IoT Managed Services Market Snapshot

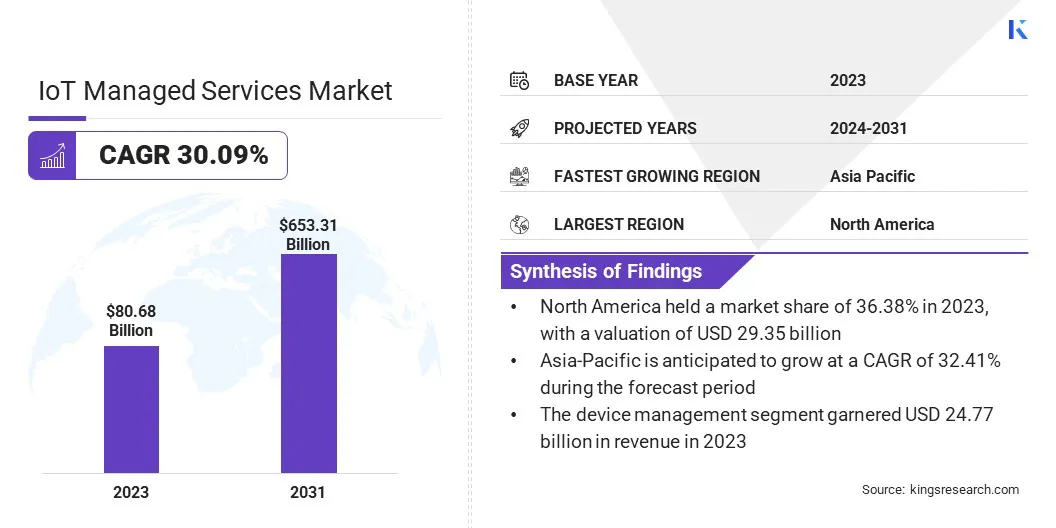

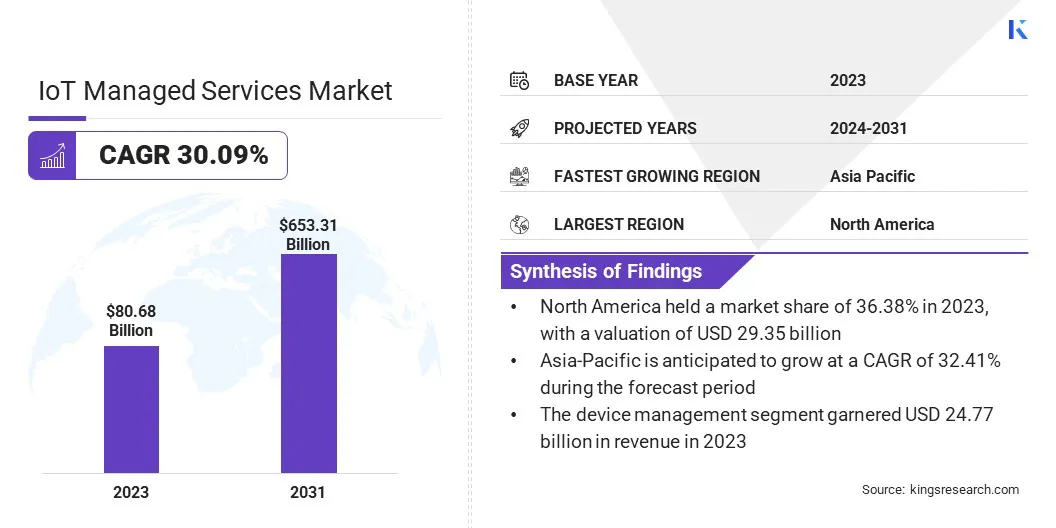

The global IoT Managed Services Market size was valued at USD 80.68 billion in 2023 and is projected to grow from USD 103.60 billion in 2024 to USD 653.31 billion by 2031, exhibiting a CAGR of 30.09% during the forecast period.

The growth of the market is driven by the increasing adoption of IoT solutions across diverse industries, the rising need for expert management of complex IoT ecosystems, and ongoing advancements in AI, machine learning, and edge computing technologies.

Key Market Highlights:

- Market Value (2023): USD 80.68 Billion.

- Forecasted Value (2031): USD 653.31 Billion.

- CAGR (2024-2031): 30.09%.

- Fastest Growing Region: Asia-Pacific is poised to experience a substantial growth at a CAGR of 32.41% through the projection period.

- Largest Region: The North America market held a significant share of around 36.38% in 2023, with a valuation of USD 29.35 billion.

- The manufacturing segment secured the largest market share of 25.06% in 2023.

