Market Definition

Lithium-ion battery recycling encompasses recovering valuable metals from used or end-of-life lithium-ion batteries commonly found in portable electronics, electric vehicles (EVs), and energy storage systems.

The primary objective is to extract critical raw materials such as lithium, cobalt, nickel, and manganese and reintegrate them into the manufacturing supply chain. This process reduces the reliance on virgin mining, minimizes environmental impact, and mitigates safety risks such as fire hazards and toxic chemical leakage associated with battery disposal.

Lithium Ion Battery Recycling Market Overview

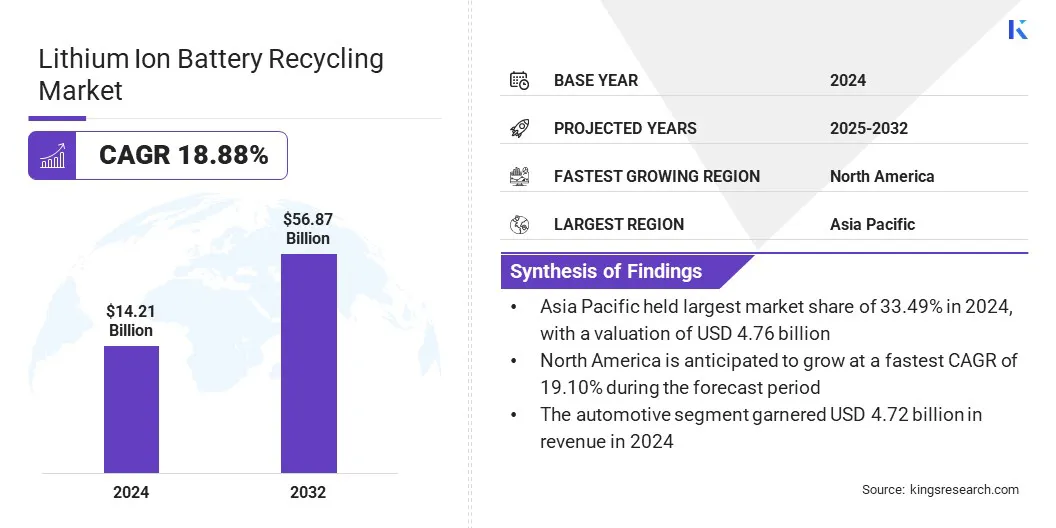

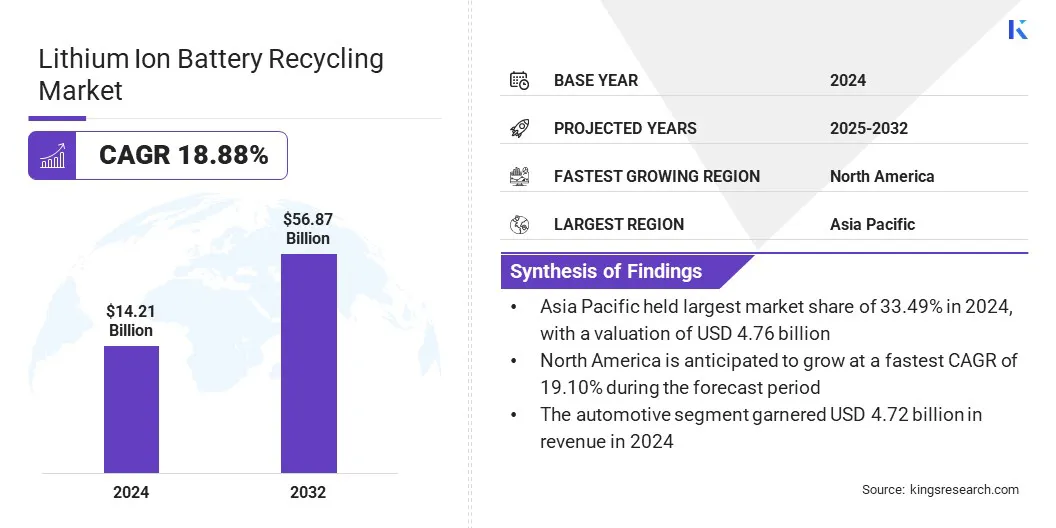

The global lithium ion battery recycling market size was valued at USD 14.21 billion in 2024 and is projected to grow from USD 16.86 billion in 2025 to USD 56.87 billion by 2032, exhibiting a CAGR of 18.88% during the forecast period.

