Market Definition

Innovation management involves structured frameworks and processes designed to capture, evaluate, and implement novel ideas. It leverages tools such as idea management platforms, innovation portfolios, and collaboration networks to drive creative problem‑solving. The scope includes sectors such as technology, manufacturing, consumer goods, and services that require continuous improvement.

Organizations adopt innovation management for applications such as new product development, process optimization, digital transformation, and strategic growth initiatives to maintain a competitive edge and adapt to evolving market demands.

Innovation Management Market Overview

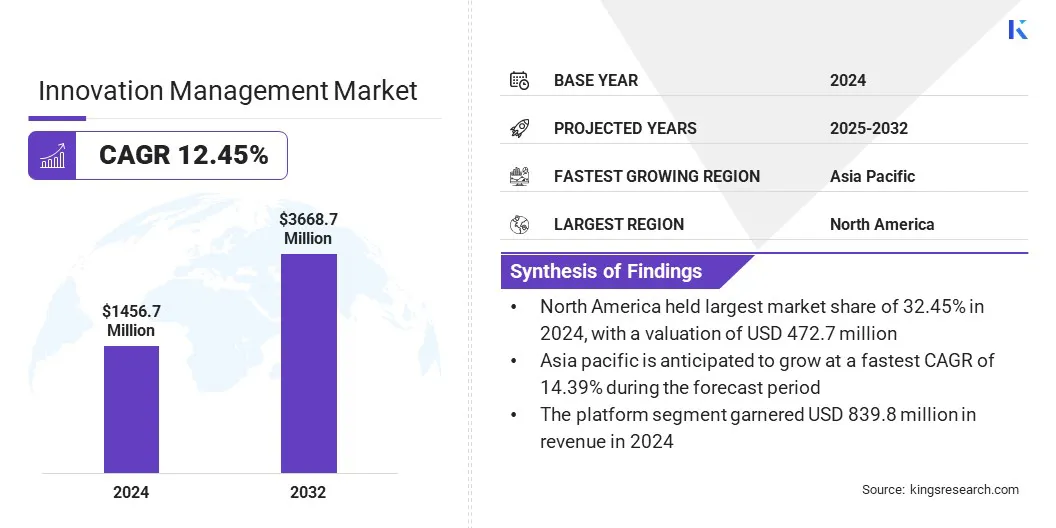

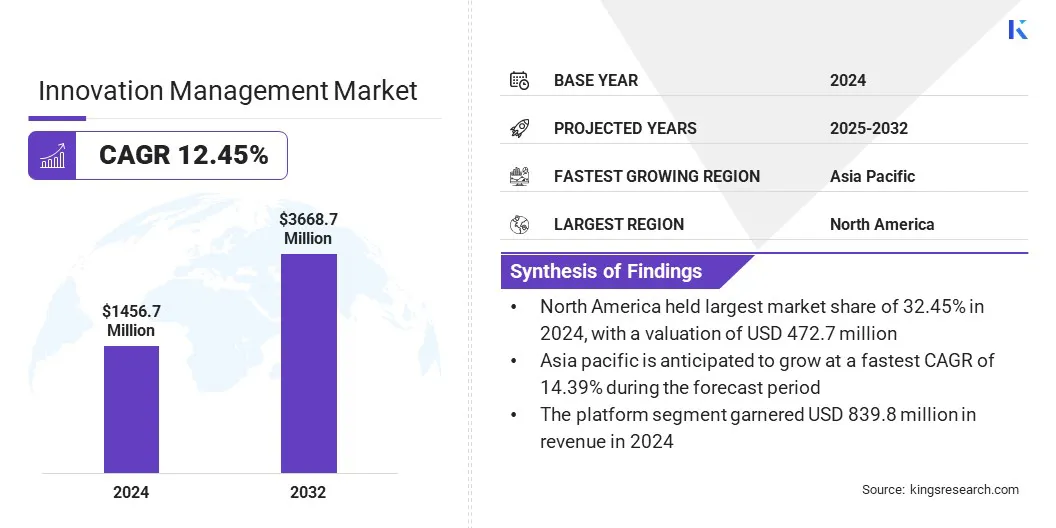

The global innovation management market size was valued at USD 1,456.7 million in 2024 and is projected to grow from USD 1,614.0 million in 2025 to USD 3,668.7 million by 2032, exhibiting a CAGR of 12.45% during the forecast period.

The market is driven by the increasing demand for centralized idea management platforms that streamline collaboration and align innovation efforts across departments. Additionally, advancements in AI are enhancing idea evaluation by automating ranking, filtering, and decision-making processes, helping organizations identify high-potential ideas more efficiently and accelerate innovation.

Major companies operating in the innovation management industry are Aha! Labs Inc., Wellspring, Planview, Planisware, IdeaScale, Wazoku, AEVO TI., ITONICS GmbH, HYPE, Brightidea, Qmarkets, Canny, NanoNotion, Medallia Inc., and Preferred Patron Loyalty, LLC.

