Maritime Patrol Naval Vessels Market Size

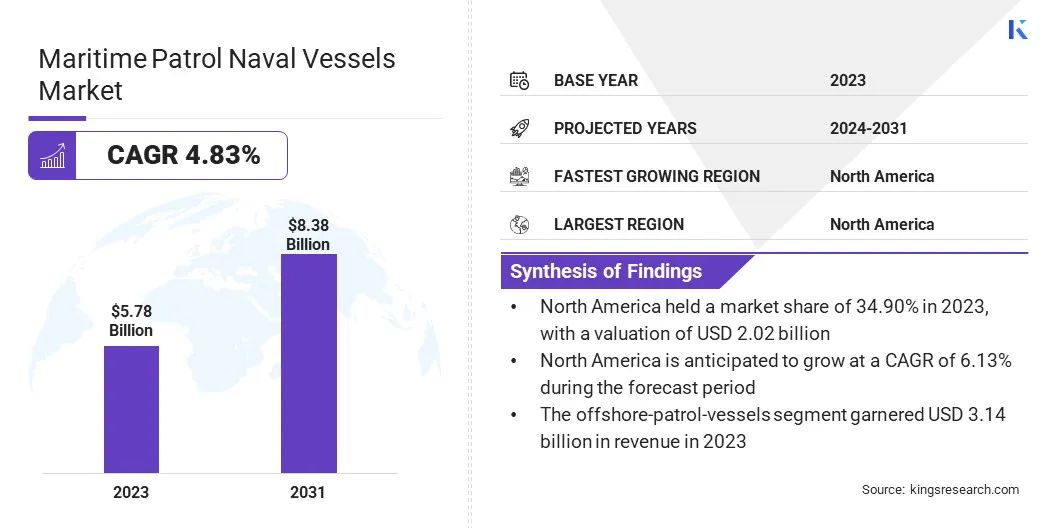

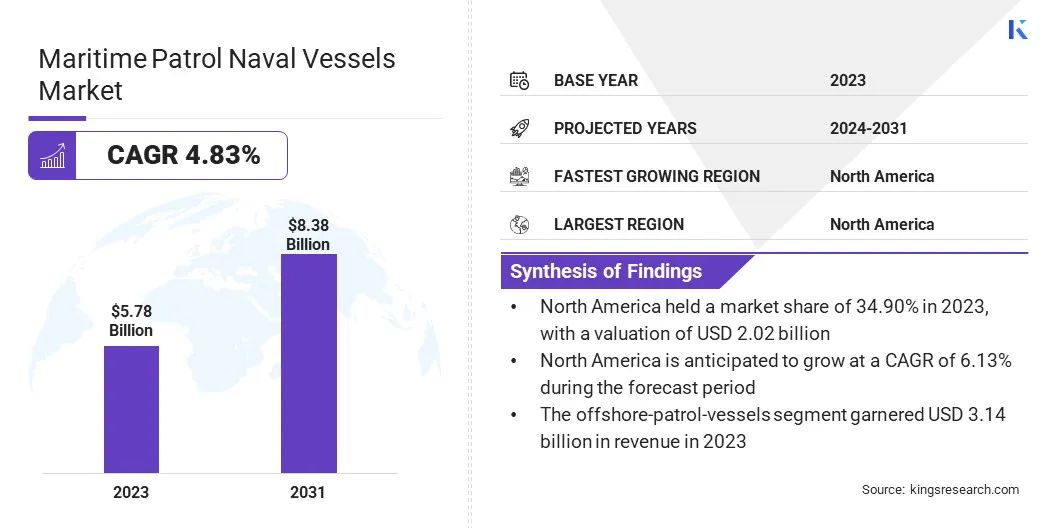

The Maritime Patrol Naval Vessels Market size was valued at USD 5.78 billion in 2023 and is projected to grow from USD 6.02 billion in 2024 to USD 8.38 billion by 2031, exhibiting a CAGR of 4.83% during the forecast period. The expansion of the market is driven by rising maritime security threats, increasing geopolitical tensions, ongoing technological advancements, and the pressing need for enhanced surveillance capabilities.

In the scope of work, the report includes solutions and products offered by companies such as Austal, Damen Marine Components, Huntington Ingalls Industries, Naval Group, Navantia, Saab AB, BAE Systems, FINCANTIERI S.p.A., MITSUBISHI HEAVY INDUSTRIES, LTD., NVL B.V. & Co. KG, and others.

The escalation of piracy, smuggling, and unauthorized fishing has compelled nations to invest in modern patrol vessels. Technological advancements in sensor and weapon systems for naval patrol vessels are further boosting the maritime patrol naval vessels market growth.

