Injection Pen Market Size

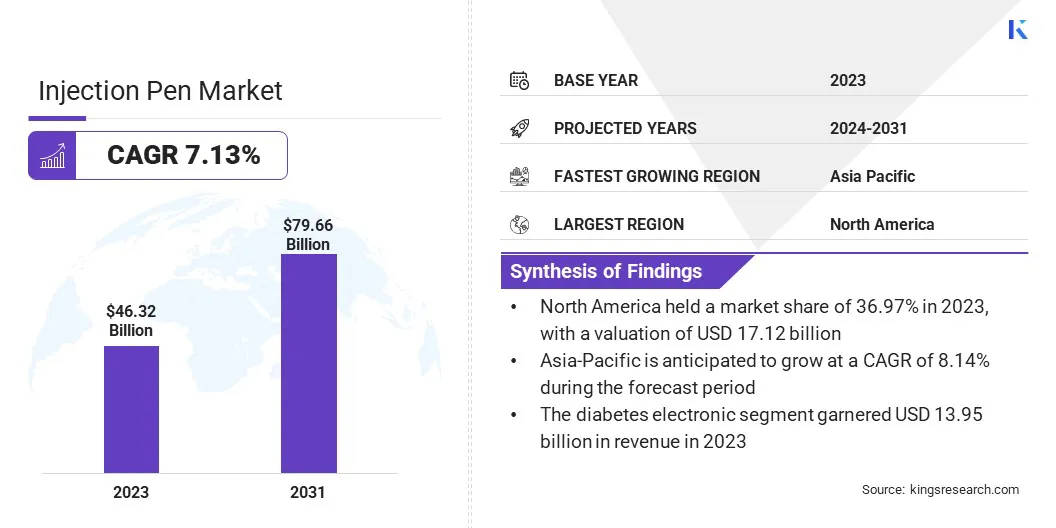

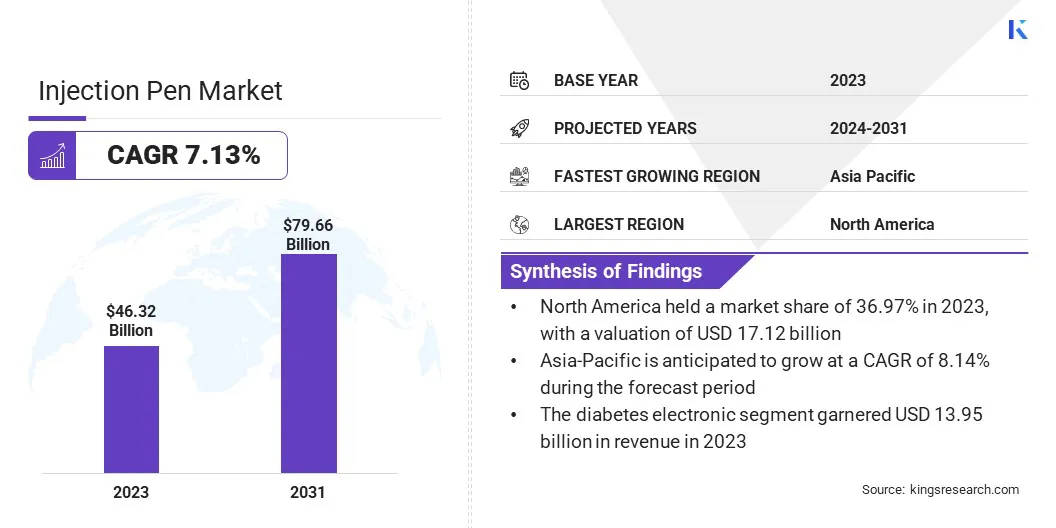

The global Injection Pen Market size was valued at USD 46.32 billion in 2023 and is projected to grow from USD 49.20 billion in 2024 to USD 79.66 billion by 2031, exhibiting a CAGR of 7.13% during the forecast period. The market is expanding as technological advancements foster both innovation and accessibility.

The introduction of affordable insulin biosimilars and the growing adoption of smart devices with digital features are reshaping the market landscape. This growth is further supported by ongoing improvements in manufacturing efficiency and an increasing focus on patient-centric solutions for chronic disease management.

In the scope of work, the report includes solutions offered by companies such as Novo Nordisk A/S., Medtronic, B. Braun SE, BD, Merck KGaA, Terumo India Pvt Ltd, Sanofi, AstraZeneca, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, and others.

The injection pen market is experiencing significant growth driven by the rising prevalence of chronic diseases such as diabetes and rheumatoid arthritis, which necessitate regular and precise medication administration.

- According to the World Health Organization (WHO), approximately 422 million people worldwide are affected by diabetes, with the majority residing in low- and middle-income countries. Diabetes is directly responsible for 1.5 million deaths annually.

