IoT Chip Market Overview

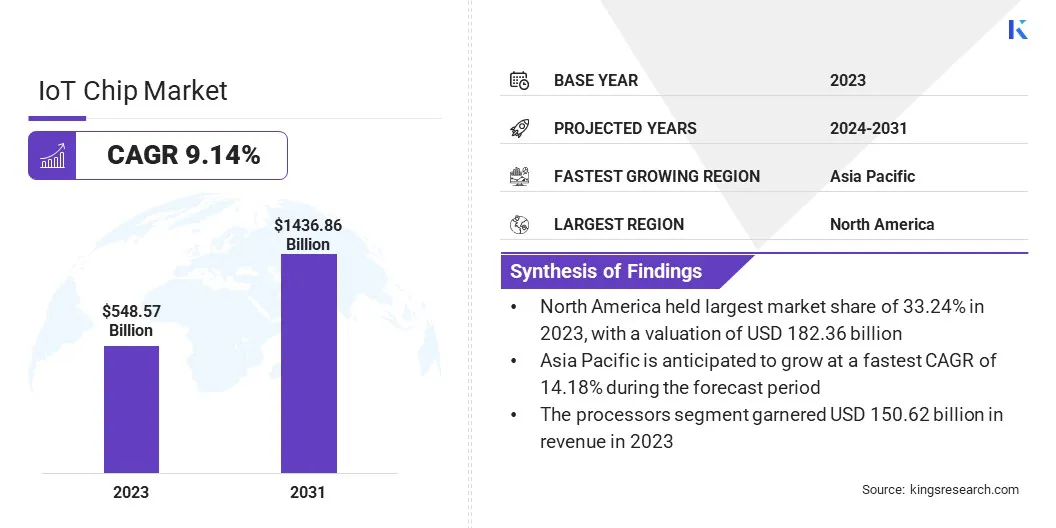

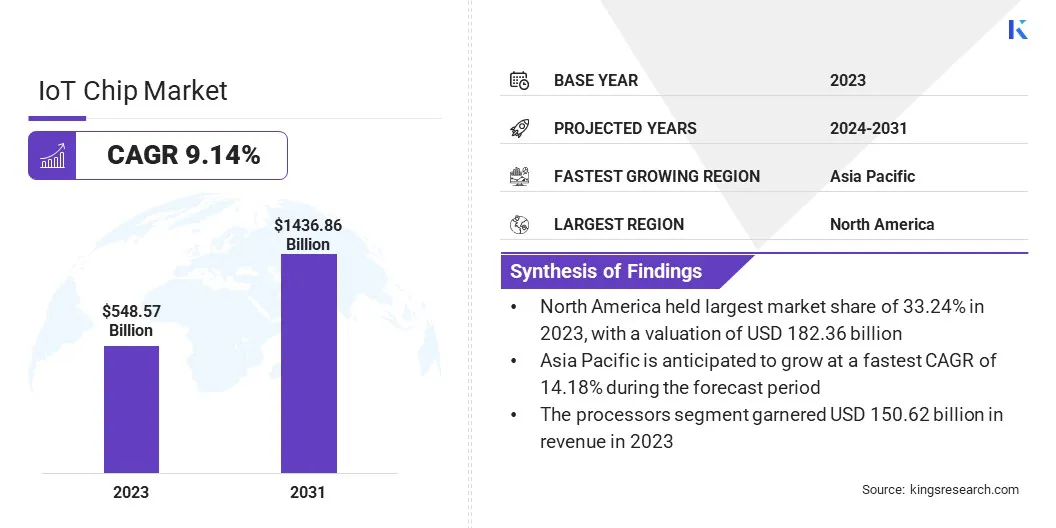

According to Kings Research, the global IoT chip market size was valued at USD 548.57 billion in 2023 and is projected to grow from USD 605.95 billion in 2024 to USD 1436.86 billion by 2031, exhibiting a CAGR of 13.13% during the forecast period.

Market growth is driven by the growing integration of connected systems across sectors, enhancing operational visibility and automation. Additionally, the rapid expansion of smart consumer electronics ecosystems is increasing demand for compact, energy-efficient chips that support real-time data processing and connectivity.

Major companies operating in the IoT chip ndustry are Qualcomm Incorporated, NXP Semiconductors, Unisoc (Shanghai) Technologies Co., Espressif Systems, Semtech Corporation, Taiwan Semiconductor Manufacturing Company, Intel Corporation, MediaTek Inc., Texas Instruments Incorporated, STMicroelectronics N.V., Microchip Technology Inc., Analog Devices, Inc., Infineon Technologies AG, Broadcom, and Samsung.

Key Market Highlights:

- The IoT chip industry size was recorded at USD 548.57 billion in 2023.

- The market is projected to grow at a CAGR of 13.13% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, valued at USD 182.36 billion.

