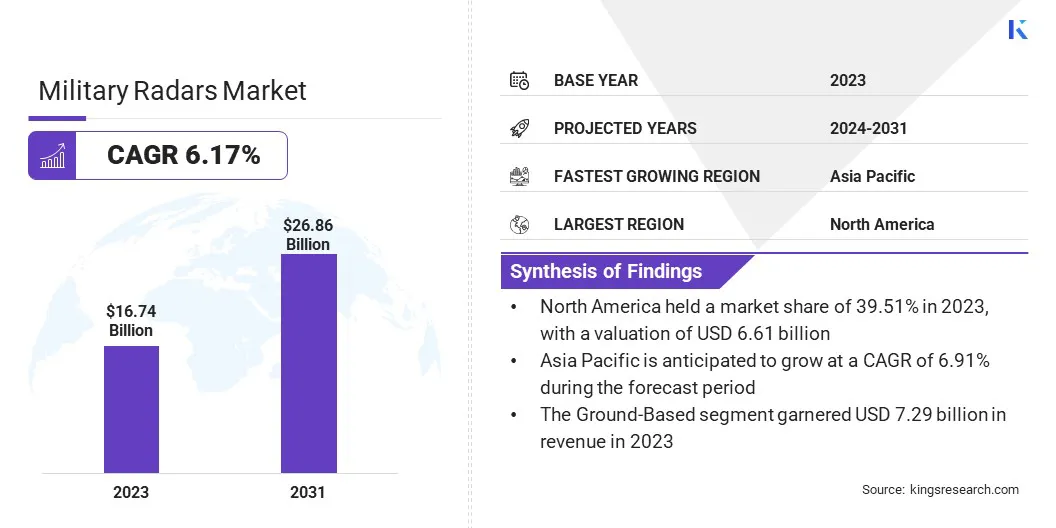

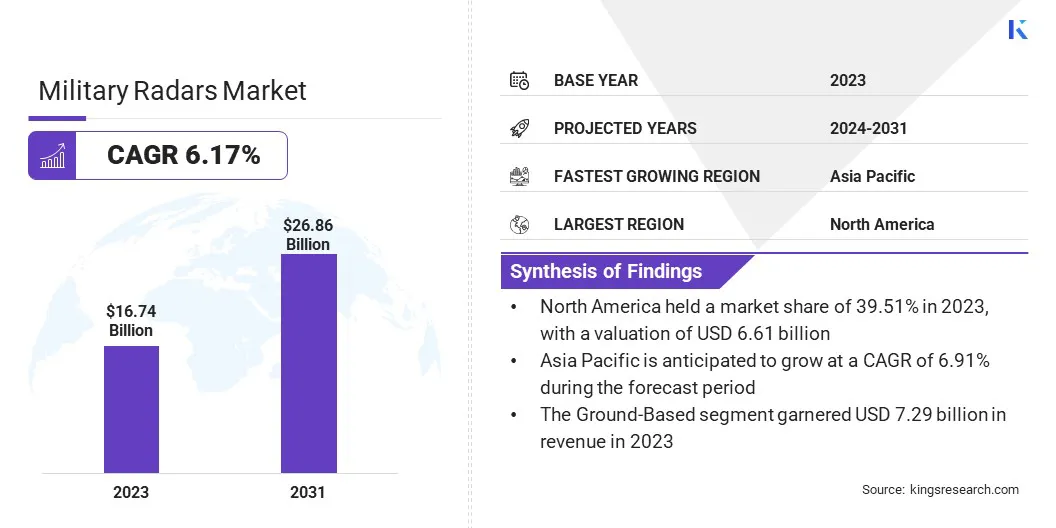

Global military radars market size was valued at USD 16.74 billion in 2023, which is estimated to be valued at USD 17.67 billion in 2024 and reach USD 26.86 billion by 2031, growing at a CAGR of 6.17% from 2024 to 2031.

Neuromorphic AI technology is driving market growth by enabling advanced radar systems to process complex data with low power consumption, enhancing performance in power-constrained environments such as drones and missiles.

Major companies operating in the military radars industry are RTX, Leonardo S.p.A., Thales, IAI, Lockheed Martin Corporation., BAE Systems, Hanwha Systems Co., Ltd., Hensoldt AG, Honeywell International Inc., L3Harris Technologies, Inc., Northrop Grumman., Saab AB, Tata Advanced Systems Limited, Bharat Electronics Limited (BEL), Indra, and others.

The market is witnessing strong demand, driven by the rising demand for border surveillance and homeland security, particularly in regions experiencing increased geopolitical tensions.

As nations focus on safeguarding their territorial integrity and responding to evolving threats such as terrorism, missile attacks, and unauthorized aerial incursions, radar systems play a crucial role in early detection and real-time monitoring.

