Market Definition

The market includes devices that precisely deliver precise fluids, medications, and nutrients into the bloodstream. These pumps regulate flow rates with high accuracy, ensuring the controlled administration of critical formulations, including analgesics, chemotherapy drugs, antibiotics, and insulin.

Widely used in hospitals, ambulatory care, and home settings, they support pain management, hydration therapy, and parenteral nutrition.

Intravenous Infusion Pumps Market Overview

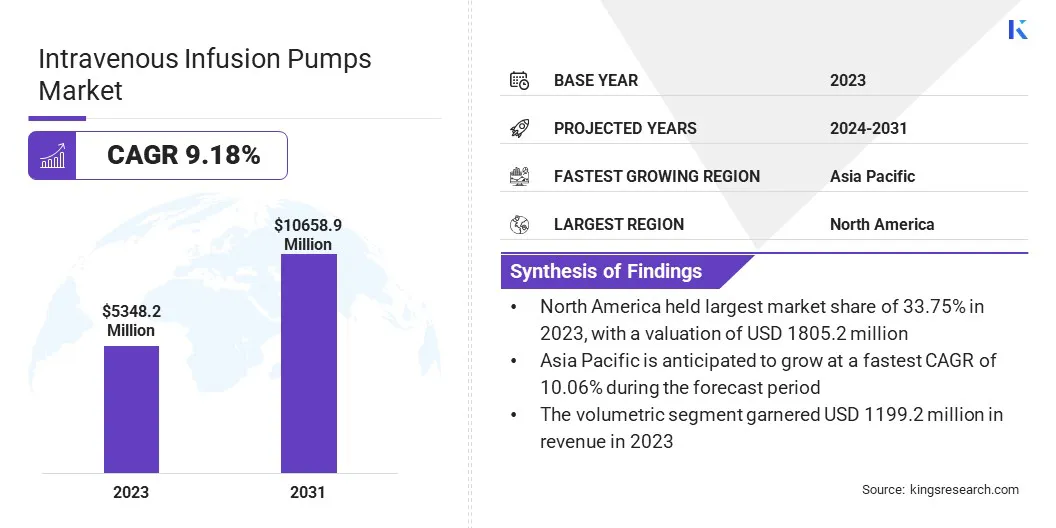

The global intravenous infusion pumps market size was valued at USD 5348.2 million in 2023 and is projected to grow from USD 5765.3 million in 2024 to USD 10658.9 million by 2031, exhibiting a CAGR of 9.18% during the forecast period.

The increasing incidence of chronic conditions is creating a strong demand for intravenous infusion pumps, as patients require continuous and precise medication delivery for long-term treatment. Growing surgical procedures and critical care admissions further contribute to market expansion, with hospitals and outpatient facilities relying on infusion systems for accurate drug administration.

Additionally, technological advancements, including smart pumps with dose error reduction systems and wireless connectivity, are improving safety and efficiency, leading to higher adoption in healthcare settings.

Major companies operating in the intravenous infusion pumps industry are Baxter, ICU Medical, Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Medtronic, Trivitron Healthcare, Terumo Corporation, Mindray Medical International Limited, Nipro Corporation, Eitan Medical, Zyno Medical, Moog Inc., Becton, Dickinson and Company, Micrel Medical Devices SA, AdvaCare Pharma, and others.

The increasing incidence of chronic conditions, including cancer, diabetes, and neurological disorders, is fueling market growth. The need for controlled and continuous drug administration in chemotherapy, insulin therapy, and long-term pain management propels the demand for infusion pumps.

The surging prevalence of lifestyle-related diseases further accelerates the adoption of advanced drug delivery systems, enhancing accuracy, reducing complications, and improving patient outcomes. This trend is fostering growth in across hospitals, home healthcare, and specialized clinics.

Key Highlights:

- The intravenous infusion pumps industry size was recorded at USD 5348.2 million in 2023.

- The market is projected to grow at a CAGR of 9.18% from 2024 to 2031.

- North America held a share of 33.75% in 2023, valued at USD 1805.2 million.

- The crystalloid solutions segment garnered USD 3097.7 million in revenue in 2023.

- The volumetric segment is expected to reach USD 2378.0 million by 2031.

- The Crohn's disease is proejcetd to grow at a robust CAGR of 9.32% through the projection period.

- Asia Pacific is anticipated to grow at a CAGR of 10.06% over the forecast period.

Market Driver

Growing Surgical Procedures and Critical Care Admissions

The increasing number of surgical interventions and intensive care admissions is proepliing the expansion of the market. These devicesare essential in perioperative and critical care settings, ensuring precise delivery of anesthesia, pain management drugs, and intravenous fluids.

The rising complexity of surgical procedures and the need for controlled drug administration in intensive care units are prompting hospitals to invest in technologically advanced infusion systems. The expansion of emergency and trauma care services is further leading to the adoption of infusion pumps for high-risk patient management.

