Market Definition

The market encompasses the development, sale, and rental of equipment designed to simulate electrical loads for testing, maintaining, and commissioning power generation systems, such as generators and Uninterruptible Power Supplies (UPS).

These devices are crucial for ensuring the reliability, performance, and efficiency of power systems across industries like manufacturing, telecommunications, and energy, fueled by the growing need for continuous power. The report outlines the major factors driving the market, along with key drivers and the competitive landscape shaping its growth trajectory over the forecast period.

Load Bank Market Overview

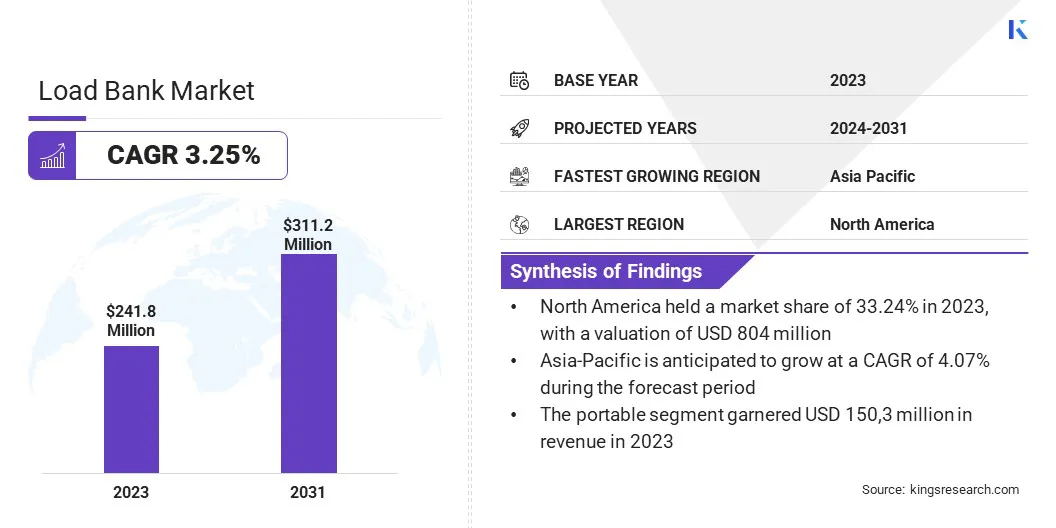

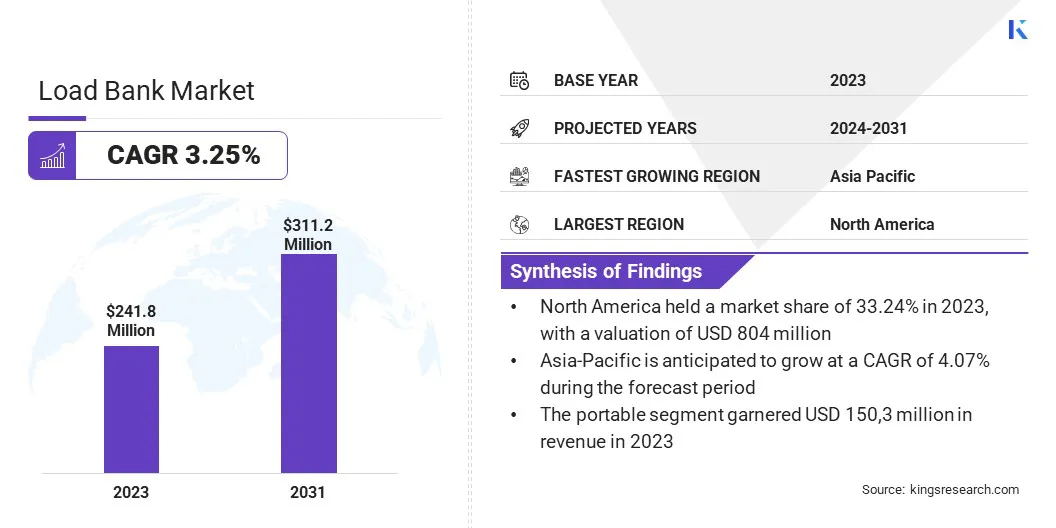

The global load bank market size was valued at USD 241.8 million in 2023 and is projected to grow from USD 248.8 million in 2024 to USD 311.2 million by 2031, exhibiting a CAGR of 3.25% during the forecast period.