This growing emphasis on national defense and situational awareness is propelling investments in modern radar technologies across land, air, sea, and space-based platforms.

- In September 2024, Indra secured one of Europe’s largest radar contracts to supply the Polish Air Force bases with 15 advanced, transportable systems, enhancing airspace control and dual-use operations. This contract reinforces Indra’s global leadership in civil-military radar technologies amid rising regional defense priorities.

Key Highlights:

- The military radars industry size was recorded at USD 16.74 billion in 2023.

- The market is projected to grow at a CAGR of 6.17% from 2024 to 2031.

- North America held a share of 39.51% in 2023, valued at USD 6.61 billion.

- The receiver & transmitter segment garnered USD 5.30 billion in revenue in 2023.

- The X band segment is expected to reach USD 6.98 billion by 2031.

- The short segment is anticipated to grow at a CAGR of 6.81% over the forecast period.

- The ground-based segment accounted for a share of 43.52% in 2023.

- The air & missile defense segment is anticipated to hold a share of 35.23% by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.91% through the proejction period.

Market Driver

"Growing Adoption of Neuromorphic AI Technology"

Advanced signal processing powereded by neuromorphic AI technology is propelling the growth of the military radars market. Neuromorphic processors, designed to mimic the human brain, enable radar systems to process complex data with remarkable efficiency while consuming significantly less power.

This technology allows for enhanced radar performance in power-constrained environments, such as drones and missiles, where size, weight, and energy consumption are critical. As radar systems become more compact and energy-efficient, the adoption of neuromorphic AI is expected to accelerate.

- In April 2025, BrainChip partnered with RTX’s Raytheon to support a USD 1.8 million U.S. Air Force Research Laboratory contract aimed at advancing neuromorphic radar signal processing for enhanced performance in size, weight, power, and cost (SWaP-C)-constrained platforms, inlcluding missiles, drones, and defense systems.

Market Challenge

"High Development Cost"

A major challenge hampering the expansion of the military radars market is the high development and procurement costs of advanced radar systems, which often limit adoption by budget-constrained defense agencies. These systems require significant investment in R&D, cutting-edge components, and integration capabilities.

This challenge can be addressed through modular designs and open architecture platforms, which allow for easier upgrades and interoperability, thereby reducing long-term costs.

Additionally, increased public-private partnerships and multi-nation collaborations can help share financial burdens while accelerating innovation and deployment of cost-effective radar solutions.

Market Trend

"Increased Demand for Next-Generation Systems"

A significant trend influencing the military radar market is the increased demand for next-generation systems. This shift reflects the modernization of legacy radar technologies, supported by the need for improved reliability and enhanced performance in challenging environments.

New radar systems are being designed to offer better operational capabilities in adverse weather, complex terrains, and combat conditions. This trend emphasizes long-term sustainability, advanced signal processing, and versatility, providing military forces with efficient, adaptable, and resilient radar solutions for modern defense requirements.

- In October 2024, Honeywell was awarded a USD 103 million contract by the U.S. Army to provide its Next-Gen APN-209 Radar Altimeter system. This next-generation system offers improved reliability, superior performance in challenging conditions, and flexible integration, replacing legacy systems to enhance military aircraft capabilities.

Military Radars Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Antenna, Receiver & Transmitter, Signal Processor, Power Amplifiers, Duplexers, Software & Algorithms

|

|

By Frequency Band

|

L Band, S Band, C Band, X Band, Ku Band, Ka Band, VHF Band, UHF Band

|

|

By Range

|

Long, Medium, Short, Very Short

|

|

By Platform

|

Ground-Based, Naval, Airborne, Space-Based

|

|

By Application

|

Air & Missile Defense, Airborne Surveillance, Ground Surveillance, Weapon Guidance, Naval Surveillance, Space Situational Awareness

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Antenna, Receiver & Transmitter, Signal Processor, Power Amplifiers, Duplexers, and Software & Algorithms): The receiver & transmitter segment earned USD 5.30 billion in 2023 due to rising demand for advanced threat detection systems with enhanced signal clarity and range across various defense platforms.

- By Frequency Band (L Band, S Band, C Band, X Band, Ku Band, Ka Band, VHF Band, and UHF Band): The X band segment held a share of 25.77% in 2023, attribuited to its high-resolution imaging capabilities and growing adoption in missile tracking, weather monitoring, and tactical military operations.

- By Range (Long, Medium, Short, and Very Short): The long segment is projected to reach USD 9.84 billion by 2031, fueled by increasing investments in early warning systems and cross-border threat detection across large geographical areas.

- By Platform (Ground-Based, Naval, Airborne, and Space-Based): The airborne segment is anticipated to grow at a CAGR of 6.30% over the forecast period, mainly due to growing military aircraft modernization programs and demand for agile, high-performance radar systems.

