Market Definition

Loyalty management encompasses a range of strategies, tools, and platforms designed to build and maintain long-term customer relationships through rewards, incentives, and personalized engagement. The market includes customer loyalty programs, CRM-integrated solutions, mobile applications, analytics tools, and digital platforms designed to improve customer retention and lifetime value.

It also covers the development, deployment, and management of these solutions across sectors such as retail, hospitality, BFSI (banking, financial services, and insurance), telecommunications, and e-commerce.

Loyalty Management Market Overview

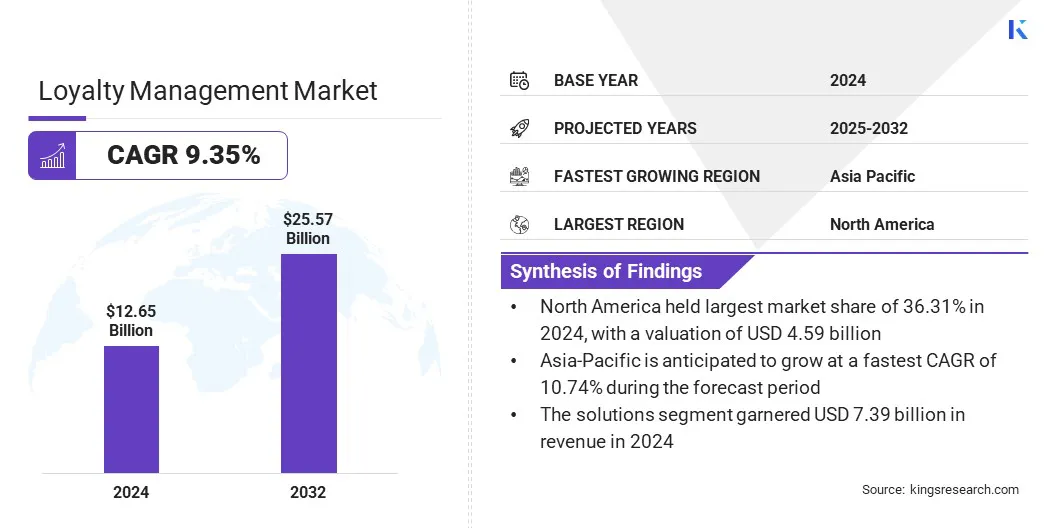

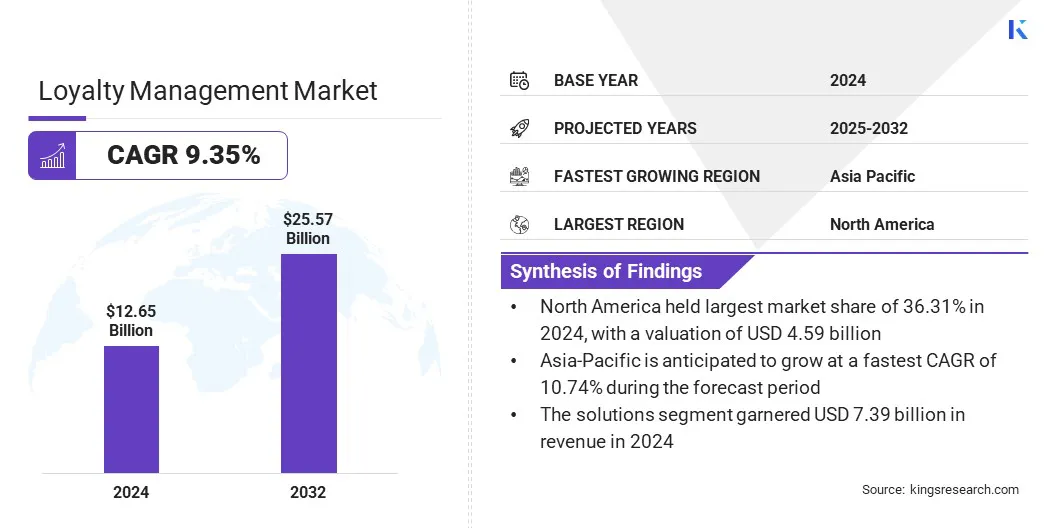

The global loyalty management market size was valued at USD 12.65 billion in 2024 and is projected to grow from USD 13.68 billion in 2025 to USD 25.57 billion by 2032, exhibiting a CAGR of 9.35% during the forecast period. This growth is attributed to the increasing need for businesses to retain customers, enhance brand loyalty, and remain competitive.

