Market Definition

The market involves the systematic handling, treatment, and disposal of waste generated by healthcare facilities, laboratories, and research centers. This includes infectious waste, pathological waste, sharps, and chemical residues.

The process begins with categorization and segregation at the source. This is followed by collection, storage, treatment through incineration, autoclaving, or chemical disinfection and safe final disposal.

Applications span hospitals, diagnostic labs, and pharmaceutical industries, ensuring compliance with regulatory standards and safe handling of biohazardous materials to protect both public health and the environment. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Medical Waste Management Market Overview

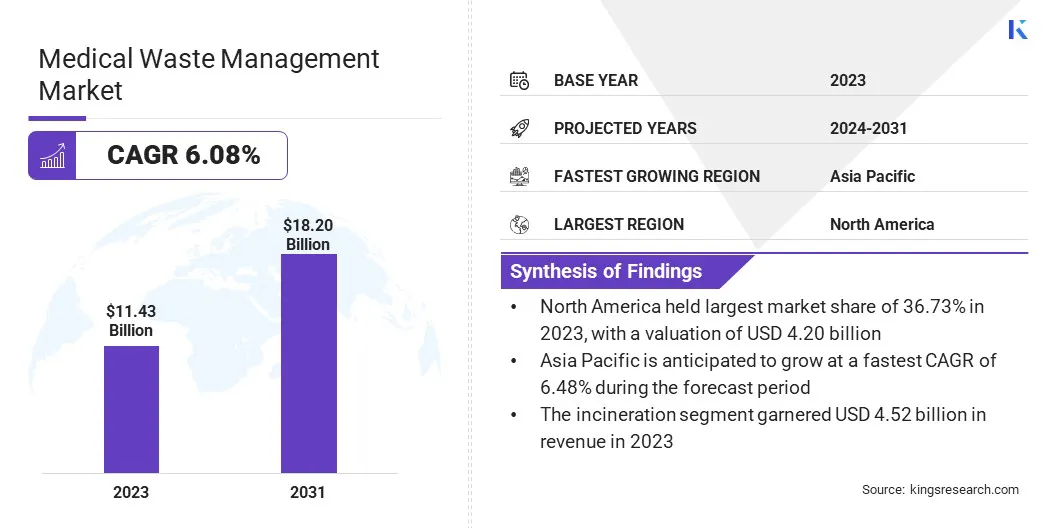

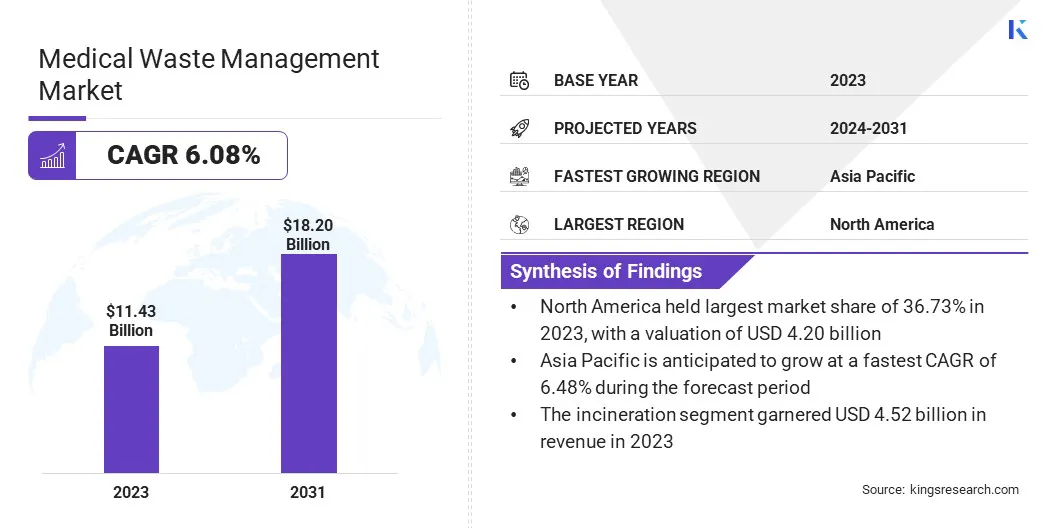

According to Kings Research, the medical waste management market size was valued at USD 11.43 billion in 2023 and is projected to grow from USD 12.04 billion in 2024 to USD 18.20 billion by 2031, exhibiting a CAGR of 6.08% during the forecast period.

