Intelligent Document Processing Market Size

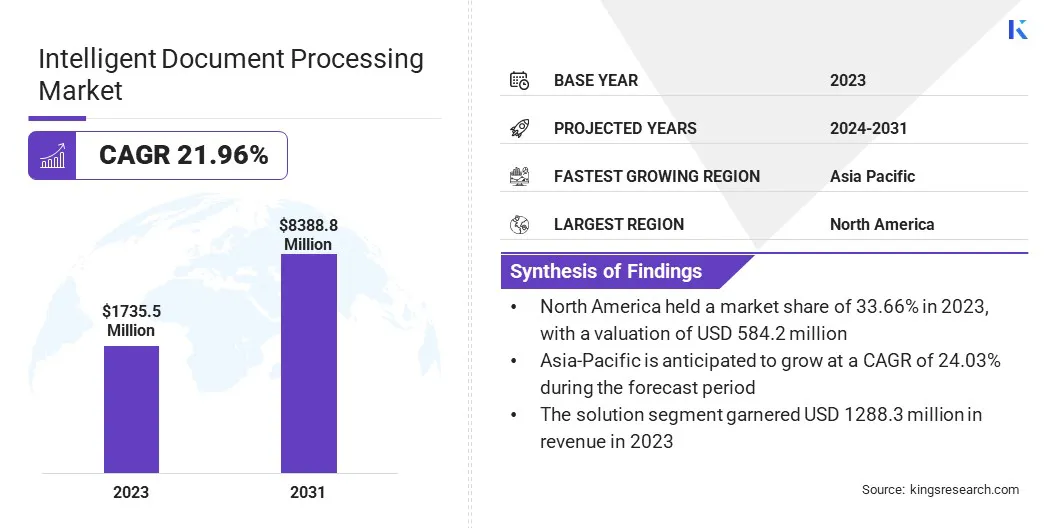

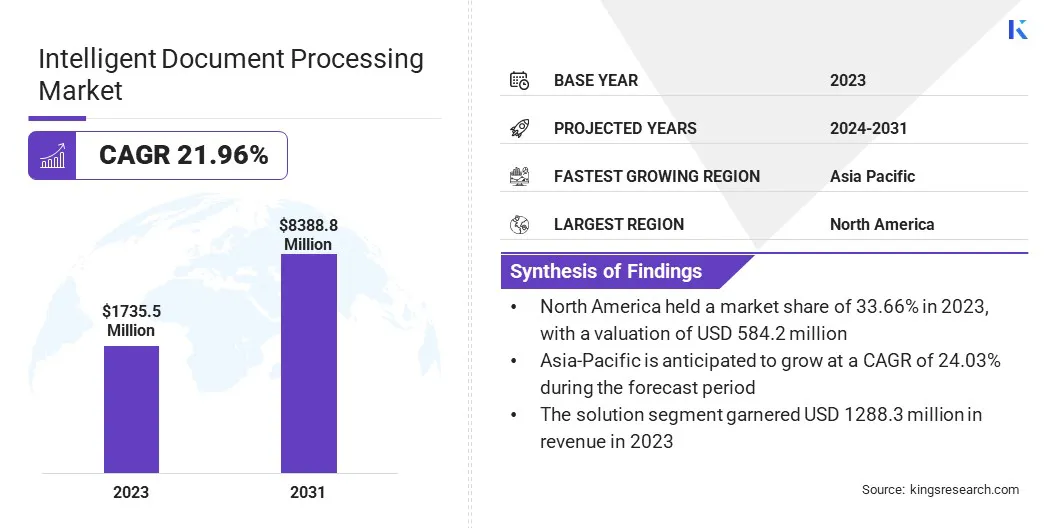

The global Intelligent Document Processing Market size was valued at USD 1,735.5 million in 2023 and is projected to grow from USD 2,090.6 million in 2024 to USD 8,388.8 million by 2031, exhibiting a CAGR of 21.96% during the forecast period.

In the scope of work, the report includes solutions offered by companies such as ABBYY, IBM, Tungsten Automation Corporation, WorkFusion, Inc., Automation Anywhere, Inc., Copyright Parascript., Hyperscience, Extract Systems, Infrrd Inc., Kodak Alaris Inc. and others.