The rapid adoption of digital technologies, including mobile apps, e-wallets, and personalized marketing platforms is driving the implementation of loyalty management solutions across various sectors.

Major companies operating in the loyalty management industry are Comarch SA, Antavo, LoyaltyXpert, Zinrelo, Oracle, Loyltwo3ks IT Pvt Ltd, Capillary Technologies, BOND BRAND LOYALTY INC., Open Loyalty, Epsilon Data Management, LLC., ICF International Inc., IBM, LoyaltyLion Ltd, Yotpo Ltd., and AnnexCloud.

Growing focus on customer experience, data-driven engagement, and long-term value creation is further supporting market expansion. Technological advancements such as artificial intelligence (AI), machine learning, and cloud-based platforms are enabling real-time analytics, targeted rewards, and seamless omnichannel integration.

These innovations, combined with rising investments in customer relationship management (CRM) and the shift toward digital-first strategies, are accelerating the development and adoption of advanced loyalty management systems globally.

- In September2024, Commerce Bank partnered with FIS to roll out an advanced card-based loyalty solution across North America. The program enables real-time point redemption at checkout through FIS’s Premium Payback feature, aiming to deliver a personalized and seamless rewards experience.

Key Highlights

- The loyalty management industry size was valued at USD 12.65 billion in 2024.

- The market is projected to grow at a CAGR of 9.35% from 2025 to 2032.

- North America held a market share of 36.31% in 2024, with a valuation of USD 4.59 billion.

- The solutions segment garnered USD 7.39 billion in revenue in 2024.

- The points-based segment is expected to reach USD 8.70 billion by 2032.

- The cloud-based segment is anticipated to witness the fastest CAGR of 9.61% over the forecast period.

- The retail & consumer goods segment garnered USD 4.86 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 10.74% through the projection period.

Market Driver

Increasing Digital Integration Across Industries

The loyalty management market is strongly influenced by the increasing digital integration across industries, as businesses adopt advanced technologies to enhance customer engagement and retention. Industries such as retail, BFSI, hospitality, and telecommunications are adopting cloud platforms, mobile applications, artificial intelligence (AI), and analytics to deliver seamless, personalized loyalty experiences.

This digital shift enables real-time insights, automated rewards, and consistent customer interaction across multiple channels. As consumer expectations grow for convenience and tailored experiences, businesses are aligning their loyalty programs with digital infrastructure. This integration is driving innovation, improving operational efficiency, and making loyalty solutions more scalable and data-driven.

- In March 2024, Tech Mahindra partnered with Mobily to enhance its Neqaty loyalty program using Comviva’s AI-powered MobiLytix Rewards platform. The partnership introduces generative AI automation for seamless earning and redemption experiences, with Tech Mahindra using its digital transformation expertise to support successful deployment across customer segments.

Market Challenge

Complexity Associated with Integration with Legacy Systems

Integration barriers with legacy systems present a significant challenge for the effective deployment of modern loyalty management solutions. Several organizations, especially in sectors like retail and BFSI still operate on outdated IT infrastructures that are not designed to support advanced digital tools or real-time data exchange.

These systems often lack interoperability, making it difficult to synchronize customer data, automate reward mechanisms, or deliver consistent experiences across channels. The resulting fragmentation limits the personalization and agility of loyalty programs, reducing their overall impact and customer satisfaction.

To overcome these challenges, businesses are gradually investing in system upgrades, middleware solutions, and API-driven architectures that bridge the gap between old and new platforms. Collaborative efforts with technology vendors and system integrators are also helping organizations streamline operations and unlock the full potential of loyalty management technologies.

