Market Definition

The market encompasses the development, production, and deployment of advanced unmanned aerial systems designed to loiter, identify targets, and engage via self-destruction.

It includes components such as airframes, warheads, guidance systems, and communication technologies. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Loitering Munition Market Overview

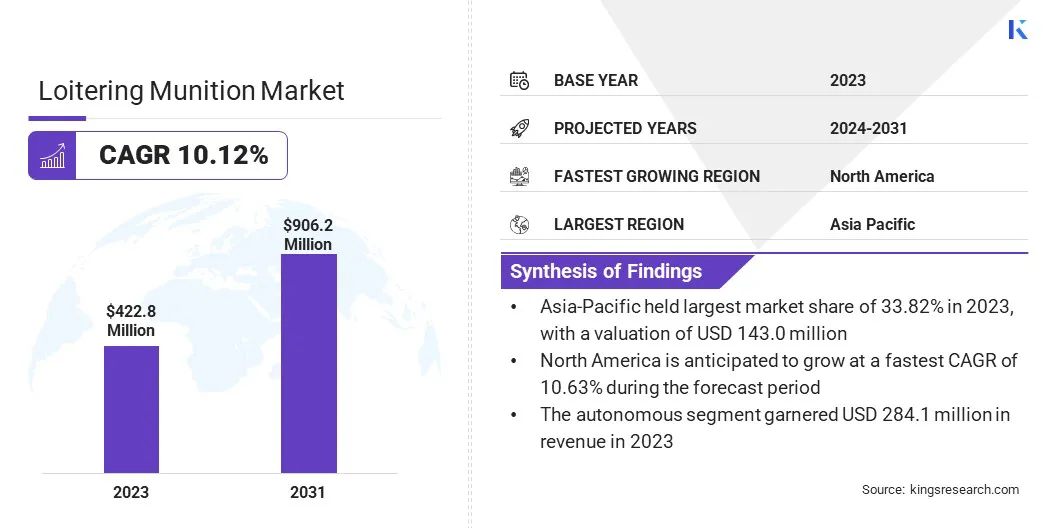

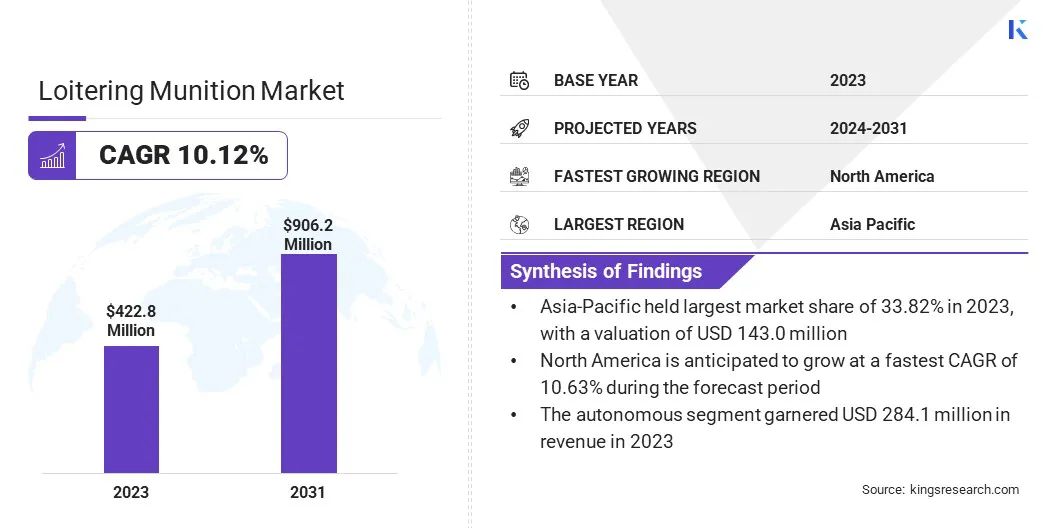

The global loitering munition market size was valued at USD 422.8 million in 2023 and is projected to grow from USD 461.5 million in 2024 to USD 906.2 million by 2031, exhibiting a CAGR of 10.12% during the forecast period.

Market growth is primarily driven by its increasing adoption in modern military operations for precision strikes, real-time surveillance, and cost-effective combat solutions.

This growth is further supported by the rising demand for advanced unmanned systems capable of engaging dynamic targets in complex and asymmetric warfare, particularly in regions with escalating geopolitical tensions.

Major companies operating in the loitering munition industry are Elbit Systems Ltd., AeroVironment, Inc., Israel Aerospace Industries Ltd., Rheinmetall AG, Uvision, Northrop Grumman, STM Savunma Teknolojileri Mühendislik ve Ticaret A.Ş, WB Group, AEVEX Aerospace, Paramount Group, Embention, MBDA, Kratos Defense & Security Solutions, Inc., avisionsystems.com, and Thales.

