Market Definition

The light electric vehicles (LEVs) market comprises electrically powered, lightweight transportation solutions for urban mobility, last-mile connectivity, and sustainable transportation. The market includes electric bikes, electric scooters, and similar vehicles.

Light Electric Vehicles Market Overview

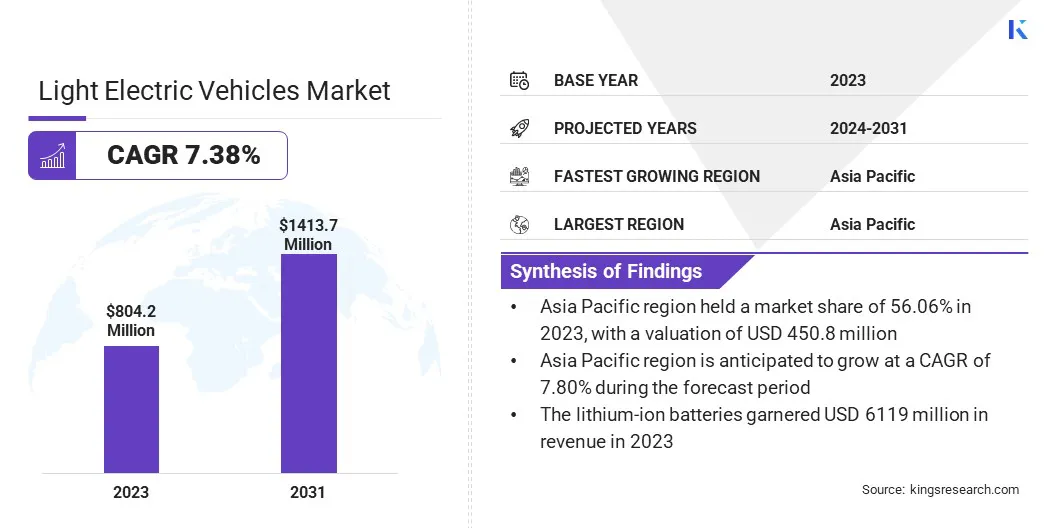

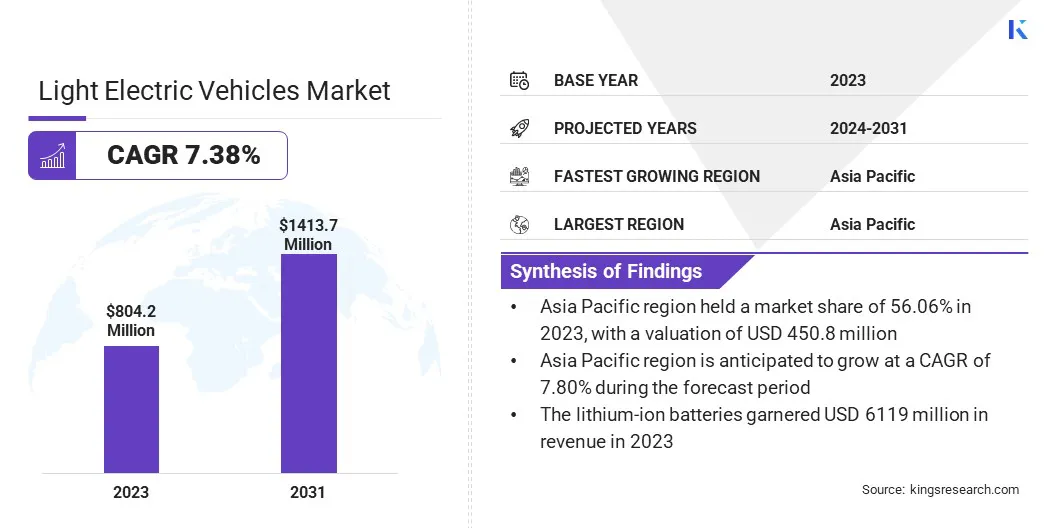

The global light electric vehicles market size was valued at USD 804.2 million in 2023 and is projected to grow from USD 859.1 million in 2024 to USD 1,413.7 million by 2031, exhibiting a CAGR of 7.38% during the forecast period. This growth is driven by technological advancements in battery efficiency, expansion of charging infrastructure, and integration of battery-swapping technology.

