Market Definition

The market encompasses instruments, consumables, software, and services that measure molecular or cellular interactions without the use of fluorescent, radioactive, or enzymatic labels.

It covers biophysical and biosensing platforms such as surface plasmon resonance (SPR and SPR-i), bio-layer interferometry (BLI), mass spectrometry based label-free quantitation, isothermal titration calorimetry (ITC), differential scanning calorimetry (DSC), quartz-crystal microbalance (QCM/QCM-D), resonant waveguide grating, and impedance-based live-cell analysis.

Primary applications include binding kinetics/affinity, epitope binning, mechanism-of-action studies, comparability for biologics/biosimilars, hit confirmation, lead optimization, endogenous receptor assays, and cell phenotypic screening in drug discovery and bioproduction QA.

Label Free Detection Market Overview

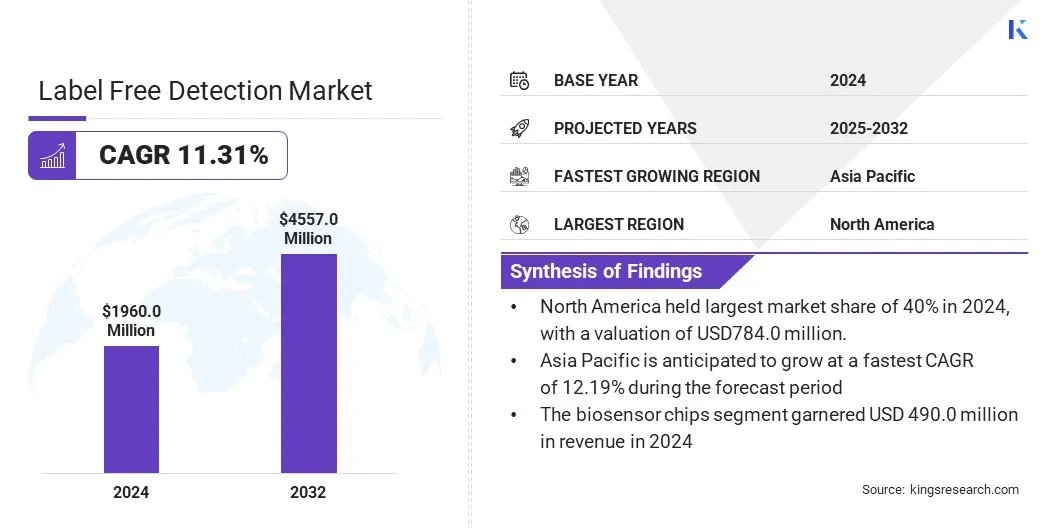

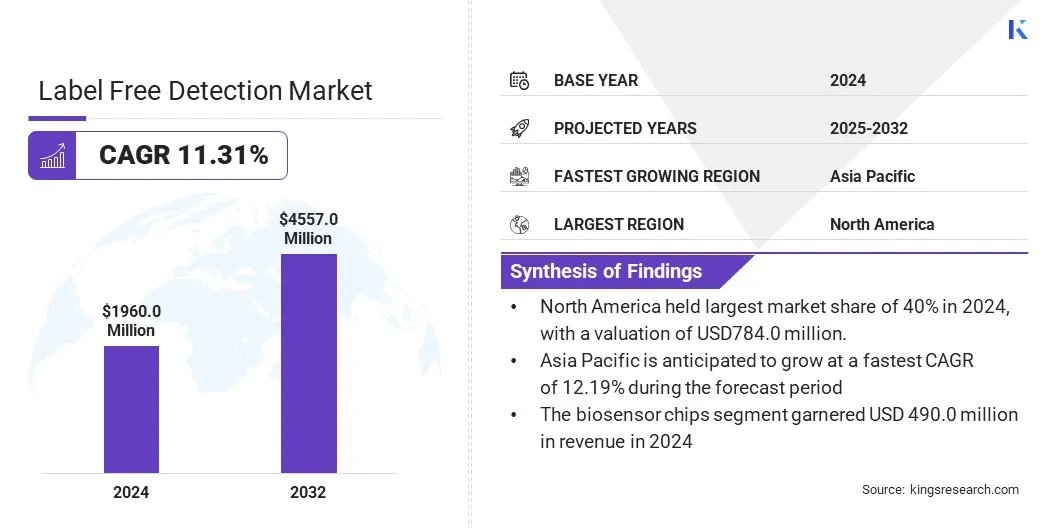

The global label free detection market size was valued at USD 1,960.0 million in 2024 and is projected to grow from USD 2,152.9 million in 2025 to USD 4,557.6 million by 2032, exhibiting a CAGR of 11.31% during the forecast period.

