Market Definition

The market comprises advanced laser-based solutions for high-precision applications such as cutting, welding, marking, and engraving across industrial sectors.

The market is driven by the accelerating adoption of Electric Vehicles (EVs), which demand precision component manufacturing, and the broader shift toward high-accuracy, automated production. These dynamics position laser processing as a critical enabler in next-generation manufacturing.

Laser Processing Market Overview

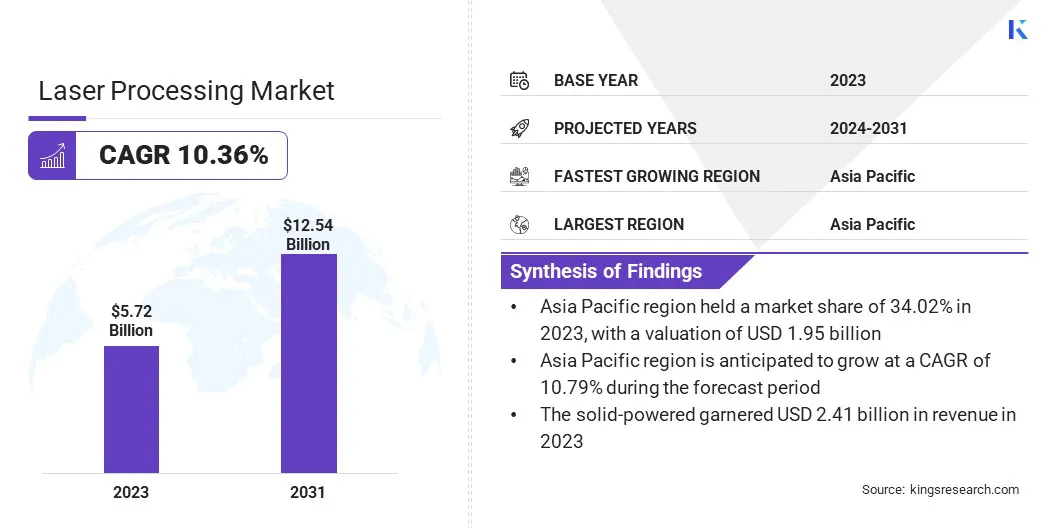

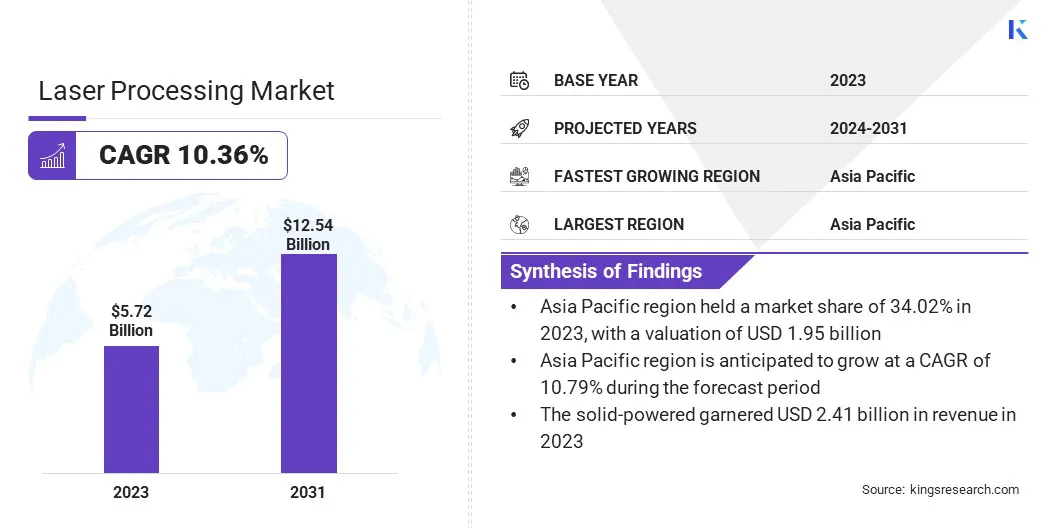

The global laser processing market size was valued at USD 5.72 billion in 2023 and is projected to grow from USD 6.29 billion in 2024 to USD 12.54 billion by 2031, exhibiting a CAGR of 10.36% during the forecast period.

The rise of EVs and the growing demand for precision manufacturing are driving the need for laser processing, with the technology ensuring efficient, high-quality production of complex components.

Major companies operating in the laser processing industry are Coherent Corp, IPG Photonics Corporation, ALTEC Metalltechnik GmbH, Universal Laser Systems, Inc, Newport Corporation, AMADA CO., LTD., Bystronic Group, Epilog Laser, eurolaser GmbH, Han's Laser Technology Industry Group Co., Ltd., TRUMPF, Kent Lasers Ltd, Mitsubishi Electric Corporation, Trotec Laser GmbH., and FOBA.

