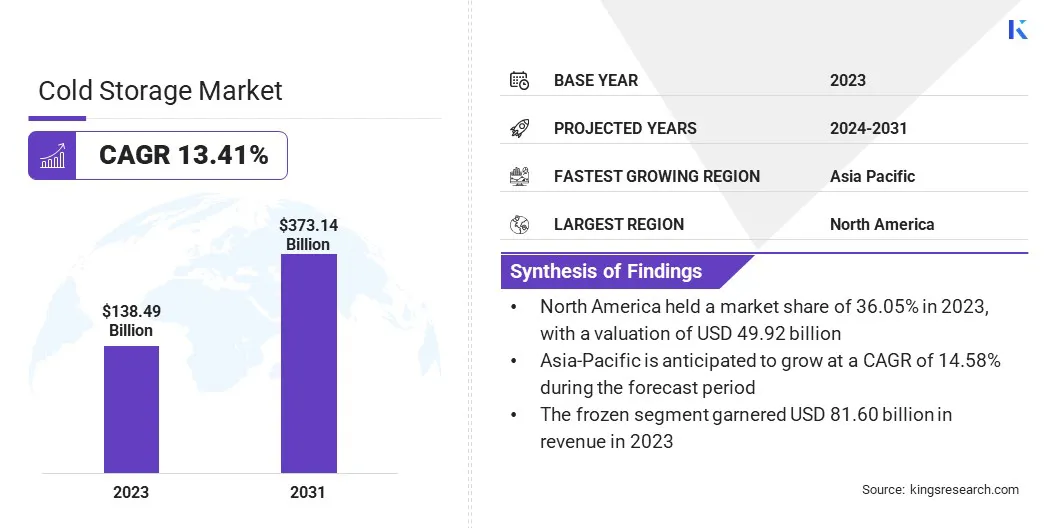

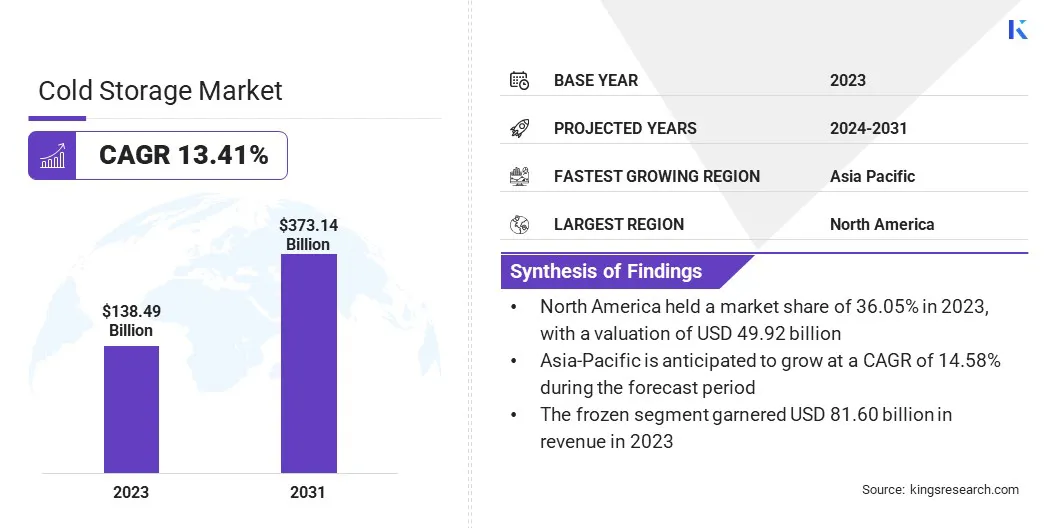

Cold Storage Market Size

The global Cold Storage Market size was valued at USD 138.49 billion in 2023 and is projected to grow from USD 154.65 billion in 2024 to USD 373.14 billion by 2031, exhibiting a CAGR of 13.41% during the forecast period. In the scope of work, the report includes services offered by companies such as Americold Logistics, Inc., Barloworld Logistics., Coldrush Logistics, John Swire & Sons (H.K.) Ltd., Kloosterboer, Lineage, Inc., Penguin Coldstorages Pvt Ltd, United States Cold Storage, VersaCold Logistics Services, Wabash National Corporation. and others.

The growth of the market is driven by rising demand for perishable food products, technological advancements in refrigeration, and the expansion of e-commerce for groceries. The expansion of the cold storage market is primarily fueled by increasing demand for perishable goods such as fruits, vegetables, dairy, meat, and seafood.

Rising consumer preference for frozen food, coupled with the expansion of the pharmaceutical sector, further propels market progress. Additionally, advancements in refrigeration technologies and the growth of the e-commerce sector, particularly for online grocery shopping, bolster market growth. Government initiatives to reduce food waste and improve food safety standards contribute significantly to the rising need for efficient cold storage solutions.