Major companies operating in the global light electric vehicles industry are Jiangsu Xinri E-Vehicle Co. Ltd, Niu International, Luyuan e-vehicle, Inokim Inc, Gogoro Inc., Lectric eBikes, Yadea, TVS Motor Company, Honda Motor Co., Ltd., Ather Energy Limited, SEGWAY INC., KWANG YANG MOTOR CO., LTD., Okinawa Autotech Internationall Private Limited, Giant Bicycles, Vmoto Limited.

Advancements in battery technology and the adoption of swappable battery systems are influencing the market, enhancing efficiency, convenience, and affordability. As battery innovation progresses, LEVs are becoming a scalable, cost-effective mobility solution, boosting adoption in both personal and commercial transportation.

- In September 2024, Amprius Technologies, a leader in next-generation lithium-ion batteries, has secured two contracts exceeding USD 20 million to supply 40 Ah high-performance cells for Light Electric Vehicle (LEV) applications. These agreements underscore the company's rapid commercialization capabilities, volume commitments, and production scaling.

Key Highlights:

- The global light electric vehicles market size was recorded at USD 804.2 million in 2023.

- The market is projected to grow at a CAGR of 7.38% from 2024 to 2031.

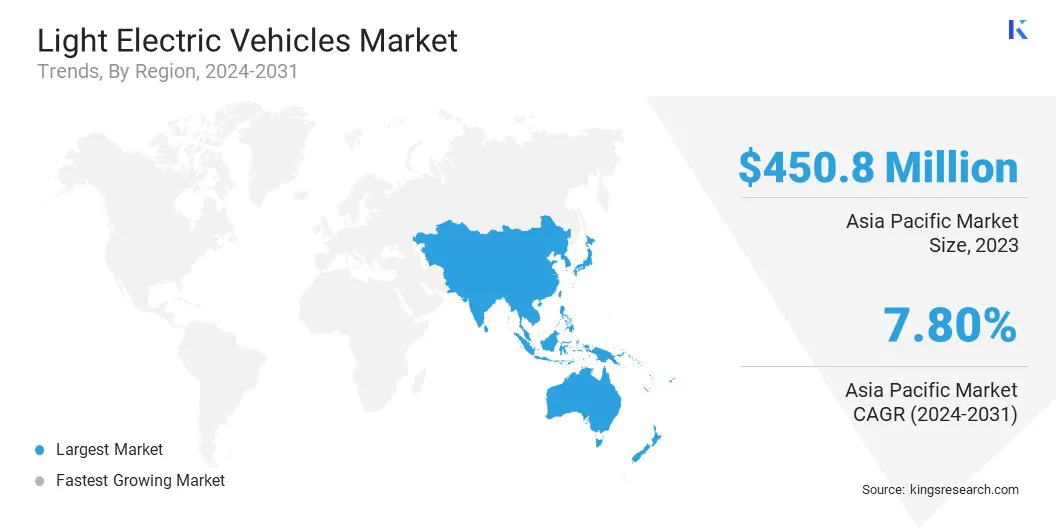

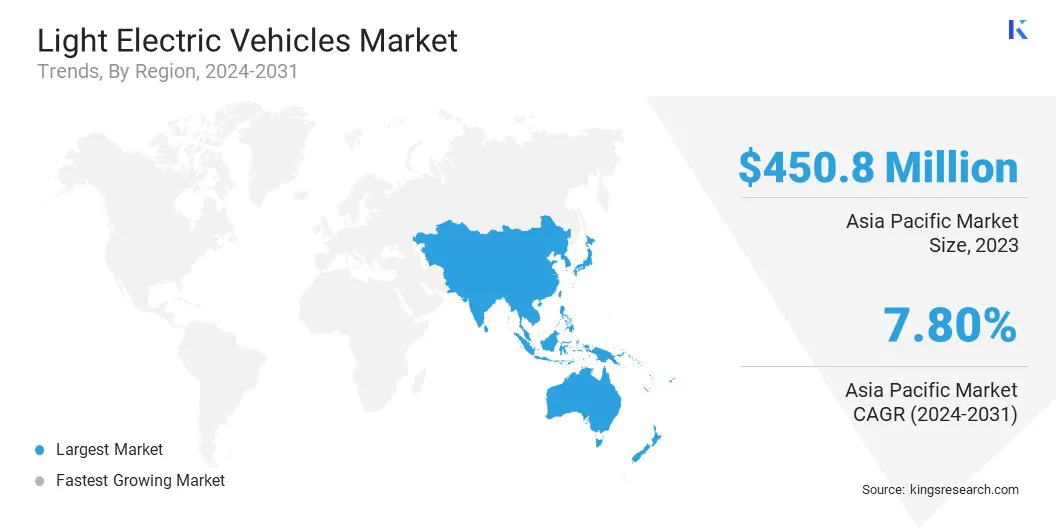

- Asia-Pacific held a share of 56.06% in 2023, valued at USD 450.8 million.

- The electric bikes segment garnered USD 386.7 million in revenue in 2023.

- The lithium-ion batteries segment is expected to reach USD 1,058.3 million by 2031.

- The personal use segment is projected to generate a value of USD 938.9 million by 2031.

- Europe is anticipated to grow at a CAGR of 7.26% over the forecast period.

Market Driver

"Advancements in Battery Technology"

The growth of the light electric vehicles market is driven by advancements in battery technology, enhancing efficiency, performance, and cost-effectiveness. The development of high-energy-density lithium-ion and solid-state batteries is extending the range of light electric vehicles (LEVs) and reducing charging times, addressing key adoption barriers.

Ongoing innovations are lowering costs, enhancing durability, and positioning LEVs as a scalable solution for urban mobility and commercial use.

- In January 2025, Yadea launched its latest electric two-wheeler in Hangzhou, China, featuring cutting-edge sodium battery technology. With an energy density of 145 Wh/kg and a cycle life of 1,500 cycles, the battery offers enhanced durability and performance. Its superior low-temperature efficiency, maintaining 92% discharge retention at -20°C, makes it ideal for cold regions.

Market Challenge

"Charging Infrastructure Limitations"

