Market Definition

The market refers to the industry focused on secure, reliable, and automated data transfer between systems, organizations, and users. MFT solutions improve security, compliance, and efficiency through encryption, automation, monitoring, and integration with enterprise applications. Businesses use MFT to transfer large volumes of sensitive data while meeting regulatory requirements.

Managed file transfer Market Overview

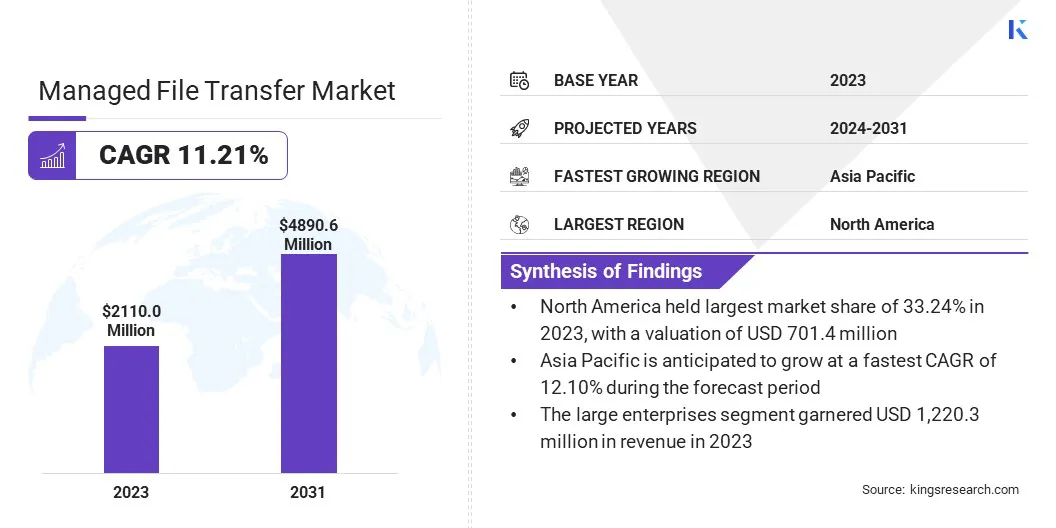

The global managed file transfer market size was valued at USD 2,110.0 million in 2023 and is projected to grow from USD 2,323.9 million in 2024 to USD 4,890.6 million by 2031, exhibiting a CAGR of 11.21% during the forecast period.

This market is expanding rapidly as organizations seek secure, efficient, and automated data transfer solutions to handle increasing data volumes. With the growing reliance on digital transactions and cloud-based services, businesses are prioritizing MFT to ensure data security and seamless integration with enterprise applications.

The integration of advanced encryption technologies with real-time monitoring and automation is further enhancing MFT solutions, making them suitable for industries like banking, healthcare, retail, and manufacturing.

Major companies operating in the managed file transfer industry are IBM, Fortra, LLC., Pro2col Limited, Axway, Gartner, Inc., Coviant Software LLC, SEEBURGER AG, SolarWinds Worldwide, LLC., Progress Software Corporation, Kiteworks, MASV Inc., Open Text Corporation, Oracle, Stonebranch, and BMC Software, Inc.

Additionally, the growing adoption of hybrid cloud environments is driving market growth by enabling secure and flexible file transfers across on-premises and cloud systems. Additionally, the rising demand for governance, risk, and compliance (GRC) solutions is increasing the need for MFT platforms that ensure regulatory compliance, data security, and auditability.

Key Highlights

- The managed file transfer industry size was valued at USD 2,110.0 million in 2023.

- The market is projected to grow at a CAGR of 11.21% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 701.4 million.

- The on-premises segment garnered USD 1,096.5 million in revenue in 2023.

- The large enterprises segment is expected to reach USD 2,817.5 million by 2031.

- The IT & telecommunications segment is expected to reach USD 1,464.2 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.10% during the forecast period.

