Market Definition

The market encompasses the global industry involved in the development, manufacturing, distribution, and application of laser-based measurement systems used primarily for large-scale dimensional inspection and alignment.

It spans a wide range of industries including aerospace, automotive, energy, heavy machinery, and shipbuilding, where precise 3D measurements are essential for quality control, assembly, and reverse engineering tasks. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Laser Tracker Market Overview

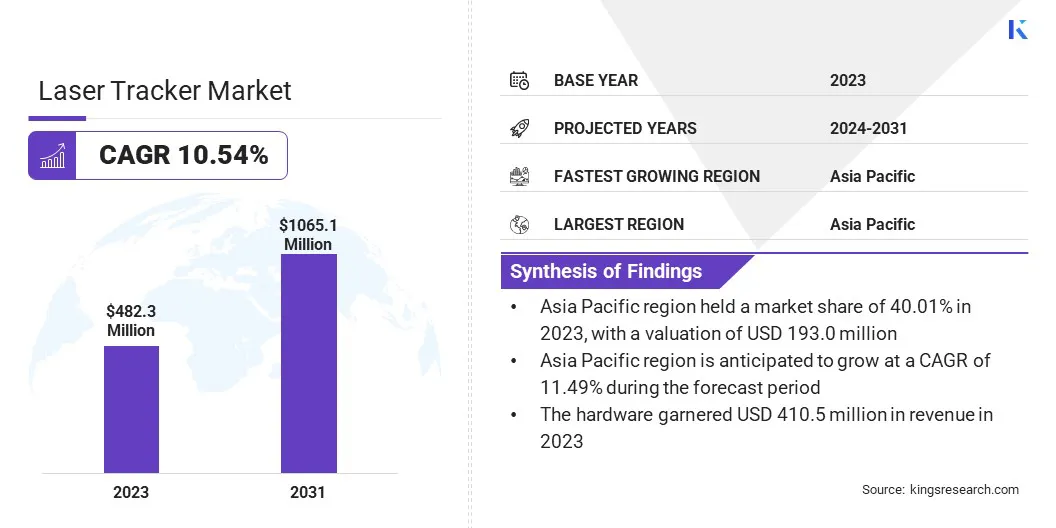

The global laser tracker market size was valued at USD 482.3 million in 2023 and is projected to grow from USD 528.0 million in 2024 to USD 1065.1 million by 2031, exhibiting a CAGR of 10.54% during the forecast period.

The growth is growth driven by advancements in manufacturing technologies and the increasing demand for high-precision measurement tools. As industries such as aerospace, automotive, and energy continue to focus on improving product quality and production efficiency, the need for accurate, reliable measurement systems is increasing, thereby driving the adoption of advanced laser trackers.

Major companies operating in the laser tracker industry are VMT GmbH, Verisurf Software, Inc., InnovMetric Software Inc., Northern Digital Inc., SGS Société Générale de Surveillance SA., Hexagon AB, PLX Inc, CHOTEST TECHNOLOGY INC., Kreon, FARO, 3D Systems, Inc., HUBBS Machine & Manufacturing, Brunson Instrument Company, Automated Precision Inc (API), and MAP Group.

Moreover, the increasing use of modular 3D laser scanner attachments is also contributing to the market’s expansion, as they offer greater flexibility and improve productivity in automated robotic applications. These factors are driving the global market as industries seek more efficient, accurate, and cost-effective solutions for large-scale manufacturing and assembly operations.

- In September 2024, Hexagon AB introduced the Leica Absolute Tracker ATS800 that combines non-contact measurement and laser tracking to improve quality inspections in large-scale manufacturing. The ATS800 aids manufacturers to accurately measure detailed features from a distance, significantly reducing inspection times from hours to minutes.

Key Highlights

- The laser tracker market size was recorded at USD 482.3 million in 2023.

- The market is projected to grow at a CAGR of 10.54% from 2024 to 2031.

- Asia Pacific held a market share of 40.01% in 2023, with a valuation of USD 193.0 million.

- The hardware segment garnered USD 410.5 million in revenue in 2023.

- The quality control and inspection segment is expected to reach USD 480.2 million by 2031.

- The Automotive segment is expected to reach USD 381.0 million by 2031.

- North America is anticipated to grow at a CAGR of 10.77% during the forecast period.

Market Driver

Growing Demand for Precision in Manufacturing

The market is being driven by the increasing need for high-precision measurement in modern manufacturing. Industries like aerospace, automotive, and energy depend on precision tools to check alignment, dimensions, and overall product quality. Laser trackers enable high-resolution measurement of large structures to ensure strict geometric tolerances are met.

This precision is critical for seamless assembly and optimal performance of complex parts. As manufacturers aim to reduce rework, cut waste, and boost reliability, laser trackers are becoming integral to quality assurance in large-scale production.

- In April 2025, FARO announced the release of the Vantage Max Laser Tracker, available in two models, the VantageS6 Max and the VantageE6 Max. These laser trackers provide large-volume 3D measurement capabilities up to 80 meters, improving measurement speed and reducing inspection cycle times.

Market Challenge

High Initial Cost

One of the key challenges in the laser tracker market is the significant upfront cost associated with purchasing and deploying the technology. These systems often require substantial capital, along with additional expenses for maintenance, training, and integration. This can be a deterrent for small and mid-sized enterprises with constrained budgets.

To overcome this barrier, manufacturers are focusing on developing modular, cost-effective solutions tailored to specific needs. Flexible financing models, such as leasing and rental services, are also helping increase accessibility and drive adoption across a broader user base.

Market Trend

Integration with Modular 3d Laser Scanner

A growing trend in the market is the adoption of modular 3D laser scanners. These modular systems allow users to connect 3D laser scanners directly to laser trackers, making it easier to switch between point-based tracking and full-surface scanning without changing equipment.

