Market Definition

The market includes systems designed to control the speed and torque of electric motors of marine vessels by varying the input frequency and voltage. These drives are made with robust enclosures and corrosion-resistant materials to meet harsh maritime conditions.

VFDs are integral to propulsion systems, thrusters, pumps, winches, compressors, and HVAC systems on ships, enabling efficient energy use and improved operational control. Their application spans commercial cargo ships, naval fleets, offshore platforms, and passenger vessels. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping industry’s growth.

Marine VFD Market Overview

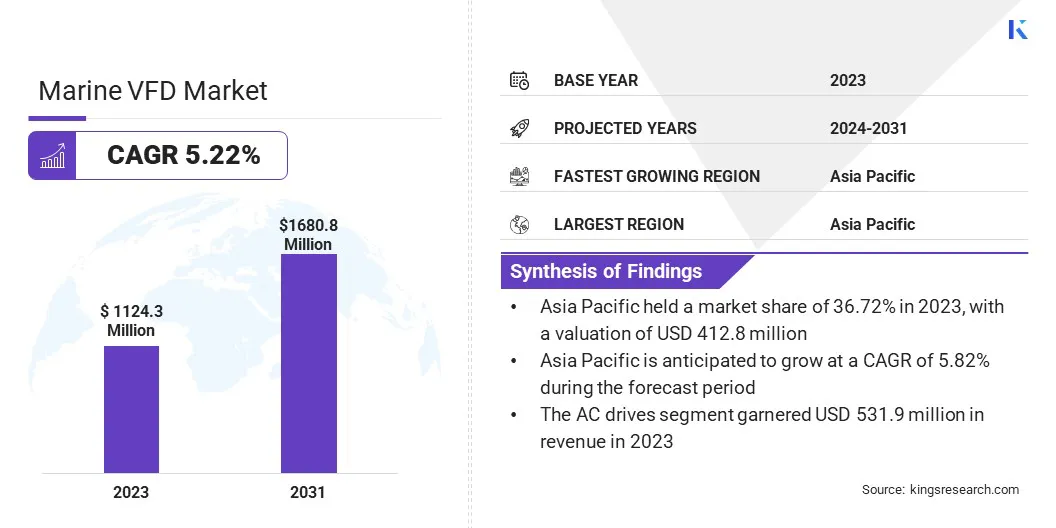

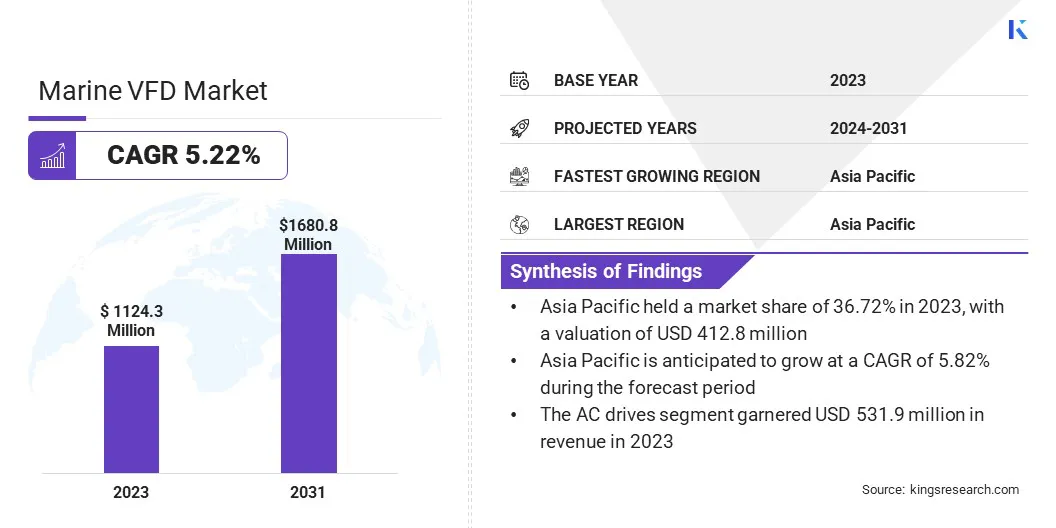

The global marine VFD market size was valued at USD 1,124.3 million in 2023 and is projected to grow from USD 1,176.9 million in 2024 to USD 1,680.8 million by 2031, exhibiting a CAGR of 5.22% during the forecast period.

