Insomnia Therapeutics Market Overview

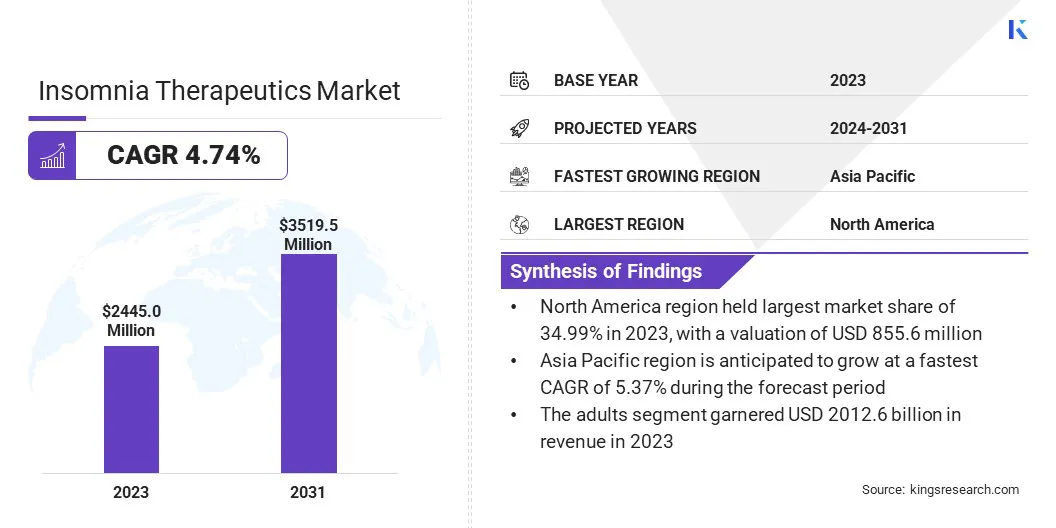

The global insomnia therapeutics market size was valued at USD 2445.0 million in 2023 and is projected to grow from USD 2545.8 million in 2024 to USD 3519.5 million by 2031, exhibiting a CAGR of 4.74% during the forecast period.

The market is driven by the increasing prevalence of sleep disorders globally and rising awareness of the importance of sleep health. The expanding aging population, which is more susceptible to sleep disturbances, along with lifestyle changes leading to heightened stress and anxiety, has fueled the demand for effective insomnia treatments.

Key Market Highlights:

- The insomnia therapeutics industry size was valued at USD 2445.0 million in 2023.

- The market is projected to grow at a CAGR of 4.74% from 2024 to 2031.

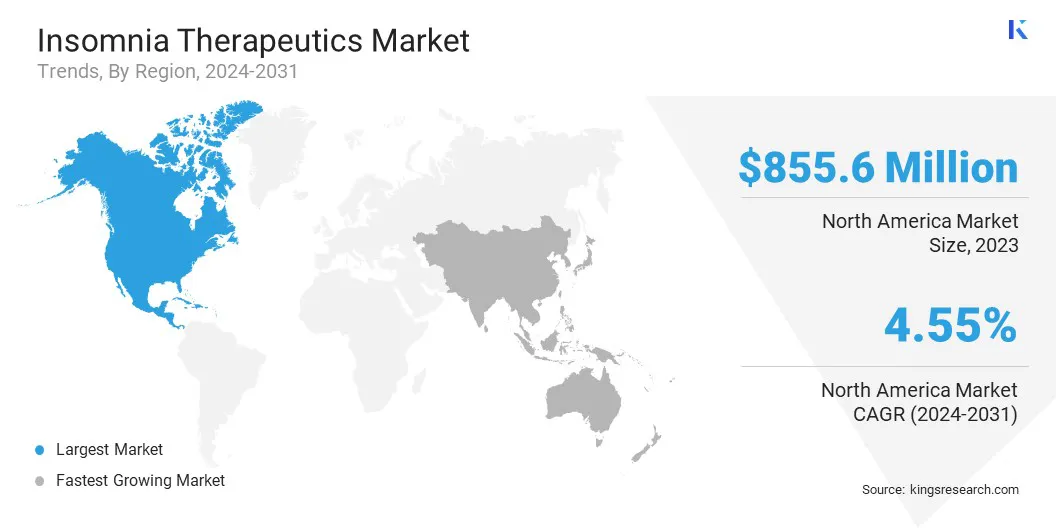

- North America held a market share of 34.99% in 2023, with a valuation of USD 855.6 million.

- The pharmacological therapy segment garnered USD 1661.6 million in revenue in 2023.

- The oral segment is expected to reach USD 2749.1 million by 2031.

- The retail pharmacies segment is expected to reach USD 1690.1 million by 2031.

