Market Definition

Infrared thermography is a technique that uses infrared imaging cameras to capture and measure temperature variations on surfaces, enabling non-contact detection of heat patterns and anomalies. The market includes handheld, fixed-mount, and UAV-based thermal cameras, along with lenses, accessories, and analytical software.

Key applications span predictive maintenance, non-destructive testing, medical diagnostics, surveillance, and quality control across industries such as automotive, aerospace, energy, oil and gas, healthcare, and construction.

Infrared Thermography Market Overview

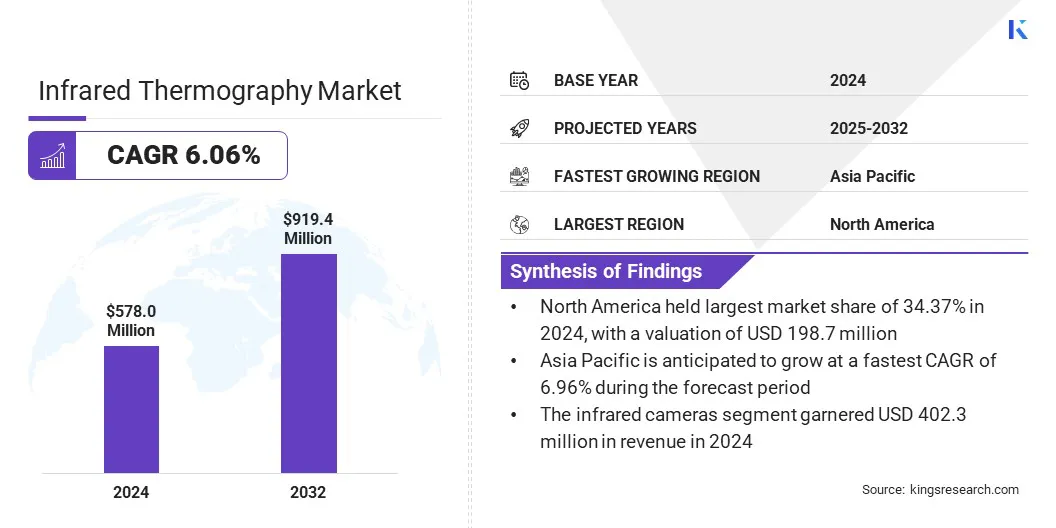

The global infrared thermography market size was valued at USD 578.0 million in 2024 and is projected to grow from USD 608.8 million in 2025 to USD 919.4 million by 2032, exhibiting a CAGR of 6.06% during the forecast period.

The market is experiencing steady growth as industries emphasize reliability, safety, and precision in operations. Adoption is accelerating in aerospace, defense, automotive, and energy sectors, where infrared cameras and analytics enable accurate monitoring and fault detection. Rising use in healthcare diagnostics and quality inspection further supports market expansion.

Key Highlights

- The infrared thermography industry size was valued at USD 578.0 million in 2024.

- The market is projected to grow at a CAGR of 6.06% from 2025 to 2032.

- North America held a share of 34.37% in 2024, valued at USD 198.7 million.

- The infrared cameras segment garnered USD 402.3 million in revenue in 2024.

- The handheld thermal cameras segment is expected to reach USD 423.7 million by 2032.

- The predictive maintenance segment is projected to generate a revenue of USD 289.6 million by 2032.

- The aerospace and defense segment is estimated to reach USD 251.3 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.96% over the forecast period.

Major companies operating in the infrared thermography market are Teledyne Technologies Incorporated, Fluke Corporation, Seek Thermal, Leonardo S.p.A., L3Harris Technologies, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Gevasol, Panasonic Corporation, JENOPTIK AG, Axis Communications AB, Exosens, Testo SE & Co. KgaA, Allied Vision Technologies GmbH, XIMEA GmbH, and Tempsens.

