Laboratory Balances and Scales Market Size

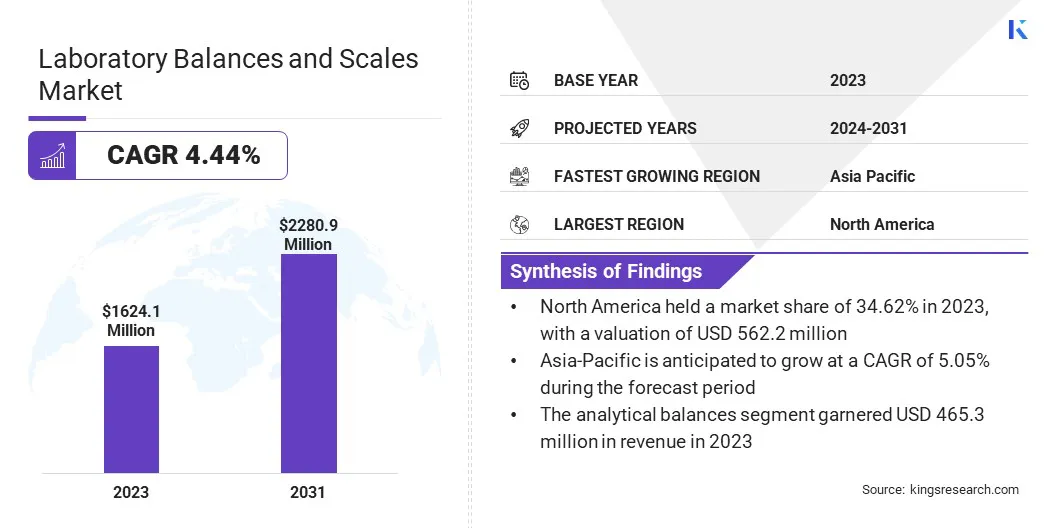

The global Laboratory Balances and Scales Market size was valued at USD 1624.1 million in 2023 and is projected to grow from USD 1683.4 million in 2024 to USD 2280.9 million by 2031, exhibiting a CAGR of 4.44% during the forecast period. The market is growing due to advancements in precision measurement technologies and increasing investments in laboratory infrastructure.

Rising healthcare expenditure and the expansion of research and development activities across emerging economies are further contributing to market growth. Additionally, the integration of smart technologies and the focus on sustainability, featuring eco-friendly and energy-efficient devices, are fostering innovation and adoption in the market.

In the scope of work, the report includes solutions offered by companies such as A&D Company, Ltd., Adam Equipment, Essae, KERN & SOHN GmbH, METTLER TOLEDO, PCE Instruments UK Ltd., RADWAG Balances and Scales, Sartorius AG, Shimadzu Corporation, Scientech Inc., and others.

The laboratory balances and scales market is experiencing robust growth, mainly propelled by increasing research activities across various fields such as pharmaceuticals, chemistry, materials science, and biotechnology. The need for precise measurement tools in these sectors is paramount, fueling the demand for advanced balances and scales.

Additionally, stringent quality control regulations across diverse industries such as food and beverage, pharmaceuticals, and electronics are stimulating market growth. The trend toward automation, data connectivity, and user-friendly features, such as automatic calibration and touch screen interfaces, is enhancing efficiency and data management in laboratories. These factors collectively contribute to the expanding market for laboratory balances and scales.

- For instance, in June 2024, Adam Equipment launched the Luna LBL large pan precision balance, further enhancing its Luna line. Expanding beyond the analytical LAB and precision LTB/LBB/LPB models, the Luna LBL set a new standard in precision weighing. With innovative features and a robust design, it offers superior accuracy and convenience due to its advanced load cell and processing capabilities.

Laboratory balances and scales are essential precision instruments used in scientific research and industrial applications to measure the weight or mass of samples with exceptional accuracy. They are critical for ensuring precise quantitative analysis across various fields, including pharmaceuticals, chemistry, and materials science.

These instruments range from analytical balances, which provide high sensitivity and precision for small samples, to precision balances and microbalances designed for specific measurement needs. Laboratory balances and scales are indispensable tools for weighing reagents, compounds, and other materials, thereby ensuring the reliability and consistency of experimental and production outcomes. Their accuracy and reliability make them fundamental in achieving precise measurement results.

Analyst’s Review

The increasing focus on environmental monitoring and regulatory compliance for greenhouse gas emissions is bolstering the demand for advanced analytical instruments.

