Market Definition

Joint replacement is a surgical procedure in which a damaged or worn-out joint is removed and replaced with an artificial implant to restore mobility and relieve pain. The market includes medical devices, surgical tools, and services supporting these procedures across various joints such as hips, knees, and shoulders.

It is widely used in orthopedics to treat arthritis, trauma injuries, and degenerative joint diseases, enhancing patient mobility and quality of life. This report outlines the primary drivers of the market, emerging trends, and evolving regulations shaping the market.

Joint Replacement Market Overview

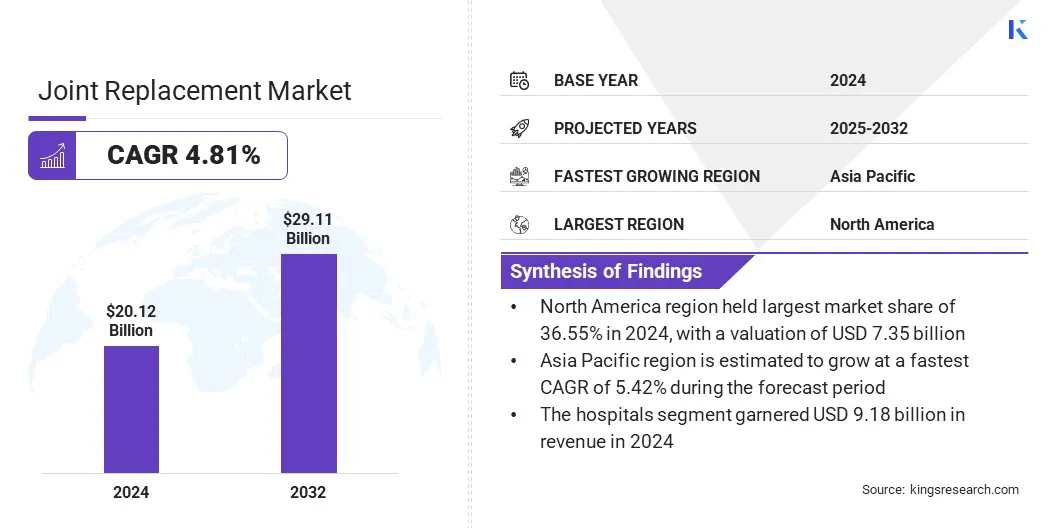

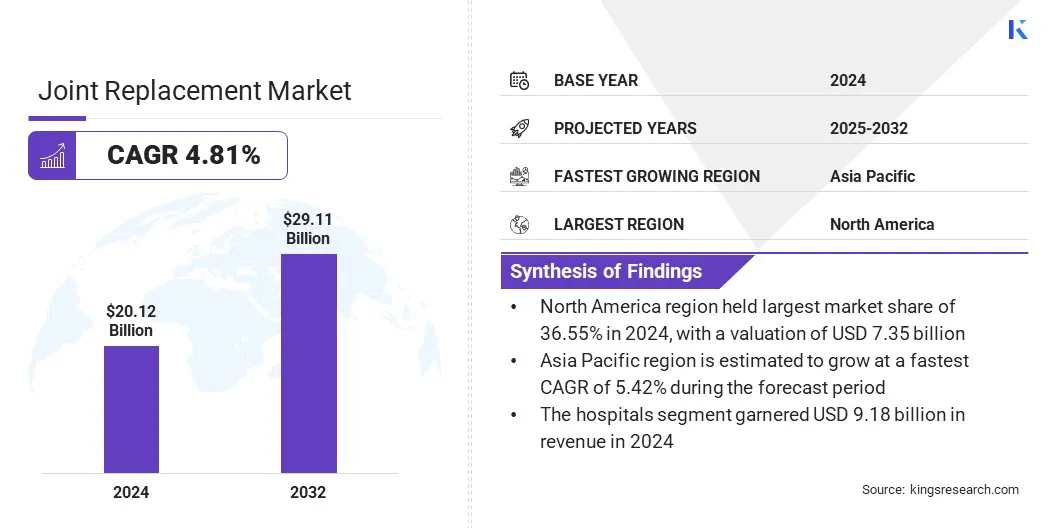

According to Kings Research, the global joint replacement market size was valued at USD 20.12 billion in 2024 and is projected to grow from USD 20.96 billion in 2025 to USD 29.11 billion by 2032, exhibiting a CAGR of 4.81% during the forecast period.

The market is fueled by the growing geriatric population and the rising incidence of degenerative joint conditions such as osteoarthritis. Additionally, the integration of robotic-assisted systems is boosting surgical accuracy, leading to better patient outcomes and promoting technology-led advancements in joint replacement procedures.

Key Market Highlights:

- The joint replacement industry size was valued at USD 20.12 billion in 2024.

- The market is projected to grow at a CAGR of 4.81% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 7.35 billion.

- The hip replacement segment garnered USD 7.69 billion in revenue in 2024.

- The revision joint replacement segment is expected to reach USD 11.46 billion by 2032.

