Market Definition

The market involves systems designed to manage and optimize the operation of microgrids by controlling generation sources, storage units, and loads. These controllers coordinate energy flow, ensure stability, and maintain power quality within isolated or grid-connected microgrids to support real-time monitoring, fault detection, and load forecasting.

Used across military bases, campuses, remote communities, and industrial plants, microgrid controllers are formulated for both hardware integration and advanced software control. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Microgrid Controller Market Overview

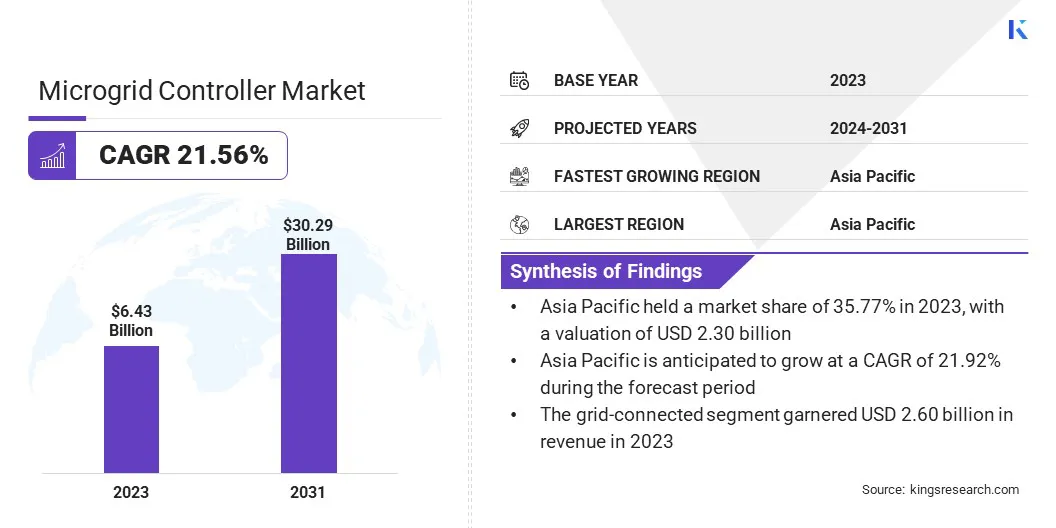

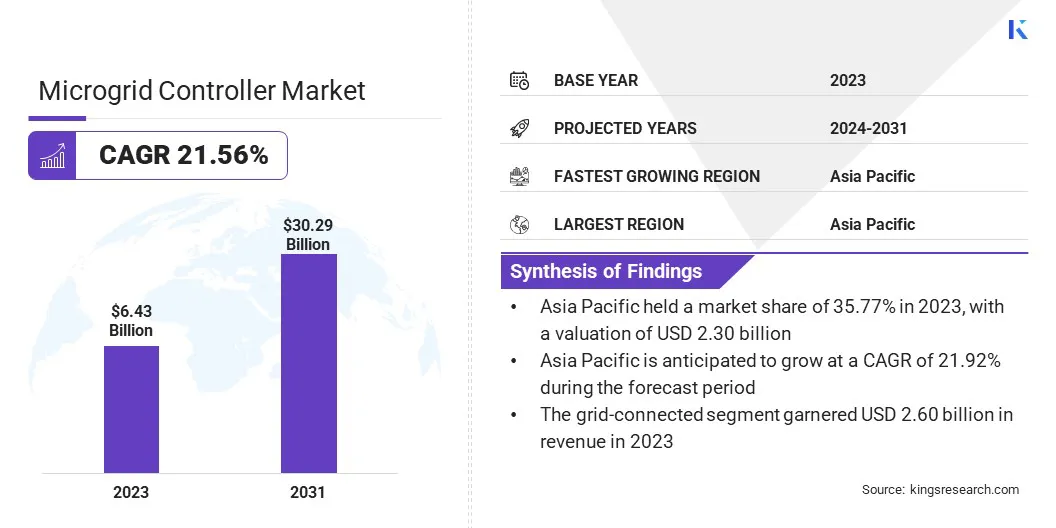

The global microgrid controller market size was valued at USD 6.43 billion in 2023 and is projected to grow from USD 7.72 billion in 2024 to USD 30.29 billion by 2031, exhibiting a CAGR of 21.56% during the forecast period.

