Market Definition

Liquid organic hydrogen carriers (LOHCs) are organic compounds that reversibly absorb and release hydrogen through chemical reactions. These carriers enable hydrogen to be stored in liquid form under ambient conditions, facilitating safer and more efficient transportation and storage compared to gaseous or cryogenic methods.

Applications span hydrogen storage, transportation, and energy conversion in industries such as automotive, maritime, and power generation. LOHCs are utilized to enhance hydrogen infrastructure, support decarbonization efforts, and integrate renewable energy sources into existing systems, thereby contributing to the development of a sustainable hydrogen economy.

Liquid Organic Hydrogen Carrier Market Overview

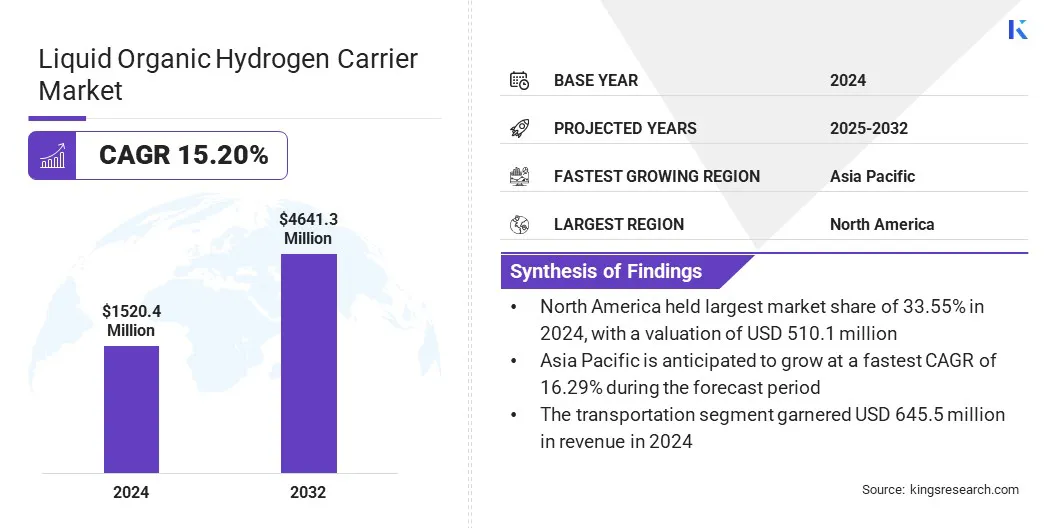

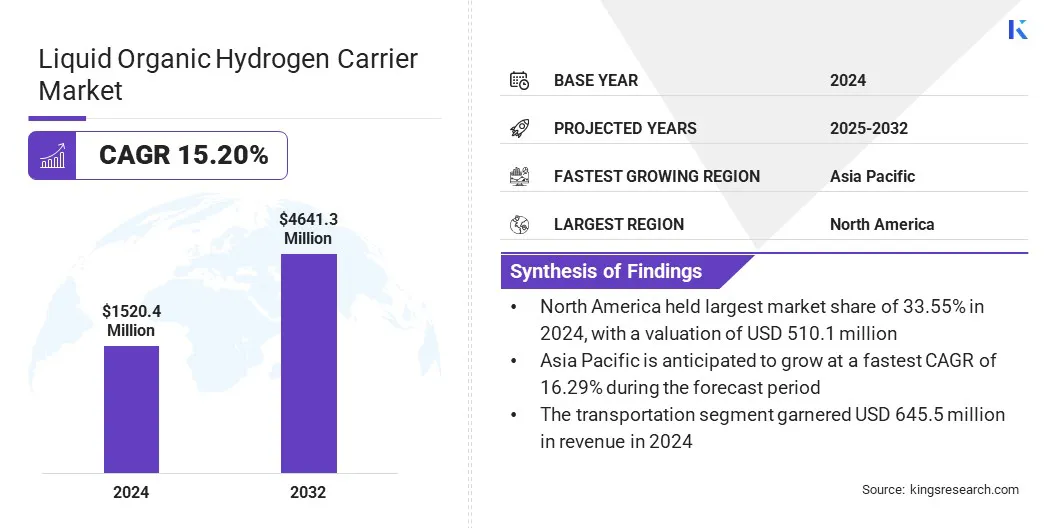

The global liquid organic hydrogen carrier market size was valued at USD 1,520.4 million in 2024 and is projected to grow from USD 1,723.9 million in 2025 to USD 4,641.3 million by 2032, exhibiting a CAGR of 15.20% during the forecast period. This growth is driven by the integration of renewable energy, which creates demand for efficient long-distance hydrogen transport solutions.

Additionally, advancements in catalysts for hydrogenation and dehydrogenation are improving energy efficiency and reducing costs, reinforcing the liquid organic hydrogen carrier's role in large-scale hydrogen deployment.

Key Highlights

- The liquid organic hydrogen carrier industry was valued at USD 1,520.4 million in 2024.

- The market is projected to grow at a CAGR of 15.20% from 2025 to 2032.