The integration of sustainability and circular economy principles is driving the growth of the market by encouraging healthcare facilities to adopt eco-friendly waste treatment solutions.

Additionally, outsourcing trends among healthcare providers are boosting the demand for specialized waste management services, as hospitals seek efficient, compliant, and cost-effective solutions.

Major companies operating in the medical waste management industry are Veolia, Clean Harbors, Inc., Stericycle, Inc., WM Intellectual Property Holdings, L.L.C, Republic Services, Waste Connections, Cleanaway, Casella Waste Systems, Inc., Sharps Compliance, Inc., Reworld, REMONDIS SE & Co. KG, BioMedical Waste Solutions, LLC, BWS Incorporated, EcoMed Services, and Gamma Waste Services.

The growing push for sustainability by governments, healthcare institutions, and environmental agencies has led stakeholders to explore eco-friendly alternatives in medical waste disposal.

These alternatives include energy recovery from waste, recycling of non-hazardous components, and the use of biodegradable materials in healthcare packaging and consumables. Medical waste management companies are aligning their strategies with these principles to reduce landfill dependence and lower carbon emissions.

The integration of circular economy models in healthcare waste handling is further enhancing the adoption of advanced solutions, such as automated waste segregation systems and energy-efficient treatment technologies, positively impacting the growth of the market.

- In March 2025, Reworld completed the acquisition of R.E.D. Technologies, LLC, a privately owned company specializing in profiled waste and field remediation services. Through this acquisition, Reworld aims to transform waste management through resource recovery, recycling, and reuse.

Key Highlights

- The medical waste management industry size was valued at USD 11.43 billion in 2023.

- The market is projected to grow at a CAGR of 6.08% from 2024 to 2031.

- North America held a market share of 36.73% in 2023, with a valuation of USD 4.20 billion.

- The hazardous waste segment garnered USD 6.67 billion in revenue in 2023.

- The offsite treatment segment is expected to reach USD 10.41 billion by 2031.

- The incineration segment secured the largest revenue share of 39.55% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 6.48% during the forecast period.

Market Driver

"Growing Awareness About Environmental and Health Hazards"

Heightened awareness regarding the adverse effects of improper disposal of medical waste has encouraged public and private healthcare institutions to adopt safer waste handling practices. Exposure to infectious waste, toxic chemicals, or sharp instruments can lead to serious health complications and environmental contamination.

Growing concern among stakeholders about these issues is accelerating the adoption of sustainable and efficient waste management systems, which in turn is driving the growth of the medical waste management market.

- In October 2023, BD, in collaboration with Casella Waste Systems, Inc., a provider of solid waste, recycling, and resource management services, announced the successful results of a pilot program aimed at recycling used syringes and needles. Through this initiative, the companies managed to recycle and divert 40,000 pounds of medical waste from landfills.

Market Challenge

"Regulatory Compliance and Disposal Restrictions"

A significant challenge in the medical waste management market is the strict regulatory requirements surrounding the disposal of hazardous waste. These regulations vary by region and often demand high compliance costs and extensive documentation.

Key players are addressing this by investing in advanced technologies that streamline compliance processes, such as automated tracking systems for waste disposal.

Additionally, several players are partnering with local authorities and regulatory bodies to stay ahead of evolving laws, ensuring they can meet new requirements efficiently. Emphasis is also being placed on employee training to manage and dispose of medical waste properly, reducing risks and improving operational efficiency.