- According to the International Society of Aesthetic Plastic Surgery (ISAPS), total surgical and non-surgical procedures increased by 3.4% in 2023, reaching 34.9 million. Aesthetic and cosmetic surgical procedures saw a higher growth rate of 5.5%, with plastic surgeons performing over 15.8 million surgeries and 19.1 million non-surgical treatments. Over the past four years, the total number of aesthetic procedures have risen by 40%.

Market Challenge

Risk of Infusion Errors and Patient Safety Concerns

Infusion errors, including incorrect dosing, medication mix-ups, and device malfunctions, present a major challenge to the expansion of the intravenous infusion pumps market. These errors can lead to severe patient complications, increasing liability concerns for healthcare providers.

To mitigate these risks, companies are integrating advanced safety features such as dose error reduction systems (DERS), real-time monitoring, and automated drug libraries. Additionally, the adoption of smart pumps with wireless connectivity allows for seamless integration with electronic medical records (EMRs), reducing manual programming errors.

Continuous R&D efforts and collaboration with healthcare institutions further enhance device safety and reliability, fostering market expansion.

Market Trend

Technological Advancements

The integration of smart infusion pumps with two-way interoperability between intravenous (IV) medication pumps and electronic medical records (EMRs) is emerging as a notable trend in the market. These advancements eliminate manual programming, enhance infusion accuracy, and significantly reduce administration errors.

Features such as wireless connectivity, dose error reduction systems, and automated monitoring improve workflow efficiency while improving patient safety. The adoption of programmable dosing, drug libraries, and real-time infusion tracking is increasing in critical care, perioperative settings, and ambulatory infusion centers, ensuring precise medication delivery.

- In April 2024, Mackenzie Health became Canada's first healthcare system to enable two-way data exchange between an intravenous (IV) medication pump and a patient’s electronic medical record (EMR). The BD Alaris EMR Interoperability system eliminates the need for manual pump programming by healthcare professionals while automatically transmitting infusion safety data to the Epic EMR. This advancement enhances accuracy, minimizes the risk of administration errors, and ensures precise infusion records.

Intravenous Infusion Pumps Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fluid

|

Crystalloid solutions, Colloids solutions

|

|

By Product

|

Volumetric, Syringe, Insulin, Enteral, Ambulatory, Patient-Controlled Analgesia, Implantable, Others

|

|

By Disease Indication

|

Chemotherapy, Diabetes, Crohn’s disease, Analgesia/Pain Management, Pediatrics/Neonatology, Hematology, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fluid (Crystalloid Solutions and Colloids Solutions): The crystalloid solutions segment earned USD 3097.7 million in 2023 due to its widespread use in fluid resuscitation, electrolyte balance maintenance, and perioperative care, supported by its cost-effectiveness, rapid plasma expansion capability, and compatibility with various medical conditions.

- By Product (Volumetric, Syringe, Insulin, Enteral, Ambulatory, Patient-Controlled Analgesia, Implantable, and Others): The volumetric segment held a share of 22.42% in 2023, due to its ability to deliver large fluid volumes with high precision, making it essential for critical care, chemotherapy, and long-duration infusions in hospital and ambulatory settings.

- By Disease Indication (Chemotherapy, Diabetes, Crohn’s disease, Analgesia/Pain Management, Pediatrics/Neonatology, Hematology, and Others): The Crohn’s diseasesegment is likely to grow at a CAGR of 9.32% through the forecast period, largely attributed to the rising prevalence of the condition and the increasing reliance on biologic therapies that require precise and continuous intravenous administration for effective disease management.

Intravenous Infusion Pumps Market Regional Analysis

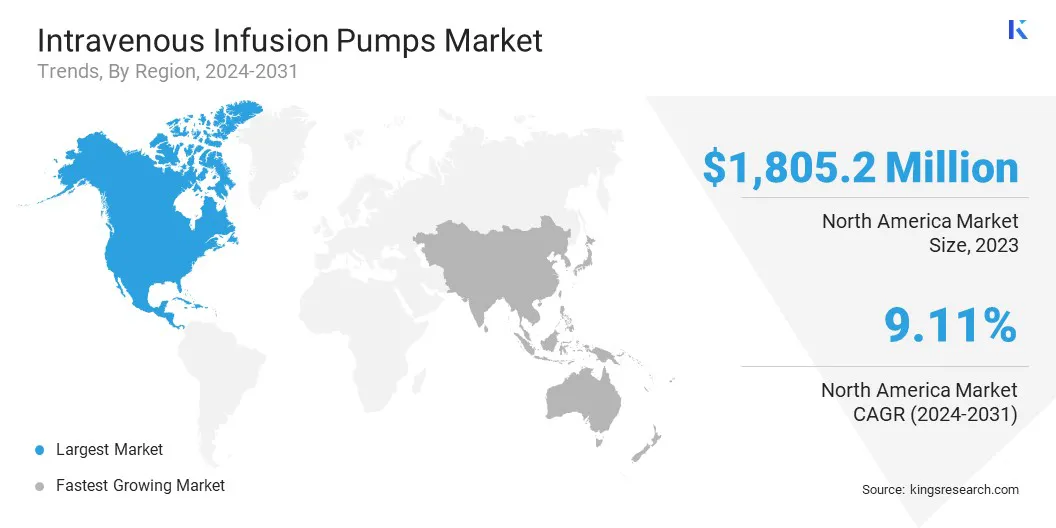

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America intravenous infusion pumps market share stood at around 33.75% in 2023, valued at USD 1805.2 million. The increasing preference for home-based and ambulatory care in North America is accelerating the demand for portable and user-friendly infusion pumps.