The defense sector's focus on rapid-response capabilities and precision missions with minimal collateral damage is boosting demand. Furthermore, growing defense budgets, military modernization initiatives, and technological advancements in drone warfare are broadening the application scope and production capacity in key global markets.

- In July 2024, the Australian Government announced the acquisition of the Switchblade 300 loitering munition to strengthen the Australian Defence Force’s drone capabilities. This lightweight, precision-guided system is scheduled for deliver later in the year andis expected to enter service in 2025, aligning with the nation’s defense modernization goals.

Key Highlights

- The loitering munition industry size was valued at USD 422.8 million in 2023.

- The market is projected to grow at a CAGR of 10.12% from 2024 to 2031.

- Asia-Pacific held a market share of 33.82% in 2023, valued at USD 143.0 million.

- The autonomous segment garnered USD 284.1 million in revenue in 2023.

- The ground segment is expected to reach USD 378.1 million by 2031.

- The catapult segment is anticipated to witness the fastest CAGR of 10.35% over the forecast period

- The market in North America is anticipated to grow at a CAGR of 10.63% through the projection period.

Market Driver

"Rising Demand for Precision Strike Capabilities"

The growing need for precision strike capabilities in modern military operations is contributing significantly to the expansion of the loitering munitions market. These operations often occur in complex environments, such as urban areas or regions with civilian populations, where traditional weapons pose a high risk of collateral damage.

Loitering munitions address this challenge by allowing forces to closely monitor a target area, identify the exact threat, and strike with high accuracy. This reduces the risk to civilians and the surrounding infrastructure. These systems also reduce the need for manned aircraft and can carry out missions more quickly and at a lower cost.

- In July 2024, the U.S. Department of State approved a potential $60.2 million foreign military sale of AeroVironment’s Switchblade 300 loitering munitions to Taiwan. This move aims to enhance Taiwan’s defense capabilities and support regional stability in the Indo-Pacific.

Market Challenge

"Vulnerability to Electronic Warfare and Countermeasures"

Loitering munitions are highly dependent on GPS, communication links, and onboard sensors, making them vulnerable to electronic warfare tactics such as jamming, spoofing, and signal disruption. Adversaries with advanced EW capabilities can compromise navigation and targeting, risking mission failure.

Additionally, the growing use of anti-drone technologies such as jammers and directed energy weapons further undermines their operational reliability. These vulnerabilities limit deployment in contested environments and highlight the need for enhanced EW-resilient systems.

To overcome vulnerabilities to electronic warfare, loitering munitions can adopt alternative navigation systems such as inertial or terrain-based navigation to reduce GPS reliance. Secure communication methods, including encryption and frequency hopping, counter jamming threats.

AI-driven autonomy allows munitions to operate independently of external control, while electromagnetic shielding and hardened components improve resistance to interference.

Multi-sensor redundancy, combining optical, infrared, and radar systems, enhances targeting accuracy, and low-observable designs reduce detection risk. These measures collectively enhance resilience in contested environments.

Market Trend

"Increased Adoption of Autonomous Systems"

The increased adoption of autonomous systems is influencing the loitering munition market, enhancing effectiveness. By integrating artificial intelligence (AI) and machine learning, these munitions can independently identify, track, and engage targets without human intervention.

This autonomy enhances operational efficiency, reduces risks to personnel, and accelerates decision-making in complex, time-sensitive missions. Autonomous loitering munitions improve accuracy and versatility, allowing them to perform multiple roles, such as surveillance, reconnaissance, and precise strikes, with minimal human oversight. This trend is transforming their use in dynamic and contested environments.

- In November 2023, Israel Aerospace Industries (IAI) secured USD 145 million in agreements with two countries to deliver long-range loitering munitions, including the Harpy NG, Harop, and Mini Harpy. IAI, a pioneer in loitering munitions since 1980s with the Harpy for Autonomous Suppression of Enemy Air Defence (SEAD) missions, now offers the next-generation Harpy NG, capable of targeting a broader range of radiating threats.

Loitering Munition Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Autonomous, Manual

|

|

By Deployment

|

Ground, Aerial, Marine

|

|

By Launch

|

Vertical Takeoff and Landing, Canister, Catapult, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Autonomous and Manual): The autonomous segment earned USD 284.1 million in 2023 due to its advanced capabilities in target identification, autonomous engagement, and reduced reliance on human operators for mission execution.

- By Deployment (Ground, Aerial, and Marine): The ground segment held a share of 42.17% in 2023, propelled by its cost-effectiveness, ease of deployment, and ability to support a wide range of tactical operations in various combat scenarios.