The market's growth is driven by rising demand for grid stability and the growing deployment of localized energy systems. Technological advancements in renewable energy integration and microgrid control systems are improving real-time energy management, making microgrids more efficient, scalable, and best suited for diverse operational environments.

Major companies operating in the microgrid controller industry are Schneider Electric SE, General Electric, ABB, Siemens AG, Eaton, Schweitzer Engineering Laboratories, Inc., Honeywell International Inc., S&C Electric Company, Emerson Electric Co., Lockheed Martin Corporation, Cummins Inc., Caterpillar Inc., Encorp, LLC, Powerhive, Inc., and Heila Technologies.

The growth of the market is influenced by the increasing need for reliable and uninterrupted power, especially in remote and off-grid areas. Microgrids offer independent power solutions that reduce dependency on centralized grids and provide stable energy.

The ability to manage energy from various sources through a centralized control system boosts the demand for advanced microgrid controllers, leading to market growth.

- In May 2024, Pacific Gas and Electric (PG&E) introduced six new remote microgrid installations in California, aiming to serve individual customers and eliminate 6 miles of overhead lines in high fire-risk zones. PG&E plans to operate 12 remote grids, serving 18 customers and removing approximately 13 miles of overhead distribution lines.

Key Highlights

- The microgrid controller industry size was valued at USD 6.43 billion in 2023.

- The market is projected to grow at a CAGR of 21.56% from 2024 to 2031.

- Asia Pacific held a market share of 35.77% in 2023, with a valuation of USD 2.30 billion.

- The grid-connected segment garnered USD 2.60 billion in revenue in 2023.

- The cities and municipalities segment is expected to reach USD 8.32 billion by 2031.

- Europe is anticipated to grow at a CAGR of 21.47% during the forecast period.

Market Driver

"Advancements in Renewable Energy Integration"

The shift toward renewable energy sources, such as solar and wind, is driving the growth of the microgrid controller market. Microgrid controllers play a vital role in integrating renewable energy into local grids by efficiently managing energy storage and distribution.

With renewable energy adoption increasing globally, microgrid controllers are being used for optimizing energy flow, ensuring stability, and supporting sustainability goals.

- In September 2024, Honeywell Automation India Limited commissioned India's first on-grid solar microgrid with battery energy storage in Lakshadweep. This project integrates solar power with energy storage and management systems, reducing diesel consumption and carbon emissions, and enhancing the resilience of the island's power supply.

Market Challenge

"Complexity in System Integration"

A significant challenge in the growth of the microgrid controller market is the complexity of integrating diverse energy assets like solar panels, wind turbines, diesel generators, and battery storage into a unified control system. Each component operates on different protocols, making synchronization difficult.

To address this, key players are developing standardized communication platforms, modular controller architectures, and plug-and-play solutions. Some companies are partnering with software firms to enhance compatibility and reduce deployment time.

These efforts aim to simplify integration, improve interoperability, and make microgrid systems easier to manage, supporting broader adoption across industrial, commercial, and remote applications.

Market Trend

"Technological Advancements in Microgrid Control Systems"

Advancements in control technologies are enhancing the capabilities of microgrid systems, contributing to the growth of the microgrid controller market. Innovations such as real-time monitoring, predictive analytics, and automated response mechanisms allow for more efficient energy management. These technological improvements make microgrid controllers more attractive, fostering their widespread adoption.

- In July 2024, Xendee Corporation launched its adaptive microgrid control technology, OPERATE, which utilizes AI and machine learning for real-time monitoring and optimization of distributed energy resources. The technology has demonstrated up to 79.4% of operational cost savings in pilot projects, including installations at the University of California San Diego and a Midwest site.

Microgrid Controller Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Grid-connected, Off-grid, Hybrid

|

|

By Application

|

Utilities, Cities and Municipalities, Defense, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Grid-connected, Off-grid, and Hybrid): The grid-connected segment earned USD 2.60 billion in 2023, on account of its cost efficiency, easier regulatory approval, and ability to support energy trading while ensuring uninterrupted power supply through grid interaction.

- By Application (Utilities, Cities and Municipalities, Defense, Industrial, and Others): The cities and municipalities segment held 27.44% of the market in 2023, due to rising investments in urban energy resilience and the need for reliable and decentralized power systems to support critical infrastructure and public services.