- The adults segment is expected to reach USD 2917.0 million by 2031.

- The male segment is expected to reach USD 1821.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.37% during the forecast period.

Major companies operating in the insomnia therapeutics market are Jazz Pharmaceuticals plc, Sanofi S.A., Takeda Pharmaceutical Company Limited., Natrol, LLC., Idorsia Pharmaceuticals Ltd, Merck & Co., Inc., Eisai Co., Ltd., SUSMED, Inc, BigHealth, Eli Lilly and Company, Pfizer Inc., and dsm-firmenich.

The growing adoption of digital therapeutics and cognitive behavioral therapy for insomnia (CBT-I) is reshaping treatment approaches, offering non-invasive and long-term management solutions. Supportive healthcare policies, increased investments in sleep research, and the integration of Artificial Intelligence (AI) in sleep tracking and therapy delivery are also contributing to the market's positive trajectory.

- In April 2024, dsm-firmenich and Oz Medicann Group (OMG) Pharma announced their strategic collaboration to advance the development of cannabidiol (CBD)-based orally dispersible tablets for insomnia. This collaboration aims to introduce the world’s first regulatory-approved CBD sleep medication, reinforcing dsm-firmenich’s role in cannabinoid research and patient-focused innovation.

Rising Prevalence of Insomnia

The market is driven by the rising prevalence of insomnia and sleep disorders, which has become a growing public health concern globally. Modern lifestyle changes, including increased stress, anxiety, and exposure to digital screens, have significantly contributed to disrupted sleep patterns.

Additionally, the aging population, which is more susceptible to sleep disturbances due to physiological changes and comorbid conditions, further fuels the market demand. The impact of shift work, irregular sleep schedules, and mental health disorders has also led to a surge in insomnia cases across various demographics.

Several individuals are seeking effective therapeutic solutions as awareness of the long-term health risks associated with poor sleep such as cardiovascular diseases, cognitive decline, and weakened immune function increases. This rising burden of insomnia is accelerating the demand for both pharmacological and non-pharmacological treatments, propelling the market growth.

Safety Concerns and Dependency Risks

Major challenges in the insomnia therapeutics market are the long-term safety concerns and dependency risks associated with pharmacological treatments. Many prescription sleep medications, such as benzodiazepines and non-benzodiazepine sedatives, are linked to side effects like daytime drowsiness, cognitive impairment, and addiction potential, leading to regulatory scrutiny and restricted usage.

A potential solution lies in the development of safer alternatives, such as orexin receptor antagonists, melatonin-based therapies, and digital therapeutics like cognitive behavioral therapy for insomnia (CBT-I), which offer non-habit-forming and sustainable treatment options.

AI-driven Digital Solutions and OTC Sleep Aids

The market is evolving with the rise of AI-driven digital health solutions and the growing demand for OTC and natural sleep aids. AI-powered CBT-I programs, wearable sleep trackers, and virtual therapy platforms are enhancing personalized treatment options.

Simultaneously, consumers are shifting toward melatonin supplements, herbal remedies, and nutraceutical sleep aids due to their accessibility and perceived safety. This trend is driving innovation in non-prescription sleep solutions, expanding availability across retail and online platforms.

- In November 2024, Sleepinox.com introduced a natural sleep supplement formulated by anesthesiologists to enhance sleep quality. It features borage, ashwagandha, magnesium glycinate, and valerian root (10:1 concentrate)-a scientifically backed blend designed to promote relaxation, reduce stress, and support deep, restorative sleep.

Insomnia Therapeutics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Therapy Type

|

Pharmacological Therapy (Prescription Drugs (Benzodiazepines, Non-Benzodiazepine Hypnotics, Orexin Receptor Antagonists, Antidepressants, Antihistamines) OTC Drugs (Melatonin Supplements, Herbal and Natural Remedies), Non-Pharmacological Therapy (CBT-I, Light Therapy, Acupuncture and Relaxation Techniques, Digital Therapeutics)

|

|

By Route of Administration

|

Oral, Injectable

|

|

By Distribution Channel

|

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

|

|

By Patient Population Type

|

Adults, Geriatric, Pediatric

|

|

By Patient Gender

|

Male, Female, Other

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Therapy Type (Pharmacological Therapy, Non-Pharmacological Therapy): The pharmacological therapy segment earned USD 1661.6 million in 2023, due to the widespread use of prescription sleep medications and the continuous development of novel hypnotic drugs with improved efficacy and safety.

- By Route of Administration (Oral, Injectable): The oral segment held 78.92% share of the market in 2023, due to the high patient preference for convenience, ease of administration, and the availability of a wide range of oral insomnia medications.

- By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies): The retail pharmacies segment is projected to reach USD 1690.1 million by 2031, owing to the increasing accessibility of OTC and prescription sleep aids through brick-and-mortar and chain pharmacies.