The market is experiencing notable expansion as biopharma pipelines are focusing oncomplex biologics and modalities that benefit from real-time kinetics and label-free cell readouts. This growth is further supported by high-throughput SPR/BLI systems for antibody discovery, automation-ready platforms, and integration with AI/ML data workflows.

Key Highlights

- The label free detection industry size was recorded at USD 1,960.0 million in 2024.

- The market is projected to grow at a CAGR of 11.31% from 2024 to 2032.

- North America held a share of 40% in 2024, valued at USD 784.0 million.

- The biosensor chips segment garnered USD 490.0 million in revenue in 2024.

- The surface plasmon resonance segment is expected to reach USD 1,697.6 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 12.19% over the forecast period.

Major companies operating in the label free detection market are Agilent Technologies, Inc., Biolin Scientific AB, BioNavis, Biosensing Instrument, Bruker, Carterra, Inc., Cytiva, HORIBA Scientific, NanoTemper Technologies, Nicoya Lifesciences Inc., Reichert, Inc., Sartorius AG, Spectris, Thermo Fisher Scientific Inc., and Waters Corporation.

Vendors are launching larger-format instruments, upgraded sensor chemistries, and software that shortens analysis times. These include next-gen high-throughput SPR (Surface Plasmon Resonance), expanded BLI (Biolayer Interferometry) product lines, and upgraded calorimetry for stability analytics, enabling faster candidate screening and better developability assessments across discovery to CMC (Chemistry, Manufacturing, and Controls).

Market Driver

Rising Demand for Real-Time Kinetic Analysis in Biologics Development

Growing reliance on real-time kinetic analysis is driving market growth in biologics and antibody discovery. Label-free techniques such as Surface Plasmon Resonance (SPR) and Biolayer Interferometry (BLI) are becoming essential for evaluating molecular interactions with high precision.

These technologies support critical functions such as affinity profiling and quality control, while high-throughput SPR platforms enable large-scale screening during discovery and development.

Improved sensor chemistries and advanced software are reducing analysis times, making candidate selection more efficient and less risky. By accelerating screening and improving accuracy, real-time kinetic analysis is strengthening decision-making across research and Chemistry, Manufacturing, and Controls (CMC) workflows.

- In January 2025, Carterra Inc. shipped its first Carterra Ultra biosensor platform. The new instrument, which used gold-standard Surface Plasmon Resonance (SPR) detection, enabled high-throughput screening for both small and large molecules. This technology allowed investigators to conduct molecular analysis at an industrial scale for a range of applications, including fragment-based lead discovery and protein-protein interactions.

Market Challenge

Regulatory and Validation Barriers

A significant challenge impeding the progress of the label free detection market is that many LFD systems are being marketed as “Research Use Only” (RUO). This restricts their deployment in regulated diagnostic applications and complicates the translation of validated research protocols into Good Manufacturing Practice (GMP) environments. Moreover, adoption in clinical workflows is slowed, and regulatory compliance and technology transfer become more complex.

To address this challenge, companies are establishing analytical validation protocols that align with ICH guidance and ensure compliance with RUO labeling. They are testing label-free methods to meet international drug testing rules, using approved materials for reliability, and implementing secure software that tracks all changes and maintains accurate records to meet regulatory standards.

Market Trend

Rising Adoption of Automated, High-Throughput LFD Systems

A trend influencing the label free detection market is the notable shift toward automated, high-throughput LFD systems with integrated analytics. Companies are launching advanced SPR platforms that can analyze thousands of molecular interactions, complemented by automation tools that streamline assay set up and analysis.

Additionally, existing BLI and SPR instruments are being upgraded to enhance performance. These technologies are adopted by academic and pharmaceutical labs to speed up key processes such as hit triage and epitope mapping, thereby shortening research and development timelines.

- In June 2025, Nicoya Lifesciences acquired British-based Applied Photophysics to enhance its biopharma technology offerings. The deal combined Nicoya’s Surface Plasmon Resonance (SPR) instruments with Applied's technologies, including circular dichroism (CD) and stopped-flow kinetics. This integration was intended to create a comprehensive platform for customers, providing data on protein function, structure, and stability from a single provider.

Label Free Detection Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Consumables, Biosensor Chips, Microplates, Instruments

|

|

By Technology

|

Mass Spectrometry, Surface Plasmon Resonance (SPR), Bio-Layer Interferometry, Isothermal Titration Calorimetry, Differential Scanning Calorimetry, Other LFD Technologies

|

|

By Application

|

Binding Kinetics, Binding Thermodynamics, Endogenous Receptor Detection, Hit Confirmation, Lead Generation, Other Applications

|

|

By End-User

|

Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Consumables, Biosensor Chips, Microplates, and Instruments): The consumables segment earned USD 882.0 million in 2024, due to recurring demand for biosensor chips, microplates, and assay reagents required for SPR/BLI and other label-free detection platforms. Demand is supported by higher assay throughput and an expanding installed instrument base.