- The SMEs segment is estimated to experience significant growth at a robust CAGR of 31.05% through the forecast period (2024-2031).

- The device management segment led the market in 2023, reaching a valuation of USD 24.77 billion.

Key Companies in IoT Managed Services Market

- Cognizant

- Deutsche Telekom IoT GmbH.

- Huawei Cloud Computing Technologies Co., Ltd.

- Infosys Limited

- Tietoevry

- Wipro

- AT&T Intellectual Property.

- HCL Technologies Limited

- IBM

- TATA Consultancy Services Limited

IoT Managed Services Market Overview

The expansion of the IoT managed services market is primarily fueled by the growing demand for efficient management of connected devices and networks. As businesses increasingly adopt IoT solutions, the need for expert management services to handle complex networks, ensure security, and optimize performance becomes paramount.

Additionally, the proliferation of IoT-enabled devices across various industries, such as healthcare, manufacturing, and transportation, fuels market growth.

- For Instance, in August 2023, Schneider Electric launched EcoStruxure for Healthcare, an IoT-based solution designed to enhance the resilience of India's healthcare sector. This system aimed to ensure reliable power supply to hospitals and supported the Ayushman Bharat Mission’s goals of expanding primary health centers. EcoStruxure provided seamless digital management of hospital assets, offering real-time operational insights and supporting continuous operations even in remote areas.

Companies seek to leverage IoT managed services to streamline operations, enhance decision-making processes, and gain a competitive edge in the market. Moreover, the rising concerns regarding data privacy and cybersecurity propel the demand for comprehensive managed services to safeguard IoT ecosystems.

The IoT managed services market is witnessing rapid expansion globally, spurred by the proliferation of connected devices and the growing complexity of IoT deployments. The increasing adoption of IoT across diverse industries has resulted in businesses seeking reliable solutions to effectively manage their connected ecosystems.

IoT managed services encompass a range of offerings, including device management, network monitoring, data analytics, and security services.

These services help organizations optimize performance, mitigate risks, and extract actionable insights from IoT data. Moreover, the evolution of cloud computing and advancements in connectivity technologies further bolster market growth, enabling seamless integration and management of IoT devices and applications.

The market encompasses the provision of comprehensive solutions and support services for the effective management of IoT deployments. It includes a wide array of services such as device management, connectivity management, data analytics, security, and support services.

Organizations leverage IoT managed services to overcome the complexities associated with deploying and maintaining IoT infrastructure, thereby ensuring optimal performance, reliability, and security. These services enable businesses to focus on their core activities while entrusting the management of IoT ecosystems to experienced service providers.

IoT managed services play a crucial role in enhancing operational efficiency, driving innovation, and facilitating digital transformation across various industries, including healthcare, manufacturing, retail, and transportation.

Analyst’s Review

The market is experiencing substantial growth, mainly due to key efforts from manufacturers to innovate and expand their offerings.

Leading companies are continuously investing in advanced technologies, including AI and edge computing, to enhance service capabilities and address complex IoT ecosystem challenges. Newly introduced products are emphasizing robust security, seamless device management, and efficient data analytics to cater to diverse industry needs.

-

For Instance, in July 2024, Rakuten Symphony announced the full-scale commercial launch of its new product "Rakuten NEO.” It is an AI-based IoT solution for automating space management in Japan. The solution aimed to improve efficiency for unmanned businesses and transition staffed businesses to unmanned operations. It enhanced space management, provided remote support for various systems, and reduced operational costs. Developed in partnership with South Korean startup Alicorn, Rakuten NEO was set to expand globally following its initial success in South Korea.

Businesses in the market prioritize partnering with experienced IoT managed service providers to leverage these advanced solutions. Additionally, companies focus on ensuring interoperability and adopting standardized protocols to maximize the benefits of their IoT investments, streamline operations, and gain competitive advantage in a rapidly evolving market.

IoT Managed Services Market Growth Factors

The increasing adoption of IoT solutions across diverse industry verticals is a significant factor propelling the growth of the IoT managed services market. Companies are continuously integrating IoT technology into their operations to improve efficiency, enhance decision-making, and optimize resource utilization.

This creates a growing demand for expert management services to handle the complexity of IoT ecosystems, thereby ensuring seamless connectivity, data management, and security.

Moreover, as businesses are striving to stay competitive in the digital age, they are outsourcing IoT management to specialized service providers, enabling them to focus on core business activities while leveraging the expertise of managed service providers.

The complexity of managing diverse IoT devices and platforms, leading to interoperability issues and integration issues, presents a key challenge to market development. To overcome this challenge, industry players are increasingly investing in interoperable solutions and standardized protocols that facilitate seamless connectivity and data exchange between different IoT devices and platforms.

