Market Definition

The injector nozzle market encompasses the production and development of precision-engineered nozzles used in fuel injection systems to optimize fuel atomization and combustion efficiency. These nozzles are designed to deliver fuel in precise quantities and patterns, ensuring improved engine performance, lower emissions, and enhanced fuel economy.

Manufactured using high-strength alloys and advanced coatings, injector nozzles undergo complex processes, including micro-machining and laser drilling, to achieve accurate spray patterns.

They are widely used in gasoline and diesel engines across passenger cars, commercial vehicles, and industrial machinery. Additionally, evolving applications in alternative fuel systems, such as methanol and ammonia injection, are expanding their role in sustainable transportation.

Injector Nozzle Market Overview

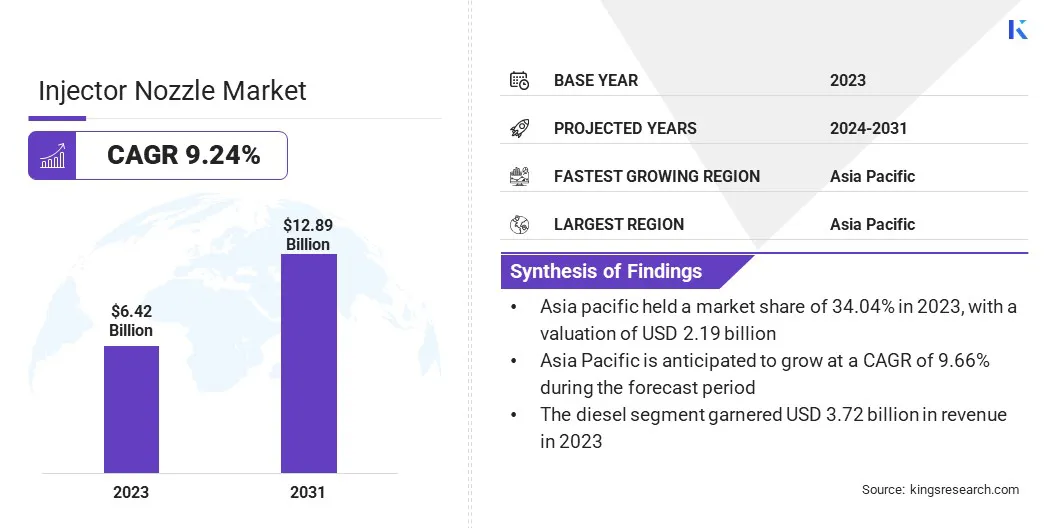

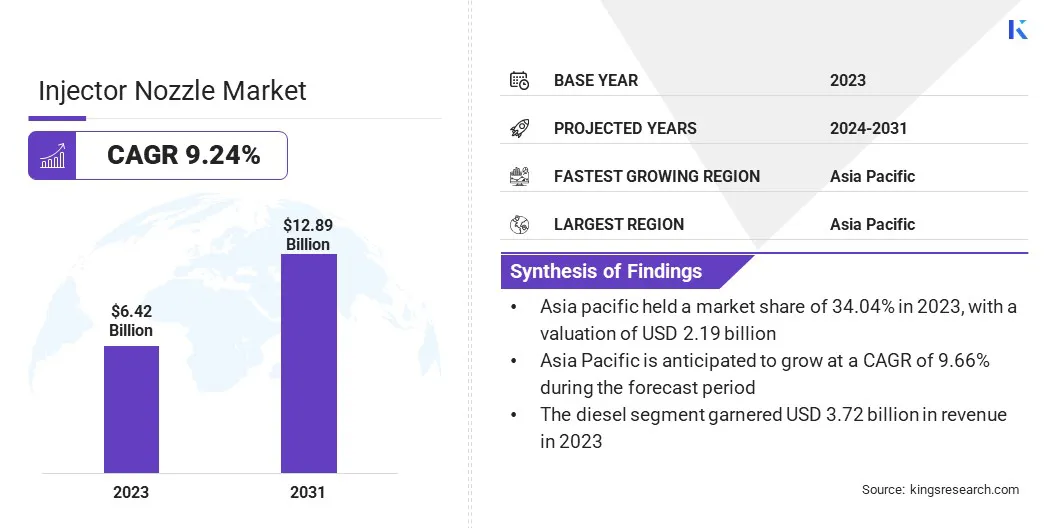

The global injector nozzle market size was valued at USD 6.42 billion in 2023 and is projected to grow from USD 6.95 billion in 2024 to USD 12.89 billion by 2031, exhibiting a CAGR of 9.24% during the forecast period.