- The cementless fixation segment is anticipated to register a CAGR of 5.80% during the forecast period.

- The traditional surgery segment is estimated to account for a market share of 42.34% by 2024.

- The hospitals segment held a market share of 39.88% in 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.42% during the forecast period.

Major companies operating in the market are Stryker, Johnson & Johnson Services, Inc., Zimmer Biomet, B. Braun SE, Globus Medical, Arthrex, Inc., Acumed LLC, Orthofix Medical Inc., MicroPort Scientific Corporation., CONMED Corporation, Medacta International, Paragon 28, Inc., Meril Life Science, Gruppo Bioimpianti s.r.l., and Corin Group.

The joint replacement market is driven by the increasing number of accidents that lead to severe joint injuries, requiring surgical intervention. Road traffic collisions, workplace incidents, and sports-related trauma contribute significantly to bone and joint damage, especially in hips, knees, and shoulders

The demand for joint replacement procedures grows as the global rate of accidents continues to rise, supporting market expansion. This surge in accident-related joint damage has created a consistent need for advanced, durable implant solutions and surgical treatments.

- The U.S. Department of Transportation’s National Highway Traffic Safety Administration in April 2025 highlighted early estimates showing 39,345 traffic fatalities in 2024, a 3.8% decline from 2023. Despite increased vehicle miles traveled, fatality rates fell to 1.20 per 100 million miles, the lowest since 2019, reflecting ongoing improvements but remaining above pre-pandemic averages.

Increasing Geriatric Population Globally

The joint replacement market is registering significant growth, due to the increasing geriatric population globally. Aging individuals are more prone to degenerative joint diseases such as osteoarthritis and rheumatoid arthritis, boosting the demand for joint replacement procedures.

Older adults often require hip, knee, and shoulder replacements to restore mobility and improve quality of life. This demographic shift places greater pressure on healthcare systems and drives innovations in surgical techniques, prosthetic materials, and post-operative care solutions across the market.

- In October 2024, the World Health Organization highlighted that the global population aged 60 and above will reach 2.1 billion by 2050, nearly doubling from 12% to 22%. Around 80% of these individuals will live in low- and middle-income countries. This rapid demographic shift demands significant enhancements in healthcare and social systems to meet ageing-related needs.

Risk of Post-surgical Complications

The joint replacement market faces a significant challenge in the form of post-surgical complications, including infection, implant loosening, blood clots, and joint stiffness. These complications can lead to revision surgeries, increased healthcare costs, and patient dissatisfaction, impacting the overall success and adoption of joint replacement procedures.

Companies are developing advanced implant materials with antibacterial coatings, enhancing sterilization techniques, and promoting minimally invasive surgical methods to reduce tissue damage. Additionally, innovations such as smart implants and remote monitoring tools help detect early signs of complications, enabling timely interventions and improving long-term patient outcomes.

Integration of Robotic-Assisted Systems

The joint replacement market is increasingly integrating robotic-assisted systems to improve surgical precision and patient outcomes. These systems utilize advanced imaging and real-time navigation to enable personalized surgical plans and optimal implant placement. By minimizing tissue damage and preserving bone, robotic assistance enhances recovery times and reduces complications.

Additionally, the growing adoption of surgeon-controlled robotics reflects a shift toward technology-driven procedures that offer greater accuracy, versatility across joint types, and improved overall efficiency in joint replacement surgeries.

- In January 2025, A J Hospital and Research Centre launched Smith+Nephew’s advanced robotic joint replacement system, enhancing surgical precision through 3D imaging and real-time navigation. This surgeon-controlled technology supports knee, partial knee, and hip replacements, enabling personalized surgery with optimal implant placement, bone preservation, minimal tissue damage, and faster patient recovery.

Joint Replacement Market Report Snapshot

|

Segmentation

|

Details

|

|

By Joint Type

|

Hip Replacement, Knee Replacement, Shoulder Replacement, Ankle Replacement, Others

|

|

By Procedure Type

|

Total Joint Replacement, Partial Joint Replacement, Revision Joint Replacement

|

|

By Fixation Type

|

Cemented Fixation, Cementless Fixation, Hybrid Fixation, Reverse Hybrid Fixation

|

|

By Technique

|

Traditional Surgery, Minimally Invasive Surgery, Computer-assisted Surgery

|

|

By End User

|

Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers (ASCs)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Joint Type (Hip Replacement, Knee Replacement, Shoulder Replacement, Ankle Replacement, and Others): The hip replacement segment earned USD 7.69 billion in 2024, owing to the increasing prevalence of osteoarthritis and the growing demand for advanced, long-lasting implant solutions.

- By Procedure Type (Total Joint Replacement, Partial Joint Replacement, and Revision Joint Replacement): The total joint replacement held 43.21% share of the market in 2024, on account of the widespread clinical adoption of joint replacement for managing severe joint damage and delivering long-term functional outcomes.

