Market Definition

Industrial refrigeration includes large-scale cooling systems designed to maintain precise low temperatures across facilities. It utilizes compressors, evaporators, condensers, and refrigerants to efficiently control temperature in demanding environments.

The market spans industries such as food processing, chemical manufacturing, cold storage logistics, and pharmaceuticals, where stringent thermal control is essential. Primary applications of industrial refrigeration include meat and seafood preservation, chillers for chemical reactors, vaccine storage, and climate-controlled warehousing to ensure product integrity and safety.

Industrial Refrigeration Market Overview

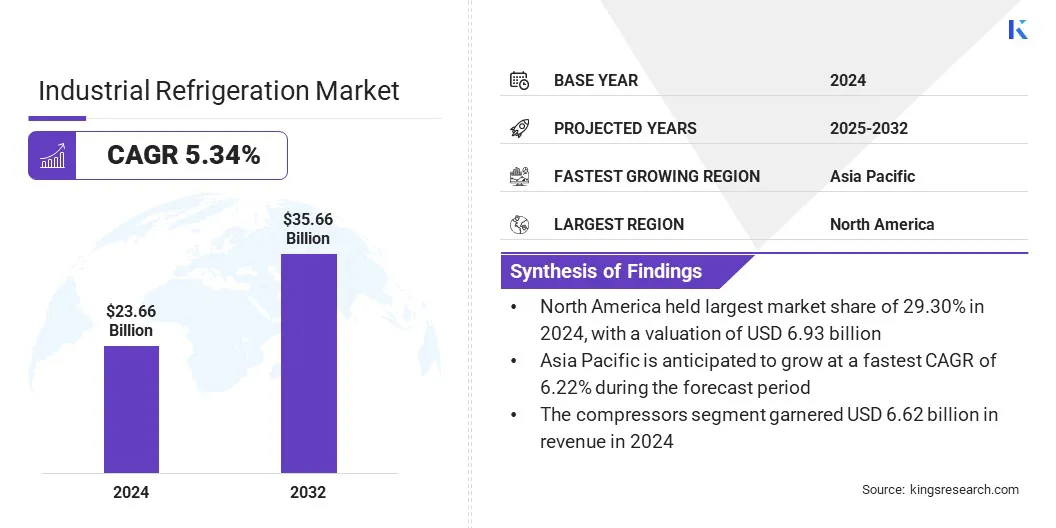

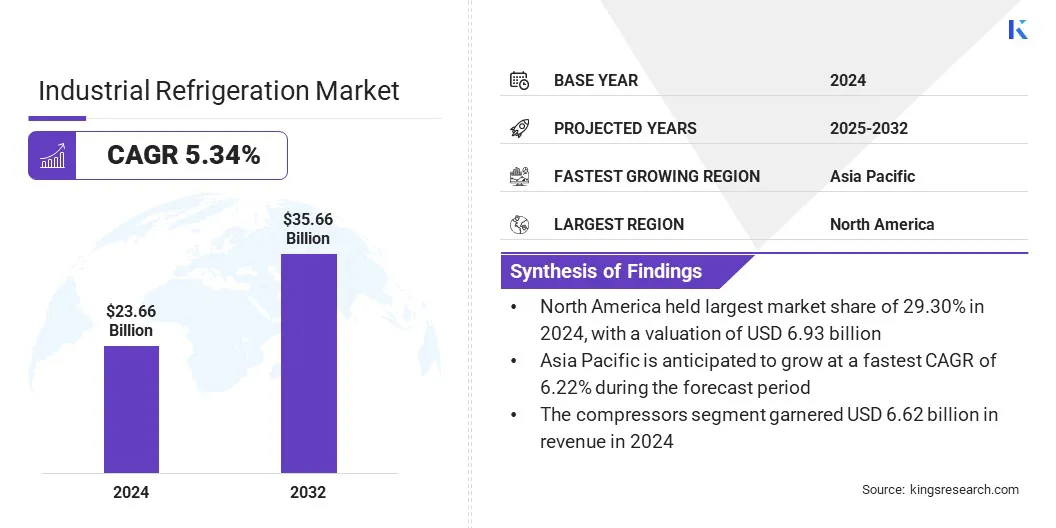

The global industrial refrigeration market size was valued at USD 23.66 billion in 2024 and is projected to grow from USD 24.82 billion in 2025 to USD 35.66 billion by 2032, exhibiting a CAGR of 5.57% during the forecast period.