Increasing patient preference for self-administration and minimally invasive drug delivery methods further boosts market expansion. Innovations in smart injection pens with digital connectivity and tracking features are becoming prominent, offering enhanced user convenience and improved adherence.

- For instance, in January 2023, Civica revealed its partnership with Ypsomed AG to produce and supply insulin dosing injector pens for its cost-effective insulin products. Civica plans to introduce three insulin biosimilars named lispro, glargine, and aspart that will be available in both vials and prefilled pens. The company aims to offer these insulins at prices significantly lower than those currently available on the market.

Additionally, advancements in technology and the development of new, more efficient products are contributing to market expansion.

Analyst’s Review

A key factor supporting the expansion of the injection pen market is the growing emphasis on environmental sustainability, as evidenced by initiatives focused on developing recycling solutions for used products. Such efforts reflect the broader industry trend toward integrating eco-friendly practices with technological advancements to meet both regulatory demands and consumer expectations.

- For instance, in September 2023, as part of its eco-design commitment, Sanofi began developing solutions to address the end-of-life disposal of its products. The company launched take-back programs in several countries to collect and recycle injection pens. In Germany, Sanofi initiated a collaboration with 35 pharmacies in Berlin in April 2023, with plans to expand the program nationwide. The goal is to achieve a 30 percent take-back rate for SoloStars pens within one year.

This initiative aligns with the growing trend of incorporating sustainable practices in the market, highlighting the industry's rising focus on both innovative technology and environmental responsibility.

Injection Pen Market Growth Factors

The increasing prevalence of chronic diseases, such as diabetes and rheumatoid arthritis, is propelling the growth of the market. As the incidence of these conditions rises globally, there is increased demand for efficient and user-friendly medication delivery systems.

Injection pens, known for their accuracy in dosing and ease of self-administration, are becoming the preferred choice for both patients and healthcare providers. This trend is fueling market expansion, as manufacturers are actively investing in innovative injection pen technologies to cater to the growing need for better chronic disease management. Enhanced patient compliance and improved therapeutic outcomes associated with injection pen usage are further stimulating market growth.

A major challenge impeding the development of the injection pen market is the high cost associated with developing and manufacturing advanced smart injection pens, thereby restricting affordability and accessibility for patients, especially in low- and middle-income regions. This financial barrier hampers market growth by limiting the widespread adoption of these devices.

To address this issue, key players are making substantial investments in cost-effective production technologies and forming strategic partnerships to share development costs. They are further optimizing supply chain processes and exploring alternative materials to lower manufacturing expenses, making smart injection pens more affordable and accessible.

Injection Pen Market Trends

Rising patient preference for self-administration and minimally invasive drug delivery methods is emerging as a significant trend in the injection pen market. This shift toward more convenient and less invasive treatment options is fostering the adoption of injection pens, which offer the ease of use, portability, and precision needed for effective self-management of various conditions.

As patients increasingly seek autonomy in their healthcare routines, manufacturers are responding to this trend by introducing advanced injection pen designs that enhance user experience and compliance, thereby fueling market growth.

- For instance, in September 2022, Terumo India, a subsidiary of the global medical technology leader Terumo Corporation, launched FineGlide. This sterile pen needle was specifically designed for patients requiring regular insulin injections or other self-medication.

FineGlide, which is compatible with the most commonly available pen devices in India, enhances patient comfort and improves drug compliance by offering a more comfortable injection experience. This innovation highlighted the growing trend of developing advanced, patient-friendly injection solutions to meet the increasing demand for self-administration and minimally invasive drug delivery methods.

The development of smart injection pens with digital connectivity and tracking features is emerging as a major market trend propelling the growth of the injection pen sector.

- For instance, in October 2022, Merck KGaA extended its collaboration with Biocorp to develop a Bluetooth-enabled clip-on device specifically designed for one of its drug delivery systems.

These advanced pens offer features such as dose tracking, medication reminders, and real-time data sharing with healthcare providers, which enhance patient adherence and treatment management. As patients and healthcare professionals increasingly prioritize connected and user-friendly solutions, the demand for these innovative pens is rising.

The integration of digital technology into injection pens is improving patient outcomes and offering lucrative market growth opportunities. Manufacturers are investing heavily in developing and incorporating these advanced features to meet the evolving needs of the healthcare industry, thereby augmenting market expansion.

Segmentation Analysis

The global market is segmented based on therapy, type, end-user, and geography.

By Therapy

Based on therapy, the market is categorized into diabetes, growth hormone, osteoporosis, fertility, auto-immune diseases, cancer, and others. The diabetes segment led the injection pen market in 2023, reaching a valuation of USD 13.95 billion. Insulin delivery systems, including injection pens and insulin pumps, are becoming more sophisticated, with smart pens offering digital tracking and pumps providing continuous insulin delivery.

