Insulation Materials Market Size

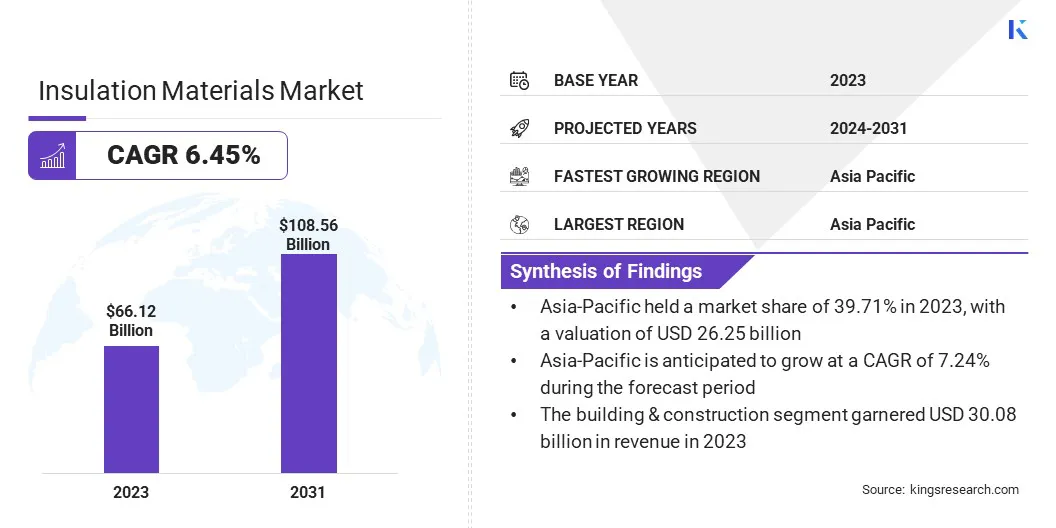

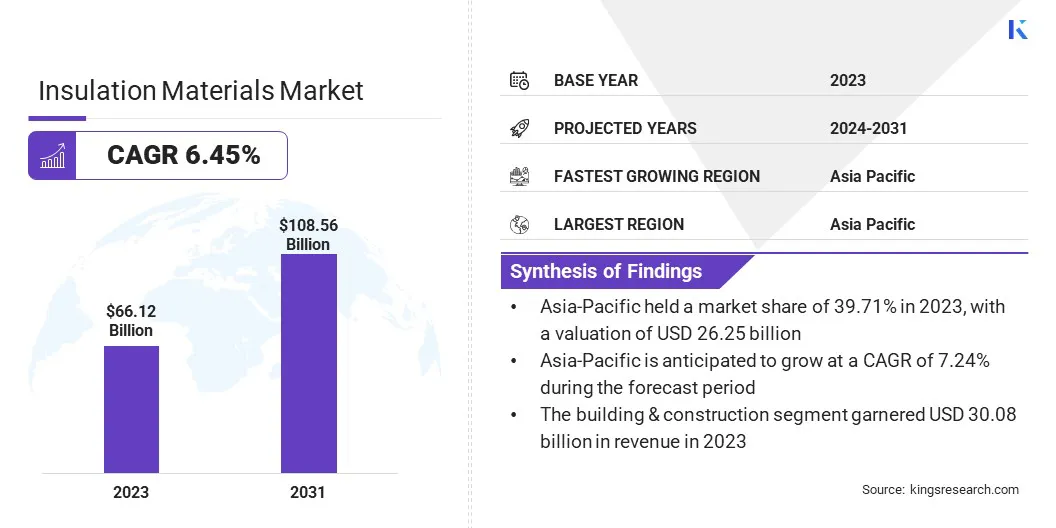

The global Insulation Materials Market size was valued at USD 66.12 billion in 2023 and is projected to grow from USD 70.11 billion in 2024 to USD 108.56 billion by 2031, exhibiting a CAGR of 6.45% during the forecast period. The growing urbanization and focus on sustainable construction practices are fueling the demand for insulation materials, which reduce heating and cooling costs and enhance energy efficiency, thereby fostering market growth.

In the scope of work, the report includes products offered by companies such as Johns Manville, Cellofoam North America Inc, Owens Corning, Atlas Roofing Corporation, Compagnie de Saint-Gobain, Kingspan, Knauf Insulation, JSP, Korff Isolmatic Sp. z o.o., HOLCIM, and others.

The market is a vital sector in the construction industry, focused on enhancing energy efficiency, thermal comfort, and safety in buildings. With growing emphasis on sustainability and energy conservation, there is an increasing demand for high-performance materials.

These materials are crucial for reducing heating and cooling costs, improving building durability, and ensuring compliance with energy efficiency standards. The market is evolving with innovations in material technology, meeting the needs of both residential and commercial construction projects globally.