The market is driven by the increasing adoption of digitalization and IoT-AI integration, which improve system efficiency, monitoring, and predictive maintenance. Additionally, the exploration of magnetic and multicaloric refrigeration technologies offers eco-friendly, high-efficiency alternatives to traditional systems, driving innovation and expanding application potential across key industries..

Key Highlights

- The industrial refrigeration industry size was valued at USD 23.66 billion in 2024.

- The market is projected to grow at a CAGR of 5.34% from 2025 to 2032.

- North America held a market share of 29.30% in 2024, with a valuation of USD 6.93 billion.

- The ammonia segment garnered USD 9.09 billion in revenue in 2024.

- The compressors segment is expected to reach USD 9.62 billion by 2032.

- The installation & commissioning segment secured the largest revenue share of 38.90% in 2024.

- The pharmaceuticals & biotech segment is poised for a robust CAGR of 6.17% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.22% during the forecast period.

Major companies operating in the industrial refrigeration market are Johnson Controls, Emerson Electric Co., Danfoss, GEA Group Aktiengesellschaft, MAYEKAWA MFG. CO., LTD., BITZER Kühlmaschinenbau GmbH, EVAPCO, Inc., Guntner GmbH & Co. KG, Daikin Industries Ltd., Carrier, Ingersoll Rand, Dover Corporation, Star Refrigeration, Embraco LLC., and ALFA LAVAL.

Surge in demand for cold chain infrastructure is driving adoption of industrial refrigeration systems across key industries. Rapid growth in global cold storage facilities is being fueled by the need to preserve perishable goods such as food, beverages, and pharmaceuticals under strict temperature control. Expansion of quick commerce and online grocery delivery services is increasing the need for efficient and scalable refrigeration solutions.

Industrial refrigeration systems are supporting large-scale storage, transportation, and processing of temperature-sensitive products with reliability and precision. Manufacturers and logistics providers are investing in advanced systems to ensure compliance with safety standards and extend product shelf life.

- In March 2025, Americold invested USD 127 million to acquire a 10.7 million cubic-foot cold storage warehouse in Houston, adding 35,700 pallet positions to its portfolio. This facility targets high-turn retail clients and accommodates temperature-sensitive goods like perishables and pharmaceuticals, directly responding to growth in quick-commerce and pharma cold chain needs.

Market Driver

Digitalization and IoT-AI Integration

Digitalization and the integration of IoT and AI technologies are driving significant advancements in the industrial refrigeration market. Smart sensors are enabling real-time monitoring of temperature, energy consumption, and system performance across cold storage and processing facilities. AI and machine learning algorithms are being used to predict equipment failures, optimize energy use, and schedule preventive maintenance.

Remote monitoring capabilities are allowing operators to manage systems more efficiently, reduce downtime, and respond quickly to operational issues. These intelligent technologies are improving system reliability and reducing operational costs for food processing, pharmaceutical storage, and logistics applications.

- On March 12, 2025, Topchill Refrigeration launched an AI- and IoT-enabled remote monitoring system for unit coolers used in industrial refrigeration. The platform combines edge computing with cloud-based AI analytics to predict equipment faults such as compressor wear and refrigerant leaks up to 48 hours in advance, with 92% accuracy. It also helps optimize energy consumption, achieving an 18% reduction through adaptive airflow control. Additionally, the system enables centralized management of over 500 unit coolers across multiple facilities through a unified dashboard.

Market Challenge

High Capital Expenditure and Long ROI Cycles Slowing Adoption

A key challenge in the industrial refrigeration market is the substantial upfront investment required for installing complex systems, including compressors, condensers, controls, and supporting infrastructure.

These installations involve high equipment costs and engineering requirements, making the initial financial commitment significant. The long payback periods further discourage rapid adoption, especially among small and mid-sized industrial facilities with budget constraints.

To address this challenge, market players are offering energy-efficient systems, modular solutions, and financing options that reduce initial financial pressure. Companies are also focusing on optimizing system design and lifecycle performance to shorten return on investment and support broader market uptake.

Market Trend

Exploring Magnetic and Multicaloric Technologies

A key trend in the industrial refrigeration market is the exploration of magnetic and multicaloric refrigeration as alternatives to traditional vapor-compression systems. These technologies rely on magnetocaloric and other caloric effects to enable cooling without the use of harmful refrigerants. Early-stage developments are focusing on improving energy efficiency and minimizing environmental impact.