- By Application (Air & Missile Defense, Airborne Surveillance, Ground Surveillance, Weapon Guidance, Naval Surveillance, and Space Situational Awareness): The air & missile defense segment is likley to hold a share of 35.23% by 2031, propelled by rising geopolitical tensions and the need for advanced interception and tracking capabilities.

Military Radars Market Regional Analysis

Based on region, the market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America military radars market share stood at around 39.51% in 2023, valued at USD 6.61 billion. This dominance is reinforced by the region's high defense expenditure, rapid technological advancements, and strong focus on modernizing military infrastructure.

This growth is further boosted by rising emphasis on enhancing long-range detection, integrated air defense systems, and mobile radar capabilities to address evolving security challenges.

Extensive research and development initiatives, along with the presence of major defense contractors and government backing, further support innovation and deployment of advanced radar technologies.

- In December 2024, Saab secured a USD 48 million contract from BAE Systems to supply Giraffe 4A radar systems to the U.S. Air Forces in Europe. These AESA-based multi-function radars will enhance expeditionary airbase defense through high mobility and long-range surveillance capabilities.

Asia-Pacific military radars industry is estimated to grow at a CAGR of 6.91%. This notable growth is bolstered by increasing defense budgets, rising geopolitical tensions, and the urgent need to modernize aging surveillance infrastructure.

Countries across the region are heavily investing in advanced radar technologies to enhance airspace security, counter growing missile threats, and improve border monitoring.

The region’s diverse climate and complex terrain further boost demand for robust, all-weather radar systems with high accuracy and resilience in challenging environments, supporting long-term regional market growth.

- In December 2024, Indra secured a contract to supply its long-range Lanza radar to the Thai Air Force, reinforcing its presence in Asia and showcasing its capability to deliver advanced air defense solutions tailored to regional operational needs.

Regulatory Frameworks

- In the U.S., the National Defense Authorization Act (NDAA) authorizes funding and provides authorities for military and defense priorities, ensuring forces are equipped and trained for mission success.

- In India, the Defence Procurement Organisation (DPO),comprising the Defence Acquisitions Council (DAC), Defence Procurement Board (DPB), Defence Production Board, Defence Research & Development Board, and Acquisition Wing, oversees efficient defense acquisitions, including military radars.

- In the EU, the Commission's report on Directive 2009/81/EC addresses defense and sensitive security procurement, aiming to enhance procurement processes and ensure competitiveness and transparency.

Competitive Landscape

In the military radars market, companies are focusing on developing advanced radar systems to enhance defense capabilities, particularly in air and missile defense, surveillance, and target tracking.

These systems incorporate cutting-edge signal processing, sensor fusion, and artificial intelligence to provide real-time situational awareness, improve decision-making, and support tactical operations.

Additionally, efforts are being made to integrate radar systems with command and control platforms, creating more efficient, interconnected defense solutions for modern combat environments.

- In January 2025, Anduril Industries acquired the Radar and Command-and-Control businesses of Numerica Corporation. This acquisition enhances Anduril's air and missile defense solutions by integrating Numerica’s radar systems, including Spyglass and Spark, and its Mimir command software, bolstering mission capabilities with advanced tracking and sensor fusion technologies.

List of Key Companies in Military Radars Market:

- RTX

- Leonardo S.p.A.

- Thales

- IAI

- Lockheed Martin Corporation.

- BAE Systems

- Hanwha Systems Co., Ltd.

- Hensoldt AG

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Northrop Grumman.

- Saab AB

- Tata Advanced Systems Limited

- Bharat Electronics Limited (BEL)

- Indratis S.A.,

Recent Developments (Partnerships/Product Launch)

- In April 2025, Lockheed Martin delivered the first U.S. Air Force TPY-4 radar after successfully completing early phase testing. This milestone marks significant progress in the Three-Dimensional Expeditionary Long-Range Radar (3DELRR) program, enhancing global air surveillance and defense capabilities and aligning with evolving U.S. Air Force requirements.

- In February 2025, Raytheon, an RTX business, successfully conducted a live-fire test of its Lower Tier Air and Missile Defense Sensor (LTAMDS) radars. The test demonstrated LTAMDS' ability to detect and track high-speed threats while guiding the PAC-2 GEM-T missile. This milestone advances integration into the U.S. Army's missile defense architecture and strengthens international interest, particularly from Poland.

- In July 2024, Raytheon, an RTX business, secured a USD 1.2 billion contract to provide Germany with additional Patriot Configuration 3+ radars and missile defense systems. This contract enhances Germany's air defense infrastructure with the latest Patriot Configuration 3+ systems, strengthening NATO's defense posture and bolstering Germany's defense capabilities against advanced missile threats.