The market is driven by the rapid growth of the EV industry, which requires high-precision, efficient, and scalable solutions for battery assembly, lightweight material processing, and complex welding applications.

Laser technologies provide the speed and accuracy needed to meet evolving EV manufacturing standards, positioning them as critical tools in advanced automotive production.

- In September 2023, the Rocky Mountain Institute (RMI) published research highlighting the rapid growth of EV sales, projected to account for 62% to 86% of the global market share by 2030. This surge in demand drives the need for advanced manufacturing solutions, with laser processing playing a critical role in EV production, enabling precise battery assembly, lightweight component fabrication, and welding to meet high-performance, scalable production needs.

Key Highlights:

- The laser processing industry size was valued at USD 5.72 billion in 2023.

- The market is projected to grow at a CAGR of 10.36% from 2024 to 2031.

- Asia Pacific held a market share of 34.02% in 2023, with a valuation of USD 1.95 billion.

- The solid-powered segment garnered USD 2.41 billion in revenue in 2023.

- The fixed beam segment is expected to reach USD 4.68 billion by 2031.

- The machining segment secured the largest revenue share of 24.88% in 2023.

- The medical segment is poised for a robust CAGR of 10.65% through the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 10.38% during the forecast period.

Market Driver

"Rising Demand for Precision Manufacturing"

The global laser processing market is driven by the rising demand for precision manufacturing across various industries, including aerospace, automotive, and electronics.

These industries require increasingly accurate solutions for complex component production. Laser technologies provide the precision and efficiency needed to meet these demands, optimizing production cycles, minimizing material waste, and ensuring high-quality standards.

- In October 2024, the Institute of Physics (IOP) Science highlighted significant advancements in laser-based manufacturing across industries such as automotive, aerospace, and electronics. Technologies like laser shock peening enhance surface properties, while laser deposition facilitates the creation of high-strength alloys. The growth of Additive Manufacturing (AM) techniques like Selective Laser Melting (SLM) is expected to drive the market, fueled by the increasing demand for high-precision components and cost-effective production.

Market Challenge

"Environmental & Energy Use Regulations"

The global laser processing market faces several challenges, due to stringent environmental and energy regulations, with manufacturers required to invest in advanced, eco-friendly laser systems to meet policies promoting lower emissions and higher energy efficiency.

This transition can drive up operational costs and create adoption barriers, especially in cost-sensitive regions. Manufacturers can mitigate these challenges by adopting energy-efficient technologies, investing in sustainable R&D, and leveraging government incentives and green financing.

Strategic partnerships and collaborative knowledge-sharing can also support the industry’s shift toward compliance, reducing costs and facilitating the broader adoption of environmentally friendly solutions.

Market Trend

"EV & Automotive Applications"

The global laser processing market is registering strong growth, due to the rising adoption of electric and autonomous vehicles. Automotive manufacturers are leveraging laser technologies for high-precision welding, cutting, and battery assembly to meet the performance and safety demands of EVs.

This trend supports scalable production, lightweight component manufacturing, and the industry’s shift toward electrification and advanced mobility solutions.

- In June 2023, the Society of Photo-Optical Instrumentation Engineers (SPIE) reported that IPG Photonics introduced advanced Adjustable Mode Beam (AMB) fiber lasers to support EV manufacturing. These lasers are gaining global traction for their ability to deliver higher precision, improved processing quality, and reduced defect rates in battery and component fabrication.

Laser Processing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Laser

|

Solid-powered, Liquid-powered, Gas-powered

|

|

By Configuration

|

Fixed Beam, Moving Beam, Hybrid

|

|

By Application

|

Machining, Joining, Surface Modification, Marking & Engraving, Micro/Nano Fabrication

|

|

By Vertical

|

Manufacturing, Automotive, Aerospace & Defense, Medical, Electronics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Laser (Solid-powered, Liquid-powered, Gas-powered): The solid-powered segment earned USD 2.41 billion in 2023, due to its high efficiency, reliability, and ability to deliver precise, high-quality results across a wide range of industrial applications, making it a preferred choice in the automotive, electronics, and aerospace industries.

- By Configuration (Fixed Beam, Moving Beam, Hybrid): The fixed beam segment held 37.74% share of the market in 2023, due to its ability to deliver stable and precise laser output, ensuring consistent performance and high-quality results in industrial applications such as material cutting, welding, and engraving.