Rising investments in thermal imaging are contributing significantly to the expansion of the market. Companies are securing significant funding to develop advanced thermal imaging satellites, cameras, and software solutions that enhance monitoring and analysis capabilities. These investments foster innovation, expand applications across energy, defense, and climate monitoring, and support broader adoption of infrared thermography technologies worldwide.

- In November 2024, SatVu secured USD 25 million in funding to advance the launch of its HotSat-2 and HotSat-3 satellites, aimed at providing high-resolution thermal imaging to support global climate initiatives.

Market Driver

Advancing Space Operations with Thermal Imaging

The global infrared thermography market is witnessing significant growth due to its expanding role in space activities. Thermal imaging is critical for monitoring spacecraft, satellites, and space station components, ensuring precise temperature regulation in extreme extraterrestrial environments. It aids in identifying heat anomalies, preventing equipment overheating, and optimizing thermal management systems.

Additionally, infrared thermography supports planetary exploration missions by mapping surface temperatures, detecting material stress, and evaluating instrument performance under harsh conditions. Its ability to provide real-time, accurate thermal data enhances spacecraft design, operational safety, and mission reliability. Growing investment in satellite deployment and space research further boosts its adoption across the aerospace sector.

- In May 2025, NASA’s Europa Clipper passed by Mars to capture infrared images with its E-THEMIS thermal imager. This calibration ensured accurate temperature measurements, preparing the instrument for its mission to Jupiter’s moon Europa and enabling precise mapping of surface activity and potential subsurface oceans.

Market Challenge

Maintaining High-Resolution and Efficient Imaging

A major challenge restraining the progress of the infrared thermography market is maintaining high-resolution and efficient imaging, particularly in industrial and research applications where rapid and precise detection is critical. Limitations in sensor sensitivity, frame rates, and integration with existing systems can reduce measurement accuracy and slow inspection processes.

To overcome this challenge, manufacturers are developing advanced cameras with higher sensitivity, faster readout speeds, and optimized pixel architecture. Additionally, modular and easily integrable designs allow seamless system adoption, while software enhancements, including real-time processing and AI-assisted analysis, ensure accurate and efficient thermal measurements, reducing errors and operational delays.

- In June 2025, LYNRED launched the LiSaSWIR high-performance SWIR LineScan camera for silicon wafer, solar panel, and waste inspection. The camera offers double the sensitivity, 30% faster readout, and improved operational speed, enabling high-resolution, cost-efficient industrial imaging, defect detection, and production optimization while ensuring compatibility with standard optics and easy system integration.

Market Trend

Technological Innovations Accelerating Infrared Thermography Adoption

The infrared thermography market is witnessing a notable trend toward technological innovations that enhance operational efficiency and data accuracy. The use of wireless and portable thermal cameras enables safer and more flexible field inspections, while AI-enhanced imaging improves resolution and supports precise anomaly detection.

Smart features, including voice control and mobile integration, simplify operations and streamline workflows. Additionally, Industry 4.0 adoption is fueling demand, as thermal imaging solutions facilitate predictive maintenance, real-time monitoring, and comprehensive asset management, helping industries optimize performance and mitigate operational risks.

- In July 2025, Raythink Technology launched the IX2 AIR Pro Wireless Thermal Camera for smartphones, featuring AI super-resolution, wireless transmission, adjustable focus, and AI voice control. The device supports Industry 4.0 by transforming temperature data into actionable insights for asset health management and enhancing industrial intelligence.

Infrared Thermography Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Infrared Cameras, Lenses and Accessories, Software

|

|

By Product Type

|

Handheld Thermal Cameras, Fixed-Mount Cameras, UAV/Drone-Based Cameras

|

|

By Application

|

Predictive Maintenance, Quality Control and Inspection, Non-Destructive Testing, Medical Diagnostics, Surveillance and Security, Others

|

|

By End-Use Industry

|

Aerospace and Defense, Automotive and Mobility, Healthcare and Life Sciences, Energy and Utilities, Oil and Gas, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Infrared Cameras, Lenses and Accessories, and Software): The infrared cameras segment earned USD 402.3 million in 2024, mainly due to their widespread use in industrial inspections, surveillance, and medical diagnostics.