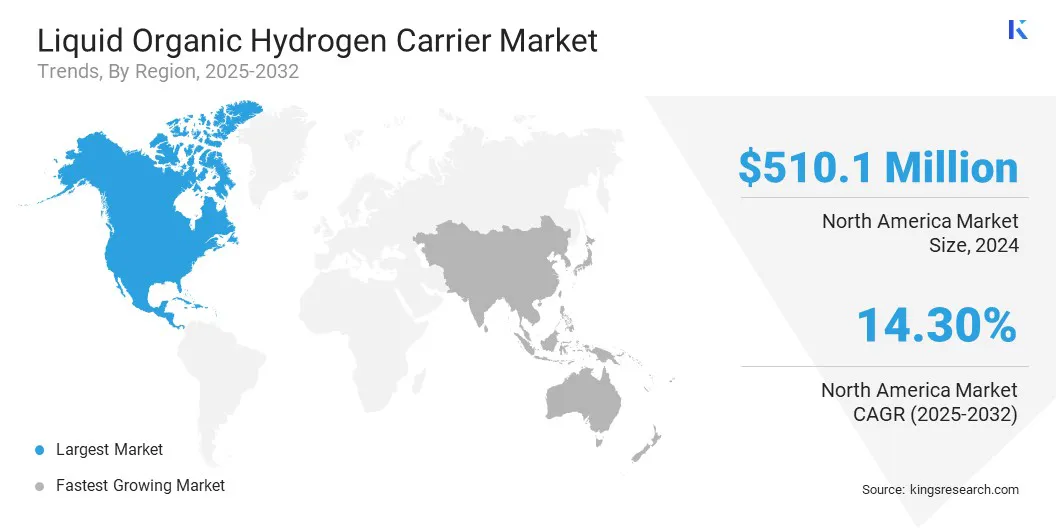

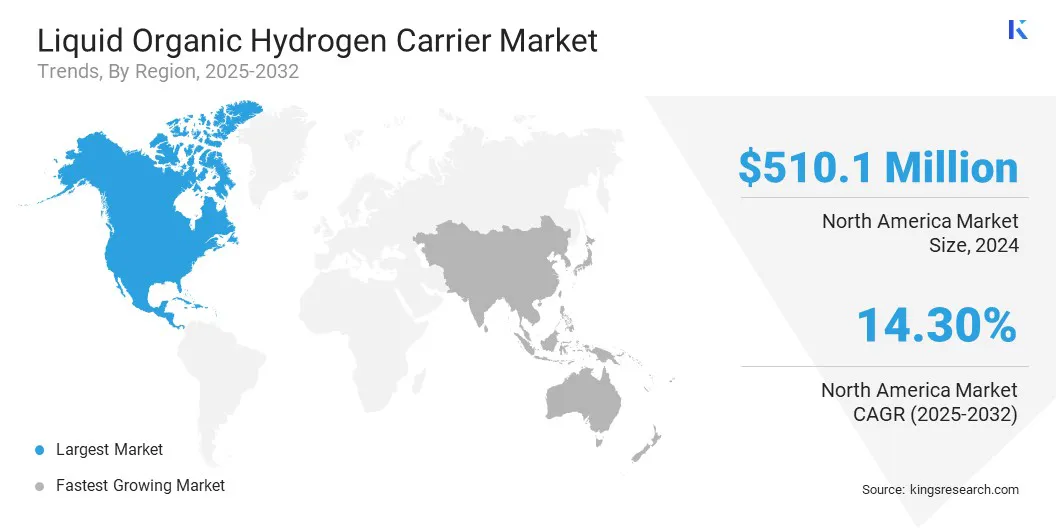

- North America held a share of 33.55% in 2024, valued at USD 510.1 million.

- The hydrocarbon-based segment garnered USD 888.4 million in revenue in 2024.

- The transportation segment is expected to reach USD 2,115.3 million by 2032.

- The automotive segment secured the largest revenue share of 37.55% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 16.29% over the forecast period.

Major companies operating in the liquid organic hydrogen carrier market are Hydrogenious LOHC Technologies, Chiyoda Corporation, Hynertech Co. Ltd., Covalion, Areva, Sumitomo Chemical, Mitsubishi Corporation, Repsol, Air Products and Chemicals, Toyota Tsusho Corporation, Linde plc, Honeywell International Inc., Exxon Mobil Corporation, Clariant, and MAN Energy Solutions.

Market expansion is propelled by the increasing use of hydrogen across refineries, chemical production, and fuel cell applications that require safe and efficient storage and transport solutions.

- In April 2025, Hydrogenious LOHC Technologies received approval for its ‘Hector’ storage plant at Chempark Dormagen, which is set to be the world's largest commercial plant for storing hydrogen in a liquid organic hydrogen carrier (LOHC) using benzyltoluene.

Industries are seeking methods to handle large volumes of hydrogen without the challenges of high-pressure or cryogenic systems. LOHCs provide a stable medium for storing hydrogen at ambient conditions, making it practical for industrial operations.

Refineries and chemical plants are adopting LOHC technology to integrate hydrogen seamlessly into existing infrastructure. Fuel cell applications, particularly in transportation and backup power, are creating a strong demand for LOHCs that ensure a reliable and continuous hydrogen supply.

Market Driver

Integration of Renewable Energy