- For instance, in July 2024, Shimadzu Corporation launched a new greenhouse gas analyzer, a specialized gas chromatograph (GC) designed for measuring climate-related gases. This advanced instrument is capable of simultaneously detecting carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O), which collectively account for 95% of greenhouse gases. Developed with a patent from the National Agriculture and Food Research Organization (NARO), Shimadzu's analyzer provides precise and efficient analytical data for a range of applications, including agricultural greenhouse gas measurements.

These developments enhance measurement capabilities and address critical needs across various industries, such as environmental monitoring, pharmaceuticals, and biotechnology. The introduction of new technologies improves precision in detecting and quantifying emissions, thereby meeting stringent regulatory requirements and boosting demand. These innovations expand application possibilities, set higher industry standards, and contribute to market growth.

Laboratory Balances and Scales Market Growth Factors

The growth of research activities across fields such as pharmaceuticals, chemistry, materials science, and biotechnology is aiding the expansion of the laboratory balances and scales market. As these sectors expand, the need for precise measurement tools becomes more critical, leading to increased demand for advanced laboratory balances and scales. Accurate measurement is essential for ensuring the reliability and reproducibility of research outcomes and product formulations.

Moreover, laboratories are actively investing in high-quality balances and scales to meet their precision needs. This rising demand for precision measurement tools is bolstering market progress, as companies develop and supply advanced solutions to support the expanding research and development activities across these industries.

A significant challenge hindering market development is the high cost associated with advanced laboratory balances and scales, limiting accessibility for smaller laboratories and research facilities with constrained budgets. The expense of these precision instruments is acting as a barrier to widespread adoption, particularly in developing regions. To mitigate this challenge, key players are developing cost-effective models and offering financing options or leasing programs.

Additionally, they are investing in research and development to improve manufacturing efficiency, thereby reducing production costs and passing those savings on to customers. These strategies are helping to make advanced laboratory balances and scales more accessible and affordable, thereby supporting market growth.

Laboratory Balances and Scales Market Trends

The increasingly stringent quality control regulations in industries such as pharmaceuticals, food and beverage, and electronics are aiding the growth of the market. Compliance with these rigorous standards requires precise and reliable measurement of materials to ensure product safety, efficacy, and consistency.

This necessity creates a demand for advanced laboratory balances and scales, which offer the high precision and accuracy needed to meet these regulatory requirements. As companies strive to adhere to these quality standards, they invest more in sophisticated measurement tools, thereby fueling market expansion.

The laboratory balances and scales market is witnessing a notable trend toward automation, data connectivity, and improved user-friendliness. Instruments equipped with features such as automatic calibration, data transfer capabilities, and touch screen interfaces are gaining immense popularity among laboratory professionals. These advanced features enhance operational efficiency by reducing manual intervention, minimizing errors, and streamlining workflows.

- For instance, in April 2024, Sartorius introduced the Quintix Pro laboratory balance, marking a major advancement in standard weighing technology. The balance, designed for modern laboratories, features a 7-inch, high-resolution touch display and an automated motorized leveling system. These innovations enhance usability, flexibility, and accuracy, setting a new benchmark in laboratory weighing technology.

Automated calibration ensures consistent accuracy, while data transfer capabilities facilitate seamless integration with laboratory information management systems (LIMS), thereby improving data management and traceability. The inclusion of touch screen interfaces makes the instruments more user-friendly, thus reducing training time and increasing productivity. As laboratories seek to achieve higher efficiency and better data management, the demand for these technologically advanced balances and scales is increasing.

Segmentation Analysis

The global market is segmented based on product type, end-user, and geography.

By Product Type

Based on product type, the market is categorized into analytical balances, precision balances, microbalances, portable scales, moisture analyzers, and laboratory scale accessories. The analytical balances segment led the laboratory balances and scales market in 2023, reaching a valuation of USD 465.3 million.

Analytical balances are designed for tasks that demand exceptional accuracy, such as weighing small quantities of substances in pharmaceuticals, chemistry, and materials science. Their ability to deliver precise measurements enhances the reliability of experimental results and product formulations.

The increasing emphasis on research and development, coupled with stringent quality standards, is spurring the demand for these advanced balances. Furthermore, technological advancements, such as improved digital displays and enhanced calibration systems, continue to increase their appeal, thereby supporting segmental expansion.

By End-User

Based on end-user, the market is categorized into pharmaceutical and biotechnology companies, academic and research institutions, food and beverage industry, environmental testing laboratories, and chemical and petrochemical industry. The pharmaceutical and biotechnology companies segment captured the largest laboratory balances and scales market share of 35.02% in 2023.

These companies rely heavily on advanced laboratory balances and scales for tasks such as weighing compounds, formulating drugs, and conducting clinical trials. The increasing focus on drug development and personalized medicine creates the need for high-precision measurement tools to ensure the accuracy and consistency of results.