- According to the European Union, buildings account for approximately 40% of the total energy consumption and over a third of regional emissions. To enhance energy efficiency, the EU has updated the Energy Performance of Buildings Directive, effective across all member states from May 2024.

The insulation materials market refers to the industry involved in the production and supply of materials that are used to reduce the transfer of heat, sound, and electricity in buildings and other structures. These materials are essential for improving energy efficiency, enhancing indoor comfort, and ensuring safety by providing fire resistance and preventing moisture buildup.

They play a critical role in reducing heating and cooling costs, maintaining temperature control, and minimizing environmental impact. The market encompasses a broad range of materials, each serving specific purposes in construction and industrial applications.

Insulation materials are widely used in new buildings, renovations, and retrofitting projects to meet energy efficiency standards, contributing to long-term sustainability and cost savings.

Analyst’s Review

The insulation materials market is highly dynamic, with manufacturers focusing on product innovation, cost efficiency, and sustainability to maintain competitiveness. Companies are expanding product portfolios, enhancing material performance, and using eco-friendly manufacturing processes to cater to growing demand for energy-efficient and sustainable solutions.

Strategic partnerships, acquisitions, and global expansion are key strategies for companies to strengthen market presence and capitalize on emerging opportunities in new constructions and retrofitting projects.

- In December 2024, Saint-Gobain acquired Kilwaughter Minerals, a leading provider of façade mortars and external wall insulation systems in the UK and Ireland. This strategic move enhances Saint-Gobain’s sustainable construction solutions, aligning with its commitment to innovation, decarbonization, and sustainability in insulation materials.

Insulation Materials Market Growth Factors

The rising focus on indoor air quality is boosting the demand for non-toxic, mold-resistant insulation materials that prevent allergen buildup, thereby enhancing the health and well-being of building occupants. As consumers become more conscious of the materials used in their living and working spaces, bio-based insulation materials derived from renewable resources are gaining popularity.

These materials improve air quality and support sustainability goals, propelling the growth of the insulation materials market.

- In March 2024, Bauder introduced its innovative biomass-balanced thermal insulation, BauderECO FF, at the Futurebuild event in London. This product is designed to meet stricter energy consumption reduction standards and sustainability goals, responding to the growing demand for non-toxic, eco-friendly insulation materials that improve indoor air quality. The launch reflects the industry's shift toward sustainable, health-conscious solutions.

The production of certain insulation materials relies on raw materials that are either scarce or subject to market fluctuations, such as petroleum-based products or specific minerals,which poses a challenge to the expansion of the insulation materials market. These supply chain vulnerabilities can increase costs and disrupt production.

Innovation, along with diversifying sourcing and investing in renewable alternatives, can help stabilize supply chains, reduce reliance on volatile raw materials, and ensure more consistent production and pricing for insulation products.

Insulation Materials Industry Trends

Technological advancements are reshaping the insulation materials market, focusing on improved performance and sustainability. There is a growing trend toward the development of high-performance insulation materials that offer superior thermal resistance while being thinner and lighter, which enhances energy efficiency without occupying excessive space.

Additionally, manufacturers are adopting sustainable production techniques and leveraging advanced technologies to improve the quality and durability of these materials. This trend aligns with the increasing demand for energy-efficient and sustainable insulation material.

- In December 2024, ICL launched VeriQuel R100, a reactive phosphorus flame retardant designed for rigid polyurethane insulation products. Backed by over USD 2 million invested in R&D, this sustainable alternative to traditional flame retardants offers enhanced safety, durability, and stability while ensuring compliance with environmental regulations.

Another notable trend in the insulation materials market is the rising demand for customized solutions that cater to specific requirements. As consumer preferences evolve and environmental conditions vary, manufacturers are focusing on specialized products that address unique thermal, acoustic, and moisture control needs.

This trend spans residential, commercial, and industrial sectors, with insulation materials being designed to meet distinct performance standards based on climate, building type, and regulatory requirements. Tailored solutions enhance energy efficiency, durability, and comfort, contributing to more sustainable and efficient building practices.

- In May 2023, researchers from the Fraunhofer Institute and PROCERAM GmbH developed a sustainable, mineral-based insulation material that outperforms polystyrene, providing equivalent insulation with half the thickness. This innovation aligns with the increasing demand for customized insulation solutions that enhance energy efficiency and sustainability.

Segmentation Analysis

The global market has been segmented based on application, end-use industry, material type, form, and geography.

By Application

Based on application, the market has been segmented into automotive, building & construction, cold storage, and others. The building & construction segment led the insulation materials market in 2023, reaching a valuation of USD 30.08 billion. This growth is largely attributed to the increasing focus on energy efficiency, sustainability, and environmental regulations.