Market Trend

"Outsourcing of Medical Waste Management Services by Healthcare Providers"

Healthcare institutions are increasingly outsourcing medical waste handling to specialized third-party service providers to enhance compliance and reduce operational risks.

Outsourcing allows hospitals and clinics to focus on patient care while delegating waste management to licensed professionals with expertise in regulatory requirements and best practices.

This shift in operational strategy has opened new opportunities for waste management companies, accelerating the expansion of the medical waste management market across various regions.

- In October 2024, the University of California entered into a systemwide agreement with Clean Harbors to deliver hazardous and medical waste disposal services. Under this contract, Clean Harbors will manage waste generated across all UC campuses, medical centers, laboratories, and other affiliated facilities throughout the university system.

Medical Waste Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type of Waste

|

Hazardous Waste, Non-Hazardous Waste

|

|

By Treatment Site

|

Onsite Treatment, Offsite Treatment

|

|

By Treatment

|

Incineration, Autoclaving, Chemical Treatment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type of Waste (Hazardous Waste and Non-Hazardous Waste): The hazardous waste segment earned USD 6.67 billion in 2023 due to the high volume of infectious, pathological, and chemically contaminated materials generated by hospitals and laboratories.

- By Treatment Site (Onsite Treatment, Offsite Treatment): The offsite treatment segment held 58.35% of the market in 2023, due to its ability to handle large volumes of waste through specialized facilities, ensuring cost-efficiency, regulatory compliance, and minimized on-site operational burden for healthcare providers.

- By Treatment (Incineration, Autoclaving, Chemical Treatment, and Others): The incineration segment is projected to reach USD 6.97 billion by 2031, owing to its ability to effectively treat large volumes of hazardous and infectious waste while significantly reducing waste volume and eliminating pathogens.

Medical Waste Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America medical waste management market share stood at around 36.73% in 2023 in the global market, with a valuation of USD 4,199.2 million. The growing shift toward outpatient care and same-day surgeries across North America has led to a rise in ambulatory surgical centers and standalone clinics.

These facilities generate a consistent volume of regulated medical waste, including sharps, contaminated PPE, and pharmaceuticals, contributing to the growth of the market in the region.

Moreover, the trend toward centralizing treatment operations in the U.S. and Canada has led to the development of large-scale, high-capacity treatment plants. These centralized facilities, equipped with autoclaves, incinerators, and chemical disinfection units, are able to process waste from multiple healthcare providers.

Their emergence ensures consistent waste disposal capacity and regulatory compliance, supporting market growth through enhanced operational efficiency and reduced per-unit treatment costs.

- In October 2024, Stericycle, Inc. introduced its new, advanced Hospital, Medical, and Infectious Waste Incinerator (HMIWI) facility at the Tahoe Reno Industrial Center in McCarran, Nevada, U.S. Spanning 110,000 square feet, the facility is designed to meet the increasing demand for medical waste management in the region. Stericycle allocated approximately USD 110 million toward the development and outfitting of the site with cutting-edge systems and engineering solutions to ensure the safe treatment of infectious waste and proper disposal of unused pharmaceuticals.

Asia Pacific medical waste management industry is poised for significant growth at a robust CAGR of 6.48% over the forecast period. Rapid urbanization across major cities has led to the expansion of large multi-specialty hospitals, diagnostic laboratories, and private healthcare clinics.

These facilities are generating increasing volumes of biomedical waste on a daily basis. Due to limited in-house waste treatment capacities, most institutions are turning to specialized third-party vendors for safe and compliant waste disposal, driving market growth across urban centers.

Furthermore, the region has seen a gradual shift toward the adoption of advanced biomedical waste treatment technologies that enable faster, cleaner, and more sustainable disposal practices.

These modern systems allow for the effective neutralization of infectious waste while minimizing environmental impact, supporting stricter regulatory compliance across Asia Pacific.