Key challenge influencing the market is the lack of a robust charging infrastructure. Unlike electric cars, LEVs often rely on standard outlets, which are not widely available in public spaces. This limitation impacts convenience and adoption rates, particularly in urban settings where users may not have dedicated parking spaces with charging access.

Governments and private stakeholders must invest in expanding dedicated LEV charging networks, including micro-mobility hubs and battery-swapping stations. Standardization of charging interfaces across manufacturers can further enhance accessibility.

- For Instance, in September 2024, Amazon launched a new EV charging network in Bengaluru as part of its Climate Pledge initiative with a collective investment exceeding USD 2.65 million. This development aims to support urban e-mobility, reduce downtime for LEVs, and accelerate adoption by improving accessibility to efficient charging solutions.

Market Trend

"Integration of Swappable Battery Technology"

A key trend in the light electric vehicles market is the increasing adoption of swappable battery technology, which minimizes downtime by enabling quick battery replacements instead of long charging times.

This innovation benefits commercial fleet operators and ride-sharing services by enhancing operational efficiency. Battery-as-a-Service (BaaS) models allows users to subscribe to battery usage, reducing upfront costs.

- In December 2024, the Malaysian Green Technology and Climate Change Corporation (MGTC) and the United Nations Industrial Development Organization (UNIDO) launched the Demonstration of Electric Motorcycle Battery Swapping Systems Project. The initiative aims to assess the feasibility of battery-swapping technology in accelerating electric motorcycle adoption in Malaysia. It evaluates system viability, user acceptance, and provides recommendations for national implementation.

- In December 2023, Yamaha Motor Co., Ltd. announced the establishment of ENYRING, a joint venture focused on battery-swapping solutions for electric motorcycles and light electric vehicles (LEVs). The initiative aims to provide a shared, reusable battery-swapping service to improve user convenience and promote sustainable mobility.

Light Electric Vehicles Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vehicle Type

|

Electric Bikes, Electric Scooters, Others

|

|

By Battery Type

|

Lithium-ion Batteries, Lead-acid Batteries, Other Battery Types

|

|

By End Use

|

Personal Use, Commercial Use

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Vehicle Type (Electric Bikes, Electric Scooters, and Others): The electric bikes segment earned USD 386.7 million in 2023 due to increasing consumer demand for sustainable urban mobility solutions.