- By Technology (Mass Spectrometry, Surface Plasmon Resonance (SPR), Bio-Layer Interferometry, Isothermal Titration Calorimetry, Differential Scanning Calorimetry, and Other LFD Technologies): The surface plasmon resonance (SPR) segment held a share of 35% in 2024, reflecting its role as the reference technique for real-time affinity/kinetics and epitope binning.

- By Application (Binding Kinetics, Binding Thermodynamics, Endogenous Receptor Detection, Hit Confirmation, Lead Generation, and Other Applications): The binding kinetics segment is projected to reach USD 1,400.3 million by 2032, owing to the broader use of kinetic ranking in antibody and biosimilar programs.

- By End-User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Contract Research Organizations): The pharmaceutical & biotechnology companies segment held a share of 55% in 2024, supported by continuous biologics pipelines and the internalization of high-throughput kinetics and comparability testing.

Label Free Detection Market Regional Analysis

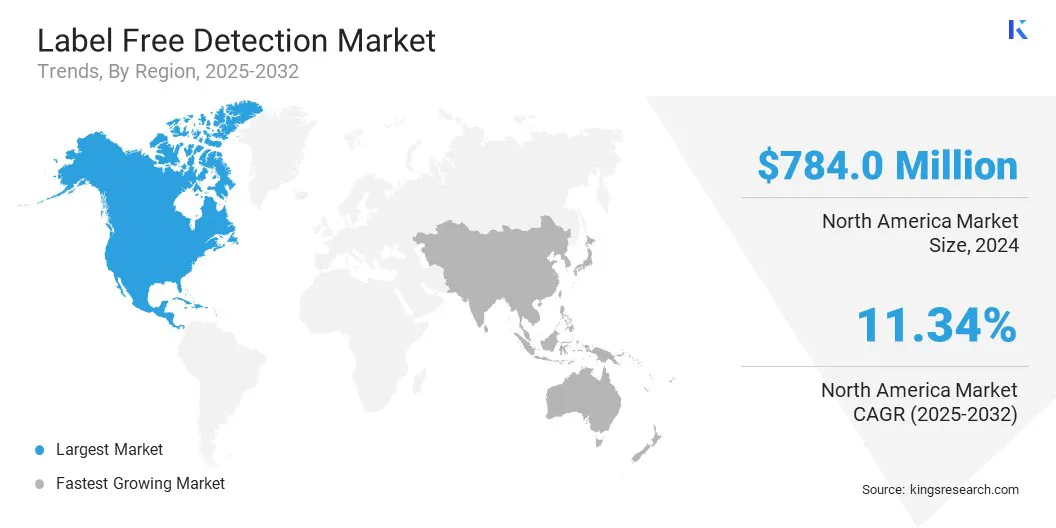

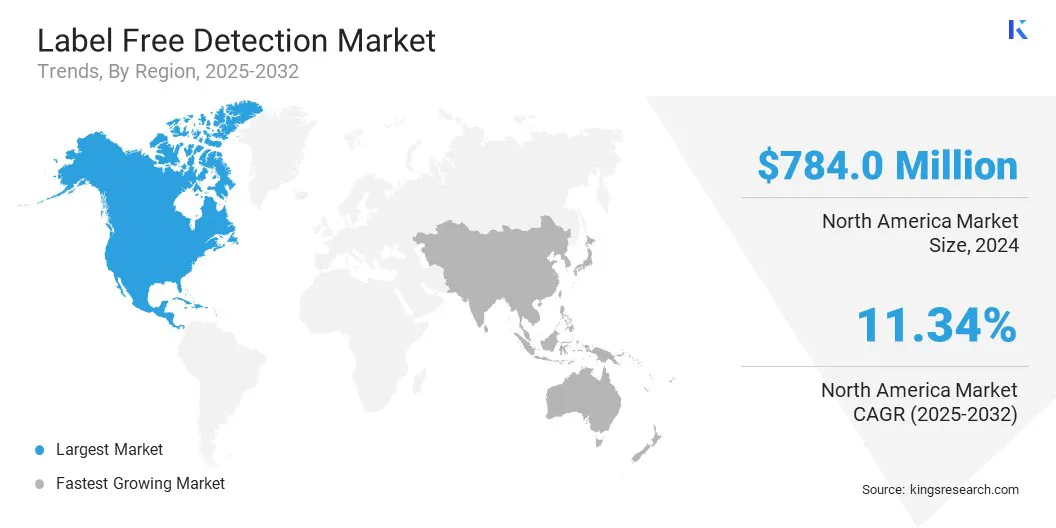

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America label free detection market share stood at 40% in 2024, valued at USD 784.0 million. This dominance is reinforced by strong support from university core labs, which continually invest in advanced scientific equipment. Additionally, the frequent launch of new LFD technologies and products at major scientific congresses accelerates adoption among researchers and industry professionals, boosting regional market growth and innovation.

