Market Definition

The market involves the design, manufacturing, and commercialization of semiconductor laser diodes, which generate coherent light through electric current. These diodes are widely used in telecommunications, data storage, medical devices, consumer electronics, and industrial laser systems.

Laser Diode Market Overview

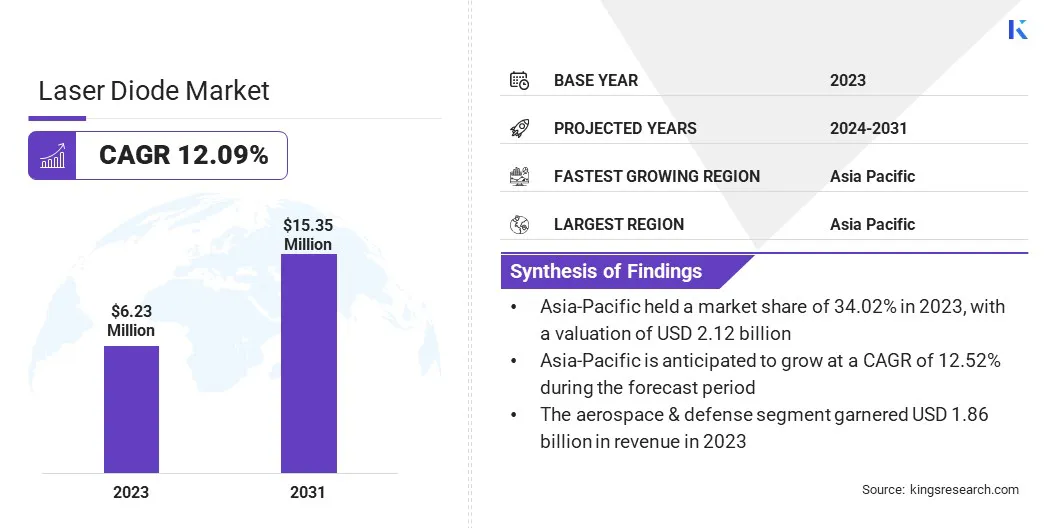

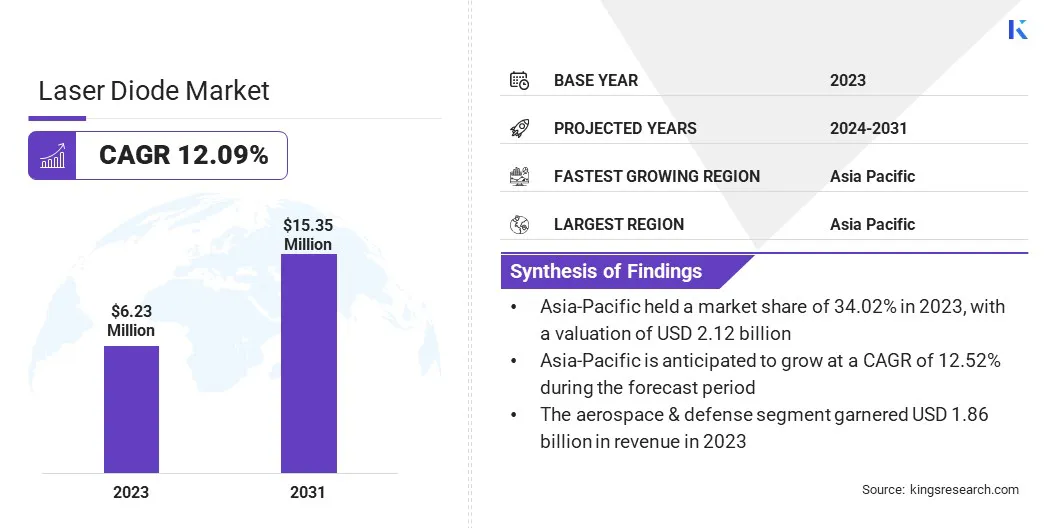

The global laser diode market size was valued at USD 6.23 billion in 2023 and is projected to grow from USD 6.90 billion in 2024 to USD 15.35 billion by 2031, exhibiting a CAGR of 12.09% during the forecast period. The increasing demand for high-speed internet, precision manufacturing, and advanced medical treatments is further fueling this growth.

Major companies operating in the laser diode industry are ams-OSRAM AG., Lumentum Operations LLC, JENOPTIK AG, Hamamatsu Photonics K.K, Thorlabs, Inc., ROHM Co., Ltd, Power Technology, Inc, BLUGLASS LIMITED, Sumitomo Electric Industries, Ltd., IPG Photonics Corporation, SHARP CORPORATION, Infineon Technologies AG, TRUMPF, MKS Instruments, and Coherent Corp.

Laser diodes are essential for fiber-optic communications, medical equipment, industrial material processing, and consumer electronics. The growing adoption of laser diodes in autonomous vehicles, defense systems, and 3D sensing technologies is further propelling market expansion.

- In November2024 , Laserline GmbH introduced the world’s first blue diode laser with a 6 kW continuous wave (CW) output power At Formnext 2024, setting a new benchmark in high-power laser technology. This innovation is designed for advanced industrial applications, particularly in copper processing, where high absorption of blue wavelengths significantly enhances efficiency and precision.