- By Application (Machining, Joining, Surface Modification, Marking & Engraving, Micro/Nano Fabrication): The machining segment is projected to reach USD 3.31 billion by 2031, owing to its ability to offer high-precision, non-contact processing solutions that enhance efficiency, reduce material waste, and enable the production of complex components in industries like aerospace, automotive, and electronics.

- By Vertical (Manufacturing, Automotive, Aerospace & Defense, Medical, Electronics): The medical segment is poised for significant growth at a CAGR of 10.65% through the forecast period, due to the increasing demand for precise, minimally invasive surgical procedures, as well as the need for advanced laser technologies in medical device manufacturing, diagnostics, and treatment applications.

Laser Processing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific laser processing market share stood at around 34.02% in 2023, with a valuation of USD 1.95 billion. The dominance is attributed to the growing EV sector, which requires precision manufacturing.

This growth is driving increased reliance on laser technology for applications such as welding, cutting, and surface treatment, which are essential for meeting the high standards of efficiency and quality in EV production.

- In January 2024, the Institute for Management Development (IMD) reported that China reached a significant milestone in its automotive industry, producing 30 million vehicles in 2023, including 9 million New Energy Vehicles (NEVs). This dominance in NEV production is boosting the need for advanced manufacturing technologies, such as laser processing, to enhance precision and efficiency.

The laser processing industry in Europe is poised for significant growth at a robust CAGR of 10.38% over the forecast period. The growth is driven by the expanding applications of laser technologies in the medical sector.

The rising adoption of lasers in medical devices, diagnostics, and minimally invasive surgical procedures is playing a key role in this market expansion. Lasers offer high precision, efficiency, and reduced recovery times in medical treatments, hence, their integration into healthcare technologies is creating opportunities for innovation and growth.

This increasing demand for advanced laser-based medical solutions is strengthening Europe’s position in the market, enhancing its competitiveness by fostering advancements in both healthcare and manufacturing technologies.

Regulatory Frameworks

- In the U.S., the ANSI Z136 Series, developed by the American National Standards Institute, sets essential safety standards for laser use across various industries. Specifically, ANSI Z136.1 provides detailed guidelines on laser classifications, hazard assessments, and safe operational practices, helping organizations comply with best practices to mitigate risks and improve operational efficiency.

- In Europe, the Laser Directive (2006/42/EC) regulates the safety requirements for laser products within the European Union (EU). It establishes guidelines for the design, manufacturing, and market placement of laser devices, ensuring that they meet stringent safety standards to protect users.

- In Asia Pacific, Japan enforces strict regulations through its Industrial Safety and Health Law, which includes specific provisions for laser safety in manufacturing environments. Standards like JIS C 6802 define laser classifications and establish safety measures to safeguard workers and operators, ensuring compliance with high safety standards in industrial laser applications.

Competitive Landscape:

The laser processing industry is highly competitive, with leading players driving growth through strategic acquisitions and technological innovations. These companies are expanding their portfolios by investing in advanced laser systems and enhancing product offerings for applications in industries like automotive, aerospace, and healthcare.

Focused on R&D, they are exploring emerging technologies to maintain a competitive edge.

- In July 2024, Alcon completed its USD 81 million acquisition of BELKIN Vision, including USD 65 million in cash. This acquisition enhances Alcon's laser processing capabilities in glaucoma treatment by integrating BELKIN’s Direct Selective Laser Trabeculoplasty (DSLT) technology, strengthening its portfolio of laser-based solutions alongside implantable devices and pharmaceutical offerings.

List of Key Companies in Laser Processing Market:

- Coherent Corp

- IPG Photonics Corporation

- ALTEC Metalltechnik GmbH

- Universal Laser Systems, Inc

- Newport Corporation.

- AMADA CO., LTD.

- Bystronic Group

- Epilog Laser

- eurolaser GmbH

- Han's Laser Technology Industry Group Co., Ltd.

- TRUMPF

- Kent Lasers Ltd

- Mitsubishi Electric Corporation

- Trotec Laser GmbH.

- FOBA

Recent Developments (M&A/Product Launch)

- In July 2024, TRUMPF and SiMa.ai announced a strategic partnership to integrate AI technology into TRUMPF’s laser systems to enhance welding, cutting, marking, and 3D printing with advanced AI capabilities.

- In June 2023, Coherent showcased its latest advancements in deep copper welding, as published by the Society of Photo-Optical Instrumentation Engineers (SPIE). The company introduced a low-magnification upgrade to its "HIGHMOTION 2D" laser processing heads, enabling deep copper welds over 3 mm with minimal spatter. This innovation is particularly ideal for welding EV battery busbars and motor hairpin components.