The growth of the market is witnessing growth due to the rising expansion of offshore oil and gas exploration and production projects, which demand advanced propulsion and control systems for operational efficiency. Additionally, the increasing trend of retrofitting older vessels with variable frequency drives to enhance energy efficiency and meet evolving emission norms is supporting market expansion.

Major companies operating in the marine VFD industry are Siemens, ABB, Danfoss A/S, WEG, Nidec Motor Corporation, Wärtsilä Corporation, Parker Hannifin Corp., Becker Marine Systems GmbH, Rockwell Automation, Schneider Electric, Yaskawa Electric Corporation, Fuji Electric, Mitsubishi Electric Corporation, Toshiba Corporation, and Emerson Electric Co.

Retrofitting existing vessels with VFDs is becoming a practical approach to enhancing operational efficiency without full system replacements. Shipowners are focusing on upgrading motor control technologies to improve power distribution, reduce energy consumption, and support automation.

This is particularly evident among aging cargo ships, tankers, and offshore supply vessels. The cost-effective nature of VFD retrofitting, combined with measurable performance gains, is contributing to the sustained growth of the market.

Key Highlights:

- The marine VFD industry size was valued at USD 1,124.3 million in 2023.

- The market is projected to grow at a CAGR of 5.22% from 2024 to 2031.

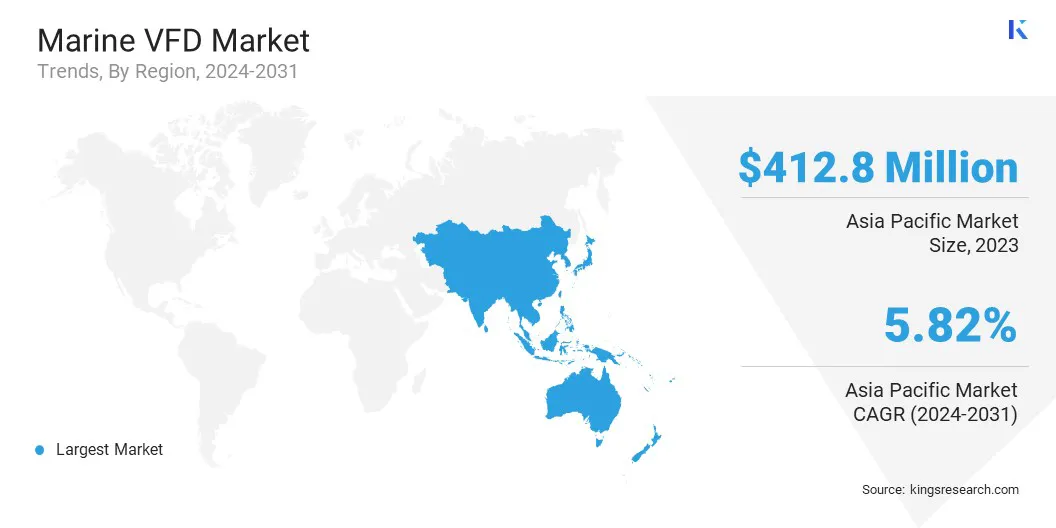

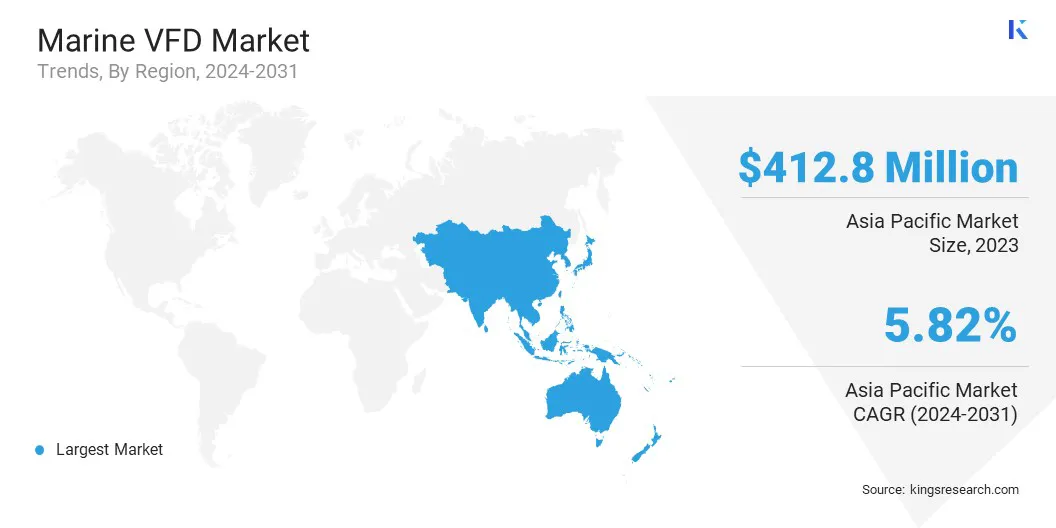

- Asia Pacific held a market share of 36.72% in 2023, with a valuation of USD 412.8 million.