Market Driver

"Rising Data Security Needs and Cloud Adoption"

The managed file transfer market is expanding rapidly, driven by increasing cybersecurity threats and the growing need for secure data exchange. As cyberattacks become more frequent and sophisticated, businesses are prioritizing MFT solutions to protect sensitive information.

Traditional file-sharing methods like FTP and email are vulnerable to interception, making encrypted MFT solutions essential for data integrity and compliance enforcement. Industries such as finance, healthcare, and government are adopting MFT to meet stringent security regulations and ensure controlled file transfers.

The shift toward cloud-based MFT solutions is gaining momentum as organizations prioritize digital transformation. Businesses are moving from on-premises infrastructure to cloud-hosted platforms for greater scalability, flexibility, and cost efficiency.

Cloud-based MFT supports secure remote file transfers with real-time tracking while reducing IT costs by eliminating the need for hardware maintenance and software updates. Moreover, these solutions integrate seamlessly with enterprise applications like ERP, CRM, and collaboration tools for secure and compliant data exchange across operations.

- In March 2025, Progress announced the addition of Web Application Firewall (WAF) functionality to its MOVEit Cloud managed file transfer (MFT) solution to enhance file transfer security and support PCI DSS 4.0 compliance. This new feature protects sensitive data by blocking malicious web traffic and mitigating cyber threats.

Market Challenge

"Integration Complexity within Diverse IT Environments"

The integration of managed file transfer (MFT) solutions into existing IT infrastructures presents significant challenges, particularly in environments that include a mix of legacy on-premises systems, cloud-based applications, third-party SaaS platforms, and hybrid architectures.

Many traditional systems lack compatibility with modern security standards, cloud-based data exchanges, and API-driven integrations, creating barriers to seamless implementation.

Furthermore, organizations often rely on multiple file transfer protocols and authentication mechanisms, leading to additional complexities in establishing interoperability. Inadequate integration may result in data silos, security vulnerabilities, and increased reliance on manual processes.

These challenges can slow down operations, elevate implementation costs, and necessitate specialized IT expertise. To address these issues, enterprises are adopting API-driven and hybrid MFT solutions designed to support multi-platform compatibility and streamlined system interoperability.

Market Trend

"AI-Driven Automation and Multi-Cloud Adoption"

The managed file transfer market is evolving with advancements in AI-driven automation and the increasing adoption of hybrid and multi-cloud environments. AI-powered threat detection and anomaly monitoring are revolutionizing file transfer security by identifying suspicious activities in real time, and mitigating risks such as unauthorized access, ransomware, and data breaches.

Automated workflows enhance operational efficiency by minimizing manual intervention and optimizing large-scale data transfers. Simultaneously, businesses are adopting hybrid and multi-cloud MFT solutions to optimize flexibility, performance, and security.

A hybrid approach allows organizations to retain critical workloads on-premises while leveraging cloud infrastructure for agility and cost savings, balancing control with adaptability.

Multi-cloud strategies further enhance resilience by distributing file transfer operations across multiple cloud providers, reducing vendor dependency to ensure business continuity in case of disruptions.

- In October 2024, OPSWAT released MetaDefender Managed File Transfer v3.8.0, introducing advanced features for secure file collaboration, automation, and protocol integration. The update includes custom user groups, shared workspaces, and an automation coordinator role, enhancing cross-user collaboration and workflow efficiency. Additionally, the solution supports multiple automated file transfer protocols, including SFTP, SMB, and SharePoint Online (SPO), streamlining secure data exchange between internal and external networks while ensuring compliance and operational transparency.

Managed File Transfer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

IT & Telecommunications, BFSI, Retail, Healthcare, Media & Entertainment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (Cloud-based, On-premises): The on-premises segment earned USD 1,096.5 million in 2023 due to its higher security, compliance adherence, and preference among industries handling sensitive data, such as finance and healthcare.

