Lithium Carbonate Market Size

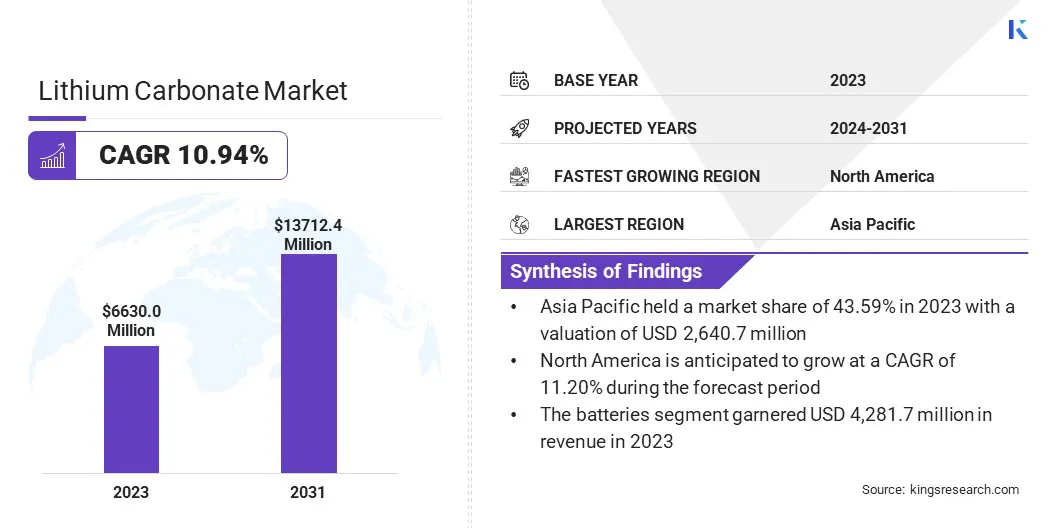

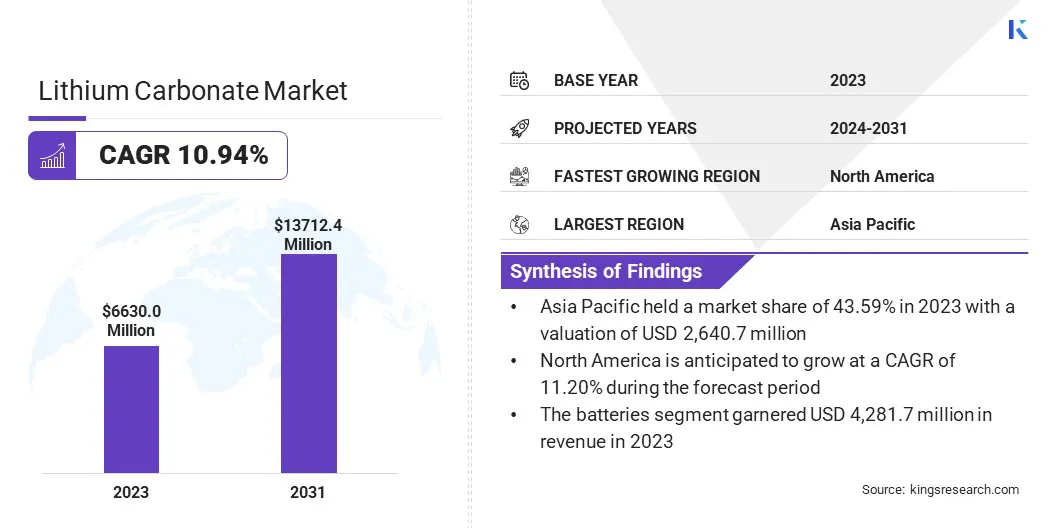

The global Lithium Carbonate Market size was valued at USD 6,058.1 million in 2023 and is projected to grow from USD 6,630.0 million in 2024 to USD 13,712.4 million by 2031, exhibiting a CAGR of 10.94% during the forecast period. The global market is expanding rapidly due to rising electric vehicle adoption, growth in renewable energy storage, and increased use in consumer electronics.

This growth is further driven by technological advancements in battery efficiency, the shift toward sustainable energy solutions, and expanding production capacities. These factors are positioning lithium carbonate as a crucial component in the transition to cleaner technologies.

In the scope of work, the report includes products offered by companies such as Albemarle Corporation., Arcadium Lithium, Ganfeng Lithium Group Co., Ltd, LevertonHELM Limited., Lithium Americas Corp., Lithium Argentina Corp., Shandong Ruifu Lithium Co. Ltd, SQM S.A., Tianqi Lithium, General Motors, and others.