The expansion of the telecommunications sector and increasing investments in renewable energy are driving the demand for load bank testing, as telecom towers and renewable energy systems require reliable backup power solutions to ensure operational efficiency and system performance.

Major companies operating in the load bank industry are Eagle Eye Power Solutions, Coudoint S.A.S., Crestchic Limited, The Vanjen Group, LLC, Power House Manufacturing Inc., Cannon Load Banks Inc., Air+MAK, Shenzhen Sikes Electric Co., Sephco Smartload Banks, Emaxloadbank.com., Simplex, Inc., Om Industries, Schneider Electric, Avtron Power Solutions, and Mosebach Manufacturing Company.

The market is registering growth, due to increasing investments in renewable energy, particularly wind and solar power. Load banks are crucial for testing and managing backup power systems, ensuring their reliability and efficiency. The demand for load banks to maintain power stability and performance continues to expand as the adoption of sustainable energy sources rises.

- In March 2025, the International Renewable Energy Agency (IRENA) reported that renewable energy accounted for 92.5% of global power expansion in 2024, with 585 GW added, largely driven by China. Despite this growth, a 16.6% annual increase is required to meet the 2030 renewable capacity target, revealing significant regional disparities.

Key Highlights:

- The load bank industry size was valued at USD 248.8 million in 2023.

- The market is projected to grow at a CAGR of 3.25% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 80.4 million.

- The AC segment garnered USD 131.6 million in revenue in 2023.

- The portable segment is expected to reach USD 191.5 million by 2031.

- The resistive segment secured the largest revenue share of 37.74% in 2023.

- The oil & gas segment is poised for a robust CAGR of 3.74% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 4.07 % during the forecast period.

Market Driver

Expansion of the Telecommunications Sector

The market is registering growth, driven by the expansion of the telecommunications sector. Telecom towers require reliable backup power systems to maintain uninterrupted service. The demand for load bank testing is increasing to ensure operational efficiency, supporting the reliability and performance of backup systems crucial for telecom infrastructure.

- In November 2024, India Brand Equity Foundation (IBEF reported that India’s telecom sector, now the world’s second-largest with 1.2 billion subscribers, is expanding rapidly, supported by government reforms, liberal policies, and deregulated FDI norms. This aids in the proliferation of telecom towers, thereby amplifying the demand for reliable backup power systems and load bank testing to maintain operational efficiency.

Market Challenge

Maintenance and Operational Costs

The global load bank market faces a key challenge with the significant ongoing maintenance and operational costs associated with regular servicing of load banks and their infrastructure. These recurring expenses can strain operational budgets, especially for companies managing large fleets of load banks, making it essential to balance cost-effective maintenance with maintaining optimal performance.

Market Trend

Growth in Rental Services

The global market is registering a growing trend in rental services, driven by businesses seeking cost-effective solutions for temporary power testing needs. Industries with fluctuating load requirements, such as construction and telecommunications, are increasingly opting for rented load banks, as it offers flexibility, reduces capital expenditure, and ensures efficient use of resources without long-term investment commitments.

- In May 2023, Rentaload expanded into North America by launching Rentaload USA in Indianapolis. It offers a range of networkable load banks, from 100 kW to 3.5 MW, featuring smart commissioning and real-time data capabilities for diverse customer needs.

Load Bank Market Report Snapshot

|

Segmentation

|

Details

|

|

By Current

|

AC, DC

|

|

By Site

|

Portable, Stationary

|

|

By Type

|

Inductive, Resistive, Capacitive

|

|

By End User

|

Power Generation, Data Centers, Oil & Gas, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Current (AC, DC): The AC segment earned USD 131.6 million in 2023, due to its widespread application in testing electrical systems and cooling infrastructure in industries such as data centres, where consistent and reliable power is critical for operational efficiency and system reliability.