- By Organization (Large Enterprises, Small & Medium Enterprises): The large enterprises segment held 57.83% of the market in 2023, due to their extensive data transfer requirements, stringent security policies, and higher IT budgets for advanced MFT solutions.

- By Vertical (IT & Telecommunications, BFSI, Retail, Healthcare, Media & Entertainment, Others): The IT & telecommunications segment is projected to reach USD 1,464.2 million by 2031, owing to the increasing demand for secure data exchange, cloud adoption, and compliance-driven file transfer solutions.

Managed File Transfer Market Regional Analysis

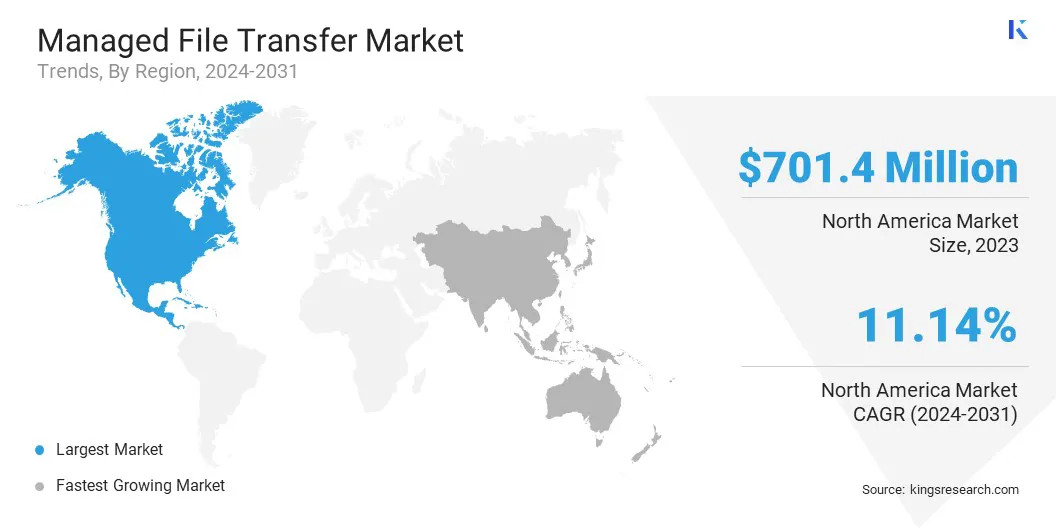

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America managed file transfer market accounted for a substantial market share of 33.24% in 2023 in the global market, with a valuation of USD 701.4 million. The region’s dominance in the market can be attributed to the presence of major technology providers, a well-established IT infrastructure, and stringent data security regulations.

Large enterprises in industries like BFSI, healthcare, and government agencies increasingly rely on MFT solutions to ensure compliance, secure file exchanges, and protect sensitive data from cyber threats.

The growing adoption of cloud-based MFT solutions, driven by digital transformation initiatives and the need for secure remote access, has further fueled market growth in North America.

Additionally, the rising frequency of cyberattacks in the U.S. and Canada has accelerated investments in secure file transfer technologies, in turn driving the growth of the market in North America.

The managed file transfer industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 12.10% over the forecast period. This rapid expansion is primarily driven by increasing digitalization and the rising adoption of cloud computing across the region.

The surge in e-commerce, financial services, and manufacturing industries has created a high demand for secure and efficient file transfer solutions to facilitate cross-border transactions and supply chain operations.

Moreover, government initiatives promoting data localization and cybersecurity policies are prompting organizations to invest in advanced MFT solutions. The increasing penetration of SMEs in this region, coupled with the growing awareness of cybersecurity risks, is further contributing to market expansion.

Regulatory Frameworks

- In the United States, Managed File Transfer (MFT) is regulated under key data protection laws. The Health Insurance Portability and Accountability Act (HIPAA) mandates secure healthcare data transfers, while the Sarbanes-Oxley Act (SOX) enforces financial data security. Additionally, the National Institute of Standards and Technology (NIST) Cybersecurity Framework provides best practices for securing file transfers.