The lithium carbonate market is experiencing robust growth, largely due to the increasing demand for lithium-ion batteries used in electric vehicles (EVs), renewable energy storage, and consumer electronics. Lithium carbonate, a key raw material in battery production, is essential for enhancing battery performance and efficiency.

- According to the International Energy Agency (IEA), around 14 million new electric vehicles were registered worldwide in 2023, bringing the total number to 40 million. This aligns with projections from the 2023 Global EV Outlook (GEVO-2023). The 2023 sales figures, showing a 35% increase from 2022 with 3.5 million additional units sold, highlight the rapid transition to cleaner transportation options.

The surge in EV adoption and expansion of solar and wind energy projects are significantly boosting market growth. Technological advancements in extraction methods and the expansion of production capacities are further supporting market growth.

Lithium carbonate is a white, crystalline powder used primarily as a key raw material in the production of lithium-ion batteries. It is essential for manufacturing high-performance batteries found in electric vehicles, renewable energy storage systems, and consumer electronics.

Extracted from lithium-rich brine or mineral deposits, lithium carbonate enhances battery energy density, longevity, and overall efficiency. It is also utilized in the pharmaceutical industry to treat bipolar disorder. The rise in demand for clean energy and advanced electronic devices is highlighting the growing significance of lithium carbonate.

Analyst’s Review

The rising global demand for battery energy storage systems (BESS) is set to boost the demand for lithium carbonate.

- According to the Rystad Energy 2022 report, BESS capacity is projected to increase tenfold, from 43 GWh in 2022 to 421 GWh by 2030.

Furthermore, mergers and acquisitions among key players in the lithium carbonate sector are expected to support market growth by enhancing production capabilities and expanding supply chains.

- In January 2023, General Motors Co. and Lithium Americas Corp. announced a joint investment to develop the Thacker Pass mine in Nevada, the largest lithium source in the U.S. and the third largest globally. GM's USD 650 million equity investment in Lithium Americas marks the significant commitment by an automaker for battery raw materials. The lithium extracted from this project is projected to support the production of up to 1 million electric vehicles annually, highlighting a major step toward meeting the growing demand for EV battery components.

These strategic moves aim to meet the surging demand for lithium-ion batteries, crucial for both energy storage and electric vehicles, thereby reinforcing lithium carbonate’s importance in the evolving energy landscape.

Lithium Carbonate Market Growth Factors

The rising adoption of electric vehicles (EVs) is leading to increased demand for lithium carbonate. As EVs become increasingly popular due to their environmental benefits and government incentives, the demand for lithium-ion batteries, which rely on lithium carbonate, has surged.

Automakers are expanding EV production to meet consumer and regulatory demands, increasing the need for lithium carbonate to ensure battery performance and longevity. This growing demand is propelling the growth of the lithium carbonate market, as manufacturers invest in expanding production capacities and developing new technologies to meet the rising requirements of the rapidly evolving automotive sector.

The market is expected to face challenges due to the environmental impact of lithium extraction, such as water depletion and land degradation, as well as price volatility and supply chain disruptions. To address these issues, key players are increasingly focusing on sustainable extraction methods such as direct lithium extraction (DLE) and enhanced brine processing, which improve both efficiency and environmental outcomes.

- In April 2023, General Motors invested USD 50 million in EnergyX to advance lithium extraction technologies, securing North American lithium supplies and supporting GM’s EV expansion.

Additionally, companies are diversifying their sourcing strategies, investing in local resources, and forging strategic partnerships to enhance supply chain stability and minimize risks. These efforts are essential for meeting growing demand while adhering to sustainability and cost-effectiveness goals.

Lithium Carbonate Market Trends

Innovations in lithium extraction, such as direct lithium extraction (DLE) and enhanced brine processing, are boosting efficiency and reducing environmental impact. DLE enables sustainable extraction with lower water use and minimal land disruption, while enhanced brine processing improves recovery rates and reduces costs.

These advancements are reshaping lithium carbonate production, optimizing supply chains, and ensuring environmental compliance. The market is witnessing notable growth as producers expand supply capacity to meet the rising demand from electric vehicles and energy storage sectors.

- In July 2024, Eramet inaugurated its direct lithium extraction plant in Argentina, becoming the first European firm to produce battery-grade lithium carbonate at an industrial scale.

Li-ion batteries are increasingly utilized in solar energy battery banks for solar photovoltaic systems due to their lightweight, low self-discharge, low maintenance, and high scalability. The rapid expansion in solar power installations is boosting the demand for these batteries, which are ideal for storing solar energy and ensuring efficient power supply.