The growth of the liquid organic hydrogen carrier market is propelled by the increasing need to store and transport excess renewable energy generated from solar and wind in the form of hydrogen. LOHC technology allows energy produced during peak renewable generation periods to be safely captured and stored for later use.

Power grids are benefiting from LOHC-enabled hydrogen storage, which helps balance supply and demand and enhances stability. Industrial and transport sectors are using hydrogen released from LOHCs as a clean energy source, supporting decarbonization goals. LOHC systems are offering a practical solution for long-distance hydrogen transport without the risks associated with high-pressure or cryogenic handling.

- In November 2024, Exolum launched the first commercial-scale demonstration of green hydrogen transport and storage using LOHC within existing oil infrastructure. Conducted at Immingham, the UK’s largest freight port, the project transported 20 tonnes of hydrogen through a 1.5 km pipeline, leveraging Exolum’s oil storage and pipeline assets.

Market Challenge

High R&D and Production Costs

A key challenge hindering the expansion of the laboratory proficiency testing market is managing the high investment required for advanced analytical equipment and testing processes. Laboratories are relying on technologies such as liquid chromatography–tandem mass spectrometry (LC-MS/MS), which involve significant setup and operational expenditure.

Additionally, costs associated with sample preparation, logistics, data handling, and recruitment of skilled personnel are creating further financial pressure, particularly for smaller laboratories with limited budgets.

To address this challenge, market players are offering cloud-based data management systems, developing cost-sharing consortium models, and introducing scalable testing solutions that reduce upfront capital needs. These approaches are enabling broader participation in proficiency testing programs while easing the financial burden on resource-constrained laboratories.