Research institutions and companies are conducting pilot projects to test performance, reliability, and scalability in industrial settings. Challenges related to cost, material availability, and system integration are being addressed through ongoing R&D efforts.

- In June 2024, California Energy Commission–backed researchers at General Engineering & Research installed a pilot furnace system to scale up production of magnetocaloric materials, achieving over 20% performance improvement and producing one kilogram per day of core magnetocaloric material for industrial refrigeration applications. This aims to address key challenges in deploying magnetic refrigeration systems, including material availability and scalability.

Industrial Refrigeration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Refrigerant Type

|

Ammonia, CO₂, HFCs/HFOs, Others

|

|

By Component

|

Compressors, Condensers, Evaporators, Controls, Vessels & Pumps, Others

|

|

By Service

|

Installation & Commissioning, Maintenance & Repairs, Design & Consulting, Retrofit & Upgrades

|

|

By Application

|

Food & Beverage Processing, Cold Storage & Warehousing, Chemical & Petrochemical, Pharmaceuticals & Biotech, Dairy & Ice Cream Plants, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Refrigerant Type (Ammonia, CO₂, HFCs/HFOs, and Others): The ammonia segment earned USD 9.09 billion in 2024 due to its high thermodynamic efficiency, low operating cost, and zero global warming potential.

- By Component (Compressors, Condensers, Evaporators, Controls, Vessels & Pumps, and Others): The compressors segment held 28.00% of the market in 2024, due to its critical role in maintaining system pressure and enabling efficient refrigerant circulation.

- By Service (Installation & Commissioning, Maintenance & Repairs, Design & Consulting, and Retrofit & Upgrades): The installation & commissioning segment is projected to reach USD 13.34 billion by 2032, owing to rising demand for customized, energy-efficient refrigeration systems that require expert setup to ensure optimal performance, safety compliance, and long-term operational reliability.

- By Application (Food & Beverage Processing, Cold Storage & Warehousing, Chemical & Petrochemical, Pharmaceuticals & Biotech, Dairy & Ice Cream Plants, and Others): The pharmaceuticals & biotech segment is poised for significant growth at a CAGR of 6.17% through the forecast period, attributed to its critical demand for precise temperature control and reliability in cold chain logistics.

Industrial Refrigeration Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America industrial refrigeration market share stood at 29.30% in 2024 in the global market, with a valuation of USD 6.93 billion. This dominance is attributed to North America's well-established pharmaceutical industry, which depends heavily on temperature-sensitive logistics. The rising production of biologics, vaccines, and specialty drugs in the region is significantly increasing the demand for reliable cold chain solutions.

Industrial refrigeration systems play a crucial role in maintaining strict temperature control in pharmaceutical manufacturing and large-scale storage and transportation, fueling the regional market growth.

- In April 2024, CSafe introduced its new “CGT Cryo Series” multi-use dewars, designed for ultra-low-temperature (-150 °C) storage of cell and gene therapy products. The dewars include real-time data tracking via the TracSafe‑RLT system and cater directly to temperature-sensitive biologics logistics needs.

Asia Pacific industrial refrigeration industry is poised for a CAGR of 6.22% over the forecast period. This growth is driven by the rapid expansion of food processing in the Asia Pacific region, particularly in sectors such as packaged meat, dairy, seafood, and ready-to-eat meals. Rising urbanization and growing middle-class incomes are fueling higher demand for processed and frozen foods.

In response, businesses are investing heavily in large-scale cold storage facilities and temperature-controlled processing environments, thereby increasing the need for industrial refrigeration systems.

Additionally, the region has emerged as a key hub for the trade of perishable goods such as seafood, fruits, and pharmaceuticals. To ensure quality during long-distance transportation, governments and private logistics operators in Asia Pacific are expanding refrigerated infrastructure. Investments are directed toward seaports, inland storage hubs, and airport terminals, further boosting demand for reliable, high-capacity refrigeration solutions.

- In August 2024, ARCH Capital Management opened a new temperature-controlled logistics facility near the South Luzon Expressway in Metro Manila, Philippines. The 14,000‑pallet cold storage warehouse accommodates dry, refrigerated, and frozen goods, meeting both international safety standards and IFC EDGE pre-certification for energy, water, and materials efficiency.