- The processors segment garnered USD 150.62 billion in revenue in 2023.

- The Wi-Fi segment is expected to reach USD 392.76 billion by 2031.

- The healthcare segment secured the largest revenue share of 24.47% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 14.18% over the forecast period.

Widespread deployment of connected systems in sectors such as manufacturing, agriculture, logistics, and utilities is increasing demand for highly integrated and energy-efficient chips. Enterprises are investing in industrial IoT infrastructure to enhance operational efficiency, automate processes, and improve supply chain visibility.

These requirements are accelerating the adoption of specialized microcontrollers and sensors tailored for industrial-grade performance, supporting market growth by expanding deployment opportunities across diverse verticals.

Expansion of Smart Consumer Electronics Ecosystems

The consumer electronics sector is experiencing a notable shift toward smart, interconnected products, including smart TVs, wearable devices, voice assistants, and home automation systems.

These devices rely on IoT chips to facilitate seamless communication and device interoperability, propelling the growth of the IoT chip market. Increasing consumer preference for convenience, automation, and personalization in daily tasks is prompting device manufacturers to integrate advanced chipsets into their product lines.

- In January 2023, MediaTek introduced the Genio 700, an octa-core chipset tailored for IoT applications in smart home, retail, and industrial sectors. Supported by the Genio 700 SDK, it allows developers to build customized solutions using Yocto Linux, Ubuntu, or Android, streamlining product development for efficient IoT solutions across various applications.

High Power Consumption and Thermal Management Issues

A significant challenge hindering the growth of the IoT chip market is high power consumption and the resulting thermal management issues, particularly in compact, always-connected devices.

As IoT applications expand across consumer electronics, industrial systems, and smart infrastructure, ensuring energy efficiency without compromising performance is critical.

To address this challenge, companies are focusing on designing ultra-low-power chip architectures, incorporating advanced power management techniques, and leveraging smaller process nodes such as 5nm and 3nm.

Additionally, chipmakers are integrating AI-powered dynamic power control and investing in materials that offer improved heat dissipation to optimize device reliability and efficiency.

Shift Toward Edge Computing and Real-Time Processing

Growing need for real-time data analysis and decision-making in remote environments is advancing the role of edge computing. This trend is creating strong demand for embedded IoT chips that enable low-latency processing with minimal power consumption, propelling the development of the IoT chips market.

From smart factories to autonomous systems, edge-based architectures are replacing centralized models, highlighting the need for chips with integrated processing, storage, and connectivity features.

- In October 2024, MediaTek introdued the Dimensity 9400, a smartphone chipset engineered to enhance Edge-AI performance. The chipset incorporates a second-generation All Big Core architecture built on Arm’s v9.2 CPU, paired with an upgraded GPU and NPU to deliver strong computational capabilities with efficient power usage. Manufactured using TSMC’s second-generation 3nm process, the chipset offers a 40% increase in power efficiency, extending battery life and enhancing AI-driven user experiences.

IoT Chip Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Processors, Connectivity Integrated Circuits (ICs), Sensors, Memory Devices, Logic Devices

|

|

By Connectivity

|

Wi-Fi, Bluetooth, RFID, Cellular Networks, Others

|

|

By End User

|

Healthcare, Consumer Electronics, Automotive, BFSI, Retail, Building Automation, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Processors, Connectivity Integrated Circuits (ICs), Sensors, Memory Devices, and Logic Devices): The processors segment earned USD 150.62 billion in 2023 due to its central role in enabling real-time data processing, device control, and integration of advanced functionalities across diverse connected applications.

- By Connectivity (Wi-Fi, Bluetooth, RFID, and Cellular Networks): The Wi-Fi segment held a share of 27.30% in 2023, mainly due to its widespread integration in smart home devices, consumer electronics, and industrial applications requiring high data throughput, stable connectivity, and cost-effective infrastructure.

- By End User (Healthcare, Consumer Electronics, Automotive, and BFSI): The healthcare segment is projected to reach USD 352.89 billion by 2031, propelled by the increasing integration of connected medical devices for real-time patient monitoring, diagnostics, and data-driven treatment.

IoT Chip Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America IoT chip market share stood at around 33.24% in 2023, valued at USD 182.36 billion. Healthcare systems across North America are integrating IoT-enabled technologies to address challenges related to chronic care and remote monitoring.

- According to a 2024 report by the American Telemedicine Association, nearly 62% of healthcare providers have deployed IoT-based patient monitoring devices.

Devices such as wearable ECG monitors, smart insulin pens, and telemetry systems use low-power chipsets with wireless communication modules to function effectively. The presence of major medical device manufacturers and supportive FDA policies for digital health solutions is accelerating product rollouts, fueling regional market growth.

Additionally, North America is home to major tech giants such as Amazon Web Services, Microsoft Azure, and Google Cloud, which are collaborating with semiconductor firms to optimize edge computing architectures.