- By Site (Portable, Stationary): The portable segment held 62.15% share of the market in 2023, due to its flexibility, ease of transport, and ability to provide on-site testing and maintenance for diverse industries, particularly where temporary or mobile power solutions are required.

- By Type (Inductive, Resistive, Capacitive): The resistive segment is projected to reach USD 116.2 million by 2031, owing to its simplicity, cost-effectiveness, and ability to simulate real-world electrical loads, making it ideal for testing power supplies and ensuring system reliability across various applications.

- By End User (Power Generation, Data Centers, Oil & Gas, and Others): The oil & gas segment is poised for significant growth at a CAGR of 3.47% through the forecast period, due to its critical need for reliable power generation and backup systems in remote and harsh environments, where load banks are essential for testing and maintaining equipment performance.

Load Bank Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 33.24% share of the load bank market in 2023, with a valuation of USD 80.4 million. The market dominance is attributed to its extensive data center infrastructure, which necessitates a continuous power supply and frequent load testing. This demand for uninterrupted operations fuels the growth of load bank solutions, solidifying the region as a key player in the market.

- In December 2024, the U.S. Department of Energy's (DOE) 2024 United States Data Center Energy

Usage report highlighted the rapid increase in energy use by data centers, with demand expected to double or triple by 2028. This growth, fueled by AI advancements and industrial expansion, emphasizes the DOE's role in developing innovative energy solutions to meet rising electricity needs.

The market in Asia-Pacific is poised for significant growth at a robust CAGR of 4.07% over the forecast period. The load bank industry is driven by rapid infrastructure development in Asia Pacific, particularly in China, with smart city projects and renewable energy installations.

The demand for reliable power testing and maintenance solutions grows as energy grids expand and infrastructure modernizes, making APAC the fastest-growing region for load banks.

- In July 2024, the Global Energy Monitor published data highlighting China's leadership in renewable energy, with 339 GW of utility-scale solar and wind power under construction. This ambitious development, far exceeding global construction rates, drives the demand for advanced energy solutions, including load banks, to ensure operational reliability.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces regulations regarding emissions and environmental impact, encouraging the adoption of energy-efficient load bank solutions that reduce carbon footprints and support the transition to cleaner energy sources.

- In Europe, the Energy Efficiency Directive (2012/27/EU) promotes energy conservation across industries. These regulations drive the use of load banks to optimize energy consumption during testing and maintenance of power systems, ensuring efficient and sustainable operations across the region.

- In China, the 13th Five-Year Plan prioritizes the development of renewable energy and energy-efficient technologies, driving the increased adoption of load banks. These solutions are particularly critical in sectors such as manufacturing and data centers, where they are used to test and manage power systems efficiently.

Competitive Landscape

The global load bank market is becoming more dynamic with the introduction of advanced load bank solutions. Leading companies are emphasizing innovations such as greater energy efficiency, compact designs, and enhanced testing functionalities.

Strategic investments in research and development are aimed at meeting the rising demand across sectors like data centers, manufacturing, and renewable energy, positioning these players for market leadership.

List of Key Companies in Load Bank Market:

- Eagle Eye Power Solutions

- Coudoint S.A.S.

- Crestchic Limited

- The Vanjen Group, LLC

- Power House Manufacturing Inc.

- Cannon Load Banks Inc.

- Air+MAK

- Shenzhen Sikes Electric Co.

- Sephco Smartload Banks

- com.

- Simplex, Inc.

- Om Industries

- Schneider Electric

- Avtron Power Solutions

- Mosebach Manufacturing Company

Recent Developments (Product Launch)

- In September 2024, Crestchic introduced a 200kW stackable load bank tailored for data centres. Featuring a compact design and remote control functionality, it streamlines heat load testing, optimizes cooling system performance, and supports up to 20 linked units for thorough system validation.