- According to the U.S. Department of State, global food demand was projected to increase by over 50% by 2050, while climate change threatened to reduce major crop yields. This is anticipated to result in price spikes, food insecurity, and conflict. The US allocated USD 100 million in 2023, to the Vision for Adapted Crops and Soils (VACS) program, focusing on Africa to map soils, promote farm management, and develop climate-resilient crops.

Emerging economies are witnessing increased investment in cold chain infrastructure, which notably impacts market expansion and modernization efforts. The global market is witnessing substantial growth due to the surging demand for temperature-controlled logistics in various industries.

Cold storage facilities are essential for preserving the quality and extending the shelf life of perishable goods. The market encompasses a wide range of storage types, including refrigerated warehouses, cold rooms, and blast freezers, catering to diverse sectors such as food and beverage, pharmaceuticals, and biotechnology.

North America and Europe are regions with a significant presence in the market, driven by well-established cold chain infrastructure, while Asia-Pacific is rapidly expanding due to rising consumer demand and increased investments in the cold chain network.

The market refers to the sector that provides temperature-controlled storage facilities and logistics services to preserve perishable goods. These facilities maintain specific temperature conditions required to store products such as food, pharmaceuticals, and other temperature-sensitive items. Cold storage solutions include various technologies and infrastructure, such as refrigerated warehouses, cold rooms, and blast freezers.

The market further involves the integration of advanced monitoring systems to ensure optimal storage conditions and maintain product quality. It serves multiple industries by preventing spoilage, extending product shelf life, and complying with regulatory standards for food safety and pharmaceutical storage.

Analyst’s Review

Manufacturers in the cold storage market are making significant efforts to enhance efficiency and sustainability. They are increasingly adopting automation and energy-efficient technologies to reduce operational costs and environmental impact.

- In February 2024, Groupe Robert partnered with Dematic to open Quebec's first fully automated cold storage facility for third-party logistics. The facility featured a 130-foot-tall Automated Storage and Retrieval System (AS/RS) with a storage capacity of 60,000 pallets, including both fresh and frozen products. The advanced system used carbon dioxide refrigeration and low-oxygen fire management.

New products, such as smart refrigeration units with advanced monitoring systems, are being introduced in the market, offering improved temperature control and real-time data analytics. Companies are further investing in expanding their cold storage capacities to meet rising demand from the food and pharmaceutical sectors.

Market participants should focus on sustainable practices, leverage renewable energy sources, and continue to innovate with smart technologies. These strategies are anticipated to help maintain competitiveness and meet the evolving needs of the cold storage market.

Cold Storage Market Growth Factors

The growing demand for online grocery shopping is boosting the growth of the market, as consumers are increasingly purchasing perishable goods through e-commerce platforms, which requires efficient and reliable cold storage solutions to ensure product freshness during transit. This shift in consumer behavior prompts retailers and logistics companies to invest in advanced cold storage facilities and technologies.

Enhanced refrigeration methods, real-time temperature monitoring, and improved inventory management systems are being implemented to meet this surging demand. This trend is significantly boosting market expansion, as businesses increasingly strive to provide high-quality perishable products, maintain customer satisfaction, and reduce spoilage rates during last-mile delivery.

However, a prominent challenge in the cold storage market is the high energy consumption of refrigeration units, leading to increased operational costs and environmental impact. Overcoming this challenge necessitates the adoption of energy-efficient technologies and sustainable practices. Implementing solar-powered refrigeration systems, using advanced insulation materials, and integrating smart energy management systems are significantly reducing energy usage.

Additionally, retrofitting existing facilities with energy-efficient equipment and investing in renewable energy sources helps mitigate operational costs. Focusing on these solutions is enabling industry players to achieve cost savings, reduce their carbon footprint, and ensure long-term sustainability while maintaining the integrity of stored products.

Cold Storage Market Trends

Companies are integrating automated storage and retrieval systems (AS/RS), conveyor systems, and robotic palletizers to enhance operational efficiency and accuracy due to the increasing adoption of automation and robotics. This trend is fueled by the need to reduce labor costs, minimize human error, and improve inventory management.

Automation allows for faster processing times and optimal space utilization, which are crucial in maintaining the quality of perishable goods. By implementing these advanced technologies, cold storage facilities are becoming more efficient, reliable, and capable of handling the growing volume of goods in the global supply chain.

Moreover, there is a significant rise in sustainable and eco-friendly cold storage solutions. Businesses are increasingly focusing on reducing their environmental impact by adopting green building practices and energy-efficient technologies. The use of natural refrigerants, such as ammonia and carbon dioxide, is becoming more common due to their lower global warming potential.