As digital transformation becomes a strategic priority, overcoming legacy integration barriers will be essential for achieving scalable and data-driven customer engagement.

Market Trend

Expansion of AI-Led Personalization Strategies

The expansion of AI-led personalization strategies is transforming the loyalty management market by enabling brands to deliver more relevant, timely, and engaging customer experiences. Businesses are increasingly using AI and ML to analyze real-time customer data such as purchasing behavior, preferences, and engagement patterns to create highly targeted loyalty offers and rewards.

These intelligent systems support dynamic segmentation, predictive recommendations, and automated interactions, allowing brands to personalize communication and incentives at scale. This approach strengthens customer relationships, boosts program effectiveness, and enhances overall satisfaction.

Advancements in AI algorithms, natural language processing, and behavioral analytics are making personalization more accurate and adaptive across digital and physical touchpoints. As competition intensifies and consumer expectations for tailored experiences grow, AI-led personalization is becoming a strategic imperative for businesses aiming to increase customer lifetime value and differentiate their loyalty programs in a crowded market.

- In March 2025, Comviva launched its next-generation MobiLytix Rewards, an AI-led, SaaS-based loyalty platform aimed at enhancing customer engagement across telecom, retail, and BFSI sectors. The platform offers real-time points management, tier upgrades, gamification, multi-wallet support, and advanced analytics, enabling businesses to deliver personalized, data-driven loyalty experiences at scale.

Loyalty Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Solutions (Platform-based Solutions, API-based Solutions), and Services (Consulting, Implementation, Support & Maintenance)

|

|

By Program Type

|

Points-based, Subscription-based, Value-based, and Others

|

|

By Deployment Mode

|

Cloud-based, and On-premise

|

|

By Industry Vertical

|

Retail & Consumer Goods, BFSI (Banking, Financial Services, and Insurance), Hospitality, IT & Telecommunication, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Solutions (Platform-based Solutions, API-based Solutions), and Services (Consulting, Implementation, Support & Maintenance)): The solutions segment earned USD 7.39 billion in 2024, due to the rising demand for scalable and data-driven platforms that enable personalized and automated customer engagement.

- By Program Type (Points-based, Subscription-based, Value-based, and Others): The points-based segment held a share of 38.42% in 2024, attributed to its simplicity, widespread adoption, and effectiveness in encouraging repeat purchases through easily understandable reward structures.

- By Deployment Mode (Cloud-based, and On-premise): The on-premise segment is projected to reach USD 14.52 billion by 2032, owing to greater control over data security, customization capabilities, and compliance with internal IT policies in large enterprises.

- By Industry Vertical (Retail & Consumer Goods, BFSI (Banking, Financial Services, and Insurance), Hospitality, IT & Telecommunication, and Others): The hospitality segment is anticipated to grow at a CAGR of 10.42% through the projection period, due to the increasing demand for personalized guest experiences, repeat bookings, and brand loyalty in a highly competitive service-driven environment.

Loyalty Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America loyalty management market share stood at 36.31% in 2024, valued at USD 4.59 billion. This dominance is attributed to the region’s strong digital infrastructure, early adoption of advanced technologies, and a mature customer engagement ecosystem. High levels of mobile and internet penetration, coupled with a data-driven approach to marketing, have enabled businesses to implement personalized and scalable loyalty strategies across industries.

Moreover, the presence of leading loyalty management providers, continuous innovation in AI-driven platforms, and the integration of omnichannel engagement tools are driving regional adoption. Regulatory support for consumer data protection and increasing investments in cloud-based solutions are further enhancing the credibility and performance of loyalty programs.

The region’s emphasis on customer retention, brand differentiation, and long-term value creation continues to stimulate innovation and market growth.

- In May 2025, TD SYNNEX unveiled its new North American partner loyalty program, designed to deepen engagement and reward solution providers for adopting advanced technologies, training, and go-to-market efforts. The digital platform enables real-time incentive tracking and tiered rewards including market development funds, training credits, and exclusive event access, all aimed at fostering partner growth and loyalty.