- The AC Drives segment garnered USD 531.9 million in revenue in 2023.

- The Propulsion segment is expected to reach USD 637.0 million by 2031.

- The Marine Vessels is poised for a robust CAGR of 5.54% over the forecast period.

- North America is anticipated to grow at a CAGR of 5.24% during the forecast period.

Market Driver

Expansion of offshore exploration and production activities

The growth of the market is strongly influenced by the rise in offshore oil and gas exploration projects. Offshore platforms require efficient and reliable motor control systems to operate critical equipment such as pumps, compressors, and cranes.

VFDs enhance operational reliability while minimizing energy losses in these systems. The increasing number of offshore installations, particularly in deepwater and ultra-deepwater zones, is supporting VFD technologies for harsh marine environments.

- According to the Global Energy Monitor report, March 2025, new offshore discoveries announced in the year accounted for at least 8 billion barrels of oil equivalent (bboe). Approximately 4 bboe were approved for offshore development, while around 6.5 bboe entered production as offshore projects commenced operations. These figures represent slight increases compared to 2023. Notably, 85% of the total volume of new discoveries was concentrated in just ten offshore fields.

Market Challenge

High Initial Investment and Integration Complexity

A key challenge restricting the growth of the marine VFD market is the high upfront cost of advanced VFD systems, especially when integrating them into existing vessels . Installation often requires specialized components, system redesign, and skilled labor, making it capital intensive.

To address this, companies are focusing on modular VFDs that reduce integration complexity and allow phased implementation. They are also offering leasing models, extended service contracts, and digital twins for simulation-based planning to minimize downtime and ensure long-term operational savings.

Market Trend

Integration of Electric Propulsion Systems in Vessels

The market is expanding in response to the growing adoption of electric propulsion systems in offshore shipping. Electric propulsion smoothens vessel maneuverability, reduces mechanical wear, and improves energy management.

VFDs serve regulates motor speed and torque, optimizing propulsion efficiency under variable load conditions. As shipping companies invest in modernizing fleets with hybrid and fully electric systems, the demand for advanced motor control technologies continues to support the growth of the market.

- In March 2025, ABB was awarded a contract by West Sea Shipyard in Viana do Castelo, Portugal, to supply an integrated power, propulsion, and automation solution for six new offshore patrol vessels (OPVs) built for the Portuguese Navy. The vessels will feature ABB’s Azipod electric propulsion units, the Onboard DC Grid power distribution platform, and the ABB Ability System 800xA distributed control system. The Azipod propulsion technology is expected to significantly enhance the operational efficiency of the new fleet.

Marine VFD Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

AC Drives, DC Drives, Servo Drives

|

|

By Application

|

Propulsion, Pumps, Fans, Compressors, Others

|

|

By End User

|

Marine Vessels, Offshore Platforms

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (AC Drives, DC Drives, Servo Drives): The AC Drives segment earned USD 531.9 million in 2023 due to its higher efficiency, precise speed control, and adaptability in a wide range of marine applications.

- By Application (Propulsion, Pumps, Fans, Compressors, and Others): The Propulsion segment held 34.43% of the market in 2023, due to its critical role in enhancing vessel energy efficiency, maneuverability, and flexibility while supporting compliance with evolving marine emission regulations.

- By End User (Marine Vessels and Offshore Platforms): The Marine Vessels segment is expected to see significant growth at a CAGR of 5.54% over the forecast period, due to its demand in advanced propulsion and energy management systems for enhancing fuel efficiency, reducing emissions, and ensuring compliance with maritime regulations.

Marine VFD Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific marine VFD market share stood at around 36.72% in 2023 in the global market, with a valuation of USD 412.8 million. The market in Asia Pacific is benefitting from an increase in shipbuilding activities, especially across China, South Korea, and Singapore. Modern vessels are being designed with integrated electrical propulsion and automated auxiliary systems, where VFDs are widely used.