Additionally, cold storage facilities are incorporating renewable energy sources, such as solar and wind power, to minimize their carbon footprint. This trend reflects a broader industry shift toward sustainability, propelled by regulatory pressures and rising consumer demand for environmentally responsible practices. Sustainable cold storage solutions are gaining traction and reshaping the market landscape.

Segmentation Analysis

The global market is segmented based on temperature range, warehouse type, application, and geography.

By Temperature Range

Based on temperature range, the market is categorized into chilled and frozen. The frozen segment led the cold storage market in 2023, reaching a valuation of USD 81.60 billion. This expansion is attributed to the increasing consumption of frozen food products globally. Frozen foods offer convenience, longer shelf life, and easy availability, thereby influencing consumer preference.

Moreover, advancements in freezing technologies ensure the preservation of nutritional value and quality of frozen products. The growing demand for frozen fruits, vegetables, ready-to-eat meals, and bakery products further fuels the expansion of this segment, as consumers increasingly seek convenient meal solutions in response to busy lifestyles.

By Warehouse Type

Based on warehouse type, the market is classified into public warehouses, private warehouses, and others. The public warehouse segment is poised witness significant growth at a CAGR of 14.73% through the forecast period (2024-2031). This expansion is propelled by several factors, including the rising demand for third-party logistics (3PL) services, particularly in emerging economies.

Public warehouses offer flexible storage solutions, allowing businesses to scale operations without heavy capital investment. Additionally, outsourcing warehouse operations to 3PL providers reduces overhead costs and improves supply chain efficiency. Increasing globalization and rising e-commerce activities are highlighting the need for accessible and cost-effective storage solutions, thus fostering the growth of the public warehouse segment.

By Application

Based on application, the market is segmented into food & beverages, pharmaceuticals, and others. The food & beverages segment secured the largest cold storage market share of 45.84% in 2023. This expansion is fueled by several factors, including population growth, rapid urbanization, and changing consumer dietary preferences. The rising demand for processed and convenience foods, coupled with the expansion of the food retail sector, highlights the need for cold storage solutions.

Furthermore, stringent regulations regarding food safety and quality necessitate proper storage conditions throughout the supply chain. The pharmaceuticals segment further contributes to market growth, stimulated by the increasing demand for temperature-controlled storage of drugs and vaccines, particularly in the healthcare sector.

Cold Storage Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America cold storage market held around 36.05% in 2023, with a valuation of USD 49.92 billion. This dominance is attributed to a well-established cold chain infrastructure, ongoing technological advancements, and robust demand from various end-user industries. The region's mature retail sector, coupled with increasing consumer demand for perishable goods, boosts the need for efficient cold storage solutions.

Additionally, stringent regulations regarding food safety and quality further stimulate regional market growth. Moreover, North America's strong economic growth and high adoption of advanced refrigeration technologies contribute to its leading position in the cold storage market.

Asia-Pacific is poised to experience the fastest growth, recording a CAGR of 14.58% through the estimated timeframe. This rapid expansion is bolstered by several factors, including population growth, rapid urbanization, and increasing disposable incomes in emerging economies. Shifting consumer preferences toward convenience foods and online grocery shopping is leading to an increased demand for cold storage facilities.

Moreover, favorable government initiatives to modernize cold chain infrastructure and improve food safety standards further regional propel market growth. Additionally, the burgeoning pharmaceutical and biotechnology sectors drive the need for temperature-controlled storage solutions, supporting the growth of the Asia-Pacific market.

Competitive Landscape

The cold storage market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Cold Storage Market

- Americold Logistics, Inc.

- Barloworld Logistics.

- Coldrush Logistics

- John Swire & Sons (H.K.) Ltd.

- Kloosterboer

- Lineage, Inc.

- Penguin Coldstorages Pvt Ltd

- United States Cold Storage

- VersaCold Logistics Services

- Wabash National Corporation.

Key Industry Developments

- March 2023 (Expansion): Americold Realty Trust, a prominent player in temperature-controlled logistics, expanded its facility in Russellville with a USD 90 million investment. The expansion included the construction of a new 131,000-square-foot cold storage and distribution facility, adding 42,000 pallet positions and 13 million cubic feet of capacity.

- May 2024 (Expansion): Lineage, a global temperature-controlled warehouse real estate investment trust (REIT), opened an expanded facility in Lębork, Pomorskie, situated in northern Poland. This expansion was aimed to meet rising customer demands in Central and Eastern Europe. The expansion increased the warehouse’s pallet space capacity by about 30%, totaling over 40,000 pallet spaces, and included mobile racking systems. This opening followed the inauguration of their new regional headquarters in Warsaw in November 2023.

The global cold storage market is segmented as:

By Temperature Range

By Warehouse Type

- Public Warehouses

- Private Warehouses

- Others

By Application

- Food & Beverages

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America