Market Trend

Advanced Catalysts for Hydrogenation/Dehydrogenation

The liquid organic hydrogen carrier (LOHC) market is witnessing a notable trend toward the development of next-generation catalysts that enhance hydrogenation and dehydrogenation processes. Improved catalysts offer higher activity, better selectivity, and longer operational lifetimes, reducing energy losses and increasing overall system efficiency.

These advancements enable faster hydrogen uptake and release, which is critical for large-scale energy storage and transport applications. By improving throughput and lowering operational costs, advanced catalysts are positioning LOHC technology as a practical solution for integrating hydrogen into energy systems and supporting the transition to low-carbon energy infrastructure.

- In July 2024, researchers from the Friedrich-Alexander University Erlangen–Nürnberg (FAU) published that bimetallic PtRu/C catalysts increased hydrogen release productivity by 65% compared to monometallic Pt/C during the dehydrogenation of the LOHC compound dicyclohexylmethanol (H₁₄-BP).

Liquid Organic Hydrogen Carrier Market Report Snapshot

|

Segmentation

|

Details

|

|

By Carrier Type

|

Hydrocarbon-based, Aromatic Hydrocarbons-based

|

|

By Application

|

Transportation, Energy Storage, Industrial Applications

|

|

By End-use Industry

|

Automotive, Aerospace, Chemical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Carrier Type (Hydrocarbon-based and Aromatic Hydrocarbons-based): The hydrocarbon-based segment earned USD 888.4 million in 2024, largely due to its availability, compatibility with existing refinery and transport infrastructure, and proven efficiency in large-scale hydrogen storage and delivery.

- By Application (Transportation, Energy Storage, and Industrial Applications): The transportation segment held a share of 42.52% in 2024, fueled by its ability to enable safe, long-distance hydrogen delivery using existing fuel infrastructure.

- By End-use Industry (Automotive, Aerospace, Chemical, and Others): The automotive segment is projected to reach USD 1,948.1 million by 2032, owing to the rising need for safe, efficient, and scalable hydrogen storage solutions that support the deployment of fuel cell vehicles.

Liquid Organic Hydrogen Carrier Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America liquid organic hydrogen carrier market share stood at 33.55% in 2024, valued at USD 510.1 million. This dominance is reinforced by large federal and state-level investments in hydrogen infrastructure.

The United States Department of Energy has launched programs that support research and deployment of hydrogen storage solutions, including liquid organic hydrogen carriers. Several states are allocating funds for hydrogen hubs where LOHCs are considered for large-scale transport and storage.

- In July 2024, the DOE allocated USD 30 million to the Appalachian Hydrogen Hub (ARCH2) and USD 27.5 million to the Pacific Northwest Hydrogen Hub under the federal initiative to build regional clean hydrogen ecosystems, including storage, transport, and infrastructure development.

Canada has also integrated hydrogen storage into its clean energy transition plans, promoting the adoption of LOHC technology. These policies are establishing a stable demand base for companies developing and commercializing LOHC solutions.

- For instance, in November 2024, the National Research Council Canada (IRAP) provided USD 103 thousands to Ayrton Energy Inc. to support the development of their LOHC system for safe and efficient hydrogen storage in remote conditions. The project aims to scale Ayrton’s technology toward field deployment in multi-modal environments.

The Asia-Pacific liquid organic hydrogen carrier industry is set to grow at a robust CAGR of 16.29% over the forecast period. This growth is propelled by the development of cross-border hydrogen trade routes that depend on safe and scalable storage methods. Asia Pacific is establishing long-term supply chains to transport hydrogen from resource-rich countries to industrial hubs. LOHCs are gaining prominence for enabling transport through existing liquid fuel infrastructure.

- In September 2023, Japan’s Suiso Energy (JSE) formed a shipping joint venture, JSE Ocean, with major Japanese shipping companies “K” LINE, MOL, and NYK. The venture focuses on building a large-scale liquefied hydrogen carrier as part of the global supply chain for hydrogen transport.

There is a rising investment in port facilities, shipping systems, and storage hubs that are compatible with LOHC technology. These developments are creating strong commercial incentives for producers and distributors to adopt LOHC-based storage. The integration of LOHCs into regional hydrogen trade plans is boosting regional market expansion.