This flexibility is especially useful in industries like aerospace and automotive where detailed surface data and precise alignment are needed. These modular 3D laser scanners are being increasingly integrated into automated robot applications, where they enable real-time, high-precision measurements during inspection, alignment, and assembly tasks.

By combining scanning and tracking capabilities in one system, they support flexible automation setups, enhance workflow efficiency, and reduce the need for manual intervention in complex manufacturing environments.

- In July 2023, Hexagon released the Absolute Scanner AS1-XL, a modular 3D laser scanner engineered for inspecting large surfaces. Built on the SHINE technology of its predecessor, the AS1, the AS1-XL offers 3D data collection at high speeds, ideal for challenging surfaces.

Laser Tracker Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Hardware, Software, Services

|

|

By Application

|

Quality Control and Inspection, Alignment, Reverse Engineering, Calibration

|

|

By End-user Industry

|

Automotive, Aerospace and Defense, Energy and Power, General Manufacturing, Architecture and Construction, Transportation

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Offering (Hardware, Software, Services): The hardware segment earned USD 410.5 million in 2023 due to the widespread adoption of precision measurement systems in industrial manufacturing and assembly processes.

- By Application (Quality Control and Inspection, Alignment, Reverse Engineering, and Calibration): The quality control and inspection segment held 40.11% of the market in 2023, due to increasing demand for accuracy in component verification and in-line inspection across high-precision industries.

- By End-user Industry (Automotive, Aerospace and Defense, Energy and Power, and General Manufacturing): The automotive segment is projected to reach USD 381.0 million by 2031, owing to the growing integration of laser trackers for real-time measurement, automation, and error reduction in vehicle production lines.

Laser Tracker Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific laser tracker market share stood around 40.01% in 2023 in the global market, with a valuation of USD 193.0 million. This region’s dominance is attributed to the rapid industrialization and expanding manufacturing sectors in countries like China, Japan, and India.

The demand for laser trackers is driven by the growing need for precision in automotive production, electronics manufacturing, and aerospace industries. Additionally, the increasing adoption of smart manufacturing technologies and automation has increased the need for high-precision measurement tools in various industries.

Government investments in infrastructure and advanced manufacturing technologies are further driving the adoption of laser tracker systems across the Asia Pacific region.

- For instance, in April 2025, the Indian Ministry of Heavy Industries established four Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Centres under the scheme for Enhancement of Competitiveness in the Indian Capital Goods Sector. These centers are part of a broader scheme to boost competitiveness in the capital goods sector, supporting the integration of advanced solutions like laser trackers.

North America is poised to grow at a CAGR of 10.77% over the forecast period. The growth is driven by the region's strong presence in industries such as aerospace and defense, automotive, and energy. These industries require high precision for assembly, inspection, and quality control processes, where laser trackers play a crucial role.

The region's advanced technological infrastructure and focus on R&D have fostered the widespread use of precision measurement systems. Additionally, the increasing investment in smart manufacturing and Industry 4.0 technologies has enhanced the demand for laser trackers, thereby driving the growth of the market in this region.

Regulatory Frameworks

- In the U.S, the regulatory framework for laser trackers primarily falls under the oversight of National Institute of Standards and Technology (NIST), which ensures the accuracy and traceability of measurement instruments used in various industries. NIST provides guidelines and standards for precision measurement tools, including laser trackers.

- In Europe, the European Union (EU) sets regulatory standards for measurement systems through ISO 9001 for quality management and ISO 10360, which specifically covers the performance of coordinate measuring machines (CMM), including laser trackers. The EU's Metrology Directive (2014/32/EU) ensures that measuring instruments, including laser trackers, are consistent with standards for accuracy and reliability.

Competitive Landscape

The competitive landscape of the laser tracker market is shaped by several key strategies. Companies are focusing on innovating products to improve accuracy, speed, and compatibility with modern technological systems like Industry 4.0. To expand their market presence, many players are entering new regions where demand for precision tools is rising.

Partnerships with software and sensor companies allow manufacturers to offer integrated solutions, combining both hardware and software to meet diverse customer needs. Additionally, acquisition is a key strategy adopted by key players for gaining access to new technologies, expanding product offerings, and entering new markets.

Companies also emphasize after-sales services, such as maintenance, calibration, and training, to help build customer loyalty and ensure long-term product performance. These strategies enable companies to stay competitive and meet the growing demand for high-precision measurement tools.

- In June 2024, Automated Precision Inc. (API) unveiled its redesigned XD Laser and wireless SwivelCheck for enhanced machine tool calibration. The XD Laser has been upgraded to improve thermal stability, internal connectivity, and power management, ensuring higher precision and efficiency. In addition, the latest version of SwivelCheck is fully wireless and 40% smaller, offering greater flexibility and improved machine coverage for industrial applications.

List of Key Companies in Laser Tracker Market:

- VMT GmbH

- Verisurf Software, Inc.

- InnovMetric Software Inc.

- Northern Digital Inc.

- SGS Société Générale de Surveillance SA.

- Hexagon AB

- PLX Inc

- CHOTEST TECHNOLOGY INC.

- Kreon

- FARO

- 3D Systems, Inc.

- HUBBS Machine & Manufacturing

- Brunson Instrument Company

- Automated Precision Inc (API)

- MAP Group

Recent Developments (Product Launch)

- In April 2025, Automated Precision Inc. (API) launched its 6th generation Laser Tracker, the Integrated Laser Tracker. The iLT is the lightest and smallest laser tracker ever created by API, weighing just 4.9kg, reducing the weight of its previous models by 50%. Designed for maximum portability, it features hot-swappable batteries, an onboard controller, and Wi-Fi, allowing for cable-free operation.

now