- By Launch (Vertical Takeoff and Landing, Canister, Catapult, and Others): The vertical takeoff and landing segment is projected to reach USD 322.2 million by 2031, fueled by its versatility in deployment from confined spaces and its ability to operate without the need for traditional runways or launch platforms.

Loitering Munition Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific loitering munition market share stood at around 33.82% in 2023, valued at USD 143.0 million. The region's strategic focus on defense modernization, particularly in response to evolving security challenges, has significantly boosted demand for loitering munitions.

Increased military investments, along with the adoption of advanced unmanned systems for both surveillance and strike capabilities, have spurred this demand. Countries within the region are increasingly turning to loitering munitions for their versatility, cost-effectiveness, and precision in both conventional and asymmetric warfare.

- In October 2024, Kadet Defence Systems introduced India’s first indigenous Loitering Aerial Munitions (LAM) under a Development cum Production Partner (DCPP) model with DRDO. These advanced systems, capable of operating across diverse terrains, mark a major step in India's self-reliance in defense technology and are set for delivery to the armed forces.

The North America loitering munition industry is estimated to grow at a robust CAGR of 10.63% over the forecast period. This growth is primarily bolstered by the increasing demand for advanced defense technologies by the U.S. military, which is heavily investing in precision-guided munitions and autonomous systems.

The region's emphasis on modernizing military assets to strengthen counterterrorism and counterinsurgency, and deterrence against peer threats is fueling the adoption of loitering munitions.

Moreover, the strong presence of key defense contractors, ongoing R&D initiatives, and the U.S. government's strategic focus on unmanned systems are expected to further propel market expansion through the forecast period.

- In August 2024, AeroVironment, Inc secured a 5-year Indefinite Delivery, Indefinite Quantity (IDIQ) contract by the U.S. Army for its Directed Requirement (DR) for Lethal Unmanned Systems (LUS), valued at up to $990 million. Deliveries of the Switchblade systems were set to begin in the coming months.

Regulatory Frameworks

- In the United States, the International Traffic in Arms Regulations (ITAR) regulate the export and import of defense-related articles and services. ITAR ensures that defense technologies are transferred only to authorized entities, with strict licensing, compliance, and end-use verification requirements.

- In the European Union, Common Position 2008/944/CFSP set rules for controlling military technology and equipment exports, focusing oninternational obligations, human rights, regional stability, and the risk of internal repression.

- In Israel, the Defense Export Control Law (2007) regulates the licensing, supervision, and enforcement of defense exports. It is administered by the Ministry of Defense’s Defense Export Control Agency (DECA) and ensures that exports align with national security and international commitments.

Competitive Landscape

Companies in the loitering munition industry are advancing autonomous technologies, increasing payload capacities, and enhancing operational flexibility to meet evolving defense needs. They are investing in R&D to improve precision strike capabilities while exploring new deployment strategies to increase the versatility of these systems.

Additionally, they are forming strategic partnerships with governments and military organizations, expanding their market presence, and integrating cutting-edge sensors and AI-driven systems to meet the growing demand for efficient and cost-effective military solutions.

- In February 2025, UVision and Omnisys partnered to integrate Omnisys' BRO software into UVision’s HERO loitering munition systems. This partnership seeks to improve mission planning and optimization through automated decision-making, ultimately enhancing operational efficiency and effectiveness during combat operations. The collaboration aims to enhance mission planning with fully automated, AI-powered optimization capabilities

List of Key Companies in Loitering Munition Market:

- Elbit Systems Ltd.

- AeroVironment, Inc.

- Israel Aerospace Industries Ltd.

- Rheinmetall AG

- Uvision

- Northrop Grumman

- STM Savunma Teknolojileri Mühendislik ve Ticaret A.Ş

- WB Group

- AEVEX Aerospace

- Paramount Group

- Embention

- MBDA

- Kratos Defense & Security Solutions, Inc.

- avisionsystems.com

- Thales

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In April 2025, UVision acquired Trim Robotics to enhance its loitering munition capabilities. The acquisition integrates Trim’s QuadiKaze, a dual-fuselage rotary-wing loitering munition, into UVision’s HERO series, offering increased maneuverability, flight endurance, and rapid target engagement in complex environments.

- In October 2024, UVision introduced an autonomous multi-launch loitering munition system designed to deploy and manage multiple HERO 120 munitions simultaneously. This advanced system enhances operational flexibility with AI-driven target recognition and mission management, allowing rapid, autonomous engagements from land or sea platforms.

- In May 2024, Teledyne FLIR Defense introduced the Rogue 1, a new loitering munition system, at SOF Week. Designed for tactical edge operations, Rogue 1 features vertical takeoff and landing (VTOL) and AI-powered autonomy for enhanced precision strike capabilities.