Additionally, the development of robust IoT management platforms and middleware solutions helps streamline device management, data integration, and application development processes.

Furthermore, collaboration among industry stakeholders to establish common standards and frameworks for IoT interoperability significantly mitigates integration challenges and boosts the adoption of IoT managed services.

IoT Managed Services Market Trends

The increasing use of artificial intelligence (AI) and machine learning (ML) for predictive maintenance and analytics is emerging as a major trend reshaping the market landscape. Companies are utilizing AI and ML algorithms to analyze data obtained from connected devices, predict potential failures, and perform maintenance before issues arise.

This proactive approach minimizes downtime, reduces maintenance costs, and enhances operational efficiency. The integration of AI and ML into IoT managed services further enables accurate data analysis, providing valuable insights to facilitate decision-making and optimize overall performance. Due to this, the adoption of AI-driven IoT solutions is rapidly gaining traction across various industries.

Another significant trend in the IoT managed services market is the growing emphasis on edge computing. Businesses are increasingly deploying edge computing solutions to process data closer to the source, thereby reducing latency and improving real-time decision-making capabilities.

This trend is further fueled by the growing need for faster data processing and lower bandwidth costs, especially in applications that require immediate response times, such as autonomous vehicles and industrial automation.

Edge computing enhances the efficiency and reliability of IoT deployments by enabling local data processing and analytics. Moreover, the adoption of edge computing in IoT managed services is transforming the management and utilization of data in various sectors.

Segmentation Analysis

The global market is segmented based on services, organization size, end-users, and geography.

By Services

Based on services, the market is categorized into network management, security management, device management, data management, and others. The device management segment led the IoT managed services market in 2023, reaching a valuation of USD 24.77 billion.

This notable growth is largely attributable to the rising adoption of IoT devices across various industries. Businesses are increasingly deploying a vast number of connected devices to streamline operations and enhance productivity.

Efficient management of these devices, including provisioning, monitoring, and maintenance, is essential to ensure optimal performance and security. Additionally, advancements in device management solutions that offer real-time monitoring and automated maintenance are contributing significantly to the growth of the segment.

By Organization Size

Based on organization size, the market is classified into SMEs and large enterprises. The SMEs segment is estimated to experience significant growth at a robust CAGR of 31.05% through the forecast period (2024-2031). This considerable growth is aided by the increasing awareness regarding IoT's potential to enhance operational efficiency and competitiveness.

Small and medium-sized enterprises are recognizing the benefits of adopting IoT solutions to optimize processes, reduce costs, and improve customer experiences. With limited in-house expertise and resources, SMEs are increasingly turning to managed service providers to handle the complexities of IoT implementation and management, which is boosting its adoption.

By End-Users

Based on end-users, the market is segmented into manufacturing, healthcare, energy and utilities, transportation and logistics, retail, and others. The manufacturing segment secured the largest market share of 25.06% in 2023, mainly attributed to the sector's extensive adoption of IoT technologies to improve production processes and operational efficiency.

Manufacturers are leveraging IoT solutions for predictive maintenance, asset tracking, and supply chain optimization. The ability to monitor and analyze data from connected devices in real-time enhances decision-making and reduces downtime, leading to cost savings and increased productivity.

As the manufacturing industry continues to adopt digital transformation, the demand for managed services to support and manage IoT ecosystems is expected to grow.