Diabetes monitoring devices are evolving with the development of continuous glucose monitoring systems that reduce the need for frequent fingerstick tests and offer real-time data. Management software, such as mobile apps and cloud-based platforms, is enhancing diabetes care by integrating with monitoring devices to facilitate seamless data tracking and remote access.

The drug market includes various insulin formulations and oral medications, with a notable trend toward biosimilars offering cost-effective alternatives. Additionally, lifestyle and educational products, including diabetes management programs and specialized nutritional supplements, are supporting comprehensive diabetes care and contributing to segmental growth.

By Type

Based on type, the market is categorized into disposable injection pens and reusable injection pen. The fully automated injection pens segment captured the largest injection pen market share of 64.56% in 2023. Fully automated injection pens are revolutionizing the medication delivery by simplifying the administration process through automated dosing and injection.

These pens, equipped with user-friendly designs and advanced safety features, improve patient compliance and reduce injection errors. Technological advancements include digital connectivity for tracking and real-time feedback. The growth of the segment is further augmented by the rising demand for precise, convenient solutions for chronic conditions such as diabetes and rheumatoid arthritis.

- In February 2023, AstraZeneca and Amgen’s Tezspire (tezepelumab) received approval from the U.S. for self-administration using a pre-filled, single-use pen for patients aged 12 years and older with severe asthma. This approval distinguished Tezspire as the sole biologic for severe asthma without limitations based on phenotype or biomarkers within its label.

This development aligns with the growing trend toward advanced, user-friendly medication delivery systems, supported by innovations in automated injection pens that enhance patient convenience and compliance.

By End-User

Based on end-user, the market is categorized into hospitals & diagnostic centers and homecare settings. The hospitals & diagnostic centers segment is expected to garner the highest revenue of USD 55.83 billion by 2031. The rising demand for user-friendly solutions, particularly for chronic disease management, is contributing significantly to the expansion of the segment.

Technological innovations, such as smart injection pens equipped with digital connectivity and tracking features, are enhancing user experience and adherence. Additionally, the expansion of biologic and biosimilar drugs that require injection pens is bolstering segmental growth.

Enhanced patient compliance through improved pen features further supports this trend. Increased awareness and greater accessibility of injection pens in both developed and emerging markets are further playing a crucial role in fostering this expansion.

Injection Pen Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America injection pen market share stood around 36.97% in 2023 in the global market, with a valuation of USD 17.12 billion. The increasing prevalence of chronic diseases, such as diabetes and rheumatoid arthritis, is boosting the demand for convenient and precise medication delivery.

Technological advancements, including smart injection pens with digital tracking and connectivity features, are enhancing user experience and adherence. Additionally, the expansion of new biologics and biosimilars that require the use of injection pens is contributing to regional market growth.

Increased awareness and a robust healthcare infrastructure in North America support widespread adoption, while improvements in accessibility and patient education propel regional market expansion.

Asia-Pacific is anticipated to witness fastest growth at a CAGR of 8.14% over the forecast period. This considerable expansion is attributed to rapid urbanization and growing healthcare awareness. The rise in disposable incomes and improvements in healthcare access are increasing the adoption of advanced medical technologies, including injection pens.

Additionally, favorable government initiatives to enhance chronic disease management and investments in healthcare infrastructure are fueling regional market growth. The diverse and growing population, coupled with the rising demand for self-administration devices in both urban and rural areas, is further propelling the adoption of injection pens across the region.

Competitive Landscape

The global injection pen market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Injection Pen Market

- Novo Nordisk A/S.

- Medtronic

- Braun SE

- BD

- Merck KGaA

- Terumo India Pvt Ltd,

- Sanofi

- AstraZeneca

- Eli Lilly and Company

- Hoffmann-La Roche Ltd

Key Industry Development

- May 2024 (Collaboration): Enable Injections expanded its collaboration with Roche to integrate its enFuse delivery technology into Roche's development programs. The agreement granted Roche a worldwide, exclusive license to develop and commercialize enFuse in combination with specific molecules. Under this partnership, Enable Injections assumed responsibility for the clinical and commercial manufacturing and supply of the enFuse technology. The expansion highlights the growing importance of advanced injection pen technologies in the market.

The global injection pen market is segmented as:

By Therapy

- Diabetes

- Growth Hormone

- Osteoporosis

- Fertility

- Auto-Immune Diseases

- Cancer

- Others

By Type

- Disposable Injection Pens

- Reusable Injection Pen

By End-User

- Hospitals & Diagnostic Centers

- Homecare Settings

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America