Market Definition

The market encompasses technologies, services, and solutions that assess the operational health and performance of industrial equipment in real-time or at scheduled intervals.

Key monitoring techniques include vibration monitoring, thermography, oil analysis, ultrasound emission, and other advanced diagnostic tools aimed at predicting equipment failure and ensuring optimal performance.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Machine Condition Monitoring Market Overview

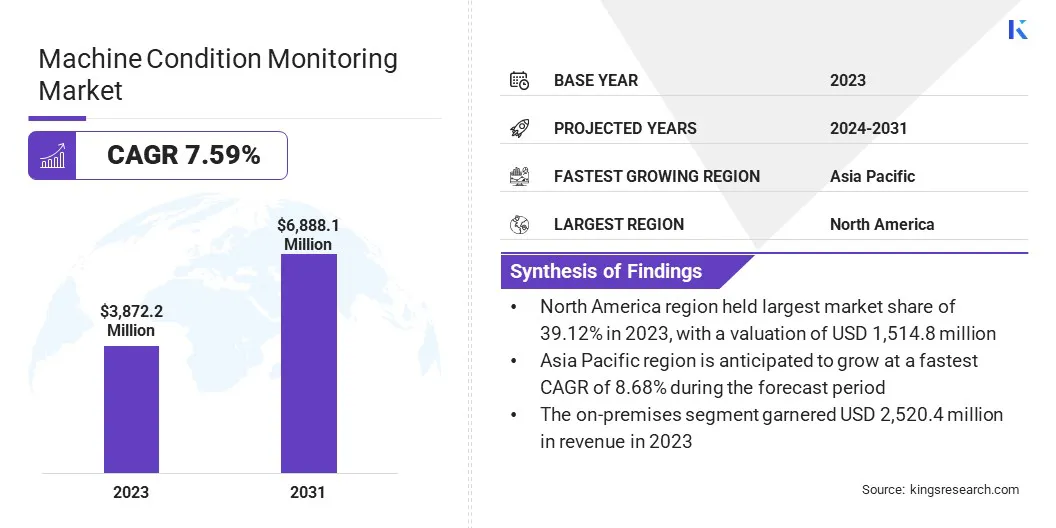

The global machine condition monitoring market size was valued at USD 3,872.2 million in 2023 and is projected to grow from USD 4,128.8 million in 2024 to USD 6,888.1 million by 2031, exhibiting a CAGR of 7.59% during the forecast period.

Market growth is driven by the increasing emphasis on equipment reliability, operational efficiency, and cost-effective maintenance strategies across industrial sectors. The adoption of condition monitoring solutions is being fueled by the rising need to reduce unplanned downtime and extend the operational life of critical machinery.

Major companies operating in the machine condition monitoring ndustry are Fluke, Brüel & Kjær Vibro, Thermo Fisher Scientific Inc., SKF, Parker Hannifin, Meggitt PLC., Siemens, Emerson Electric Co., Kistler Group, Honeywell International Inc., Rockwell Automation, Gastops Ltd., Baker Hughes Company, PerkinElmer Inc., and Teledyne FLIR LLC.

Additionally, the increasing incorporation of artificial intelligence (AI) enhances system intelligence and responsiveness. AI is revolutionizing condition monitoring by enabling advanced data analysis, automated anomaly detection, and accurate failure prediction, reducing dependence on manual diagnostics.

- In May 2023, NSK Ltd. launched the D-VibA10 wireless vibration diagnostic device in India. The compact, high-performance tool connects to an NSK app to evaluate bearing health by detecting damage and wear. The device enables customers to prevent unplanned downtime and optimize maintenance schedules. Following successful introductions in Japan and China, NSK expanded availability to the Indian market to support enhanced plant maintenance and machine health monitoring strategies.

Key Highlights:

- The machine condition monitoring industry size was recorded at USD 3,872.2 million in 2023.

- The market is projected to grow at a CAGR of 7.59% from 2024 to 2031.

- North America held a market share of 39.12% in 2023, with a valuation of USD 1,514.8 million.

- The vibration monitoring segment garnered USD 1,281.3 million in revenue in 2023.

- The hardware segment is expected to reach USD 3,012.8 million by 2031.

- The on-premises segment is estimated to generate a revenue of USD 4,387.6 million by 2031.

- The manufacturing segment is likely to register a value of USD 2,101.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 8.68% over the forecast period.

Market Driver

"Growing Industrial Automation"

The expansion of the machine condition monitoring market is fueled by the rise of industrial automation across sectors such as manufacturing, oil & gas, energy & power, and aerospace & defense.

As industries adopt automation to boost productivity, reduce operational costs, and enhance safety, the demand for intelligent monitoring systems has surged. These solutions are crucial in automated environments by continuously assessing equipment health, enabling early fault detection, and ensuring uninterrupted operation of complex machinery.