This growth is driven by the rising adoption of hydrometallurgical recycling techniques, favored for their high recovery efficiency and low environmental footprint. These methods support the industry's shift toward greener recycling solutions and align with global environmental goals.

Key Highlights:

- The lithium ion battery recycling industry size was USD 14.21 billion in 2024.

- The market is projected to grow at a CAGR of 18.88% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 4.76 billion.

- The lithium cobalt oxide segment garnered USD 3.99 billion in revenue in 2024.

- The hydrometallurgical segment is expected to reach USD 23.73 billion by 2032.

- The electronics segment is anticipated to witness the fastest CAGR of 19.21% through the projection period.

- North America is anticipated to grow at a CAGR of 19.10% over the forecast period.

Major companies operating in the lithium ion battery recycling market are Umicore, Glencore, Cirba Solutions, Duesenfeld GmbH, Lithion Technologies, LOHUM, Li-Cycle Corp., Contemporary Amperex Technology Co., Limited, American Battery Technology Company, Ecobat, LLC, SK Tes, Neometals Ltd, RecycLiCo Battery Materials Inc., Fortum Group, and ACE Green Recycling, Inc.

The integration of artificial intelligence (AI) and robotics in lithium-ion battery recycling is emerging as a transformative opportunity to enhance efficiency, safety, and precision in the dismantling and sorting of complex battery components.

Robotics, on the other hand, automates labor-intensive tasks such as unscrewing, cutting, and separating materials, reducing human exposure to hazardous substances. Together, AI and robotics improve throughput and recovery rates while lowering operational costs over time. This opportunity is especially critical as battery volumes surge due to growing EV adoption and energy storage deployments.

Companies that invest in these technologies stand to benefit from higher profitability, scalability, and compliance with increasingly stringent safety and environmental regulations. Moreover, AI-driven predictive maintenance and process optimization further enhance the sustainability and cost-effectiveness of recycling operations.

- In October 2023, Circu Li-ion, a European battery recycling startup, secured USD 9.2 million in seed funding. This includes USD 4.9 million in equity led by BonVenture, alongside support from industry experts and company leadership. Additionally, USD 4.3 million in EICA grants further supports its goal to upcycle 3 billion batteries by 2035.

Market Driver

Rising Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is fueling the expansion of the lithium-ion battery recycling market. As nations pursue carbon neutrality, EV adoption is accelerating, leading to increased production and use of lithium-ion batteries. These batteries, with a typical lifespan of 8 to 10 years, enter the waste stream and require proper end-of-life management. The rising volume of retired EV batteries is creating an urgent need for scalable, efficient recycling infrastructure.

Moreover, EV batteries are larger and contain higher concentrations of valuable materials such as lithium, nickel, and cobalt than consumer electronics batteries, making them highly attractive for recovery. The expanding EV market pressures raw material supply chains, underscoring the importance of recycling to create a closed-loop system that reduces environmental impact and secures material availability.

- According to the International Energy Agency (IEA), the global electric car sales surpassed 17 million units in 2024, marking a year-on-year growth of over 25%. The additional 3.5 million units sold compared to 2023 exceeded total electric vehicle sales of 2020, highlighting the sector’s rapid adoption and market momentum.

Market Challenge

High Initial Investment and Operational Costs

A major challenge hindering the growth of the lithium ion battery recycling market is the high initial investment and operational costs associated with establishing recycling facilities. Developing advanced recycling infrastructure requires significant capital expenditure on specialized equipment, automation technologies, environmental safeguards, and skilled labor.

Regulatory compliance, permitting, and waste management costs significantly increase financial burden, particularly for small and mid-sized companies. Operating costs remain high due to the energy-intensive nature of certain processes and the complexity of handling various battery chemistries and formats.

Moreover, profitability is heavily dependent on fluctuating prices of recovered materials such as lithium, cobalt, and nickel. These economic hurdles restrict new entrants and hinder the global expansion of recycling capacity.

