Linear Alpha Olefins Market Size

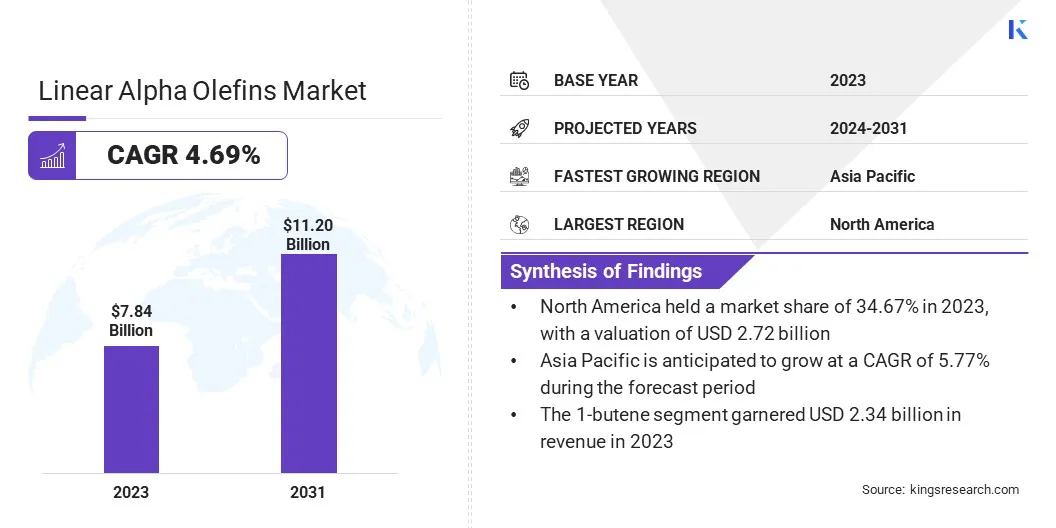

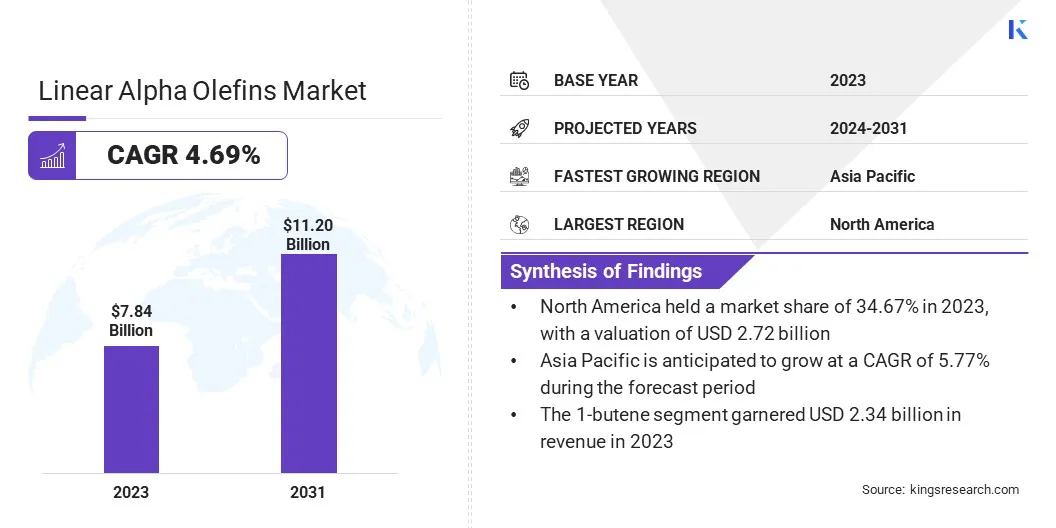

The global Linear Alpha Olefins Market size was valued at USD 7.84 billion in 2023 and is projected to grow from USD 8.12 billion in 2024 to USD 11.20 billion by 2031, exhibiting a CAGR of 4.69% during the forecast period. The market is witnessing substantial growth due to the increasing demand for their use in the production of surfactants and synthetic lubricants.

Increased industrial activities and advancements in chemical manufacturing are boosting market expansion. Additionally, innovations in catalytic processes are improving olefin production efficiency. The growing adoption of eco-friendly and sustainable products is further augmenting market growth, as industries actively seek greener alternatives to traditional petroleum-based olefins.

