Market Definition

The market encompasses a broad range of mobile units designed to support the efficient delivery of healthcare services across various clinical environments. This market includes different categories of carts such as anesthesia, emergency, and procedure carts, tailored to meet specific clinical requirements.

The report explores the critical drivers fueling market development and offers a detailed regional analysis and an overview of the competitive landscape shaping future opportunities.

Medical Carts Market Overview

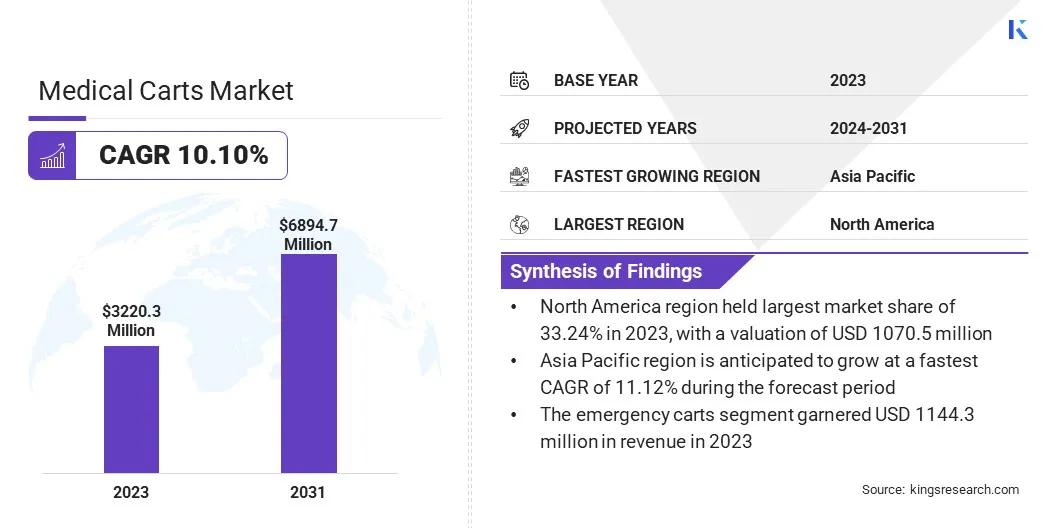

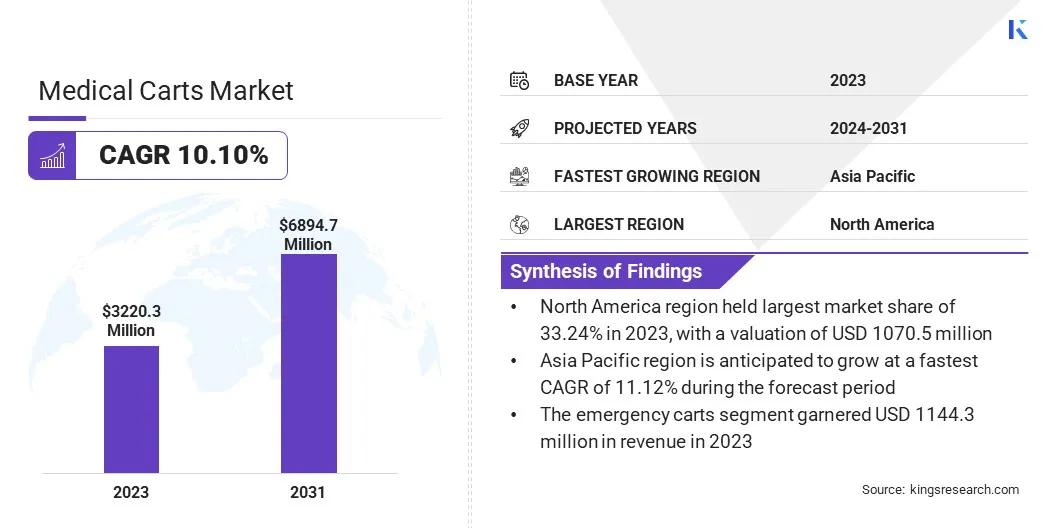

The global medical carts market size was valued at USD 3220.3 million in 2023 and is projected to grow from USD 3515.3 million in 2024 to USD 6894.7 million by 2031, exhibiting a CAGR of 10.10% during the forecast period.