Shipbuilders are incorporating VFDs to meet energy performance requirements and improve maneuverability. The construction of new commercial vessels and naval fleets continues to generate consistent demand, positively impacting the growth of the market.

- In March 2024, GE Vernova’s Power Conversion division secured a contract from Singapore-based shipbuilder ST Engineering Marine Limited to deliver its Ship’s Electric Grid featuring Integrated Full Electric Propulsion (IFEP) systems for the Republic of Singapore Navy’s six Multi-Role Combat Vessels (MRCVs). The Ship’s Electric Grid package provided by GE Vernova encompasses generators, medium-voltage switchboards, transformers, and propulsion variable frequency drives (VFDs).

Additionally, shipyards across Asia Pacific are getting modernized with evolving naval architecture and propulsion standards. These developments are leading to higher installation rates of variable frequency drives in newbuilds as well as retrofit projects.

North America is poised for significant growth at a CAGR of 5.24% over the forecast period. The marine VFD industry in North America is benefiting from a sharp rise in offshore oil, gas, and wind infrastructure expansion. The commissioning of dynamic positioning vessels, subsea construction ships, and platform supply vessels is increasing the demand for precision-controlled propulsion systems.

Furthermore, the collaborations between established industrial automation companies and naval system integrators is driving innovation in marine VFD systems across the country. These collaborations have accelerated the adoption of high-performance VFDs in newbuild programs and system retrofits, reinforcing the market’s position within advanced shipbuilding ecosystem.

Regulatory Frameworks

- The U.S. adheres to the National Electrical Code (NEC), published by the National Fire Protection Association (NFPA), which sets standards for electrical installations, including those on marine vessels.

- The U.S. Coast Guard enforces regulations pertaining to marine electrical systems.

- The Environmental Protection Agency (EPA) imposes emission standards that indirectly influence the adoption of energy-efficient technologies like VFDs in marine applications.

- The EU's FuelEU Maritime initiative mandates reductions in greenhouse gas (GHG) intensity for ships, starting with a 2% reduction in 2025 and reaching 75% by 2050, relative to 2020 levels.This regulation encourages the integration of energy-efficient technologies, including VFDs, in marine vessels.

- China's Compulsory Certification (CCC) system requires certain electrical products, including specific motor types, to meet safety and quality standards.The GB 18613-2020 standard specifies minimum energy efficiency levels for motors, promoting the use of high-efficiency technologies like VFDs.

Competitive Landscape

Market players in the marine VFD market are increasingly adopting strategies such as expanding their production facilities to accommodate cutting-edge technology. By investing in state-of-the-art manufacturing capabilities, companies are getting ready to meet the rising demand for advanced VFD solutions.

This strategic move enhances production and facilitates more energy-efficient and technologically advanced products. As the demand for sustainable and high-performance marine technologies grows, such expansions are expected to contribute significantly to the overall market growth, allowing these companies to stay competitive in a rapidly evolving industry.

- In March 2023, Invertek Drives Ltd. announced an investment of approximately USD 7.8 million to establish a new Innovation Centre at its global headquarters. The facility is intended to serve as a cutting-edge hub for research and development, focusing on the design and engineering of next-generation electric motor control Variable Frequency Drives (VFDs). This initiative reflects the company’s commitment to advancing VFD technology and enhancing energy efficiency in industrial and marine applications.

List of Key Companies in Marine VFD Market:

- Siemens

- ABB

- Danfoss A/S

- WEG

- Nidec Motor Corporation

- Wärtsilä Corporation

- Parker Hannifin Corp.

- Becker Marine Systems GmbH

- Rockwell Automation

- Schneider Electric

- Yaskawa Electric Corporation

- Fuji Electric

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Emerson Electric Co.

Recent Developments (Certification/Product Launch)

- In February 2024, Rockwell Automation achieved the IEC 62443-4-2 cybersecurity certification from TÜV Rheinland for its PowerFlex 755T-series and PowerFlex 6000T VFDs. This certification acknowledges that the VFDs adhere to the cybersecurity standards of IEC 62443-4-2 guidelines.

- In April 2024, Rockwell Automation introduced the PowerFlex 6000T medium voltage VFD, designed to enhance the efficiency of permanent magnet motor applications. This drive features expanded predictive maintenance capabilities through TotalFORCE technology, which enables real-time monitoring of component health. It provides predictive maintenance alerts for various system components, including motors, bearings, fans, transformers, and lubrication systems, helping to minimize downtime and improve overall operational efficiency.