The Asia-Pacific loyalty management industry is set to grow at a CAGR of 10.74% over the forecast period. This growth is attributed to the region’s rapid digital transformation, increasing internet and smartphone penetration, and a growing base of tech-savvy consumers with rising expectations for personalized experiences. The surge in online retail, digital payments, and mobile app usage across region’s is creating strong demand for scalable and mobile-centric loyalty solutions.

Local and global businesses are investing in loyalty platforms that cater to culturally diverse preferences and purchasing behaviors, enhancing brand engagement and customer retention. Government initiatives promoting digital ecosystems and financial inclusion are further accelerating the adoption of loyalty programs across industries.

Additionally, rising competition among regional players is encouraging innovation in rewards structures, gamification, and real-time engagement strategies supporting long-term market growth in the region.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) governs how customer data is collected, stored, and used within loyalty programs. It enforces strict consent requirements, limits data sharing, and mandates transparency, ensuring that businesses using loyalty platforms handle personal data responsibly and securely.

- In California, the California Consumer Privacy Act (CCPA) regulates how companies manage and disclose consumer data collected through loyalty programs. It gives consumers the right to access, delete, and opt out of selling their personal information, directly impacting how loyalty solutions are designed and implemented.

- In Singapore, the Personal Data Protection Act (PDPA) regulates the collection and use of personal data in loyalty programs. It requires businesses to obtain clear consent, protect data integrity, and notify customers of the purpose behind data collection, ensuring ethical use in digital marketing and rewards systems.

Competitive Landscape

The loyalty management industry features a competitive mix of established technology giants and emerging solution providers, each striving to expand their market presence through product innovation, advanced analytics, and personalized customer engagement strategies. Key players are focused on developing AI-powered platforms, enhancing omnichannel integration, and offering flexible, cloud-based solutions tailored to diverse industry needs.

They are also pursuing strategic partnerships, acquisitions, and global expansion efforts to strengthen their customer base and address evolving market demands. This dynamic landscape fosters continuous innovation and competitive differentiation, as vendors aim to deliver scalable, secure, and highly customizable loyalty programs that drive long-term customer retention and brand loyalty.

- In January 2025, GROWERS, a platform by ICL Group, introduced an AI-enhanced upgrade to its agricultural loyalty program using the Axiom engine from Agmatix. The new system utilizes predictive analytics to deliver tailored recommendations and rewards for farmers, aiming to move beyond standard discount models toward more personalized and data-driven engagement.

List of Key Companies in Loyalty Management Market:

- Comarch SA

- Antavo

- LoyaltyXpert

- Zinrelo

- Oracle

- Loyltwo3ks IT Pvt Ltd

- Capillary Technologies

- BOND BRAND LOYALTY INC.

- Open Loyalty

- Epsilon Data Management, LLC.

- ICF International Inc.

- IBM

- LoyaltyLion Ltd

- Yotpo Ltd.

- AnnexCloud

Recent Developments (M&A/Launches)

- In May 2025, Capillary Technologies acquired Kognitiv’s loyalty business, strengthening its global position in the market. The move enhances Capillary’s capabilities in coalition and enterprise loyalty solutions across North America and Europe.

- In July 2024, Flaunt introduced an AI-enabled “service-as-software” loyalty platform designed specifically for Shopify merchants, launched during Revision Skincare’s annual event in Dallas. The solution offers a blend of AI-powered personalization, expert-designed program templates, analytics, and loyalty management services, making it easier for growing brands like Barefaced and PepsiCo to create and scale effective, data-driven customer engagement strategies.

- In July 2024, Snipp Interactive Inc. launched multiple loyalty programs for a leading U.S. FMCG company using its SnippCARE platform, under an initial USD 1.2 million contract. The platform enables personalized promotions and scalable loyalty management across several brands, helping the client engage customers more effectively and build deeper connections.

- In May 2024, HUGO BOSS launched HUGO BOSS XP, a next-generation loyalty program designed to enhance customer engagement through its app. Combining traditional rewards with Web3 features like tokens and non-fungible tokens (NFTs), the program offers access to exclusive products and experiences, reflecting the brand’s push toward more immersive and tech-forward loyalty strategies.