Intraoperative Imaging Market Overview

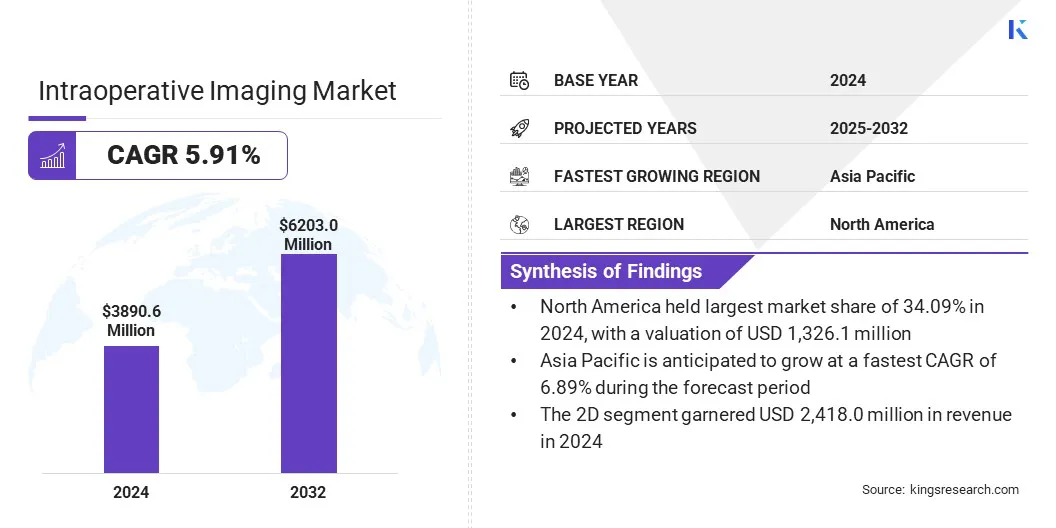

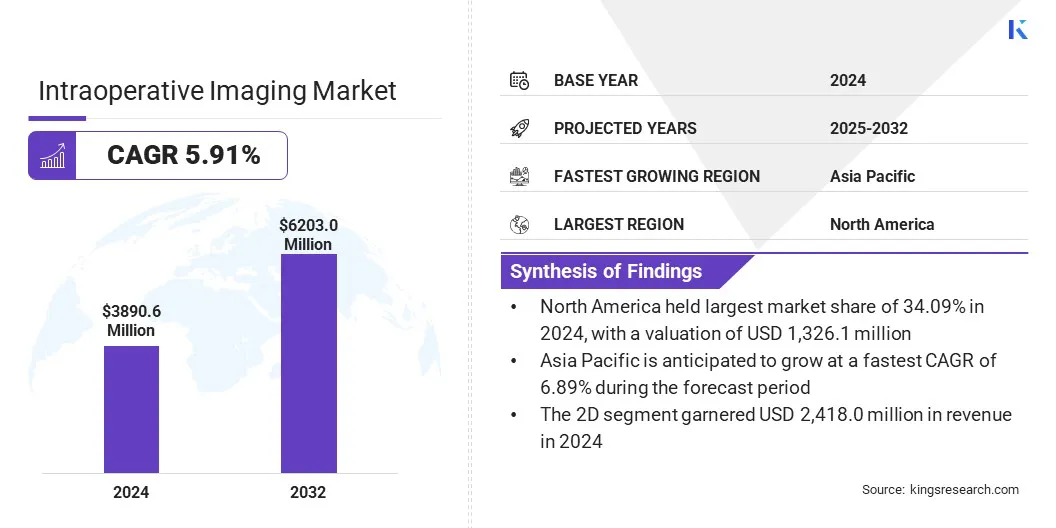

According to Kings Research, the global intraoperative imaging market size was valued at USD 3,890.6 million in 2024 and is projected to grow from USD 4,103.8 million in 2025 to USD 6,203.0 million by 2032, exhibiting a CAGR of 5.91% during the forecast period.

The market is experiencing steady growth, driven by the increasing demand for precision in surgical procedures and the rising adoption of minimally invasive techniques.

The increasing adoption of image-guided procedures in neurosurgery, orthopedic, and oncology applications is driving the use of intraoperative MRI, CT, and ultrasound. Advancements in imaging accuracy, workflow integration, and mobility are enhancing clinical decision-making.

Major companies operating in the intraoperative imaging industry are Medtronic, Grovecourt Capital Partners, Siemens AG, General Electric Company, Koninklijke Philips N.V., Brainlab AG, Canon Inc., Aton GmbH, Esaote SpA, Sumitomo Mitsui Financial Group, Inc., Shimadzu Corporation, KUBTEC, Nanjing Perlove Medical Equipment Co., Ltd., SAMSUNG, and Xoran Technologies, LLC.