The progress of the market is primarily driven by the increasing adoption of automation technologies across various industries. The need for efficient data extraction and processing from unstructured documents is boosting market growth. Additionally, the demand for enhancing operational efficiency and reducing manual errors fuels market development.

Moreover, advancements in machine learning (ML) and artificial intelligence (AI) technologies are enabling organizations to streamline document-centric processes, thus contributing to market expansion.

The intelligent document processing (IDP) market is witnessing significant growth globally, largely attributable to the increasing demand for automation solutions across diverse industries. IDP solutions facilitate the extraction, classification, and validation of data from various unstructured documents in order to improve operational efficiency.

The advancements in artificial intelligence and machine learning are enabling IDP providers to enhance accuracy and scalability in order to cater to the evolving needs of businesses. Moreover, the integration of IDP with existing systems and the availability of cloud-based solutions are further boosting adoption, making IDP a crucial component of digital transformation strategies.

Companies are further enhancing their product portfolios by strategic acquisitions, enabling them to incorporate latest technologies.

- For instance, in February 2024, Duco, a AI-powered data automation SaaS provider, announced its acquisition of Metamaze, a company specializing in intelligent document processing (IDP) and unstructured data ingestion. Metamaze used AI and no-code techniques to replace manual data extraction from documents and emails, focusing on banking and insurance. This acquisition allowed Duco to enhance its platform, enabling customers to automate data ingestion and processing from various document formats.

Intelligent document processing (IDP) refers to the use of machine learning (ML) and artificial intelligence (AI) technologies to automate the extraction, classification, and validation of data from various unstructured documents such as invoices, contracts, and forms.

IDP solutions leverage optical character recognition (OCR), natural language processing (NLP), and other AI techniques to transform unstructured data into structured formats, enabling organizations to streamline document-centric processes. IDP finds applications across diverse industries, including finance, healthcare, legal, and manufacturing, leading to its widespread adoption and stimulate market growth.

Analyst’s Review

The market is witnessing significant innovation, propelled by manufacturers' efforts to enhance automation and accuracy.

- Companies such as ABBYY and Kofax are introducing advanced AI-powered solutions that streamline data extraction and processing. ABBYY's product, Vantage, uses machine learning to improve document comprehension, while Kofax's Intelligent Automation Platform integrates IDP with robotic process automation for end-to-end workflow efficiency.

These developments are reshaping business operations, reducing manual intervention, and increasing productivity. For market participants, continued investments in AI and machine learning capabilities are crucial. Collaborating with tech leaders to integrate cutting-edge IDP solutions is expected to facilitate companies to provide a competitive edge and meet evolving business needs.

Intelligent Document Processing Market Growth Factors

The increasing need for organizations to enhance operational efficiency through automation is a key factor impacting the growth of the intelligent document processing market. Businesses are actively seeking solutions that enable automation of data extraction, classification, and validation from unstructured documents, such as invoices and forms.

The continuous advancements in artificial intelligence (AI) and machine learning (ML) technologies, enable accuracy and scalability in IDP solutions. Furthermore, organizations are striving to streamline document-centric processes and reduce manual errors, resulting in the growing demand for IDP solutions.

Ensuring the accuracy and reliability of data extraction from complex documents poses a prominent challenge, primarily due to variations in document formats, language complexities, and handwriting recognition. IDP solution providers are incorporating advanced AI algorithms, such as deep learning models, to improve data extraction accuracy and overcome this challenge.

Additionally, ongoing training and fine-tuning of these algorithms based on real-world data helps enhance the solution's performance over time. Utilization of advanced AI techniques and continuous improvement strategies, allows IDP providers to address the challenges associated with accurate data extraction from diverse documents.

Intelligent Document Processing Industry Trends

The integration of robotic process automation (RPA) capabilities with intelligent document processing (IDP) enables organizations to leverage RPA for end-to-end document automation processing workflows. This combines IDP's data extraction and validation capabilities with RPA's automation of repetitive tasks. This integration enhances operational efficiency by reducing manual intervention and accelerating document processing cycles.

Moreover, RPA integration allows for seamless connectivity with other enterprise systems, enabling organizations to achieve greater workflow orchestration and optimization. Businesses are prioritizing automation & digital transformation. This convergence of IDP and RPA is expected to augment the intelligent document processing market growth.