Key Highlights

- The laser diode industry size was recorded at USD 6.23 billion in 2023.

- The market is projected to grow at a CAGR of 12.09% from 2024 to 2031.

- Asia-Pacific held a share of 34.02% in 2023, valued at USD 2.12 billion.

- The indium gallium nitride (InGaN) segment garnered USD 1.67 billion in revenue in 2023.

- The ultraviolet segment is expected to reach USD 4.11 billion by 2031.

- The distributed feedback segment is anticipated to witness the fastest CAGR of 12.07% over the forecast period.

- The aerospace & defense segment garnered USD 1.86 billion in revenue in 2023.

- Europe is anticipated to grow at a CAGR of 12.11% through the frecast period.

Market Driver

Growing Demand for Fiber-Optic Communication

The rising demand for fiber-optic communication is fueling the progress of the laser diode market, supported by the rise of high-speed internet, 5G, and data centers. Laser diodes enable efficient, high-speed data transmission with minimal loss, making them essential for modern networks.

The risinf adoption of cloud computing, video streaming, and IoT applications is prompting significant investments in fiber-optic infrastructure, further boosting demand. The shift from copper to fiber-optic systems for enhanced bandwidth and reliability is accelerating this trend, reinforcing the critical role of laser diodes in communication networks..

- In January 2025, TOPTICA Photonics AG unveiled an ultra-low-noise 532 nm laser for high-precision applications in quantum technology, spectroscopy, and metrology. This advanced laser offers exceptional stability and performance, meeting the stringent requirements of cutting-edge scientific and industrial applications.

Market Challenge

Limited Lifespan and Heat Sensitivity

The laser diode market faces challenges due to limited lifespan and heat sensitivity, leading to material degradation, electrical stress, efficiency loss, and wavelength stability.

Inadequate thermal management, such as insufficient cooling or heat dissipation, accelerates wear and reduces operational life. Industries such as telecommunications, medical devices, and manufacturing must implement effective cooling and power regulation to ensure reliability.

To address this challenge, manufacturers focus on improving thermal management, material quality, and efficient power regulation. Advanced cooling solutions, such as heat sinks and active cooling systems, ensure heat dissipation and stable operation.

High-quality semiconductor materials enhance durability and reduce degradation. Optimized drive electronics and current regulation prevent overheating and diode stress. Additionally, continuous research in nanotechnology and packaging further improves efficiency and extends laser diode lifespan across applications.

Market Trend

Advancements in High-Power Laser Diodes

Advancements in high-power laser diodes are improving efficiency, compactness, and performance, making them more viable for industrial, medical, and defense applications. Innovations in materials and design are enabling higher power outputs while reducing heat generation and energy consumption, supporting the expansion of the market.

These improvements are replacing traditional bulky laser systems in precision cutting, welding, and medical treatments, while enhanced cooling and semiconductor technology extend lifespan and reliability.

- In June 2023, Coherent Corp introduced new 65W pump laser diodes, enhancing performance for fiber laser and solid-state laser applications. These features, along with the diode’s compatibility with existing submounts, enables cost-effective fiber laser design architectures.

Laser Diode Market Report Snapshot

|

Segmentation

|

Details

|

|

By Doping Material

|

Indium Gallium Nitride (InGaN), Gallium Nitride (GaN), Aluminum Gallium Indium Phosphide (AIGaInP), Gallium Arsenide (GaAs), Others

|

|

By Wavelength

|

Infrared, Visible, Quantum and Interband Cascade, Ultraviolet, Others

|

|

By Technology

|

Distributed Feedback, Double Hetero Structure, Quantum Dot Cascade, Vertical Cavity Surface Emitting Laser (VCSEL), Others

|

|

By Application

|

Aerospace & Defense, Automotive, Consumer Electronics, Industrial, IT & Telecommunications, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Doping Material (Indium Gallium Nitride (InGaN), Gallium Nitride (GaN), Aluminum Gallium Indium Phosphide (AIGaInP), Gallium Arsenide (GaAs), and Others): The indium gallium nitride (InGaN) segment earned USD 1.67 billion in 2023 due to its high efficiency, durability, and widespread use in displays, lighting, and optical storage.

- By Wavelength (Infrared, Visible, Quantum and Interband Cascade, Ultraviolet, and Others): The ultraviolet segment held a share of 26.78% in 2023, propelled by its growing use in sterilization, medical devices, and industrial applications.

- By Technology (Distributed Feedback, Double Hetero Structure, Quantum Dot Cascade, Vertical Cavity Surface Emitting Laser (VCSEL), and Others): The distributed feedback segment is projected to reach USD 4.19 billion by 2031, mainly fueled by its high precision, stability, and widespread use in telecommunications and fiber-optic communication.

- By Application (Aerospace & Defense, Automotive, Consumer Electronics, Industrial, IT & Telecommunications, and Others): The IT & telecommunications segment is anticipated to grow at a CAGR of 12.41% over the forecast period, aided by increasing demand for high-speed data transmission, 5G expansion, and fiber-optic network development.