IoT Managed Services Market Regional Analysis

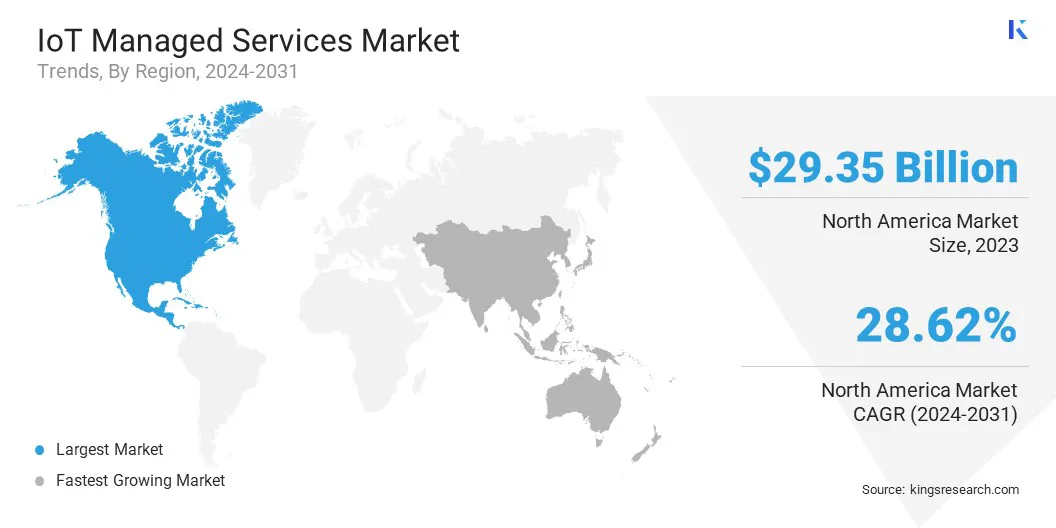

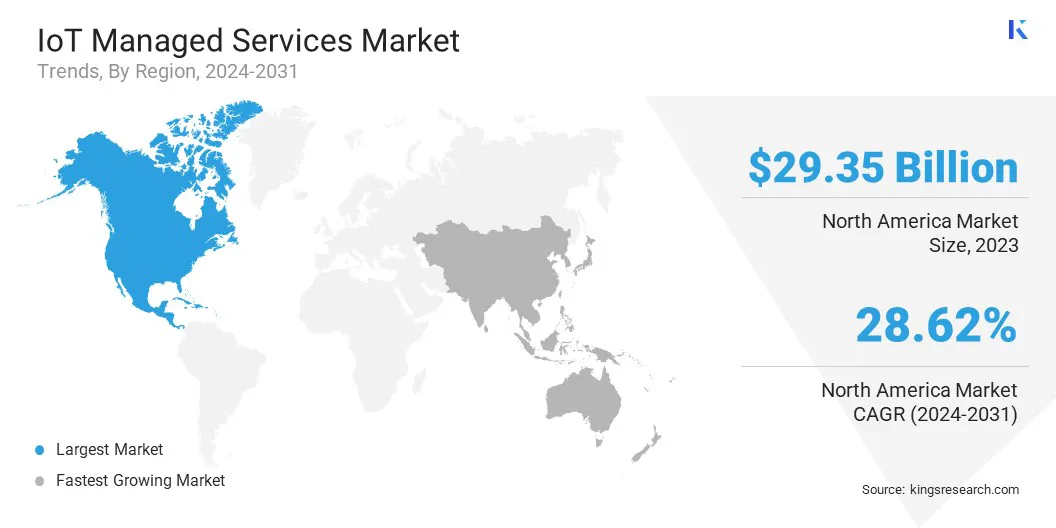

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America IoT managed services market held a significant share of around 36.38% in 2023, with a valuation of USD 29.35 billion. This dominance is attributed to the region's advanced technological infrastructure, high adoption rate of IoT solutions, and strong presence of leading IoT service providers. Businesses in North America are increasingly integrating IoT technologies to enhance operational efficiency and foster innovation.

Additionally, supportive government initiatives and significant investments in IoT research and development are propelling market growth. The region's mature market landscape and robust demand for advanced IoT managed services contribute to its leading position in the global market.

Asia-Pacific is poised to experience a substantial growth at a CAGR of 32.41% through the projection period. This rapid expansion is augmented by increasing digital transformation initiatives across various industries, rising investments in IoT infrastructure, and growing awareness regarding IoT benefits among businesses.

Countries such as China, India, and Japan are leading the adoption of IoT technologies to boost productivity and enhance operational efficiencies. Additionally, government policies that support smart city projects and industrial automation are fueling the demand for IoT managed services.

The region's dynamic economic growth and technological advancements are key factors propelling its fast-paced market expansion.

Competitive Landscape

The IoT managed services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

Key Industry Developments

- March 2024 (Partnership): XL Axiata partnered with Cisco to launch a cloud-based IoT connectivity management platform in Indonesia, aimed at helping customers securely innovate and scale their IoT businesses. This platform, named IoT Connectivity+, offers AI-powered anomaly detection, enterprise-grade security, and cost management features, effectively addressing the complexity of managing diverse IoT endpoints and improving service reliability. Furthermore, this platform is anticipated to support Indonesia's projected growth in IoT connections, which is expected to reach 404 million by 2028.

- November 2023 (Launch): IIJ and Murata announced the launch of the Crossborder Co-DataBiz IoT data service platform, combining their expertise in networking, sensing, and data analytics. This platform was developed to provide a comprehensive solution for setting up and operating cross-border data collection and analysis, including sensor devices, cloud infrastructure, networks, and security systems. The platform complies with local regulations in Southeast Asia and offers customization options for operational data management.

The global IoT managed services market is segmented as:

By Services

- Network Management

- Security Management

- Device Management

- Data Management

- Others

By Organization Size

By End-Users

- Manufacturing

- Healthcare

- Energy and Utilities

- Transportation and Logistics

- Retail

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America