The market is expanding, due to the increasing adoption of fuel-efficient technologies and emission regulations globally. Automakers are integrating advanced fuel injection systems, such as Gasoline Direct Injection (GDI) and Multi-Port Fuel Injection (MFI), to enhance engine performance and reduce emissions.

Additionally, the rising demand for alternative fuels, including methanol and ammonia, is leading to innovative injector nozzle designs that support sustainable fuel solutions.

Major companies operating in the global injector nozzle industry are Robert Bosch GmbH, Denso Corporation, Delphi Technologies, Continental AG, Stanadyne LLC, Cummins Inc., Magneti Marelli S.p.A., Eaton, Hitachi Astemo Americas, Inc, Keihin Corporation, Woodward, Yamaha Motor Co., Ltd., Mitsubishi Electric Corporation, Liebherr, and Dongguan Guanlian Hardware Auto Parts Co., Ltd.

Expanding vehicle production globally is fueling the market. Manufacturers are increasing output to meet rising consumer demand, particularly in emerging economies such as India, China, and Brazil.

- In 2024, Global Change Data Lab indicated that global new car sales increased to 76.67 million in 2023, compared to 72.86 million in 2022.

The shift toward fuel-efficient and high-performance engines has intensified the need for advanced injector nozzles that enhance combustion efficiency. Rising disposable income and rapid urbanization have led to higher automobile ownership, further strengthening demand.

The increasing preference for gasoline direct injection and common rail direct injection technologies is accelerating market expansion, as automakers focus on improving vehicle efficiency and compliance with fuel economy standards.

Key Highlights:

- The global injector nozzle market size was valued at USD 6.42 billion in 2023.

- The market is projected to grow at a CAGR of 9.24% from 2024 to 2031.

- Asia Pacific held a market share of 34.04% in 2023, with a valuation of USD 2.19 billion.

- The diesel direct injection segment garnered USD 2.47 billion in revenue in 2023.

- The diesel segment is expected to reach USD 7.45 billion by 2031.

- The commercial vehicles is poised for a robust CAGR of 9.31% through the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 9.26% during the forecast period.

Market Driver

"Rising Adoption of Alternative Fuels"

The shift toward alternative fuels such as compressed natural gas, liquefied petroleum gas, and biofuels is driving the injector nozzle market. Automakers are modifying fuel injection systems to accommodate different fuel compositions while maintaining efficiency.

Injector nozzles play a crucial role in ensuring optimal combustion and reducing emissions in vehicles using non-traditional fuels. Government incentives for clean energy adoption have encouraged automotive manufacturers to develop injection technologies that support alternative fuel applications.

The demand for fuel-flexible engines is rising, leading to increased investment in specialized injector nozzles that enhance performance while complying with environmental regulations.

- The latest report from the Alternative Fuels Data Center (AFDC) states that over 175,000 vehicles in the U.S. and approximately 23 billion vehicles globally run on natural gas. The Energy Policy Act of 1992 classifies both CNG and LNG as alternative fuels.

Market Challenge

"Complexity in Precision Manufacturing and Cost Constraints"

The injector nozzle market faces challenges, due to the high precision required in manufacturing and the associated production costs. Injector nozzles must meet performance standards, ensuring optimal fuel atomization and combustion efficiency. Achieving this level of precision increases production complexity and costs, affecting affordability for manufacturers and end-users.

Companies are investing in advanced manufacturing techniques such as laser drilling and additive manufacturing to enhance precision while reducing waste. Additionally, strategic partnerships with material suppliers and research institutions are fostering innovations in durable and cost-effective materials, improving performance while maintaining competitive pricing.