The widespread adoption of cloud-based IDP solutions helps organizations migrate their document processing workflows to the cloud to leverage benefits such as scalability, flexibility, and cost-effectiveness. Cloud-based IDP solutions offer rapid deployment, easy scalability, and seamless integration with existing systems, making them attractive to businesses of all sizes.

Furthermore, cloud platforms provide advanced security features and data analytics capabilities, enhancing overall document processing efficiency and decision-making. The increasing demand for agility and digital transformation is prompting a shift towards cloud-based IDP solutions, thereby supporting the expansion of the market.

Segmentation Analysis

The global market is segmented based on component, deployment, technology, organization size, end-use, and geography.

By Component

Based on component, the market is categorized into solutions and services. The solution segment led the intelligent document processing market in 2023, reaching a valuation of USD 1288.3 million. Businesses are increasingly adopting IDP solutions to automate document processing workflows, leading to improved operational efficiency and reduced manual errors.

Additionally, advancements in artificial intelligence (AI) and machine learning (ML) technologies have enhanced the accuracy and scalability of IDP solutions, supporting the growth of the segment. The demand for efficient data extraction, classification, and validation from unstructured documents has resulted in the expansion of the solution segment.

By Deployment

Based on deployment, the market is bifurcated cloud and on-premises. The cloud segment secured the largest revenue of USD 1017.6 million in 2023, primarily due to the increasing adoption of cloud-based IDP solutions by organizations for their scalability, flexibility, and cost-effectiveness.

Cloud deployments offer rapid implementation, easy scalability, and seamless integration with existing systems, leading to their widespread adoption across various industries. Moreover, cloud platforms provide advanced security features and data analytics capabilities, further enhancing the appeal of cloud-based IDP solutions.

By End-Use

Based on organization size, the market is classified into SMEs and large enterprise. The SMEs segment is poised to witness significant growth at a staggering CAGR of 22.90% through the forecast period (2024-2031). SMEs are increasingly adopting IDP solutions to enhance efficiency and reduce operational costs.

The flexibility and scalability of cloud-based IDP tools make them particularly attractive to SMEs, which often face budget constraints and resource limitations. Additionally, the rising need for digital transformation and automation in response to competitive pressures is prompting SMEs to invest in advanced document processing technologies.

Intelligent Document Processing Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