- In November 2023, Thales announced that it had supplied the French Navy with a sensor suite, including the NS50 radar, Bluewatcher sonar, and an IFF identification system, for its new offshore patrol vessels. Scheduled to enter service in 2027, these vessels are intended to replace the Estienne d’Orves class and OPV54-class boats. The new vessels aim to feature long endurance for escorting nuclear-powered submarines, maritime area control, and national evacuation missions. The advanced Thales systems possess the ability to enhance mission effectiveness with proven underwater detection and precise radar capabilities.

Moreover, the expansion of exclusive economic zones (EEZs) necessitates enhanced maritime domain awareness, leading to increased demand for patrol vessels equipped with sophisticated monitoring and reconnaissance technologies.

The maritime patrol naval vessels are critical for maintaining national security, enforcing maritime law, and safeguarding territorial waters. The market includes various patrol vessels, such as offshore patrol vessels (OPVs) and inshore patrol vessels (IPVs), each serving specific operational requirements. The global rise in defense budgets highlights the emphasis on maritime security, resulting in the market witnessing steady growth, supported by both governmental and commercial sectors.

Maritime patrol naval vessels are defined as ships specifically designed for surveillance, monitoring, and enforcement activities in territorial waters and high seas. These vessels are equipped with advanced radar, sonar, and communication systems to detect and track potential threats.

They play a vital role in border protection, counter-piracy operations, and environmental monitoring. The vessels vary in size and capability, encompassing both small, fast craft, and larger, more versatile ships capable of long-endurance missions. Their functions include ensuring maritime safety and security, making them an essential asset for naval and coast guard forces worldwide.

Analyst’s Review

Leading companies in maritime patrol naval vessels market are focusing on developing multi-mission vessels with advanced surveillance and combat capabilities. The introduction of new products, such as unmanned systems, is contributing to enhanced operational flexibility and efficiency. Moreover, manufacturers are investing in cutting-edge technologies such as AI and autonomous navigation to improve vessel performance and reduce operational costs.

To mainatin competitiveness, firms should prioritize partnerships and collaborations to stimulate technological advancements and facilitate cost-sharing. Additionally, continuous upgrades and maintenance services are anticipated to be crucial in extending the lifecycle of patrol vessels.

- For instance, in April 2024, Austal USA commenced construction of the first LCU 1710 Landing Craft Utility vessel for the United States Navy at its Mobile, Alabama shipyard. The company received a US$91.5 million contract in September 2023 for three LCU 1710 vessels and support services. The vessels are designed to enhance amphibious operations by transporting vehicles, personnel, and cargo.

Maritime Patrol Naval Vessels Market Growth Factors

A prominent factor aiding the expansion of the market is the rising maritime security threats. Nations are actively focusing on strengthening their maritime defenses due to increasing incidents of piracy, smuggling, and territorial disputes. The need for advanced surveillance and reconnaissance capabilities is growing, prompting investments in modern patrol vessels equipped with cutting-edge technology.

Additionally, the expansion of exclusive economic zones (EEZs) is highlighting the need for improved maritime domain awareness. Countries are actively procuring and upgrading their fleets to ensure the safety of their waters and secure their economic interests, thereby fueling market growth.

The maritime patrol naval vessels market faces significant challenges due to the high cost associated with acquisition and maintenance. Advanced vessels require significant financial investment, which pose a major burden for some countries. To overcome this challenge, governments are exploring public-private partnerships and international collaborations.

By sharing costs and resources, nations are enhancing their maritime capabilities without bearing the full financial load. Additionally, investing in modular and scalable vessel designs allows for gradual upgrades and expansions, thereby distributing costs over an extended time. These strategies help mitigate the financial strain and ensure continuous improvement in maritime security infrastructure.

Maritime Patrol Naval Vessels Industry Trends

The increasing integration of unmanned systems is a notable trend in the market. Navies and coast guards are adopting unmanned aerial vehicles (UAVs) and unmanned surface vehicles (USVs) to enhance surveillance and reconnaissance capabilities. These systems extend operational reach, reduce risks to human personnel, and offer cost-effective solutions for continuous monitoring.

The integration of unmanned systems is enabling more efficient and effective maritime patrol operations, allowing for real-time data collection and improved situational awareness, thus propelling their growing adoption across the industry.

Another significant trend is the growing emphasis on multi-mission capabilities. Maritime patrol vessels are increasingly being designed to perform a variety of roles, including search and rescue, anti-submarine warfare, and environmental monitoring. This trend is further fueled by the pressing need for versatile and cost-efficient solutions that address multiple security and operational challenges.