Market Trend

"Increasing Demand in Commercial and Heavy-duty Vehicles"

The expansion of logistics, construction, and agriculture sectors is fueling the injector nozzle market. Rising demand for commercial trucks, buses, and off-road vehicles has increased the need for high-performance fuel injection systems.

Heavy-duty diesel engines require efficient fuel delivery mechanisms to ensure optimal combustion, engine longevity, and reduced emissions. Fleet operators are investing in vehicles with advanced injector nozzle technologies to enhance operational efficiency and meet emission standards.

The growth of e-commerce and global supply chains has further intensified the demand for fuel-efficient transportation solutions, prompting manufacturers to develop high-precision injector nozzles for heavy-duty applications.

- The UN Environment Programme's February 2024 report highlights that heavy-duty vehicle (HDV) exports account for 3.6% of the total value of the global automotive trade. The study projects significant growth in the HDV segment, driven by expanding economic activities and the rising demand for transporting people and goods.

Injector Nozzle Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Gasoline Port Fuel Injection, Diesel Direct Injection, Gasoline Direct Injection

|

|

By Propulsion

|

Diesel, Gasoline

|

|

By Vehicle

|

Two Wheelers, Passenger Cars, Commercial Vehicles

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Gasoline Port Fuel Injection, Diesel Direct Injection, Gasoline Direct Injection): The diesel direct injection segment earned USD 2.47 billion in 2023, due to its higher fuel efficiency, superior combustion control, and ability to meet emission standards, making it the preferred technology for commercial vehicles and heavy-duty applications.

- By Propulsion (Diesel, Gasoline): The diesel segment held 57.87% share of the market in 2023, due to its widespread use in commercial vehicles, construction equipment, and marine applications, driven by superior fuel efficiency, high torque output, and durability in heavy-duty operations.

- By Vehicle (Two Wheelers, Passenger Cars, Commercial Vehicles): The passenger cars segment is projected to reach USD 4.46 billion by 2031, owing to the rising production and sales of fuel-efficient vehicles, increasing adoption of advanced fuel injection technologies, and emission regulations requiring precise fuel delivery systems to enhance engine performance and reduce emissions.

Injector Nozzle Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a injector nozzle market share of around 34.04% in 2023, with a valuation of USD 2.19 billion. The rising demand for two-wheelers and compact cars across Asia Pacific is contributing to the expansion of the market.

Urbanization and increasing middle-class incomes have fueled the preference for affordable and fuel-efficient vehicles. Countries such as India, Indonesia, and Vietnam are registering significant growth in motorcycle and small car sales, driving the need for efficient fuel injection systems.

Automakers are equipping these vehicles with advanced injector nozzles to enhance mileage, reduce emissions, and meet fuel economy standards. The increasing focus on cost-effective mobility solutions is further supporting the adoption of precision-engineered fuel injectors.

- The 2024 Asian Transport Outlook (ATO) report highlights that Asia is advancing rapidly in electric two- and three-wheeler sales. Around 94% of all EVs sold in the region belong to these categories, with the majority of electric two- and three-wheelers concentrated in Asia.

Additionally, the rapid expansion of automotive production in Asia Pacific is driving the market. Countries such as China, India, Japan, and South Korea serve as major automotive manufacturing hubs, supplying vehicles domestically and globally. Automakers are investing in advanced fuel injection systems to improve engine performance and meet evolving efficiency standards.

The growing presence of global and regional manufacturers has intensified competition, prompting companies to enhance production capabilities and integrate precision-engineered injector nozzles into modern vehicle designs. Rising domestic demand for passenger and commercial vehicles is further strengthening the market growth.

The injector nozzle industry in Europe is poised for significant growth at a robust CAGR of 9.26% over the forecast period. The introduction of Euro 7 emission regulations is fueling the market in Europe.

These standards require automakers to achieve stricter nitrogen oxide (NOx) and particulate matter (PM) limits, prompting the adoption of advanced fuel injection systems. Precision-engineered injector nozzles with high-pressure direct injection technology are being integrated into internal combustion engines (ICEs) to enhance fuel atomization and reduce emissions.