- By Fixation Type (Cemented Fixation, Cementless Fixation, Hybrid Fixation, and Reverse Hybrid Fixation): The cemented fixation segment is projected to reach USD 11.38 billion by 2032, as a result of its proven reliability, cost-effectiveness, and higher adoption in elderly patients with low bone density.

- By Technique (Traditional Surgery, Minimally Invasive Surgery, and Computer-assisted Surgery): The computer-assisted surgery segment is anticipated to grow at a CAGR of 6.51%, due to its ability to enhance surgical precision, reduce errors, and improve post-operative outcomes.

- By End User (Hospitals, Orthopedic Clinics, and Ambulatory Surgical Centers (ASCs)): The hospitals monitoring segment held a market share of 39.88% in 2032, due to the availability of advanced surgical infrastructure, skilled professionals, and comprehensive post-operative care facilities.

Joint Replacement Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a joint replacement market share of around 36.55% in 2024, with a valuation of USD 7.35 billion. North America dominates the market, due to its high procedural volume, driven by the widespread adoption of hip and knee arthroplasty across a large network of healthcare institutions.

The consistent year-over-year growth in surgeries reflects the region’s advanced healthcare infrastructure, robust data collection systems, and emphasis on outcome-based care, which collectively support continuous improvement in clinical practices and increased demand for joint replacement solutions, reinforcing its leadership in the global orthopedic landscape.

- In November 2024, the American Academy of Orthopaedic Surgeons reported that the American Joint Replacement Registry exceeded 4 million hip and knee arthroplasty procedures. The 2024 report analyzes over 3.7 million procedures from 1,447 institutions across the U.S., reflecting an 18% year-over-year increase in procedure volume from 2012 to 2023.

The joint replacement industry in Asia Pacific is poised for significant growth at a CAGR of 5.42% over the forecast period. This is attributed to increasing accessibility to advanced technologies, such as robotic-assisted surgical systems, which are enhancing procedural accuracy and outcomes.

Additionally, strategic collaborations enabling local manufacturing and distribution of globally recognized implants are expanding product availability and affordability across the region, thereby improving patient access and supporting the broader adoption of joint replacement procedures. These factors collectively contribute to the region’s evolving orthopedic landscape and rising procedural volumes.

- In August 2024, Alkem MedTech Pvt Ltd entered a design and technology transfer agreement with Exactech Inc. This partnership enables Alkem MedTech to manufacture and market Exactech’s large joint replacement products in India, leveraging Exactech’s design expertise and brand portfolio, including Truliant, Optetrak Logic, and Alteon, marking a first in India’s musculoskeletal sector.

Regulatory Frameworks

- In the U.S., joint replacement devices are regulated by the FDA’s Center for Devices and Radiological Health (CDRH), which is responsible for approving and monitoring orthopedic implants such as hip, knee, and shoulder replacements to ensure their safety and effectiveness.

- In India, joint replacement devices are regulated by the Central Drugs Standard Control Organization (CDSCO) under the Ministry of Health and Family Welfare. CDSCO oversees the approval, safety, and quality standards of medical devices, including orthopedic implants like hip, knee, and shoulder replacements.

Competitive Landscape

Key players in the joint replacement industry are actively employing strategies such as mergers and acquisitions, strategic partnerships, and product launches to strengthen their market position. Companies are acquiring regional and specialized firms to expand their product portfolios and geographic reach.

Simultaneously, they are introducing innovative implant technologies and surgical solutions to address evolving clinical needs. These strategic initiatives enable firms to enhance operational capabilities, broaden customer bases, and increase competitiveness within the dynamic market.

- In December 2023, Stryker announced a binding offer to Menix to acquire SERF SAS, renowned globally for innovations in hip implants, including the original Dual Mobility Cup. This acquisition will enhance Stryker’s footprint in France and Europe, strengthen its global joint replacement portfolio, and enable it to serve a broader patient population.

Key Companies in Joint Replacement Market:

- Stryker

- Johnson & Johnson Services, Inc.

- Zimmer Biomet

- Braun SE

- Globus Medical

- Arthrex, Inc.

- Acumed LLC

- Orthofix Medical Inc.

- MicroPort Scientific Corporation.

- CONMED Corporation

- Medacta International

- Paragon 28, Inc.

- Meril Life Science

- Gruppo Bioimpianti s.r.l.

- Corin Group

Recent Developments (Partnerships/ Product Launches)

- In October 2023, Johnson & Johnson MedTech announced that DePuy Synthes received FDA 510(k) clearance for its TriLEAP Lower Extremity Anatomic Plating System. Designed for orthopedic and foot specialists, this modular system offers versatile plates and instruments to support complex bone fixation procedures, enhancing surgical options related to joint replacement and reconstruction in lower extremities.

- In April 2023, OrthoAlliance expanded its presence by partnering with the Midwest Center for Joint Replacement (MCJR) in Central Indiana. This collaboration enhances MCJR’s joint replacement services, including total and partial knee and hip replacements, by integrating OrthoAlliance’s administrative expertise in billing, marketing, and support. This enables physicians to focus on patient care while expanding access to specialized orthopedic surgical solutions.