Regulatory Frameworks

- In the U.S., industrial refrigeration is regulated by the Environmental Protection Agency (EPA) under the Clean Air Act (Section 608), which mandates refrigerant handling certification, leak detection, and recovery protocols. The American Innovation and Manufacturing (AIM) Act requires an 85% phasedown of hydrofluorocarbons (HFCs) by 2035. For ammonia-based systems exceeding 10,000 pounds, the Occupational Safety and Health Administration (OSHA) enforces Process Safety Management (PSM) standards to ensure operational and worker safety.

- The European Union enforces its F-Gas Regulation (EU 2024/573), which mandates a progressive phase-out of high global warming potential (GWP) refrigerants, tightens HFC quotas, and imposes bans on equipment with GWP over 150 starting in 2025. It also mandates certification of technicians, leak checks, and recovery of refrigerants. Energy efficiency requirements under Ecodesign and Energy Labelling Regulations apply to commercial refrigeration units to reduce emissions and improve performance.

- China regulates industrial refrigeration through national standards for refrigerant management, including a phasedown of HFCs in line with its Kigali Amendment commitments. The country enforces hazardous substance restrictions under China RoHS (Restriction of Hazardous Substances), covering electronics in refrigeration systems. Manufacturers must also comply with safety requirements for ammonia and flammable refrigerants, while environmental authorities oversee leak controls, equipment registration, and certification for refrigeration service technicians.

- Japan manages industrial refrigeration under the Air Pollution Control Act and the Act on Rational Use and Proper Management of Fluorocarbons. These laws promote reduced HFC use and require maintenance logs, leak inspections, and technician licensing. Japan is phasing down HFCs in alignment with the Kigali Amendment. Ammonia-based refrigeration systems must meet strict Ministry of the Environment and Ministry of Economy, Trade and Industry (METI) safety and performance guidelines.

Competitive Landscape

Major players in the industrial refrigeration industry are adopting strategies such as investment in research and development, launching advanced product lines, and expanding into high-growth application areas to strengthen their position.

Many companies are focusing on improving compressor performance, energy efficiency, and multi-functionality to meet the evolving needs of industrial users. Market players are also collaborating with system integrators and end-user industries to deliver tailored refrigeration solutions.

- In March 2025, Frascold launched a new generation of semi‑hermetic compressors designed for both refrigeration and heating applications. These compressors can achieve temperatures up to 165 °C and deliver enhanced efficiency, reliability, and quiet operation. The development supports diverse industrial uses, including data centers, chemical processes, and heat pump systems.

Key Companies in Industrial Refrigeration Market:

- Johnson Controls

- Emerson Electric Co.

- Danfoss

- GEA Group Aktiengesellschaft

- MAYEKAWA MFG. CO., LTD.

- BITZER Kühlmaschinenbau GmbH

- EVAPCO, Inc.

- Guntner GmbH & Co. KG

- Daikin Industries Ltd.

- Carrier

- Ingersoll Rand

- Dover Corporation

- Star Refrigeration

- Embraco LLC.

- ALFA LAVAL

Recent Developments (Product Launches)

- In March 2025, Frascold launched a new generation of semi‑hermetic compressors designed for both refrigeration and heating applications. These compressors can achieve temperatures up to 165 °C and deliver enhanced efficiency, reliability, and quiet operation. The development supports diverse industrial uses, including data centers, chemical processes, and heat pump systems.

- In December 2024, Ice Make Refrigeration introduced commercial freezers and visi coolers at its Gujarat manufacturing facility. This product rollout includes chest freezers (100 L–900 L) and visi coolers. The additions strengthen the firm’s automated output capability and energy‑efficient commercial cooling portfolio.

- In June 2025, Hussmann launched the Protocol CO₂ refrigeration unit using natural refrigerant R‑744 (CO₂). The compact indoor system features a medium‑temperature compressor with direct vapor injection, variable-speed scroll technology, and an economizer to improve efficiency. The product offers a low‑GWP solution suitable for back rooms, medium‑ and split‑temperature applications.

- In May 2024, Carrier Commercial Refrigeration introduced sustainable CO₂ mechanical refrigeration systems in North America. The rollout includes CO₂ compressor racks, heat pumps, and plans to add condensing units. The systems utilize natural refrigerants and aim to service industrial, food retail, and convenience store applications.

significant