European automakers are investing in innovative injection solutions to comply with these evolving regulations, strengthening the demand for next-generation fuel injector nozzles across the region.

Furthermore, the European Union's (EU) push for alternative fuels is accelerating the adoption of hydrogen and e-fuels in internal combustion engines, creating demand for specialized injector nozzles.

Countries such as Germany, France, and the Netherlands are promoting hydrogen-powered heavy-duty vehicles, which require injector nozzles capable of handling hydrogen’s unique combustion properties.

Additionally, synthetic e-fuels, developed as a low-carbon alternative to gasoline and diesel, require modified fuel injection systems. Automakers and fuel injection system manufacturers are investing in research to develop high-performance nozzles optimized for hydrogen and synthetic fuels, supporting market expansion.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces emission standards for vehicles, directly influencing injector nozzle specifications. The EPA has finalized standards for passenger cars, light-duty trucks, medium-duty vehicles, and heavy-duty vehicles for model years 2027 through 2032 and beyond, aiming to reduce smog, soot, and toxic pollution from vehicles and engines.

- The EU has established comprehensive emission standards known as Euro standards, with the latest being Euro 7. These standards set limits on nitrogen oxides (NOx), hydrocarbons, carbon monoxide (CO), and particulate matter (PM) emissions for vehicles. Compliance with these standards requires the adoption of advanced injector nozzle technologies to ensure precise fuel delivery and optimal combustion.

- In China, the Ministry of Ecology and Environment (MEE) oversees vehicle emission standards. The China 6 emission standard, which is comparable to Euro 6, imposes limits on NOx and PM emissions. Manufacturers must utilize advanced injector nozzle technologies that ensure efficient fuel atomization and combustion.

- In Japan, the Ministry of the Environment sets vehicle emission standards, known for its rigorous regulations. The Post New Long-Term Regulations focus on reducing NOx and PM emissions, influencing the design and performance of injector nozzles to achieve cleaner combustion processes.

Competitive Landscape:

The global injector nozzle market is characterized by market players that are implementing strategic initiatives, including the expansion of fuel injection programs, to strengthen their market presence and meet the growing demand for advanced fuel injection technologies.

Companies are introducing a broader range of fuel injectors, including Gasoline Direct Injection (GDI), Multi-Port Fuel Injection (MFI), and Throttle Body Injection (TBI) systems, to enhance vehicle performance and fuel efficiency.

These expansions align with the increasing adoption of fuel-efficient technologies and emission regulations, driving the market. Continuous product innovation and comprehensive repair solutions are further contributing to market expansion.

- In January 2024, Standard Motor Products, Inc. announced the expansion of its Gasoline Fuel Injection program. The comprehensive program includes over 1,100 brand-new, non-remanufactured fuel injectors, covering Gasoline Direct Injection (GDI), Multi-Port Fuel Injection (MFI), and Throttle Body Injection (TBI) systems. Additionally, it offers Fuel Injector Multi-Packs, providing a complete repair solution. The increasing adoption of GDI and MFI systems in modern vehicles is accelerating the growth of the market, fostering technological advancements and product innovation.

List of Key Companies in Injector Nozzle Market:

- Robert Bosch GmbH

- Denso Corporation

- Delphi Technologies

- Continental AG

- Stanadyne LLC

- Cummins Inc.

- Magneti Marelli S.p.A.

- Eaton

- Hitachi Astemo Americas, Inc

- Keihin Corporation

- Woodward

- Yamaha Motor Co., Ltd.

- Mitsubishi Electric Corporation

- Liebherr

- Dongguan Guanlian Hardware Auto Parts Co., Ltd.

Recent Developments (Product Launch)

- In October 2024, Woodward introduced products featuring the latest advancements in injection systems designed for emerging P2X fuels, with a focus on methanol and ammonia. These systems have been incorporated into the company's Medium Pressure Injection (MPI) and High-Pressure Dual Fuel (HPDF) product lines, highlighting a transition toward low-carbon fuel solutions in the maritime sector.