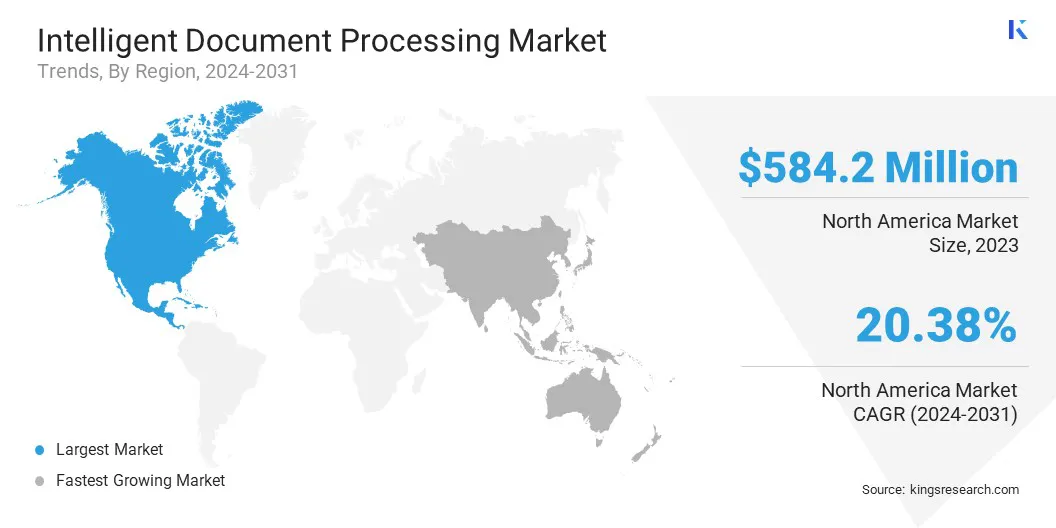

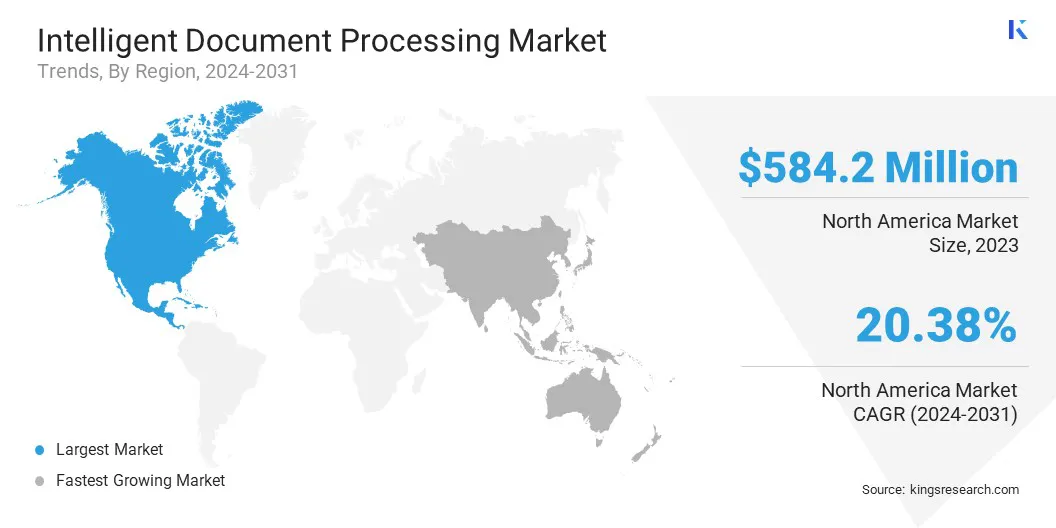

The North America intelligent document processing market share stood around 33.66% in 2023 in the global market, with a valuation of USD 584.2 million. North America dominates the market due to several key factors such as the strong technological infrastructure and high adoption rates of automation solutions across diverse industries.

Additionally, the presence of major players and ongoing advancements in artificial intelligence (AI) and machine learning (ML) technologies contribute significantly to regional market development. Moreover, North American businesses prioritize operational efficiency and data accuracy, leading to increased demand for IDP solutions in the region.

Asia-Pacific is set to witness significant growth, registering a robust CAGR of 24.03% through the projection period. Asia-Pacific is positioned as the fastest-growing region in the intelligent document processing market due to the rapid digital transformation across industries, leading to increased adoption of automation and AI-driven solutions.

Moreover, the burgeoning SME sector in Asia-Pacific is boosting demand for cost-effective and scalable IDP solutions. Additionally, supportive government initiatives, evolving regulatory landscapes, and a growing focus on operational efficiency further contribute to domestic market growth.

Competitive Landscape

The intelligent document processing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Intelligent Document Processing Market

- ABBYY

- IBM

- Tungsten Automation Corporation

- WorkFusion, Inc.

- Automation Anywhere, Inc.

- Copyright Parascript.

- Hyperscience

- Extract Systems

- Infrrd Inc.

- Kodak Alaris Inc.

Key Industry Developments

- April 2024 (Launch): Mulesoft introduced MuleSoft Intelligent Document Processing (IDP), a significant advancement toward achieving a comprehensive, interconnected automation platform. MuleSoft IDP utilizes AI to automatically extract and organize data from unstructured documents, facilitating seamless integration with downstream systems. It utilizes advanced AI algorithms, which enable effortless handling of various document formats. It further offers preconfigured templates for common documents, which reduce setup time, and enable human-in-the-loop reviews for enhanced governance and accuracy.

- February 2024 (Launch): Mphasis, an IT solutions provider specializing in cloud and cognitive services, introduced DeepInsights Doc AI. This intelligent document processing solution utilized generative AI to extract specific data from various document formats. It was developed to facilitate seamless integration with IT systems, thereby enabling actionable insights for enterprise clients. DeepInsights Doc AI offers a customized LLM solution for specific document processing needs, including Information Extraction, Discovery, Context-Aware Search, and Insight Generation. The solution further provides flexibility through self-hosting within the enterprise cloud.

The global intelligent document processing market is segmented as:

By Component

By Deployment

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

By Organization Size

By End-Use

- BFSI

- Retail

- IT & Telecom

- Government & Public Sector

- Healthcare

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America