- By Product Type (Handheld Thermal Cameras, Fixed-Mount Cameras, and UAV/Drone-Based Cameras): The handheld thermal cameras segment held a share of 46.12% in 2024, fueled by their portability, ease of use, and suitability for field inspections.

- By Application (Predictive Maintenance, Quality Control and Inspection, Non-Destructive Testing, Medical Diagnostics, Surveillance and Security, and Others): The predictive maintenance segment is projected to reach USD 289.6 million by 2032, propelled by its role in reducing downtime and extending equipment life.

- By End-Use Industry (Aerospace and Defense, Automotive and Mobility, Healthcare and Life Sciences, Energy and Utilities, Oil and Gas, and Others): The aerospace and defense segment is estimated to reach USD 251.3 million by 2032, owing to the growing demand for advanced thermal imaging in surveillance, navigation, and threat detection.

Infrared Thermography Market Regional Analysis

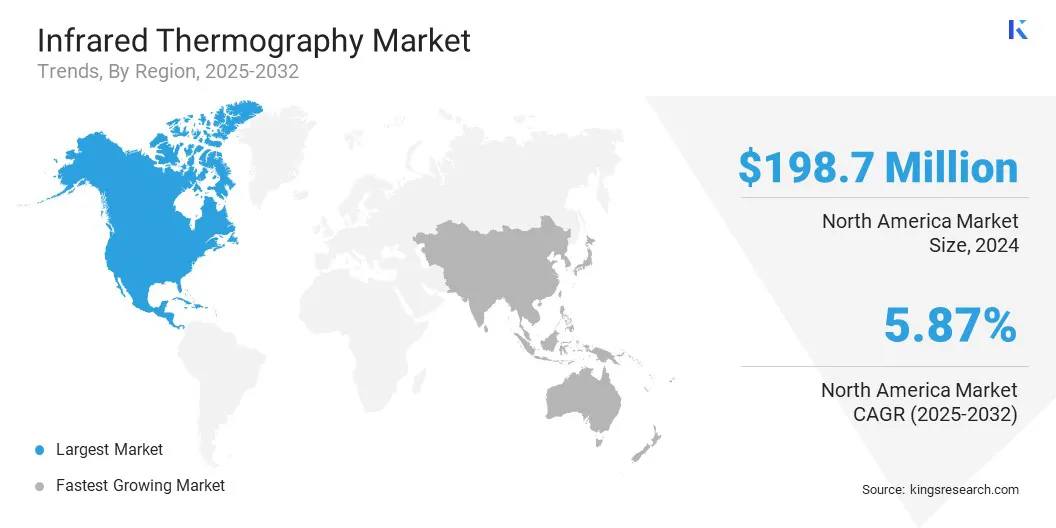

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America infrared thermography market accounted for a substantial share of 34.37% in 2024, valued at USD 198.7 million. This dominance is supported by strong investments in research and development for integrating infrared thermography into advanced satellite systems and aerospace programs.

The presence of leading technology companies and expanding space exploration initiatives strengthens regional market growth, as thermographic imaging is increasingly used for satellite payloads, thermal monitoring, and remote sensing applications.

The region’s strong industrial base and emphasis on technological innovation ensure continued demand for high-resolution and reliable infrared imaging solutions across aerospace, defense, and industrial sectors.

- In January 2025, constellr launched its first thermal infrared satellite, SkyBee-1, aboard a SpaceX Falcon 9 into sun-synchronous orbit. The satellite provides high-resolution land surface temperature data through advanced thermal and multispectral imaging. The initiative aims to support climate action, sustainable resource management, and global food security, while enabling constellr to expand its commercial services in Europe and the United States.