Microgrid Controller Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific microgrid controller market share stood around 35.77% in 2023 in the global market, with a valuation of USD 2.30 billion. This dominance is attributed to the rapid urbanization and large-scale smart city projects in the region. These developments require resilient and flexible power systems.

Microgrid controllers are being integrated into urban energy networks to manage distributed resources, ensure load balancing, and support automation. The push toward digital infrastructure and energy resilience is fueling the growth of the market within urban planning projects in the region.

- In March 2024, Schneider Electric partnered with Mainspring Energy to offer a fuel-flexible microgrid solution tailored for commercial and industrial customers. This solution allows dynamic switching among multiple fuel options, including low-and zero-carbon fuels, ensuring accessible electricity and aiding in meeting decarbonization goals.

Moreover, with the growth of the digital economy, Asia Pacific has seen a sharp rise in the number of data centers and IT hubs. These facilities require uninterrupted power and efficient energy usage. The increasing energy needs of digital infrastructure are playing a key role in driving the regional market.

Europe microgrid controller industry is poised for significant growth at a robust CAGR of 21.47% over the forecast period. The region is accelerating the shift toward decentralized power systems to reduce reliance on centralized fossil-fuel-based grids.

Microgrids are being used to support local energy generation, especially in communities aiming for energy independence. Microgrid controllers are essential for managing these distributed systems, enabling flexible energy flow and grid stability. This trend is significantly contributing to the growth of the market across Europe.

Furthermore, Europe's increasing electric vehicle adoption is driving demand for local and resilient charging infrastructure. Microgrids are being used to power EV stations while reducing stress on national grids. This growing electrification trend is supporting the expansion of the market in transport applications.

Regulatory Frameworks

- The U.S. federal framework for microgrids is shaped by the Energy Independence and Security Act of 2007, which promotes smart grid modernization and mandates the National Institute of Standards and Technology (NIST) to coordinate the development of smart grid standards. The Federal Energy Regulatory Commission (FERC) oversees the implementation of these standards. Additionally, the Energy Policy Act of 2005 encourages the integration of renewable energy sources and supports the development of microgrids.

- China has established the GB/T 43463-2023 standard, which outlines the requirements for the operation and control of microgrid clusters. This standard provides guidelines for the management and maintenance of microgrid systems, ensuring their safe and efficient operation.

- South Korea's regulatory framework includes the Act on the Construction and Promotion of Smart Grid, which supports the development of smart grids and microgrids. The government has also announced the Second Smart Grid Basic Plan, focusing on expanding smart grid services and infrastructure, including microgrids.

Competitive Landscape

Market players in the microgrid controller industry are increasingly adopting mergers and acquisitions to expand their capabilities and strengthen their position. These strategies help companies integrate advanced technologies, improve control systems, and offer more complete solutions to customers.

The acquisition of specialized firms allows major players to access proven software platforms, improve compatibility with various energy assets, and serve a broader customer base. Such moves are enhancing product value, streamlining deployment, and improving the operational efficiency of the market.

- In August 2024, Generac Power Systems acquired Ageto, a microgrid controller specialist known for its ARC controller. This acquisition has enhanced Generac's offerings in the commercial and industrial (C&I) market by integrating Ageto's advanced software, simplifying asset integration and optimization for customers.

List of Key Companies in Microgrid Controller Market:

- Schneider Electric SE

- General Electric

- ABB

- Siemens AG

- Eaton

- Schweitzer Engineering Laboratories, Inc.

- Honeywell International Inc.

- S&C Electric Company

- Emerson Electric Co.

- Lockheed Martin Corporation

- Cummins Inc.

- Caterpillar Inc.

- Encorp, LLC

- Powerhive, Inc.

- Heila Technologies

Recent Developments (Expansion/Product Launch)

- In October 2024, Encorp expanded its microgrid control services to include engineering, procurement, and construction (EPC). This move was aimed at offering customized microgrid solutions, emphasizing flexibility and independence from large multinational corporations.

- In May 2023, Schneider Electric introduced EcoStruxure Microgrid Flex, a standardized microgrid solution designed to shorten project timelines and enhance return on investment. This solution would streamline data integration and offer advanced energy management capabilities for various applications.