For instance, NVIDIA’s Jetson Orin series and Qualcomm’s AI-enabled RB5 platform support IoT and edge-AI applications. The collaboration between cloud providers and chipmakers is fostering scalable and intelligent IoT ecosystems, supporting regional market expansion.

Asia Pacific IoT chip industry is estimated to grow at a robust CAGR of 14.18% over the forecast period. Asia Pacific is experiencing significant 5G infrastructure expansion, enabling large-scale IoT deployments.

Telecom operators and OEMs are embedding 5G-compatible chipsets into industrial routers, smart meters, and edge gateways to support ultra-reliable, low-latency communication.

- With the GSM Association estimating over 600 million 5G connections in Asia Pacific by 2025, chip manufacturers are rapidly scaling production of low-power wide-area network (LPWAN) and 5G NB-IoT chipsets.

This ongoing telecom transformation is strengthening the foundation for smart city projects and IoT applications, boosting doemstic market expansion.

Regulatory Frameworks

- The U.S. IoT Cybersecurity Improvement Act of 2020 mandates the National Institute of Standards and Technology (NIST) to establish minimum security standards for IoT devices procured by federal agencies. This act aims to enhance the security of government-acquired IoT devices by enforcing guidelines on development, identity management, and configuration management.

- In the European Union, the General Data Protection Regulation (GDPR), effective since May 25, 2018, governs data privacy and enforces strict data protection and privacy measures on IoT devices. Non-compliance can result in substantial fines, making it imperative for IoT chip manufacturers to ensure their products comply with GDPR.

- Japan's Ministry of Economy, Trade and Industry (METI) introduced the IoT Security and Safety Framework in November 2020. This framework focuses on enhancing security measures, and mitigating risks associated with integrating IoT technologies into larger networks.

Competitive Landscape

Leading players operating in the IoT chip industry are increasingly focusing on the development of commercial high-performance System-on-Chip (SoC) solutions specifically tailored for Internet of Things (IoT) applications.

This strategic approach is enabling companies to address the evolving requirements of connected devices in terms of processing power, security, and energy efficiency. By prioritizing custom-built SoCs optimized for diverse IoT environments, these players are enhancing device functionality while maintaining cost efficiency.

- In May 2024, Mindgrove Technologies, a semiconductor startup, introduced India's first commercial high-performance System-on-Chip (SoC) for Internet of Things (IoT) applications. Named 'Secure IoT', the chip is priced approximately 30% lower than comparable products. It i delivers robust programmability, enhanced flexibility, advanced security, and powerful computing capabilities, making it suitable for managing a broad spectrum of connected smart devices.

Key Companies in IoT Chip Market:

- Qualcomm Incorporated

- NXP Semiconductors

- Unisoc (Shanghai) Technologies Co.

- Espressif Systems

- Semtech Corporation

- Taiwan Semiconductor Manufacturing Company

- Intel Corporation

- MediaTek Inc.

- Texas Instruments Incorporated

- STMicroelectronics N.V.

- Microchip Technology Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- Broadcom

- Samsung

Recent Developments (Agreements/Product Launch)

- In April 2025, Intel and Taiwan Semiconductor Manufacturing Co. (TSMC) reached a preliminary agreement to establish a joint venture aimed at managing Intel’s chip manufacturing operations. As part of the arrangement, TSMC is expected to acquire a 20% stake in the new entity. This development aligns with TSMC’s broader strategy, following its recent commitment to invest a minimum of USD 100 billion in the United States for the development of advanced semiconductor manufacturing facilities.

- In October 2024, Qualcomm unveiled its Qualcomm IQ series, a new product portfolio designed for demanding Internet of Things (IoT) environments, particularly those requiring safety-grade performance in extreme industrial conditions. Additionally, Qualcomm introduced the Qualcomm IoT Solutions Framework, which leverages IQ series chipsets with advanced AI tools and reference applications to enable end-to-end solutions, simplifying development processes and enhancing operational efficiency.

- In August 2024, Intel unveiled a new graphics processing unit (GPU) engineered for in-vehicle AI applications, amid ongoing scrutiny from U.S. authorities regarding advanced technology exports to China. This latest addition to Intel’s Arc Series of discrete GPUs, originally introduced in 2022 for gaming laptops, is designed to support the execution of large language models (LLMs) directly within the vehicle. It also enables high-end gaming experiences and supports local deployment of generative AI tools, reducing reliance on external cloud-based computing infrastructure.

- In June 2023, Broadcom announced the sample release of its second-generation wireless connectivity chipset solutions for the Wi-Fi 7 ecosystem. These solutions, designed for Wi-Fi routers, residential gateways, enterprise access points, and client devices, build on first-generation Wi-Fi 7 chips with enhanced features and expanded capabilities, reinforcing Broadcom’s position in next-generation wireless technology.