The integration of these systems into automated production lines helps optimize maintenance schedules, reduce manual inspections, and prevent costly downtime, making it vital for modern industrial infrastructure.

- In May 2023, Renishaw unveiled its RCS product line tailored for the industrial automation market. Leveraging its metrology expertise, the company introduced three products: RCS L-90, RCS T-90, and RCS P-series, designed to address challenges in manual robot setup, calibration, and maintenance. The solutions aim to reduce deployment time, enhance robot system accuracy, and enable in-process metrology and automatic recovery through a dedicated software suite.

Market Challenge

"High Initial Cost of Implementation"

A significant challenge hindering the expansion of the machine condition monitoring market is the high initial cost of implementation, particularly for small and medium-sized enterprises (SMEs).

Setting up a comprehensive condition monitoring system often involves substantial investment in sensors, diagnostic hardware, software platforms, and skilled personnel to interpret the data. For several companies, particularly those with limited budgets, this cost barrier can delay or prevent adoption.

However, the growing availability of cloud-based and subscription-based monitoring services is helping overcome this challenge by offering scalable, pay-as-you-go models. T These solutions lower upfront capital requirements, making advanced monitoring technologies more accessible to a wider range of industries, including SMEs.

Market Trend

"Integration of AI and Machine Learning"

The machine condition monitoring market is witnessing a notable trend toward the integration of artificial intelligence (AI) and machine learning (ML) into monitoring systems. These technologies are enhancing the accuracy and efficiency of condition monitoring by enabling real-time data analysis, pattern recognition, and automated anomaly detection.

Unlike traditional systems that rely on predefined thresholds, AI-driven platforms can learn from historical data, adapt to changing equipment behavior, and provide more precise failure predictions.

This advancement helps minimize false alarms and empowers maintenance teams to take proactive measures, thereby reducing downtime and optimizing asset performance. The adoption of AI and ML is increasing across industries as companies seek smarter, data-driven maintenance strategies.

- In March 2025, MachineMetrics unveiled an AI-driven predictive tool monitoring solution, Tool Anomaly Detection, designed to enhance machine tool maintenance for discrete manufacturers. The software identifies anomalies in machining activity such as shifts in load, torque, and spindle speed without relying on invasive sensors. By leveraging high-frequency data and proprietary AI algorithms, the solution enables real-time diagnostics, maximizes tool life, prevents quality issues, and avoids catastrophic failures.

Machine Condition Monitoring Market Report Snapshot

|

Segmentation

|

Details

|

|

By Monitoring Type

|

Vibration Monitoring, Thermography, Oil Analysis, Ultrasound Emission, Others

|

|

By Offering

|

Hardware, Software, Services

|

|

By Deployment Type

|

On-premises, Cloud-based

|

|

By Industry Vertical

|

Manufacturing, Oil & Gas, Energy & Power, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Monitoring Type (Vibration Monitoring, Thermography, Oil Analysis, Ultrasound Emission, and Others): The vibration monitoring segment earned USD 1,281.3 million in 2023 due to its widespread adoption for early fault detection and predictive maintenance across rotating equipment.

- By Offering (Hardware, Software, and Services): The hardware segment held a share of 44.00% in 2023, fuled by the growing installation of sensors and diagnostic devices in industrial machinery.

- By Deployment Type (On-premises and Cloud-based): The on-premises segment is projected to reach USD 4,387.6 million by 2031, propelled by its strong demand in industries with strict data security and control requirements.

- By Industry Vertical (Manufacturing, Oil & Gas, Energy & Power, and Aerospace & Defense): The manufacturing segment is projected to reach USD 2,101.2 million by 2031, attributed to the increasing need for uninterrupted production and equipment reliability in industrial facilities.