Key Market Highlights:

- The intraoperative imaging market size was valued at USD 3,890.6 million in 2024.

- The market is projected to grow at a CAGR of 5.91% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 1,326.1 million.

- The intraoperative computed tomography (iCT) segment garnered USD 1,293.2 million in revenue in 2024.

- The 2D segment is expected to reach USD 3,818.0 million by 2032.

- The neurosurgery segment is expected to reach USD 1,506.8 million by 2032.

- The hospitals segment is expected to be valued at USD 2,240.9 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.89% during the forecast period.

The integration of advanced imaging systems in hybrid operating rooms enhances real-time visualization and precision during procedures, driving demand for intraoperative imaging solutions.

Rising investments in surgical infrastructure expand the installation base of such advanced OR setups, thereby accelerating the adoption of intraoperative imaging technologies and contributing to overall market growth.

- In August 2024, NTU Hospital established Taiwan’s first intraoperative MRI hybrid operating room to enhance the precision and safety of neurosurgical procedures. The system integrates real-time MRI imaging with navigation, intraoperative neuro-monitoring, and fluorescence-guided resection technologies. It reduces patient transfers, supports accurate tumor localization, and improves surgical outcomes through greater precision during complex brain and spinal surgeries.

Advancements in Imaging Technology to Enhance Precision and Efficiency

The market is driven by the increasing demand for minimally invasive and image-guided surgeries. Surgeons now rely on real-time imaging tools such as intraoperative MRI, CT, and ultrasound to perform procedures with greater precision. These technologies improve intraoperative decision-making, reduce complications, and reduce hospital stays.

- In March 2025, Leiden University Medical Center (LUMC) partnered with Philips to equip the new Leiden Image Guided Therapy Center with advanced imaging systems, including Azurion and AngioCT, to support high-volume, minimally invasive procedures for cancer, vascular conditions, and stroke.

As healthcare systems aim to enhance surgical outcomes and optimize operating room efficiency, the use of intraoperative imaging is becoming a standard requirement in surgical specialties.

This shift toward less invasive interventions, combined with the need for high procedural accuracy, is expected to continue driving the integration of imaging systems into modern surgical environments.

High Cost and Limited Accessibility of 3D Imaging Systems

A major challenge in the intraoperative imaging market is limited access to 3D imaging systems due to their high cost and operational complexity. Advanced 3D intraoperative imaging modalities such as CT and MRI provide real-time visualization during surgery, but their installation and maintenance require significant capital , specialized infrastructure, and trained personnel.

As a result, many healthcare facilities, especially in low resource settings or smaller surgical centers, are unable to adopt these systems, which restricts the broader implementation of image guided surgeries.

Therefore, companies are developing technologies like the CT Fluoro registration method, which uses intraoperative fluoroscopy, a widely available and less expensive 2D imaging modality, to provide real-time guidance.

- In November 2024, Augmedics received FDA clearance for its CT-Fluoro registration method, enabling AR navigation using a preoperative CT scan and 2D fluoroscopic images. By replacing expensive 3D intraoperative imaging with fluoroscopy, the method expands access to imaging-guided spine surgery in an efficient and affordable way.

AI Integration in Imaging Systems

The market is experiencing a key trend of integration of artificial intelligence into imaging technologies. AI is incorporated to support real-time image analysis, improve anatomical visualization, and assist in intraoperative decision-making.

- In September 2024, Medtronic launched new technologies to enhance its AiBLE spine surgery ecosystem, by integrating AI-based navigation, imaging, and robotics. The company partnered with Siemens Healthineers to expand access to advanced imaging. Key updates include AI-enabled O-arm 4.3, the UNiD platform with MRI Vision, and the Mazor robotic system with AI and bone-cutting features.

These enhancements help surgeons to perform with greater accuracy, reduce variability, and minimize the need for repeat imaging. AI-powered imaging systems optimize image quality while lowering radiation exposure, which contributes to patient safety.

Additionally, the use of predictive algorithms within imaging platforms supports personalized surgical planning and execution. These technologies are advancing the efficiency and precision of intraoperative procedures, aligning with the growing demand for data-driven and outcome-focused surgical interventions.

Intraoperative Imaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Intraoperative Computed Tomography (iCT), Intraoperative Ultrasound, Intraoperative magnetic resonance imaging (iMRI), C-arms

|

|

By Imaging

|

2D, 3D

|

|

By Application

|

Neurosurgery, Cardiovascular Surgery, Orthopedic Surgery, Trauma /Emergency Room Surgery, ENT Surgery, Oncology Surgery, Others

|

|

By End Use

|

Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Intraoperative Computed Tomography (iCT), Intraoperative Ultrasound, Intraoperative magnetic resonance imaging (iMRI), and C-arms): The intraoperative computed tomography (iCT) segment earned USD 1,293.2 million in 2024, due to its high accuracy in real-time imaging and widespread use in surgical procedures.