Public-private partnerships, government subsidies, and technology-sharing initiatives play a crucial role in reducing capital burden, promoting innovation, and mitigating investment risks in recycling infrastructure, thereby facilitating cost-effective scaling of lithium-ion battery recycling operations.

Market Trend

Growing Adoption of Closed-Loop Recycling Systems

The growing adoption of closed-loop recycling systems is influencing the lithium-ion battery recycling market by promoting a sustainable, circular approach to battery lifecycle management.

These systems recover and reuse critical materials such as lithium, cobalt, and nickel from end-of-life batteries to manufacture new batteries, minimizing reliance on virgin mining and reducing environmental impact. Companies are integrating closed-loop models to enhance resource security, meet ESG goals, and lower costs over the long term.

Major automotive and battery manufacturers are partnering with recyclers to secure secondary raw material streams, creating a more resilient and environmentally responsible ecosystem. This trend is further bolstered by policy frameworks promoting circularity and material traceability. As battery demand grows, closed-loop recycling is supporting sustainability and supply chain efficiency.

- In March 2025, Panasonic Energy Co., Ltd., in partnership with Sumitomo Metal Mining Co., Ltd., launched Japan’s first closed-loop recycling initiative for nickel in lithium-ion battery cathodes. This marks a significant advancement in domestic recycling capabilities, building on their 2022 U.S. collaboration with Redwood Materials.

Lithium Ion Battery Recycling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Chemistry

|

Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Manganese Cobalt Oxide, Others

|

|

By Process

|

Hydrometallurgical, Pyrometallurgical, Physical/Mechanical

|

|

By Source

|

Automotive, Electronics, Power Tools, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Chemistry (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Manganese Cobalt Oxide, and Others): The lithium cobalt oxide segment captured the largest share of 28.08% in 2024, primarily attributed to its widespread usage in consumer electronics such as smartphones, laptops, and tablets. This is due to its high energy density, compact size, and reliable performance.

- By Process (Hydrometallurgical, Pyrometallurgical, and Physical/Mechanical): The pyrometallurgical segment is poised to record a staggering CAGR of 19.01% through the forecast period, fueled by its operational simplicity, scalability, and capacity to process mixed battery chemistries.

- By Source (Automotive, Electronics, Power Tools, and Others): The automotive segment secured the largest revenue of USD 4.72 billion in 2024, mainly propelled by the rapid growth in electric vehicle (EV) adoption, which increased the volume of end-of-life EV batteries in the recycling stream.

Lithium Ion Battery Recycling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific lithium ion battery recycling market accounted for a share of 33.49%, valued at USD 4.76 billion in 2024, fueled by the region's status as the largest battery manufacturing and electric vehicle (EV) hub.

Key countries such as China, Japan, South Korea, and India are investing heavily in battery production and EV infrastructure, generating substantial volumes of spent batteries requiring sustainable disposal. India, in particular, maintains a stronghold due to its robust regulatory framework, large-scale recycling capacity, and government policies promoting the circular economy.

Moreover, the rising adoption of clean energy technologies and ambitious decarbonization goals across the region are boosting demand for closed-loop recycling systems. Local players are rapidly expanding capacities and forming partnerships with global automakers and battery OEMs. Increasing environmental awareness and material supply chain resilience position Asia-Pacific as a major market for lithium-ion battery recycling.

- In June 2025, the Government of India granted financial assistance to BatX Energies Pvt. Ltd., to commercialize an indigenous, sustainable battery recycling process for extracting battery-grade lithium, cobalt, nickel, and manganese from end-of-life lithium-ion batteries.

The North America lithium ion battery recycling industry is projected to register the highest CAGR of 19.10% through the projection period. This growth is propelled by a surge in electric vehicle adoption, renewable energy storage projects, and increasing regulatory emphasis on battery waste management.

The U.S. and Canada are witnessing growing investment in domestic battery recycling facilities, backed by government grants, tax incentives, and infrastructure bills supporting green technologies. The rise of gigafactories and localized battery production is creating a strong demand for end-of-life recycling solutions.

- In March 2025, Siemens announced a USD 110 million investment over 5 years to establish a Global AI Manufacturing R&D Center in Canada, focused on battery and EV production to support the advancements in battery technologies, indirectly accelerating efficiency gains in battery recycling industry.