In the scope of work, the report includes solutions offered by companies such as Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Evonik Industries AG, Idemitsu Kosan Co., Ltd., INEOS, Sasol, LANXESS, Qatar Chemical Company Ltd, Shell plc, SABIC, and others.

The linear alpha olefins market is experiencing robust growth, propelled by their versatile applications across various industries. These olefins are essential for the production of high-performance plastics, detergents, lubricants, and synthetic rubber, thereby enhancing product properties and performance.

The growing demand for durable, flexible, and lightweight plastics in the packaging, automotive, and construction sectors is contributing significantly to market growth. Additionally, the expansion of the oil and gas industry is boosting the need for linear alpha olefins in chemical and lubricant production.

- For instance, according to the IEA, global oil demand rose by 2.3 mb/d, reaching a total of 101.7 mb/d in 2023.

A notable trend influencing the market is the growing shift toward bio-based alpha olefins. This shift aligns with global sustainability efforts and reduces reliance on fossil fuels, thereby propelling market growth.

Linear alpha olefins (LAOs) are a class of alkenes charaterized by a double bond located at the first carbon atom of a straight, unbranched chain. Primarily produced through the oligomerization of ethylene, LAOs are crucial intermediates in various industrial applications.

They play a vital role in the production of polyethylene, synthetic lubricants, surfactants, and plasticizers. Their unique chemical structure offers high reactivity and versatility, making them essential for manufacturing high-performance materials and chemicals. LAOs' widespread use in enhancing product properties and performance across industries underscores their significance in the global chemical market.

Analyst’s Review

A key factor stimulating the expansion of the market is the increasing investment in large-scale production facilities by major chemical companies. These investments are enabling the expansion of manufacturing capacities and enhancing production efficiencies, thereby supporting the growing demand for linear alpha olefins across various end-use applications.

- For instance, in April 2022, Shell Chemical received approval from the State Board of Commerce and Industry for an industrial tax exemption program valued at US$ 1.4 billion. This initiative is expected to facilitate the establishment of a 'world scale' linear alpha olefin production facility at Shell's Geismar site.

This development underscores the industry’s rising focus on expanding capacity to meet rising demand for linear alpha olefins.

Linear Alpha Olefins Market Growth Factors

The expansion of the oil and gas industry is supporting the growth of the market. Linear alpha olefins serve as crucial intermediates in the production of various chemicals and synthetic lubricants required for oil and gas exploration, production, and refining processes.

These olefins are being increasingly utilized to enhance the performance and efficiency of operations within the sector. As investments and activities in the oil and gas industry continues to increase, there is a corresponding rise in the demand for linear alpha olefins. This surge in demand is propelling market growth, as the need for advanced materials that withstand the rigorous conditions of the oil and gas environment is continually rising.

A major challenge impeding the development of the market is the volatility in raw material prices, which significantly impact production costs and profitability. Fluctuations in the prices of feedstocks such as ethylene, supported by market dynamics and geopolitical factors, are hindering the growth of the sector.

Additionally, rising regulatory pressures related to environmental sustainability are increasing operational costs and complicating compliance requirements. Key players are actively mitigating these challenges by investing heavily in advanced technologies to improve production efficiency and reduce reliance on volatile raw materials. They are further developing strategic partnerships and securing long-term contracts to stabilize supply chains.

Furthermore, companies are focusing on enhancing sustainability practices and adopting eco-friendly production methods to meet regulatory requirements and minimize their environmental impact, which is likely to aid linear alpha olefins market growth in the coming years.

Linear Alpha Olefins Market Trends

The growing use of polyalphaolefins (PAOs), which are derived from linear alpha olefins, in the production of high-performance synthetic lubricants is emerging as a major linear alpha olefins market trend. PAOs are being increasingly favored due to their superior properties, such as thermal stability, oxidative stability, and low-temperature fluidity, making them ideal for automotive and industrial applications.

In the automotive sector, they are enhancing engine performance and longevity by reducing friction and wear. In industrial applications, they are providing reliable lubrication under extreme temperatures and pressures. This increasing preference for PAOs due to their exceptional performance characteristics is continually boosting their demand.