- According to the International Energy Agency (IEA), demand for automotive Li-ion batteries skyrocketed by 65% in 2022, reaching 550 GWh, fueled by a 55% increase in global EV passenger car registrations.

The global expansion of solar photovoltaic systems is leading to increased demand for Li-ion batteries, particularly in residential, commercial, and utility-scale solar projects. This rising demand from solar energy industry is expected to fuel market growth.

Segmentation Analysis

The global market has been segmented based on application, end user, and geography.

By Application

Based on application, the lithium carbonate market has been categorized into batteries, glass & ceramics, aluminum production, and others. The batteries segment garnered the highest revenue of USD 4,281.7 million in 2023. The surge in EV adoption is particularly boosting the need for high-performance lithium-ion batteries.

In addition, the expansion of solar and wind projects increases the demand for reliable energy storage solutions. Technological advancements in battery efficiency and energy density, coupled with decreasing production costs, are further fueling segmental growth.

- Moreover, in May 2024, E3 Lithium Ltd. announced the expansion of its Calgary-based lab to include advanced equipment for polishing and producing lithium carbonate and lithium hydroxide. This strategic move enhances E3 Lithium’s role in the Canadian lithium market, positioning the company to meet the growing demand for high-quality battery materials essential for EVs and energy storage solutions.

The robust growth of the batteries segment, supported by rising EV adoption and advancements in energy storage technologies, underscores the critical role of lithium carbonate.

By End User

Based on end user, the market has been categorized into automotive, consumer electronics, energy storage, glass & ceramics, healthcare, and others. The automotive segment captured the largest market share of 40.88% in 2023. The increasing demand for EVs is propelling the development of sophisticated battery technologies.

Enhanced environmental regulations and a growing shift toward sustainable transportation solutions are further stimulating segmental expansion. This growth is further fueled by innovations in battery efficiency and extended vehicle ranges, coupled with substantial investments in EV charging infrastructure. The ongoing focus on electrification and automation is positioning the automotive segment for sustained growth.

Lithium Carbonate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific lithium carbonate market accounted for the largest share of 43.59% in 2023, with a valuation of USD 2,640.7 million. The Asia-Pacific region, particularly countries such as China, Japan, and India, is witnessing growing demand for lithium carbonate due to its increasing use in Li-ion batteries, pharmaceutical applications, and aluminum production.

- As reported by the International Trade Centre (Trademap), China imported lithium carbonate valued at USD 1,170 million during the fourth quarter of 2023, with approximately 88% sourced from Chile. During the same period, China exported lithium carbonate worth USD 28.23 million.

The rapid expansion of the electric vehicle (EV) market and renewable energy projects is further boosting the demand for Li-ion batteries. Additionally, government incentives supporting green energy initiatives and the shift toward sustainable technologies are contributing to regional market growth.

North America is anticipated to witness significant growth, recording a robust CAGR of 11.20% over the forecast period. Increased investment in battery manufacturing, coupled with government incentives to promote clean energy, is fostering the demand for lithium carbonate.

- In August 2024, Lithium Americas Corp. announced an extension of the second tranche subscription agreement deadline with General Motors Holdings LLC (GM) to the end of the year. GM has pledged an additional USD 330 million to support the progress of Thacker Pass, the largest measured and indicated lithium resource in North America.

The United States is emerging as a major country in the global lithium supply chain, with major companies investing in lithium extraction and battery production. Additionally, advancements in energy storage solutions and growing consumer demand for sustainable technologies are fueling regional market expansion.

Competitive Landscape

The global lithium carbonate market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Lithium Carbonate Market

- Albemarle Corporation

- Arcadium Lithium

- Ganfeng Lithium Group Co., Ltd

- LevertonHELM Limited.

- Lithium Americas Corp.

- Lithium Argentina Corp.

- Shandong Ruifu Lithium Co. Ltd

- SQM S.A.

- Tianqi Lithium

- General Motors

Key Industry Developments

- August 2024 (Acquisition): Arcadium Lithium plc acquired Li-Metal Corp.'s lithium metal business for USD 11 million in an all-cash deal. The acquisition includes intellectual property and physical assets related to lithium metal production, along with a pilot production facility located in Ontario, Canada. This strategic move strengthens Arcadium Lithium’s position in the lithium production market.

The global lithium carbonate market is segmented as:

By Application

- Batteries

- Glass & Ceramics

- Aluminum Production

- Others

By End User

- Automotive

- Consumer Electronics

- Energy Storage

- Glass & Ceramics

- Healthcare

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America