Laser Diode Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific laser diode market share stood at around 34.02% in 2023, valued at USD 2.12 billion. This dominance is reinforced by a strong demand from industries such as telecommunications, consumer electronics, and automotive.

China, Japan, and South Korea dominate the market, characterized by strong semiconductor production, advancements in fiber-optic communication, and growing adoption of LiDAR technology. The regional market further benefits from increasing government investments in industrial automation and rising adoption of laser-based medical and defense technologies.

- In July 2024, the Press Information Bureau (PIB) of India reported that the Raman Research Institute (RRI) has licensed its precision laser system technology to nexAtom Research and Instruments, establishing its first spinoff company. This initiative focuses on developing multi-channel, tunable External Cavity Diode Lasers (ECDL) for quantum optics laboratories, with potential applications in medicine, geo-mapping, remote sensing and space.

- In January 2025, Nuvoton Technology Corporation Japan introduced the 1.7W 420nm Indigo Laser Diode, designed to enhance performance in industrial and consumer laser applications. With proprietary optical design and heat dissipation technology, it delivers high efficiency and long-term reliability while reducing operating costs for optical systems.

The Europe laser diode industry is projected to grow at a robust CAGR of 12.11% over the forecast period. This rapid growth is largely attributed to increasing demand in telecommunications, healthcare, and manufacturing, coupled with advancements in laser technology.

Additionally, increased adoption in optical storage, material processing, and medical applications fuels this expansion. Supportive government initiatives and industry investments further bolster regional market expansion.

- In June 2023, ams-OSRAM AG introduced a next-generation blue and green single-mode lasers, delivering enhanced efficiency and performance for projection, automotive lighting, and industrial sensing. The blue lasers offer 100 mW optical power, while the green lasers range from 10 mW to 50 mW.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) regulates laser products under the Radiation Control for Health and Safety Act, setting performance standards to ensure safety and minimize radiation risks.

- The Occupational Safety and Health Administration (OSHA) enforces Laser Hazard Standards to ensure workplace safety. These regulations establish exposure limits, control measures, and protective equipment requirements to minimize laser-related risks for workers.

- In India, the Raja Ramanna Centre for Advanced Technology (RRCAT) oversees the MRA on Measurement of Laser Power and Energy, ensuring accuracy and compliance with international standards.

- Health Canada enforces the Guidance for Laser Products to ensure public safety. This regulation sets requirements for laser product classification, labeling, and safety features to minimize radiation exposure risks.

- The Massachusetts Department of Public Health enforces 105 CMR 121 to regulate laser and optical fiber system safety, minimizing radiation hazards.

Competitive Landscape

The laser diode industry is evolving with continuous semiconductor innovations, enhancing efficiency, thermal management, and beam quality. Companies proritize application-specific designs and cost-effective production to maintain competitiveness.

The demand for energy-efficient and high-power laser solutions is shaping industry trends, while regulatory requirements, supply chain challenges, and pricing pressures influence market dynamics.

- In June 2023, Excelitas Technologies Corp launched the third-generation TPG3AD1S09, a 905 nm pulsed laser diode for LiDAR, rangefinding, and industrial sensing. This 225 μm SMD pulsed laser diode features a triple-cavity design, delivering 120 W output power for long-distance rangefinding and enhanced efficiency in short- to mid-range systems.

List of Key Companies in Laser Diode Market:

- ams-OSRAM AG.

- Lumentum Operations LLC

- JENOPTIK AG

- Hamamatsu Photonics K.K

- Thorlabs, Inc.

- ROHM Co., Ltd

- Power Technology, Inc

- BLUGLASS LIMITED

- Sumitomo Electric Industries, Ltd.

- IPG Photonics Corporation

- SHARP CORPORATION

- Infineon Technologies AG

- TRUMPF

- MKS Instruments

- Coherent Corp.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In March 2025, ams-OSRAM AG introduced a new high-efficiency blue laser diode PLPT9 450LC_E with a 455 nm wavelength, designed for industrial, medical, and display applications. It improves precision and reliability while improving energy efficiency.

- In September 2024, Laserline GmbH acquired a 70 percent stake in WBC Photonics, a U.S.-based company specializing in wavelength beam combining technology. This strategic acquisition enables the German diode laser manufacturer to enhance its portfolio with blue laser systems that offer superior beam quality of better than 4 mm mrad.

- In November 2023, NICHIA CORPORATION announced the in-house production of a high-power red laser diode (LD) chip, accelerating the commercialization of higher-efficiency, high-output products. The company is further expanding production capacity to meet growing demand.

- In January 2023, IPG Photonics Corporation introduced six high-power diode laser solutions designed for industrial drying and heating applications. These new diode laser sources offer output power from 3.5 kW to 40 kW, with industry-leading wall plug efficiencies exceeding 52%.

- In January 2023, KYOCERA SLD Laser, Inc. unveiled a new line of high-power blue laser diodes for industrial, biomedical, defense, and display applications. These lasers enhance optical system performance with greater efficiency, increased power output, and improved beam precision.