Growing adoption of open innovation models is driving the expansion of the market across industries seeking faster and more efficient product development. Organizations are increasingly collaborating with external partners such as startups, research institutions, suppliers, and customers to access diverse knowledge and capabilities.

- The 2023 Open Innovation Report by Sopra Steria, in collaboration with Ipsos and INSEAD, found that 72% of European companies are actively engaged in open innovation projects with startups and 67% view these partnerships as important or critical to their strategic goals.

Crowdsourcing platforms and digital innovation hubs are enabling structured idea-sharing, co-creation, and rapid feedback integration. These models are helping reduce internal R&D costs and shorten development cycles by tapping into external expertise and resources. Companies are using innovation management solutions to track, evaluate, and implement ideas from across their ecosystems.

Key Highlights

- The innovation management industry size was valued at USD 1,456.7 million in 2024.

- The market is projected to grow at a CAGR of 12.45%from 2025 to 2032.

- North America held a market share of 32.45% in 2024, with a valuation of USD 472.7 million.

- The platform segment garnered USD 839.8 million in revenue in 2024.

- The cloud-based segment is expected to reach USD 2,296.4 million by 2032.

- The large enterprises segment secured the largest revenue share of 58.65% in 2024.

- The product development management is poised for a robust CAGR of 13.57% through the forecast period.

- The healthcare & pharmaceuticals segment is projected to secure the largest revenue share of 30.08% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 14.39% during the forecast period.

Market Driver

Increasing Demand for Centralized Idea Management Platforms

Rising need for structured and scalable innovation processes is driving demand for centralized idea management platforms across enterprises. Organizations are increasingly implementing dedicated software tools to capture, organize, and evaluate ideas from employees, partners, and stakeholders across various departments and locations.

These platforms are enabling teams to collaborate more efficiently, track innovation progress, and align contributions with strategic goals. Large enterprises are using centralized systems to eliminate silos, enhance transparency, and streamline decision-making in innovation workflows.

- In March 2025, Aha! Labs Inc. introduced Aha! Discovery, a tool designed to help product teams centralize meeting transcripts, uncover key product insights, and link them to a roadmap. The company also launched Aha! Teamwork is a flexible project management tool for teams to complete tasks and stay aligned with strategic plans.

Market Challenge

High Upfront Costs and Integration Complexity Hindering Adoption

A key challenge in the innovation management market is the substantial initial investment required for software licensing, customization, and integration with existing legacy systems. These costs are especially challenging for small and medium enterprises that operate with limited IT resources and constrained budgets. The difficulty of integrating new platforms with varied workflows and data systems further delays implementation and limits efficiency improvements.

To address this challenge, market players are providing modular and cloud-based solutions that lower entry costs and simplify deployment. Companies are also enhancing interoperability features and offering tailored onboarding support to ease integration and accelerate value realization.

Market Trend

Advancing Idea Evaluation with AI

A key trend in the innovation management market is the adoption of AI-enabled platforms to streamline and enhance idea evaluation processes. These platforms are using machine learning, natural language processing, and predictive analytics to automatically analyze and rank submissions. Automated filtering is helping identify high-potential ideas more efficiently, reducing manual review efforts and bias.

Predictive models are estimating success likelihood based on historical data and innovation patterns. Organizations are gaining better visibility into innovation pipelines, improving decision-making and resource allocation. The market is adopting intelligent tools to improve idea retention, accelerate development, and increase project success rates.

Innovation Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Platform, Services

|

|

By Deployment Mode

|

On-premise, Cloud-based

|

|

By Enterprise Size

|

Large Enterprises, Small & Medium Enterprises (SMEs)

|

|

By Function

|

Product Development Management, Marketing & Business Processes, Design & Engineering, Others

|

|

By End-use Industry

|

IT & Telecommunications, Healthcare & Pharmaceuticals, BFSI, Manufacturing, Retail & E-commerce, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Platform and Services): The platform segment earned USD 839.8 million in 2024 due to the rising demand for integrated solutions that centralize idea capture, evaluation, and execution, enabling organizations to streamline innovation processes and enhance decision-making efficiency.

- By Deployment Mode (On-premise and Cloud-based): The cloud-based segment held 57.66% of the market in 2024, due to its scalability, ease of integration with existing enterprise systems, and ability to support real-time collaboration across geographically dispersed teams.

- By Enterprise Size (Large Enterprises and Small & Medium Enterprises (SMEs)): The large enterprises segment is projected to reach USD 1,980.4 million by 2032, owing to their greater need for structured innovation processes, cross-functional collaboration, and scalable platforms to manage high volumes of ideas across multiple business units.

- By Function (Product Development Management, Marketing & Business Processes, Design & Engineering, and Others): The product development management segment is poised for significant growth at a CAGR of 13.57% through the forecast period, attributed to the growing demand for structured solutions that streamline innovation workflows, reduce time-to-market, and support continuous product improvement in highly competitive sectors.

Innovation Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America innovation management market share stood at 32.45% in 2024 in the global market, with a valuation of USD 472.7 million. This dominance is attributed to the region's dynamic startup ecosystem, which is supported by active venture capital networks and incubators. This environment drives demand for tools that manage idea pipelines and innovation portfolios.