- By Imaging (2D and 3D): The 2D segment held 62.15% of the market in 2024, on account of its cost-effectiveness and suitability for routine surgical imaging.

- By Application (Neurosurgery, Cardiovascular Surgery, Orthopedic Surgery, Trauma /Emergency Room Surgery, ENT Surgery, Oncology Surgery, and Others): The neurosurgery segment is projected to reach USD 1,506.8 million by 2032, owing to the increasing adoption of intraoperative imaging in tumor resection and functional brain surgeries.

- By End Use (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Others): The hospitals segment is estimated to reach USD 2,240.9 million by 2032, attributed to the growing integration of advanced imaging technologies in surgical suites and hybrid operating rooms.

Intraoperative Imaging Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 34.09% share of the intraoperative imaging market in 2024, with a valuation of USD 1,326.1 million. The region’s dominance is primarily driven by the high concentration of neurosurgical and orthopedic centers adopting advanced intraoperative imaging systems.

Collaborations between leading medical device manufacturers and academic hospitals, along with early integration of hybrid operating rooms in tertiary care facilities, have significantly boosted product demand.

- In February 2025, Texas Health Hospital Mansfield, a joint venture between Texas Health Resources and AdventHealth, began constructing a new hybrid operating room to expand its surgical services. The new OR will combine advanced imaging with surgical capabilities to support procedures in cardiology, neurosurgery, orthopedics, and trauma.

This development underscores the region’s emphasis on expanding advanced surgical infrastructure, as hospitals extensively invest in hybrid operating rooms to meet the rising demand for high-precision and image-guided procedures across multiple specialties.

Moreover, the presence of established players and their continued innovation in intraoperative MRI and CT systems has strengthened market growth across the U.S. and Canada.

Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 6.89% over the forecast period. The region is witnessing rapid growth in the intraoperative imaging industry, driven by rising demand for minimally invasive diagnostic and surgical procedures.

In Australia and Japan, the focus on early disease detection is accelerating the adoption of advanced intraoperative imaging technologies in interventional pulmonology.

- In March 2025, Body Vision Medical received regulatory approval from the Therapeutic Goods Administration (TGA) in Australia for its LungVision system, an AI-powered intraoperative imaging platform for lung cancer diagnosis. LungVision transforms standard C-arms into 3D imaging systems, enabling real-time navigation and visualization during bronchoscopic procedures.

This development highlights the region’s growing focus on integrating AI-powered imaging tools into clinical practice to enhance diagnostic accuracy and procedural efficiency in high-burden conditions, supported by active collaboration between healthcare providers and imaging technology firms.

Regulatory Frameworks

- In the U.S., the primary regulatory authority for intraoperative imaging devices is the Food and Drug Administration (FDA). The FDA's Center for Devices and Radiological Health (CDRH) is responsible for regulating the safety and effectiveness of these devices.

- In Europe, the EU Medical Device Regulation (MDR) regulates intraoperative imaging devices. The regulatory process involves conformity assessment and CE marking, ensuring that devices are fit for purpose and comply with EU standards.

Competitive Landscape

The intraoperative imaging market is characterized by continuous technological innovation, strategic collaborations, and product differentiation to enhance real-time surgical imaging capabilities. Key players in the market focus on expanding their portfolios by developing next-generation imaging systems that offer higher resolution, improved mobility, and better integration with surgical navigation platforms.

Market participants are expanding their geographic footprint through regulatory approvals, regional distribution agreements, and localized manufacturing to improve accessibility and operational efficiency in high-growth regions.

- In February 2025, Grovecourt Capital Partners acquired IMRIS Imaging, a global provider of intraoperative MRI solutions. IMRIS offers movable MRI systems that allow seamless imaging during neurosurgery without disrupting the sterile surgical field.

Key Companies in Intraoperative Imaging Market:

- Medtronic

- Grovecourt Capital Partners

- Siemens AG

- General Electric Company

- Koninklijke Philips N.V.

- Brainlab AG

- Canon Inc.

- Aton GmbH

- Esaote SpA

- Sumitomo Mitsui Financial Group, Inc.

- Shimadzu Corporation

- KUBTEC

- Nanjing Perlove Medical Equipment Co., Ltd.

- SAMSUNG

- Xoran Technologies, LLC.

Recent Developments (Product Launch)

- In November 2024, GE HealthCare expanded its OEC 3D mobile CBCT C-arm portfolio with the launch of the Lung Suite for enhanced 2D and 3D imaging during bronchoscopy. The suite features augmented fluoroscopy and a motorized 3D scan to support precise visualization during endoscopic procedures.