- By Patient Population Type (Adults, Geriatric, Pediatric): The adults segment is projected to reach USD 2917.0 million by 2031, owing to the high prevalence of insomnia among working professionals and individuals experiencing lifestyle-related stress and anxiety.

- By Patient Gender (Male, Female, Other): The male segment held 52.06% share of the market in 2023, due to higher reported cases of sleep disturbances linked to occupational stress, lifestyle habits, and a greater likelihood of seeking pharmacological treatment.

Insomnia Therapeutics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 34.99% share of the insomnia therapeutics market in 2023, with a valuation of USD 855.6 million. The market dominance of this region is attributed to the high prevalence of insomnia, increasing awareness of sleep disorders, and the widespread availability of advanced treatment options.

The strong presence of leading pharmaceutical companies, continuous Research and Development (R&D) activities, and the rapid adoption of digital therapeutics further bolster market growth.

Additionally, favorable healthcare policies, high healthcare expenditure, and a well-established distribution network contribute to the market's expansion in North America. The rising use of prescription sleep aids, cognitive behavioral therapy for insomnia (CBT-I), and AI-driven sleep tracking solutions also support market advancement.

- In March 2024, according to the survey funded by the American Academy of Sleep Medicine, 12% of the American population has been detected with chronic insomnia. The findings emphasize the rising burden of sleep disorders and the growing demand for effective therapeutic solutions.

The market in Asia Pacific is poised to grow at a significant CAGR of 5.37% over the forecast period, driven by urbanization, changing lifestyles, and increasing cases of sleep disorders linked to stress and irregular work schedules.

The rising geriatric population, particularly in China and Japan, along with a growing middle-class population with increasing healthcare awareness, is boosting the demand for insomnia therapeutics.

Additionally, expanding healthcare infrastructure, increasing investment in sleep disorder treatments, and the availability of both pharmacological and non-pharmacological therapies contribute to the market expansion in the region. The growing adoption of digital health solutions and online pharmacies is also playing a crucial role in improving treatment accessibility across Asia Pacific.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates insomnia therapeutics under the Center for Drug Evaluation and Research (CDER). Prescription sleep medications undergo a rigorous New Drug Application (NDA) process, including clinical trials for safety and efficacy.

- In Europe, the European Medicines Agency (EMA) regulates insomnia therapeutics under the Committee for Medicinal Products for Human Use (CHMP). Prescription medications undergo evaluation through the Centralized Procedure, requiring approval for use across all EU member states.

Competitive Landscape

Key market players are focusing on product innovation, strategic partnerships, regulatory approvals, and market expansion to strengthen their market positions. Companies are actively investing in R&D to introduce novel therapeutics with improved efficacy, reduced side effects, and alternative mechanisms of action, such as orexin receptor antagonists and melatonin receptor agonists.

Mergers, acquisitions, and collaborations with biotechnology firms & research institutions are common strategies to accelerate drug development and gain access to advanced technologies. Many market players are also expanding their presence in emerging markets through distribution agreements and localization strategies to tap into the growing demand for insomnia treatments.

The adoption of digital therapeutics and cognitive behavioral therapy for insomnia (CBT-I) is gaining traction, prompting companies to invest in AI-driven sleep solutions, mobile health applications, and wearable sleep monitoring devices. Additionally, the focus on extended-release formulations and combination therapies is increasing to enhance patient adherence and provide long-term treatment options.

- In October 2023, Bod Science and dsm-firmenich announced its strategic partnership, to advance the development of a CBD-based treatment for insomnia. The collaboration follows promising Phase IIb clinical trial results demonstrating the efficacy of a cannabidiol formulation in alleviating insomnia symptoms. dsm-firmenich's GMP CBD API will play a key role in the next commercialization phase.

Key Companies in Insomnia Therapeutics Market:

- Jazz Pharmaceuticals plc

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited.

- Natrol, LLC.

- Idorsia Pharmaceuticals Ltd

- Merck & Co., Inc.

- Eisai Co., Ltd.

- SUSMED, Inc

- BigHealth

- Eli Lilly and Company

- Pfizer Inc.

- dsm-firmenich

Recent Developments (Partnerships)

- In December 2024, Shionogi & Co., Ltd. and Nxera Pharma Co., Ltd. announced the launch of QUVIVIQ (daridorexant) 25 and 50 mg in Japan as a new treatment for adults with insomnia. The drug, a Dual Orexin Receptor Antagonist, selectively binds to OX1R and OX2R receptors, inhibiting excessive wakefulness and promoting sleep. Under the partnership, Shionogi will handle distribution and sales, while Nxera Pharma Japan Co., Ltd. remains the approval holder.