The development of modular platforms facilitates the easy integration of different mission-specific equipment, enabling vessels to switch roles as needed. This flexibility helps navies and coast guards optimize their fleets, thereby ensuring both readiness and adaptability in diverse maritime scenarios.

Segmentation Analysis

The global market is segmented based on type, category, application, and geography.

By Type

Based on type, the market is categorized into inshore patrol vessels and offshore-patrol-vessels. The offshore-patrol-vessels segment led the maritime patrol naval vessels market in 2023, reaching a valuation of USD 3.14 billion. This notable growth is bolstered by their enhanced capabilities and versatility. OPVs are highly favored for their ability to operate in deeper and more challenging waters compared to inshore patrol vessels.

They offer greater endurance, advanced surveillance systems, and multi-mission capabilities, making them suitable for a wide range of maritime security operations. The need for effective border control, anti-piracy measures, and the protection of exclusive economic zones (EEZs) is fostering investments in OPVs, thereby supporting segmental growth.

By Category

Based on category, the market is classified into manned patrol vessels and unmanned patrol vessels. The unmanned patrol vessels segment is poised to witness significant growth at a CAGR of 5.24% through the forecast period (2024-2031). This expansion is stimulated by the increasing adoption of unmanned systems for maritime operations. Unmanned patrol vessels offer several advantages, including reduced risk to human personnel, cost-effectiveness, and enhanced surveillance capabilities.

They are being increasingly utilized for tasks such as persistent monitoring, reconnaissance, and environmental protection. Advances in artificial intelligence and autonomous technologies are enabling more sophisticated and reliable unmanned vessels, contributing to their growing popularity and widespread deployment.

By Application

Based on application, the market is segmented into maritime surveillance and reconnaissance, search and rescue (SAR) operations, environmental protection and maritime security, and others. The maritime surveillance and reconnaissance segment secured the largest maritime patrol naval vessels market share of 53.89% in 2023.

This dominance is attributed to the critical need for constant monitoring of territorial waters and high seas. Nations are actively focusing on strengthening their surveillance capabilities to detect and deter potential threats, such as smuggling, piracy, and illegal fishing.

The integration of advanced radar, sonar, and communication systems in patrol vessels is enhancing their ability to provide real-time data and situational awareness. The emphasis on national security and the protection of maritime interests is supporting the expansion of the segment.

Maritime Patrol Naval Vessels Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America maritime patrol naval vessels market accounted for a major share of around 34.90% in 2023, with a valuation of USD 2.02 billion. This dominance is reinforced by substantial defense budgets and a strong focus on maritime security. The United States and Canada are investing heavily in modernizing their naval fleets to address growing security threats and safeguard their extensive coastlines.

Technological advancements and the presence of leading defense contractors in the region are bolstering regional market growth. Additionally, North America's strategic importance in global maritime trade routes underscores the need for a robust maritime patrol capability, thereby reinforcing its leading market position.

Asia-Pacific is poised to experience substantial growth at a CAGR of 6.13% through the projection period. This rapid expansion is supported by increasing geopolitical tensions, territorial disputes, and the pressing need for enhanced maritime security in the region.

Countries such as China, India, and Japan are significantly boosting their naval capabilities to protect their maritime interests and assert dominance in regional waters. The economic growth and rising defense budgets in Asia-Pacific enable substantial investments in advanced patrol vessels.

Additionally, the region's strategic importance in global trade and energy routes is spurring the demand for effective maritime surveillance and security solutions.

Competitive Landscape

The global maritime patrol naval vessels market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Maritime Patrol Naval Vessels Market

Key Industry Developments

- April 2024 (Launch): Dearsan Shipyard delivered the first 76-meter Offshore Patrol Vessel for the Nigerian Navy in October 2023, with the second vessel being handed over in April 2024. The event, which was attended by Nigeria's First Lady and Defense Minister, highlighted the project's significance for Nigeria's naval operations.

- February 2024 (Partnership): Austal Australia received a contract extension from the Royal Australian Navy to build two additional Evolved Cape-class Patrol Boats. This USD 103.6 million contract follows the announcement made by the Commonwealth of Australia on November 23, 2023. This brought their total to ten boats under the SEA1445-1 Project. These patrol boats are designed to enhance naval capabilities with advanced systems and amenities, thereby supporting various missions and Australia's national security.

The global maritime patrol naval vessels market is segmented as:

By Type

- Inshore Patrol Vessels

- Offshore Patrol Vessels

By Category

- Manned Patrol Vessels

- Unmanned Patrol Vessels

By Application

- Maritime Surveillance and Reconnaissance

- Search and Rescue (SAR) Operations

- Environmental Protection and Maritime Security

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America