As demand for energy-efficient buildings rises, insulation materials are being tailored to meet specific needs such as thermal, acoustic, and moisture control. Advancements in materials offer improved performance with reduced thickness, enhancing space efficiency. The demand for customized solutions, designed for different climates and building types, is fostering innovation.

Additionally, stricter building codes and growing environmental awareness are fostering the adoption of high-performance, eco-friendly insulation materials in both residential and commercial sectors.

By End-Use Industry

Based on end-use industry, the market has been classified into commercial, residential, and others. The residential segment secured the largest revenue share of 39.08% in 2023. The surging demand for energy-efficient residential buildings is significantly contributing to segmental expansion.

Homeowners and developers are increasingly prioritizing sustainable construction practices, focusing on materials that reduce energy consumption and enhance comfort. Insulation materials improve thermal performance, reduce noise, and control humidity, leading to better indoor air quality.

Stricter energy codes become stricter and rising environmental concerns are fueling the adoption of advanced, high-performance insulation solutions, fostering the growth of the residential segment.

By Material Type

Based on material, the market has been classified into fiberglass, foam, mineral wool, cellulose, and others. The fiberglass segment is set to witness significant growth, recording a CAGR of 6.12% through the forecast period. Fiberglass is widely used for its excellent thermal performance, cost-effectiveness, and ease of installation.

Composed of fine glass fibers, it effectively reduces heat transfer, making it an ideal choice for improving energy efficiency in residential and commercial buildings. Fiberglass insulation is non-combustible moisture-resistant, and prevents mold and mildew, improving indoor air quality. Additionally, it is available in various forms, including batt, roll, and blown-in insulation, making it versatile for different applications.

Insulation Materials Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific insulation materials market accounted for a substantial share of around 39.71% in 2023, with a valuation of USD 26.25 billion. This dominance is reinforced by rapid urbanization, growing construction activities, and a strong focus on energy efficiency.

Countries such as China, India, and Japan are experiencing significant infrastructure development, leading to higher demand for insulation materials in both residential and commercial buildings. Additionally, stricter energy regulations and government initiatives promoting sustainable construction practices are increasing the adoption of advanced insulation solutions.

The region's expanding middle-class population, increasing awareness of energy conservation, and a shift toward eco-friendly building practices are further boosting regional market growth. With cost-effective production and rising investments, Asia-Pacific remains the leading region the insulation material market.

Europe insualtion materials market is anticipated to experience significant growth over the forecast period, registering a CAGR of 6.91%. This rapid expansion is driven by stringent building codes, sustainability goals, and a strong emphasis on reducing carbon emissions.

With a commitment to achieving net-zero, the region is promoting the widespread adoption of energy-efficient construction materials, particularly advanced insulation solutions.

Additionally, the growing focus on retrofitting older buildings to meet modern energy standards is further boosting the demand for insulation materials. This combination of regulatory support and environmental awareness is fostering regional market growth.

Competitive Landscape

The global insulation materials market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Insulation Materials Market

- Johns Manville

- Cellofoam North America Inc

- Owens Corning

- Atlas Roofing Corporation

- Compagnie de Saint-Gobain

- Kingspan

- Knauf Insulation

- JSP

- Korff Isolmatic Sp. z o.o.

- HOLCIM

Key Industry Developments

- December 2024 (Expansion): Rockwool’s Board of Directors approved an investment of over USD 100 million to establish a new production line in Marshall, Mississippi, aimed at meeting the rising demand for industrial insulation products in North America. This facility will manufacture insulation solutions featuring Rockwool’s WR-Tech and CR-Tech technologies, designed to enhance water repellency and corrosion resistance, addressing the specific needs of the Gulf of Mexico region.

- November 2024 (Expansion): Rockwool, a global leader in non-combustible insulation, announced the acquisition of 114 acres (46 hectares) at the Peddimore site, northeast of Birmingham, for a new manufacturing facility. The plant will incorporate proprietary electric melting technology for stone wool insulation products, enhancing supply capacity for customers in the UK and Republic of Ireland. This major investment is expected to generate long-term skilled jobs, support local supply chain development, and contribute to the UK’s net-zero goals, while furthering Rockwool’s commitment to sustainability and efficient building solutions.

The global insulation materials market has been segmented as:

By Application

- Automotive

- Building & Construction

- Cold Storage

- Others

By End-Use Industry

- Commercial

- Residential

- Others

By Material Type

- Fiberglass

- Foam

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Polyurethane (PU)

- Polyisocyanurate (PIR)

- Mineral Wool

- Cellulose

- Others

By Form

- Batt and Rolls

- Loose-Fill

- Spray Foam

- Rigid Board

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America