Rising healthcare costs and a shift toward value-based care models have promoted the adoption of home infusion therapy for chronic disease management, chemotherapy, and parenteral nutrition.

Additionally, the presence of a well-established ecosystem of global and regional infusion pump manufacturers, including Becton, Dickinson and Company (BD), Baxter International, and ICU Medical, is contributing to market expansion.

This competitive landscape fosters advancements in infusion technology, ensuring a steady pipeline of next-generation devices that meet the evolving demands of hospitals, outpatient clinics, and home healthcare providers.

- In April 2023, Becton, Dickinson and Company (BD) introduced the Alaris SmartPump, equipped with SmartCare software. This advanced volumetric infusion pump enhances precision and efficiency over previous BD models. SmartCare software delivers real-time performance data, enabling healthcare providers to monitor infusion accuracy and optimize patient safety.

Asia Pacific intravenous infusion pumps industry is set to grow at a robust CAGR of 10.06% over the forecast period. The increasing number of neonatal intensive care units (NICUs) and intensive care units (ICUs) is boosting demand for infusion pumps, fostering regional market growth.

Premature births and neonatal infusion therapy are notably high in India and China. Meanwhile, Japan and South Korea are advancing digital health technologies, including smart infusion systems with wireless connectivity and real-time monitoring. The integration of AI-driven infusion management solutions is further enhancing safety and efficiency in medication administration, contributing to market expansion.

Regulatory Frameworks:

- The U.S. Food and Drug Administration (FDA) classifies infusion pumps as Class II medical devices. Manufacturers are required to submit a premarket notification, known as a 510(k), demonstrating that their device is substantially equivalent to a legally marketed predicate device. This process ensures the safety and effectiveness of the device before market entry.

- In Europe, Infusion pumps are regulated under the Medical Device Regulation (MDR) (EU) 2017/745. This regulation outlines comprehensive requirements for medical devices, including classification, conformity assessment procedures, and post-market surveillance. In Germany, the Federal Institute for Drugs and Medical Devices (BfArM) oversees compliance with these regulations.

- In China, the National Medical Products Administration (NMPA) monitors medical device regulation. Manufacturers must obtain NMPA approva through a rigorous review process to ensure safety and efficacy. The NMPA is continuously refining its regulatory framework to align with international standards.

Competitive Landscape

The intravenous infusion pumps industry is characterized by numerous players focusing on the development of ambulatory infusion systems to enhance convenience in home and outpatient settings. These advanced systems feature intuitive interfaces, seamless integration with digital health platforms, and compact designs to enhance patient mobility.

By aligning innovation with evolving healthcare needs, companies are expanding their market presence while addressing the growing demand for safe and efficient infusion therapy beyond traditional hospital settings.

- In May 2024, Moog Inc. secured 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its CURLIN 8000 Ambulatory Infusion System under the Industrial segment. Designed specifically for home infusion therapy, this advanced platform features a durable build and an intuitive user interface, ensuring ease of use for both clinical and non-clinical users. Developed in collaboration with home care professionals, the CURLIN 8000 pump and CURLIN RxManager software are designed to integrate seamlessly with existing home care protocols and workflows.

List of Key Companies in Intravenous Infusion Pumps Market:

- Baxter

- ICU Medical, Inc.

- Fresenius Kabi AG

- Braun Melsungen AG

- Medtronic

- Trivitron Healthcare

- Terumo Corporation

- Mindray Medical International Limited

- Nipro Corporation

- Eitan Medical

- Zyno Medical

- Moog Inc.

- Becton, Dickinson and Company

- Micrel Medical Devices SA

- AdvaCare Pharma

Recent Developments (Approval/Agreements)

- In April 2024, Baxter International Inc. received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Novum IQ large volume infusion pump (LVP) with Dose IQ Safety Software. This expansion of Novum IQ Infusion Platform, which includes Baxter’s syringe infusion pump (SYR) with Dose IQ Safety Software and is powered by the IQ Enterprise Connectivity Suite, allows clinicians to operate a unified system across diverse patient care settings.

- In September 2023, Fresenius Kabi partnered with Virginia Oncology Associates (VOA) to implement the Ivenix Infusion System for medication delivery. VOA, specializing in cancer and blood disorder treatment, aims to enhance patient care through advanced infusion technology.

- In August 2023, ICU Medical, Inc. obtained 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the Plum Duo infusion pump, integrated with LifeShield infusion safety software. This advanced infusion system has been available in the U.S. since early 2024.