- In July 2024, Nanyang Technological University (NTU Singapore), PSA Singapore, and Japan’s Chiyoda Corporation initiated a demonstration project using LOHC (specifically methylcyclohexane, MCH) to store and transport hydrogen safely at ambient temperature and pressure.

Regulatory Frameworks

- In the U.S., laws and incentives targeting clean hydrogen, including the Clean Hydrogen Production Standard and the Inflation Reduction Act’s tax provisions, indirectly support LOHC technologies by making low-carbon hydrogen more cost-competitive. Individual states regulate hydrogen infrastructure and offer tax credits or exemptions for alternative fuel vehicles and fueling systems.

- The UK regulates hydrogen under the Energy Act 2023, which introduces a hydrogen business model and low-carbon certification requirements. These rules directly affect LOHC projects, as carriers must align with certification standards to qualify for incentives. The Office for Gas and Electricity Markets oversees transport and storage licensing, ensuring that LOHC infrastructure complies with safety and integration requirements in the national energy system.

- China’s Medium- and Long-Term Plan for Hydrogen Energy (2021–2035) sets standards for hydrogen storage and safety, which apply to LOHC technologies. LOHC projects must comply with hazardous chemical regulations, particularly for aromatic compounds used as carriers. The plan promotes integration of hydrogen carriers in industrial hubs and mandates energy efficiency standards, making LOHC development subject to strict compliance with national safety and environmental rules.

Competitive Landscape

Major players in the liquid organic hydrogen carrier industry are adopting strategies such as developing large-scale demonstration projects, forming partnerships with energy and chemical companies, and advancing process technologies to remain competitive. Companies are focusing on integrating hydrogenation and dehydrogenation systems into existing industrial infrastructure to lower deployment costs and accelerate commercialization.

Investments in research and development are being directed toward improving carrier efficiency, enhancing system durability, and reducing conversion energy losses. Strategic collaborations are focused on securing supply chain reliability and expanding the geographic reach of LOHC-based hydrogen transport. Technological advancements aimed at scaling up hydrogen storage and delivery are positioning these players to capture early market growth opportunities.

- In February 2024, Honeywell announced that ENEOS will develop the world’s first commercial-scale LOHC project using Honeywell’s solution. The project leverages existing refinery infrastructure to transport clean hydrogen over long distances via methylcyclohexane derived from toluene hydrogenation.

Key Companies in Liquid Organic Hydrogen Carrier Market:

- Hydrogenious LOHC Technologies

- Chiyoda Corporation

- Hynertech Co. Ltd.

- Covalion

- Areva

- Sumitomo Chemical

- Mitsubishi Corporation

- Repsol

- Air Products and Chemicals

- Toyota Tsusho Corporation

- Linde plc

- Honeywell International Inc.

- Exxon Mobil Corporation

- Clariant

- MAN Energy Solutions

Recent Developments (Expansion/ Agreement/ Funding)

- In February 2025, Hydrogenious LOHC Technologies raised over USD 19.89 million from investors including AP Ventures, Temasek, Winkelmann Group, Covestro, Chevron Technology Ventures, and Anglo American Platinum. The funding supports scaling its LOHC technologies and delivering flagship projects such as the industrial-scale hydrogenation plant in Dormagen and the “Green Hydrogen @ Blue Danube” IPCEI initiative.

- In December 2024, Clarksons Specialised Products signed a Memorandum of Understanding with Hydrogenious LOHC Technologies to develop maritime supply chains for transporting green hydrogen via LOHC chemical tankers. Their partnership combines shipping logistics expertise with LOHC innovation to enable scalable, long-range hydrogen transport.

- In October 2023, Evonik expanded its catalyst plant in Shanghai to supply tailored precious-metal catalysts for Hydrogenious LOHC systems. This expansion supports commercial-ready catalysts by 2026, underpinning mobile LOHC applications and representing critical upstream investment for scalable LOHC deployment.