The Asia-Pacific infrared thermography industry is expected to register the fastest CAGR of 6.96% over the forecast period. This growth is fueled by rising defense spending and large-scale adoption of infrared thermography in national security programs. Countries such as China, India, Japan, and South Korea are rapidly integrating thermal imaging technologies into their defense strategies for surveillance, border security, and advanced combat systems.

The regional market growth is further supported by expanding industrial applications, including predictive maintenance and manufacturing quality control. Strategic military modernization, coupled with increasing domestic production of infrared imaging systems, positions the region as the fastest-growing market for infrared thermography.

Regulatory Frameworks

- In the U.S., infrared thermography devices are regulated by the Federal Communications Commission (FCC) for radiofrequency and wireless compliance, and by the Food and Drug Administration (FDA) for medical imaging applications.

- In Europe, thermal imaging equipment must comply with the CE marking directives, including the Electromagnetic Compatibility (EMC) Directive and Low Voltage Directive (LVD), to ensure safety and performance standards.

- In China, the China National Medical Products Administration (NMPA) regulates medical infrared imaging devices, while general industrial devices must follow standards set by the Standardization Administration of China (SAC).

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) governs medical thermography equipment, while industrial and safety devices comply with Japanese Industrial Standards (JIS).

Competitive Landscape

Key players operating in the infrared thermography industry are developing advanced drone-mounted thermal imaging systems with higher sensor sensitivity, improved resolution, and autonomous flight integration, enabling precise and efficient inspections across infrastructure, energy, and environmental applications.

They are also engaging in strategic collaborations with drone manufacturers to create specialized payloads equipped with high-performance infrared cameras. These partnerships facilitate deployment in challenging environments, expand application areas, and enhance operational efficiency.

- In May 2025, Teledyne FLIR OEM collaborated with AerialOGI to launch the AerialOGI-N, a midwave infrared OGI camera module for handheld and drone platforms. The device detects and quantifies over 25 greenhouse gases in real time, integrates with LDAR software, and enhances inspection efficiency while reducing emissions, costs, and environmental impact across industrial gas monitoring applications.

Key Companies in Infrared Thermography Market:

- Teledyne Technologies Incorporated

- Fluke Corporation

- Seek Thermal

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Gevasol

- Panasonic Corporation

- JENOPTIK AG

- Axis Communications AB

- Exosens

- Testo SE & Co. KGaA

- Allied Vision Technologies GmbH

- XIMEA GmbH

- Tempsens

Recent Developments (Partnerships/Product Launches)

- In June 2025, Seek Thermal launched its next-generation LWIR sensor technology for the automotive industry, designed for functional safety, cost-effective performance, and FMVSS-127 compliance. The sensors support Pedestrian Automatic Emergency Braking systems, feature MIPI CSI-2 connectivity, and offer scalable, high-performance imaging solutions for Tier 1 partners and OEMs, promoting safer roads and seamless automotive integration.

- In June 2025, ABB collaborated with Hydrosat to equip the VanZyl-2 satellite with an infrared camera, following the successful 2024 VanZyl-1 launch. The collaboration delivers high-resolution, high-frequency thermal imaging for monitoring water stress, soil temperature, and vegetation health, and supports sustainable resource management and early detection of crop and environmental issues.

- In April 2025, FLIR launched FLIR MIX Starter Kits, integrating high-speed thermal and visible-light imagery with synchronized hardware and software. The kit enables precise infrared imaging and real-time analysis for research, defense, and industrial applications.

- In June 2024, Hydrosat deployed its VanZyl-2 satellite via SpaceX’s Transporter-14 mission. The satellite captures high-resolution thermal infrared and multispectral data across 8 million km² daily, providing AI-ready insights for agriculture, resource management, and environmental monitoring, while enhancing Hydrosat’s global coverage and serving both commercial and government applications.