Additionally, stringent regulatory requirements concerning product quality and safety increase the demand for reliable laboratory equipment. As pharmaceutical and biotechnology companies expand their research and production capabilities, there is a pressing need for advanced balances and scales, which is bolstering the growth of the segment.

Laboratory Balances and Scales Market Regional Analysis

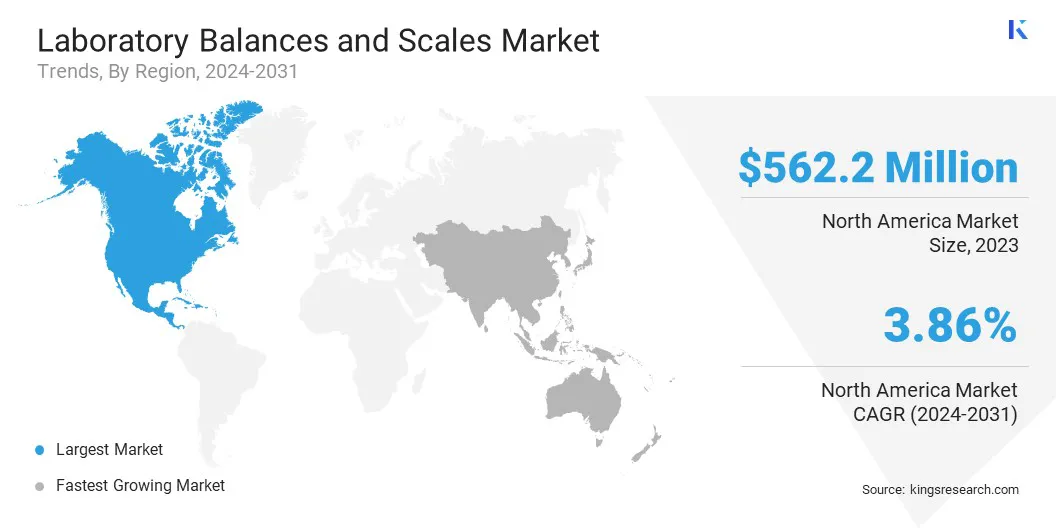

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America laboratory balances and scales market share stood around 34.62% in 2023 in the global market, with a valuation of USD 562.2 million. This notable growth is largely attributed to substantial investments in research and development across various industries, including pharmaceuticals, biotechnology, and healthcare.

The region’s advanced research infrastructure and stringent regulatory standards further propel regional market expansion, as precision measurement tools are essential for ensuring compliance and achieving high-quality outcomes. Additionally, the increasing adoption of automation and digital technologies in laboratories is enhancing operational efficiency and accuracy. The presence of key market players and ongoing technological innovations are further contributing to the expansion of the domestic market.

Asia-Pacific is anticipated to witness substantial growth at a CAGR of 5.05% over the forecast period, primarily due to the expanding research and development activities and rising investments in healthcare and biotechnology sectors. The region’s burgeoning pharmaceutical industry and increasing focus on quality control are leading to increased demand for precise measurement tools.

Additionally, the rapid development of research infrastructure and the rising adoption of advanced technologies, such as automation and digital solutions, are enhancing the efficiency and accuracy of laboratory operations. The growing emphasis on regulatory compliance and product innovation further supports regional market expansion.

Competitive Landscape

The global laboratory balances and scales market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Laboratory Balances and Scales Market

- A&D Company, Ltd.

- Adam Equipment

- Essae

- KERN & SOHN GmbH

- METTLER TOLEDO

- PCE Instruments UK Ltd.

- RADWAG Balances and Scales

- Sartorius AG

- Shimadzu Corporation

- Scientech Inc.

Key Industry Development

- March 2024 (Product launch): METTLER TOLEDO, headquartered in Switzerland, introduced its new Advanced and Standard Balance portfolio, which includes the MX, MR, MA, and LA lines. This release positioned the company at the forefront of laboratory weighing technology, emphasizing simplicity, performance, and robustness. The new balances offer enhanced resilience, superior measurement accuracy, and an improved user interface. Designed with smart features for a smoother, ergonomic, and sustainable weighing experience, METTLER TOLEDO reaffirmed its commitment to providing innovative solutions for laboratory professionals.

The global laboratory balances and scales market is segmented as:

By Product Type

- Analytical Balances

- Precision Balances

- Microbalances

- Portable Scales

- Moisture Analyzers

- Laboratory Scale Accessories

By End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Food and Beverage Industry

- Environmental Testing Laboratories

- Chemical and Petrochemical Industry

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America