- In February 2025, the Government of India introduced the Automated Biomedical Waste Treatment Plant, named "Sṛjanam," at All India Institute of Medical Sciences (AIIMS) New Delhi. Developed by CSIR-NIIST, this eco-friendly innovation marks a major step forward in sustainable biomedical waste management. The Sṛjanam system effectively disinfects infectious biomedical waste, such as blood, sputum, urine, and lab disposables, without relying on expensive, energy-heavy incineration. Furthermore, the system helps control odor by releasing a mild fragrance, improving both safety and working conditions during waste treatment.

Regulatory Frameworks

- In the U.S., medical waste management is regulated at the state level, where the states have developed their own regulations, guided by EPA recommendations and the Resource Conservation and Recovery Act (RCRA) for hazardous waste. Healthcare facilities must comply with both state and federal regulations, ensuring proper segregation, storage, transportation, and disposal of medical waste.

- The UK manages healthcare waste under the Environmental Protection Act 1990 and the Controlled Waste Regulations 2012. Healthcare providers must adhere to the Health Technical Memorandum 07-01, which outlines best practices for waste segregation, storage, and disposal. The Environment Agency oversees compliance, and facilities must ensure that waste is handled safely to prevent harm to human health and the environment.

- China regulates medical waste through the "Regulations on the Administration of Medical Wastes," issued by the State Council. These regulations cover the entire lifecycle of medical waste, including collection, transportation, storage, and disposal. Healthcare institutions must establish dedicated waste management systems and ensure that medical waste is not mixed with other types of waste.

- India's Bio-Medical Waste Management Rules, 2016, established by the Ministry of Environment, Forest and Climate Change, provides a comprehensive framework for managing biomedical waste. The rules categorize waste into four groups and prescribe specific treatment and disposal methods for each. Healthcare facilities must obtain authorization from State Pollution Control Boards and are required to treat and dispose of biomedical waste within 48 hours to prevent environmental contamination.

Competitive Landscape

Market players are increasingly focusing on strategies like collaboration and technological innovation to strengthen their position and support the expansion of the medical waste management industry.

By partnering with cleantech firms and adopting advanced treatment solutions, companies are improving operational efficiency and aligning with evolving sustainability goals. These approaches enable organizations to manage waste more safely and cost-effectively while meeting regulatory standards.

- In January 2024, Northwell Health partnered with Envetec, a cleantech company focused on eliminating unsustainable methods of managing regulated medical waste, to implement its GENERATIONS 1 technology. This advanced solution is set to treat over 500,000 pounds of regulated medical waste annually, directly at the source. The technology enables safe and efficient on-site processing of waste materials such as single-use laboratory plastics, glass, personal protective equipment (PPE), and sharps containers, supporting Northwell Health’s commitment to environmentally responsible healthcare operations.

List of Key Companies in Medical Waste Management Market:

- Veolia

- Clean Harbors, Inc.

- Stericycle, Inc.

- WM Intellectual Property Holdings, L.L.C

- Republic Services

- Waste Connections

- Cleanaway

- Casella Waste Systems, Inc.

- Sharps Compliance, Inc.

- Reworld

- REMONDIS SE & Co. KG

- BioMedical Waste Solutions, LLC

- BWS Incorporated

- EcoMed Services

- Gamma Waste Services

Recent Developments (M&A/Expansion)

- In April 2025, Veolia expanded its partnership with MassBio, a leading biopharmaceutical research consortium, through a multi-year contract extension. This agreement ensures the continued provision of advanced, safe, and reliable waste management services, along with digital energy efficiency management for MassBio members. Additionally, Veolia will assist in decarbonizing research facilities, helping MassBio companies comply with Boston and Cambridge’s carbon reduction mandates. Veolia’s expertise in energy efficiency solutions will enable these organizations to meet and exceed local environmental requirements.

- In June 2024, Cleanaway acquired Citywide Waste for USD 110 million. As part of the agreement, Cleanaway secured a 35-year lease for the waste transfer station located on Dynon Road in West Melbourne, Australia, which is the second-largest station in Victoria.