The rising global investments in healthcare infrastructure and the accelerating adoption of digital health technologies are driving the growth of the market. As healthcare systems expand and modernize, particularly in emerging economies, there is a growing need for efficient, mobile solutions that enhance clinical workflows and patient care. These factors are driving the adoption of medical carts, in turn fueling the growth of the market.

Key Market Highlights:

- The medical carts industry size was recorded at USD 3220.3 million in 2023.

- The market is projected to grow at a CAGR of 10.10% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 1070.5 million.

- The emergency carts segment garnered USD 1144.1 million in revenue in 2023.

- The hospitals segment is expected to reach USD 2552.1 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 11.12% during the forecast period.

Major companies operating in the medical carts market are Medline Industries, TouchPoint, Inc., Bergmann Group, Enovate Medical, Midmark Corporation, Ergotron, Inc., DeRoyal Industries, Inc., Stryker, iTD GmbH, AFC Industries, Inc., Bytec Healthcare Ltd, Capsa Healthcare, Advantech Co., Ltd., Harloff, and GCX Corporation.

Advancements in healthcare technology are transforming medical carts into intelligent, connected systems with features such as wireless connectivity, touchscreen interfaces, and integration with electronic health records (EHR). These enhancements are increasing the adoption of medical carts as they enable healthcare providers to deliver care with greater precision and efficiency.

- In January 2024, Rudolf Riester GmbH launched its telemedicine solutions globally, featuring advanced cart and case offerings designed to support accurate diagnostics and remote care delivery. Riester telemedicine carts integrate a wide range of medical devices to accommodate diverse clinical scenarios.

Rising Healthcare Investments

The market is driven by rising investments in healthcare infrastructure across both developed and developing regions. As hospitals and healthcare facilities undergo modernization and expansion, there is a growing need to enhance operational efficiency and patient care delivery, leading to increased adoption of versatile medical carts.

In emerging economies, governments and private players are heavily investing in the construction of new hospitals, upgrading existing facilities, and improving medical equipment availability. These developments demand efficient mobility solutions like medical carts for streamlined storage, medication management, and access to critical tools at the point of care.

- In May 2023, Temasek, a Singapore-based investment firm, invested USD 2 billion in Manipal Health Enterprises, one of India’s leading healthcare providers. The investment underscores the rising momentum in healthcare infrastructure development across Asia and supports the expansion and modernization of medical facilities to meet growing patient demand.

High Initial Cost and Maintenance Expenses

A major challenge in the medical carts market is the high initial cost and ongoing maintenance expenses associated with advanced, technology-integrated carts. Advanced medical carts equipped with electronic health record (EHR) interfaces, battery systems, and smart features, require significant upfront investment, making it difficult for smaller healthcare facilities and clinics with limited budgets to adopt them.

To address this, key players are offering modular and scalable cart systems that allow facilities to start with basic configurations and upgrade over time as budgets and needs evolve. Furthermore, leasing models or vendor-managed service contracts are lowering the financial burden to promote broader access across varied healthcare settings.

Integration of Advanced Technologies

The market is experiencing a significant shift driven by the integration of advanced technologies that enhance clinical productivity and operational efficiency. Healthcare providers are investing in medical carts equipped with touchscreen interfaces, barcode scanning capabilities, wireless connectivity, and power management systems to support EHR integration and other digital platforms.

These innovations enable faster access to patient information, streamline medication administration, and minimize manual errors, ultimately improving patient outcomes and reducing the administrative burden on healthcare professionals. As digital transformation accelerates across the healthcare sector, technologically advanced medical carts are becoming a critical component of modern care delivery models.

- In August 2024, TAGCarts and Inpro partnered to launch the TAG-X Smart Rail, a wireless, contactless charging solution designed to integrate with TAGCarts’ ecosystem of medical carts, mobile medical equipment, and software. The TAG-X Smart Rail leverages existing healthcare facility infrastructure to enhance efficiency, optimize battery health, and improve staff mobility and safety by eliminating the need for cords and swappable batteries. The collaboration combines TAGCarts’ patented technology with Inpro’s durable wall guard systems to deliver a seamless, touch-free charging experience for healthcare environments.