Startups and accelerators use these platforms to track product development and investor feedback, while larger enterprises leverage them to collaborate with startups and evaluate emerging innovations.

- According to the National Venture Capital Association (NVCA) 2025 Yearbook, in 2024, U.S. venture capital firms closed 14,320 deals worth USD 215.4 million, accounting for 57% of global venture capital deal value. Additionally, AI-related ventures accounted for 46.4% of total VC deal value and 28.9% of deal count in the U.S.

Asia Pacific is poised for significant growth at a robust CAGR of 14.39% over the forecast period. This growth is largely driven by the sharp growth of advanced manufacturing, electronics, and industrial automation in the Asia Pacific region.

Companies in these sectors are actively investing in innovation platforms to enhance product development, streamline processes, and integrate new technologies. The need to manage R&D pipelines and scale ideas across large, dispersed operations is further accelerating the adoption of structured innovation tools.

Additionally, enterprises across the region are rapidly advancing their digital transformation efforts, especially in telecom, automotive, and logistics, creating strong demand for platforms that enable digital idea submission, evaluation, and collaboration.

- In July 2024, CITIC Telecom, a leading APAC telecom operator, unveiled its “AI+ Action Plan” during the World AI Conference in Shanghai. The initiative integrates AI, big data, and cloud-network-security (“AI+ Computing Network”) across its Belt and Road infrastructure, empowering enterprises, specifically in telecom, manufacturing, and logistics to systematically submit, evaluate, and scale innovation via a centralized digital platform.

Regulatory Frameworks

- In the U.S., innovation is governed by frameworks such as the America Creating Opportunities to Meaningfully Promote Excellence in Technology, Education, and Science (COMPETES) Act, which supports regional innovation clusters, tech commercialization, and R&D financing. The Office of Science and Technology Policy (OSTP) also directs federal innovation initiatives. Recent executive actions require federal agencies to appoint Chief Artificial Intelligence Officers and establish safety standards to guide responsible innovation and emerging technology use.

- In the European Union, innovation is supported by regulations tied to the European Innovation Council (EIC) and the Horizon Europe Framework Programme, which fund high-impact R&D projects and scaleups. Regulations emphasize standardization, cross-border IP protection, and ethical AI development under the proposed Artificial Intelligence Act.

- China's regulatory approach centers on strengthening intellectual property (IP) protection and promoting commercialization. The China National Intellectual Property Administration (CNIPA) enforces stricter IP laws and mandates IP asset reporting for government-funded research. Under the 14th Five-Year Plan, the country promotes patent navigation systems and requires enterprises to develop internal IP management mechanisms.

- South Korea regulates innovation through its Regulatory Sandbox Program, which permits controlled testing of new technologies in ICT, fintech, and smart cities. The Artificial Intelligence Framework Act, passed in 2024, introduces a tiered oversight system that classifies AI by risk level, balancing safety with innovation. The Ministry of Science and ICT also launched Integrated R&D Information System (IRIS) 2.0, which leverages big data to manage national R&D projects transparently.

Competitive Landscape

Major players in the innovation management industry are adopting strategies such as platform integration, digital workflow automation, and strategic partnerships to improve efficiency and enhance innovation management.

Many companies are focusing on streamlining IP operations by investing in tools that centralize collaboration, reduce manual processes, and improve data accuracy. These efforts are often supported by targeted R&D and technology upgrades, which strengthen internal systems by improving speed and reliability in innovation workflows.

- In June 2024, Clarivate launched the IP Collaboration Hub, a platform that integrates with Clarivate IP management systems to centralize and standardize collaboration with local agents during patent and trademark filing processes. It provides automated docketing and reduces reliance on email, enhancing workflow efficiency and error reduction.

List of Key Companies in Innovation Management Market:

- Aha! Labs Inc.

- Wellspring

- Planview

- Planisware

- IdeaScale

- Wazoku

- AEVO TI.

- ITONICS GmbH

- HYPE

- Brightidea

- Qmarkets

- Canny

- NanoNotion

- Medallia Inc.

- Preferred Patron Loyalty, LLC.

Recent Developments (Partnerships/Product Launch)

- In April 2025, Wazoku entered into a partnership with the National Innovation Center par Excellence (NICE) in China. The collaboration aims to fund and support innovation initiatives within the Yangtze River Delta region. It enables access to Wazoku’s idea-management platform for government and industry stakeholders.

- In October 2024, AION Labs launched ProPhet, a startup focused on AI-based small-molecule identification. ProPhet utilizes machine learning models, including diffusion approaches and large language models, to discover active compounds targeting proteins with limited information. The venture supports AION Labs’ strategy to accelerate drug discovery innovation.

- In July 2024, FPT Software entered into a strategic partnership with the Project Management Institute (PMI). The Memorandum of Understanding supports the development of a career-long project management certification framework for FPT’s technology teams. The initiative aims to standardize delivery and enhance service consistency across offshore and onshore operations.

to