Furthermore, strategic collaborations between automakers and recycling startups are accelerating the deployment of advanced recovery technologies. Companies are leveraging AI and automation to optimize recovery yields and improve cost-efficiency. To reduce reliance on foreign critical minerals, North America is emerging as a key market for lithium-ion battery recycling.

Regulatory Frameworks

- Under the U.S. Environmental Protection Agency (EPA), spent lithium-ion batteries are classified as hazardous waste under the Resource Conservation and Recovery Act (RCRA), which codes D001 (ignitable) and D003 (reactive). Handlers must comply with universal waste regulations outlined in 40 CFR Part 273, which streamline accumulation, labeling, and disposal procedures.

- In the UK, the Batteries Regulation (EU 2023/1542), effective August 17, 2023, introduces carbon‑footprint labeling, restrictions on hazardous substances, minimum recycled-content declarations, and performance/durability criteria for all battery types.

- In India, the Battery Waste Management Rules, 2022 (BWMR) apply to all battery chemistries, including Li-ion. The rules enforce Extended Producer Responsibility (EPR), requiring producers to collect and recycle batteries, prohibit landfilling/incineration, and report via a central CPCB portal. Collection targets for EV batteries are set at 70% for 2023–24, 80% for 2024–25, and 90% thereafter.

Competitive Landscape

Key players in the lithium-ion battery recycling industry are forming strategic partnerships with EV manufacturers, battery OEMs, and energy storage providers to secure steady streams of end-of-life batteries and enable closed-loop recycling models. Many companies are expanding their recycling capacities through the establishment of regional facilities, particularly in proximity to major EV production hubs across North America, Europe, and Asia.

- In February 2025, Northstar Ventures, through its Venture Sunderland Fund, led a USD 2.2 million investment round in Lithium Salvage to support the development of a refinery in Sunderland specializing in processing waste lithium-ion battery materials from household sources.

Market participants are investing significantly in R&D to advance proprietary recycling technologies such as hydrometallurgical processes and direct recycling techniques that improve recovery rates and reduce emissions. Moreover, the automation and digital integration, such as AI-powered battery diagnostics and robotics-based disassembly systems, are being increasingly adopted to enhance operational efficiency and safety.

- In January 2025, Ace Green Recycling secured a lease in Gujarat to develop India’s largest battery recycling facility. Building on its existing operations, the company aims to establish 10,000 metric tons of annual lithium iron phosphate (LFP) battery recycling capacity in India by 2026, deploying its LithiumFirst technology.

Key Companies in Lithium Ion Battery Recycling Market:

- Umicore

- Glencore

- Cirba Solutions

- Duesenfeld GmbH

- Lithion Technologies

- LOHUM

- Li-Cycle Corp.

- Contemporary Amperex Technology Co., Limited

- American Battery Technology Company

- Ecobat, LLC

- SK Tes

- Neometals Ltd

- RecycLiCo Battery Materials Inc.

- Fortum Group

- ACE Green Recycling, Inc.

Recent Developments (Partnerships/Agreements)

- In July 2025, BASF and Contemporary Amperex Technology Co., Ltd. (CATL) signed an agreement for cathode active materials. Through its international production network, BASF will support CATL’s global expansion and strengthen their strategic collaboration within the lithium-ion battery materials value chain.

- In April 2025, Primobius and Duesenfeld partnered to enhance efficiency and sustainability in lithium-ion battery recycling, addressing the growing demand from the electromobility sector. The collaboration leverages Primobius’ expertise in recycling technologies, plant engineering, and process optimization to deliver advanced and scalable recycling solutions.

- In February 2025, Li-Cycle Holdings Corp, a prominent lithium-ion battery resource recovery firm, announced strategic partnerships with leading U.S.-based battery energy storage system (BESS) companies to deliver specialized lithium-ion battery recycling services.

- In December 2024, Li-Cycle Holdings Corp. and Glencore International AG resumed their collaboration to evaluate the technical and economic feasibility of establishing a new lithium-ion battery recycling Hub in Portovesme, Italy. The initiative includes a concept development and pre-feasibility study to guide future strategic investment.