Medical Carts Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Anesthesia Carts, Emergency Carts, Procedure Carts, Others

|

|

By End Use

|

Hospitals, Ambulatory Surgical Centers, Clinics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Anesthesia Carts, Emergency Carts, Procedure Carts, Others): The emergency carts segment earned USD 1144.1 million in 2023 due to their critical role in rapid response situations and increased adoption in emergency departments for life-saving interventions.

- By End Use (Hospitals, Ambulatory Surgical Centers, Clinics, and Others): The hospitals held 37.37% of the market in 2023, due to their high patient volume, need for organized medical supply management, and frequent use of mobile solutions across departments.

Medical Carts Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America medical carts market share stood around 33.24% in 2023 in the global market, with a valuation of USD 1070.5 million. This dominance is attributed to the region’s advanced healthcare infrastructure, high adoption of medical technologies, and increasing investment in hospital modernization.

The strong presence of leading market players, along with a high demand for efficient clinical workflow solutions in hospitals is further fueling market growth. Additionally, the growing emphasis on patient safety, coupled with the widespread integration of EHR systems, is increasing the demand for advanced medical carts across the United States and Canada.

Asia Pacific is poised to grow at a significant growth at a CAGR of 11.12% over the forecast period, fueled by rapid healthcare infrastructure development, increasing investments in hospitals, and rising awareness of patient care efficiency. Countries such as China, India, and Japan are experiencing a surge in healthcare modernization, supported by government initiatives and rising healthcare expenditure.

Furthermore, the growing patient population, combined with an expanding network of hospitals and clinics, is driving the demand for versatile and cost-effective medical carts across the region.

- In April 2025, Adani Group announced the launch of Adani Health City, a network of integrated health campuses, through its not-for-profit healthcare arm in India. In partnership with Mayo Clinic, the initiative aims to pioneer medical education, world-class medical research, and affordable healthcare. The first phase will include two 1000-bed hospitals and medical colleges in Mumbai and Ahmedabad, to provide accessible, high-quality healthcare to all sections of society across the country.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates medical carts as Class I or Class II medical devices based on their intended use, requiring manufacturers to follow appropriate labeling, registration, and reporting requirements under the FDA’s medical device guidelines.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the regulation of medical carts, requiring pre-market approval or certification based on device classification as outlined under the Pharmaceutical and Medical Device Act (PMD Act).

Competitive Landscape

The medical carts industry is highly competitive, particularly within the digital medical carts segment, where key players are increasingly focusing on innovation to strengthen their market presence. Key players are focusing on modular and ergonomic designs tailored for specialized applications such as telemedicine, point-of-care diagnostics, and mobile imaging.

New product developments increasingly feature integrated touchscreen interfaces, real-time data access systems, hot-swappable power units for uninterrupted usage, and antimicrobial surfaces to meet hospital hygiene standards. Companies are also emphasizing interoperability with hospital information systems (HIS) and incorporating AI-assisted tools for workflow optimization.

- In September 2024, Capsa Healthcare launched the Tryten P-Series tablet and monitor carts, designed to enhance telehealth, virtual care, and patient experience across modern healthcare environments. The Tryten P1 features an extended articulating arm for improved viewing flexibility and patient comfort, while its stable base ensures safe operation. The P-Series also introduces a new column design with enhanced cable management and an intuitive mounting system, allowing seamless integration of multiple peripherals to support clinical workflow and efficiency.

Key Companies in Medical Carts Market:

- Medline Industries

- TouchPoint, Inc.

- Bergmann Group

- Enovate Medical

- Midmark Corporation

- Ergotron, Inc.

- DeRoyal Industries, Inc

- Stryker

- iTD GmbH

- AFC Industries, Inc.

- Bytec Healthcare Ltd

- Capsa Healthcare

- Advantech Co., Ltd.

- Harloff

- GCX Corporation

Recent Developments (Partnerships)

- In May 2024, Baptist Health expanded its partnership with Caregility to enhance patient care by significantly increasing its deployment of Caregility’s mobile telehealth carts and devices. As part of the initiative, Baptist Health will double its bedside telehealth footprint to over 700 bedsides across its system, integrating Caregility’s APS250C carts and new APS200 Duo edge devices.

This expansion supports the health system’s virtual nursing programs and reinforces its commitment to leveraging medical cart-based telehealth solutions for improved patient outcomes and care efficiency.