A growing emphasis on sustainability and reducing reliance on fossil fuels is leading to the development and widespread adoption of bio-based alpha olefins derived from renewable sources such as plant oils. This trend reflects a broader shift toward greener products and environmentally friendly practices. Bio-based alpha olefins are offering significant environmental benefits, including reduced carbon footprints and lower dependency on non-renewable resources. By aligning with global sustainability goals, these alternatives are gaining immense traction across various industries, including plastics and lubricants.

- In November 2022, Chevron Phillips Chemical opened its new linear alpha olefin chemical facility in Beringen, Belgium. This expansion is anticipated to enable the company to serve its European customers more effectively by utilizing the facility's strategic location and regional feedstock availability.

This increasing preference for bio-based solutions is shaping the market, fueling innovation, and expanding the adoption of renewable materials in place of traditional fossil-fuel-derived alpha olefins.

Segmentation Analysis

The global market is segmented based on product, application, and geography.

By Product

Based on product, the linear alpha olefins market is categorized into 1-butene, 1-hexene, 1-octene, 1-decene, 1-dodecene, and others. The 1-butene segment garnered the highest revenue of USD 2.34 billion in 2023.

1-Butene, as a key co-monomer, is essential for producing high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE), which are extensively used in the packaging, automotive, and construction industries.

Furthermore, 1-butene is crucial for manufacturing synthetic lubricants and plasticizers, as it enhances product performance and quality. The rising demand for durable and high-performance plastics, coupled with ongoing advancements in polymer technology, is fueling the growth of the 1-butene segment. This increasing utilization across diverse industries is supporting segmental expansion, reflecting a growing emphasis on enhancing material properties and meeting evolving consumer needs.

By Application

Based on application, the market is categorized into polyethylene, detergent alcohol, synthetic lubricant, and others. The polyethylene segment captured the largest linear alpha olefins market share of 45.23% in 2023. The segment benefits from the growing need for durable, flexible, and lightweight materials that polyethylene provides.

Advancements in polyethylene production technology, including innovations in polymerization processes and catalyst development, are further propelling segmental growth. Additionally, the rising focus on sustainable and recyclable packaging solutions is boosting the demand for polyethylene, as it is increasingly being used in eco-friendly applications. The polyethylene's growing use across diverse industries supports the growth of the segment.

Linear Alpha Olefins Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America linear alpha olefins market share stood around 34.67% in 2023 in the global market, with a valuation of USD 2.72 billion. Ethylene, a primary feedstock for linear alpha olefins, benefits from the increased availability of shale gas, which enhances production capabilities and lowers costs. Additionally, ongoing oil exploration activities in the Gulf of Mexico are expected to further stimulate regional market growth by providing additional resources and fostering technological advancements in extraction and processing.

In Canada, the rise in crude oil production is set to boost the production of linear alpha olefins by enhancing the availability of feedstocks and facilitating the development of new processing facilities. These regional developments are collectively strengthening the supply chain and contributing to the growth of the North America market.

Asia Pacific is anticipated to witness robust growth at a CAGR of 5.77% over the forecast period. This growth is largely attributed to key developments in the packaging and pulp and paper industries.

- According to Packaging Industry Association of India (PIAI) the packaging industry in India is currently the fifth-largest economic sector, is experiencing rapid growth, expanding at an annual rate of 22-25%.

This growth is increasing the demand for polyethylene, including linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which in turn is fueling the need for linear alpha olefins. China, being one of the world's leading producers of paper, is seeing substantial demand for alpha olefins due to its large-scale pulp and paper industry. The increase in processed paper and cardboard manufacturing volume further propels the demand for alpha olefins, highlighting the region's expanding market potential.

Competitive Landscape

The global linear alpha olefins market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Linear Alpha Olefins Market

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Evonik Industries AG

- Idemitsu Kosan Co., Ltd.

- INEOS

- Sasol

- LANXESS

- Qatar Chemical Company Ltd

- Shell plc

- SABIC

Key Industry Development

- September 2023 (Expansion): ExxonMobil introduced two new chemical production units at its Baytown facility, marking its entry into the market. This expansion, valued at US$ 2 billion, aligns with ExxonMobil’s long-term growth strategy to provide higher-value products from its chemical and refining facilities on the US Gulf Coast.

The global linear alpha olefins market is segmented as:

By Product

- 1-Butene

- 1-Hexene

- 1-Octene

- 1-Decene

- 1-Dodecene

- Others

By Application

- Polyethylene

- Detergent Alcohol

- Synthetic Lubricant

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America