- In the European Union, MFT falls under the General Data Protection Regulation (GDPR), which mandates strict security measures for personal data transfers, including encryption and access controls. The Network and Information Security (NIS2) Directive strengthens cybersecurity requirements for critical infrastructure, including file transfer services.

- In China, data transfer regulations are governed by the Cybersecurity Law (CSL) and the Personal Information Protection Law (PIPL), which impose strict data localization and cross-border data transfer restrictions. The Data Security Law (DSL) further regulates how companies manage and transfer critical and personal data, requiring encryption and government approvals in certain cases.

- In Japan, MFT is regulated under the Act on the Protection of Personal Information (APPI), which establishes guidelines for secure file transfers of personal data.

- In India, the Information Technology Act, 2000 (IT Act) and the Personal Data Protection Bill (PDPB) (proposed) outline security requirements for electronic file transfers. The Reserve Bank of India (RBI) Guidelines on Information Security enforce secure data handling for financial institutions, while the Indian Computer Emergency Response Team (CERT-In) Guidelines mandate cybersecurity controls for managed file transfers across industries.

Competitive Landscape

The managed file transfer industry is highly competitive, with key players focusing on strategic initiatives to strengthen their market positioning. Companies are investing in technological advancements, integrating advanced encryption, automation, and real-time monitoring to differentiate their offerings.

A major focus is on expanding cloud-based offerings to ensure seamless interoperability across hybrid and multi-cloud environments, addressing the evolving demands of enterprises.

Additionally, organizations are enhancing their solutions with artificial intelligence (AI) and machine learning (ML) capabilities to improve security, detect anomalies, and optimize file transfer efficiency.

Market leaders are actively pursuing mergers and acquisitions to strengthen their solution portfolios and extend their global footprint. Partnerships with cloud service providers and cybersecurity firms are also becoming a key strategy to enhance service offerings and provide end-to-end secure file transfer solutions.

To stay competitive, firms are offering flexible pricing models, tailored solutions for specific industries, and improved customer support services to foster adoption and retention in sectors such as finance, healthcare, and retail.

Investments in user-friendly interfaces and seamless Application Programming Interface (API) integrations are also key to improving the customer experience and ensuring compatibility with various enterprise applications.

- In August 2024, Kiteworks announced a USD 456 million growth equity investment from Insight Partners and Sixth Street Growth. The investment aims to strengthen Kiteworks’ market position in secure data transfer and collaboration, leveraging its FedRAMP-authorized security platform for file sharing, managed file transfer (MFT), and email data communications to meet global compliance requirements.

List of Key Companies in Managed File Transfer Market:

- IBM

- Fortra, LLC.

- Pro2col Limited

- Axway

- Gartner, Inc.

- Coviant Software LLC

- SEEBURGER AG

- SolarWinds Worldwide, LLC.

- Progress Software Corporation

- Kiteworks

- MASV Inc.

- Open Text Corporation

- Oracle

- Stonebranch

- BMC Software, Inc.

Recent Developments (Acquisition/New Product Launch)

- In October 2024, Progress completed the acquisition of ShareFile, an AI-powered, document-centric collaboration platform from Cloud Software Group, Inc. Through this acquisition, the company aims to expand its product portfolio and provide secure document sharing and improved client collaboration across industries such as financial services, and healthcare.

- In June 2024, OPSWAT released MetaDefender Managed File Transfer v3.7.0, introducing advanced automation features to enhance secure file transfer processes. The update enables organizations to eliminate manual transfers, improve reliability, and customize file transfer schedules, ensuring seamless data exchange across internal and external networks. With multi-layered protection, including Multiscanning, Sandboxing, Deep CDR, and Malware Outbreak Prevention, the solution strengthens compliance and security while streamlining workflows.