- By Battery Type (Lithium-ion Batteries, Lead-acid Batteries, and Other Battery Types): The lithium-ion batteries held a share of 76.09% in 2023, due to superior energy density, longer lifespan, and faster charging compared to lead-acid batteries.

- By End Use (Personal Use and Commercial Use): The personal use segment is projected to reach USD 938.9 million by 2031, owing to the increasing adoption of light electric vehicles for daily commuting, last-mile transportation, and recreational activities.

Light Electric Vehicles Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific light electric vehicles market share stood at around 56.06% in 2023, valued at USD 450.8 million. This dominance is primarily reinforced by the high adoption of electric two-wheelers in countries such as China, India, and Japan, where urban congestion and rising fuel costs are accelerating the shift toward light electric vehicles (LEVs).

China, the world’s largest electric vehicle market, leads in LEV advancements, benefiting from strong government incentives, mass production, and advancements in battery technology.

India and Southeast Asian nations are witnessing substantial growth due to the increasing demand for affordable, sustainable urban mobility solutions. Expanding charging infrastructure, battery-swapping networks, and government-led electrification policies are further fueling regional market expansion

-

For instance, in December 2023, Gogoro launched its smart electric scooter and battery-swapping ecosystem in India, introducing the CrossOver GX250, its first locally manufactured Smartscooter. Initially available for B2B customers in Delhi and Goa, the company is expanding its reach to new regions as part of its growth strategy.

Europe light electric vehicles industry is poised to grow at a CAGR of 7.26% over the forecast period. This expansion is attributed to emission regulations, rising environmental consciousness, and government incentives promoting electric mobility.

The rise of shared micro-mobility services, coupled with technological advancements in smart connectivity and energy-efficient drivetrains, is further boosting regional market expansion. As key automakers and new entrants invest in sustainable transportation solutions, Europe is expected to emerge as a key market for light electric vehicles.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) regulates light electric vehicles (LEVs) by enforcing vehicle safety standards, performance requirements, and operational guidelines to ensure road safety, reliability, and consumer protection.

- In Europe, the European Commission regulates the market through directives and standards, ensuring compliance with safety, emissions, and battery performance requirements, while promoting sustainable mobility and market growth across member states.

- In India, the Ministry of Road Transport and Highways (MoRTH) regulates the market by overseeing vehicle safety, registration, and compliance with emission norms to ensure roadworthiness and environmental sustainability.

Competitive Landscape

The global light electric vehicles market is highly competition, driving innovation in battery efficiency, smart connectivity, and lightweight vehicle design. Key players are expanding their product portfolios through strategic partnerships, mergers, and acquisitions to strengthen their market presence.

Additionally, companies are heavily investing in battery-swapping infrastructure and IoT-enabled vehicle monitoring systems to enhance user convenience and operational efficiency.

With rising government incentives and growing consumer demand for sustainable mobility solutions, market participants are prioritizing affordability, performance, and scalability.

- In February 2025, PURE EV partnered with JioThings, a subsidiary of Jio Platforms, to integrate smart digital clusters and IoT-based telematics into its market, enhancing connectivity, real-time monitoring, and user experience for electric two-wheeler riders.

List of Key Companies in Light Electric Vehicles Market:

- Jiangsu Xinri E-Vehicle Co., Ltd

- Niu International

- Luyuan e-vehicle

- Inokim Inc

- Gogoro Inc.

- Lectric eBikes

- Yadea

- TVS Motor Company

- Honda Motor Co., Ltd.

- Ather Energy Limited

- SEGWAY INC.

- KWANG YANG MOTOR CO., LTD.

- Okinawa Autotech Internationall Private Limited

- Giant Bicycles

- Vmoto Limited

Recent Developments (New Product Launch)

- In February 2025, Renault unveiled a new lineup of electric light commercial vehicles (e-LCVs), including the Estafette, Goélette, and Trafic, reinforcing the growing momentum of the market with innovative, sustainable mobility solutions tailored for urban and commercial applications.

- In July 2024, BMW Motorrad India launched the BMW CE 04, its first premium electric two-wheeler in India, marking a significant step in the market. This highlights the growing demand for high-performance electric mobility solutions in the region.