Machine Condition Monitoring Market Regional Analysis

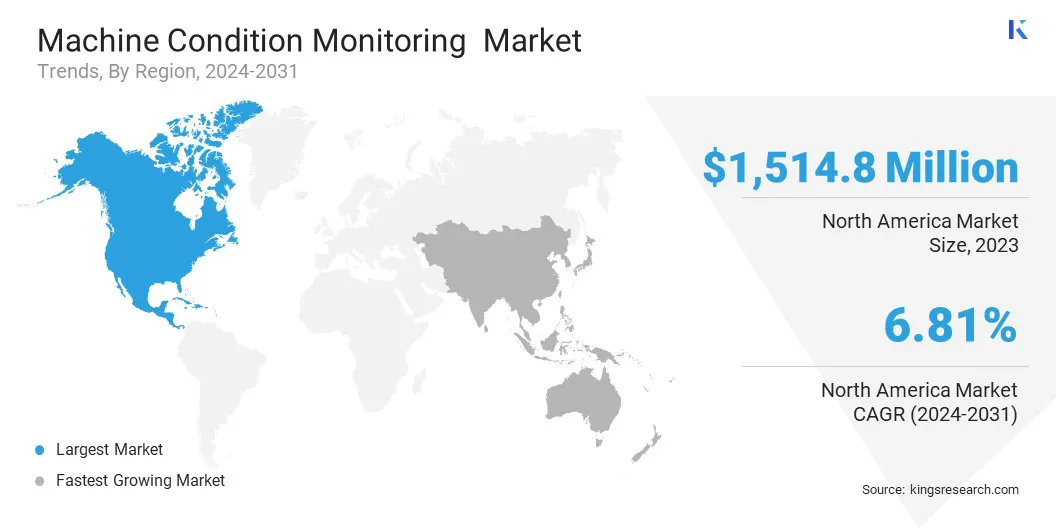

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America machine condition monitoring market share stood at around 39.12% in 2023, valued at USD 1,514.8 million. This dominance is reinforced by the region’s early adoption of advanced predictive maintenance technologies, strong presence of key industry players, and well-established industrial infrastructure.

Additionally, industries such as oil & gas, aerospace & defense, energy, and manufacturing in the U.S. and Canada are heavily investing in automation and condition monitoring solutions to enhance operational efficiency, extend asset life, and reduce unexpected equipment failures. The regional market further benefits from high awareness and integration of digital solutions such as cloud-based monitoring and AI-driven analytics.

Asia Pacific machine condition monitoring industry is poised to grow at a CAGR of 8.68% over the forecast period. This rapid growth is fueled by ongoing industrialization, expanding manufacturing base, and rising investments in energy and infrastructure development across countries such as China, India, Japan, and South Korea.

The growing emphasis on factory automation, increasing adoption of Industry 4.0 principles, and efforts to reduce unplanned downtime are leading to increased demand for machine condition monitoring solutions. Additionally, government support for smart manufacturing and foreign investments in industrial sectors are fostering regional market growth.

- In February 2024, the Ministry of Heavy Industry & Public Enterprises, Government of India, launched the SAMARTH Udyog Bharat 4.0 initiative under the Capital Goods Scheme to boost competitiveness in the Indian capital goods sector. The program aims to accelerate digital transformation in manufacturing landscape by promoting Industry 4.0 adoption through experiential and demonstration centers that connect manufacturers, vendors, and customers.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) mandates the maintenance of machinery in safe working condition, indirectly promoting the use of machine condition monitoring systems to detect faults and prevent incidents.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) enforces workplace safety and equipment maintenance standards, increasing the adoption of machine condition monitoring systems. These practices align with national standards such as JIS B 0907, which refelctsISO guidelines for vibration-based diagnostics and supports predictive maintenance in manufacturing and other industrial sectors.

Competitive Landscape

Companies operating in the machine condition monitoring industry are investing in R&D to introduce innovative solutions that offer enhanced data accuracy, real-time diagnostics, and advanced analytics capabilities.

Several market participants are integrating machine learning and artificial intelligence into their monitoring systems to improve predictive maintenance and reduce false alarms.

Partnerships and collaborations with industrial automation firms and software providers are enabling players to deliver comprehensive, end-to-end monitoring solutions. Additionally, they are priortizing mergers and acquisitions to gain access to new technologies and broaden their product portfolios.

Customization of solutions to cater to specific industry needs, such as oil & gas, manufacturing, and power generation, has emerged as a key approach to increase market penetration.

The transition from traditional monitoring systems to cloud-based platforms is prompting companies to enhance their digital capabilities, focusing on remote monitoring, scalability, and cybersecurity.

Moreover, regional expansion through strategic alliances and the establishment of service and support centers is being prioritized to enahnce customer service and responsiveness, particularly in emerging markets.

- In January 2023, Dodge Industrial, Inc. launched OPTIFY, a cloud-based condition monitoring platform that enables real-time remote management of industrial operations. Designed to enhance safety, reduce unplanned downtime, and improve cost-efficiency, OPTIFY integrates seamlessly with Dodge’s IIoT sensor and gateways to offer real-time asset health insights.

List of Key Companies in Machine Condition Monitoring Market:

- Fluke

- Brüel & Kjær Vibro

- Thermo Fisher Scientific Inc.

- SKF

- Parker Hannifin

- Meggitt PLC.

- Siemens

- Emerson Electric Co.

- Kistler Group

- Honeywell International Inc.

- Rockwell Automation

- Gastops Ltd.

- Baker Hughes Company

- PerkinElmer Inc.

- Teledyne FLIR LLC

Recent Developments (Product Launch)

- In March 2025, TDK Corporation launched the SensEI edgeRX platform, marking a significant advancement in industrial machine health monitoring. The edgeRX solution combines AI algorithms, edge computing, and high-performance sensor technology to deliver real-time monitoring, predictive maintenance, and instant alerts directly at the machine level. Designed as a ready-to-deploy system, edgeRX eliminates the need for complex setup or integration, enabling quick adoption by maintenance teams and plant operators.