- In September 2024, Vanderbilt University's Center for Structural Biology acquired a Carterra LSAXT platform to enhance the discovery and characterization of large molecules, including antibodies. The technology enables rapid screening and quantification of antibody binding. The initiative supports the university’s AI-driven protein research by providing high-throughput data for training predictive models.

The Asia-Pacific label free detection industry is estimated to grow at a robust CAGR of 12.19% over the forecast period. This expansion is fueled by the region's rapidly growing bioprocess infrastructure, with increasing adoption of LFD technologies by companies and research institutions.

This trend is further supported by vendors establishing local manufacturing and service operations, enhancing the accessibility of instruments and consumables and facilitating the implementation of new LFD workflows.

- In September 2024, Cytiva inaugurated its first Innovation Hub in Korea, located within the Songdo Bio-cluster in Incheon. The 6,100-square-meter facility features a manufacturing unit and a customer experience lab, supporting biopharmaceutical manufacturing in Korea and the wider Asia-Pacific region. The hub also incorporates sustainability measures such as energy and water efficiency, waste reduction, and lower carbon emissions.

Regulatory Frameworks

- In the U.S., the FDA (U.S. Food and Drug Administration) mandates proper “Research Use Only” labeling and restricts diagnostic claims for RUO instruments (21 CFR 809.10(c)(2)(i)). LFD methods intended for regulated use must meet applicable GMP/Part 11 requirements, and be validated according to ICH guidelines.

- In the EU, the In Vitro Diagnostic Regulation (EU) 2017/746 (IVDR) raises evidence requirements for performance and clinical validation when LFD platforms are used in IVD workflows. RUO instruments must not make diagnostic claims.

- In China, the NMPA (National Medical Products Administration) Regulations oversee IVDs under the Supervision and Administration of Medical Devices (Decree 739). LFD systems designed for clinical or IVD use must adhere to NMPA registration and quality system requirements.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) under the Ministry of Health, Labour and Welfare (MHLW) regulates IVD devices. Clinical use of LFD platforms requires proper device classification and pre-market review as per Japanese guidelines.

- In India, the Medical Device Rules, 2017, under the CDSCO, govern IVDs. RUO LFD tools must be labeled accordingly and must avoid clinical claims.

Competitive Landscape

The global label free detection industry is shaped by platform differentiation and workflow integration, as seen in innovations such as BioNavis’ Dextran-like sensor slides. Market players are advancing sensor chemistries to improve immobilization efficiency and sensitivity, scaling throughput for detailed kinetics and epitope binning, and embedding automation with integrated analysis tools.

Strategies include partnerships with core labs and CROs to drive adoption, expanding modality coverage to gene- and cell-therapy analytics, and localizing manufacturing to improve accessibility in growth regions.

- In June 2024, BioNavis launched their Dextran-like (BND) sensor slides, which demonstrate higher ligand binding capacity and reduced non-specific binding relative to conventional planar CMD-2D sensors.

Key Companies in Label Free Detection Market:

- Agilent Technologies, Inc.

- Biolin Scientific AB

- BioNavis

- Biosensing Instrument

- Bruker

- Carterra, Inc.

- Cytiva

- HORIBA Scientific

- NanoTemper Technologies

- Nicoya Lifesciences Inc.

- Reichert, Inc

- Sartorius AG

- Spectris

- Thermo Fisher Scientific Inc.

- Waters Corporation

Recent Developments (M&A/Investment/New Product Launch)

- In June 2025, Nicoya Lifesciences acquired UK-based company Applied Photophysics to broaden its technology portfolio. The deal integrated Nicoya’s Surface Plasmon Resonance (SPR) for binding analysis with Applied’s tools for protein structure and stability. The initiative aims to delivr a more comprehensive solution for biopharma customers , allowing Nicoya to expand its operations into Europe and grow its customer base.

- In June 2025, Cytiva announced a global expansion program valued at USD 1.6 million, extending through 2028, to enhance in-region manufacturing and service capacity, including in Asia. The initiative focuses on chromatography resins, filtration, single-use bags, and cell culture media. Major projects in Europe and Asia-Pacific have been completed, and a new resins site in Muskegon, U.S., is expected to be fully operational by 2028. The expansion aims to meet rising demand and improve delivery timelines.

- In May 2025, Sartorius introduced the Octet R8e biolayer interferometry system for real-time, label-free biomolecular interaction analysis. The system offers higher sensitivity for low molecular weight and low-abundance analytes, compatibility with 96- and 384-well plates for flexible assay design, and advanced evaporation control for extended runtimes. These capabilities are designed to facilitate high-throughput research in drug discovery, development, and quality control.