Industrial PC Market Size

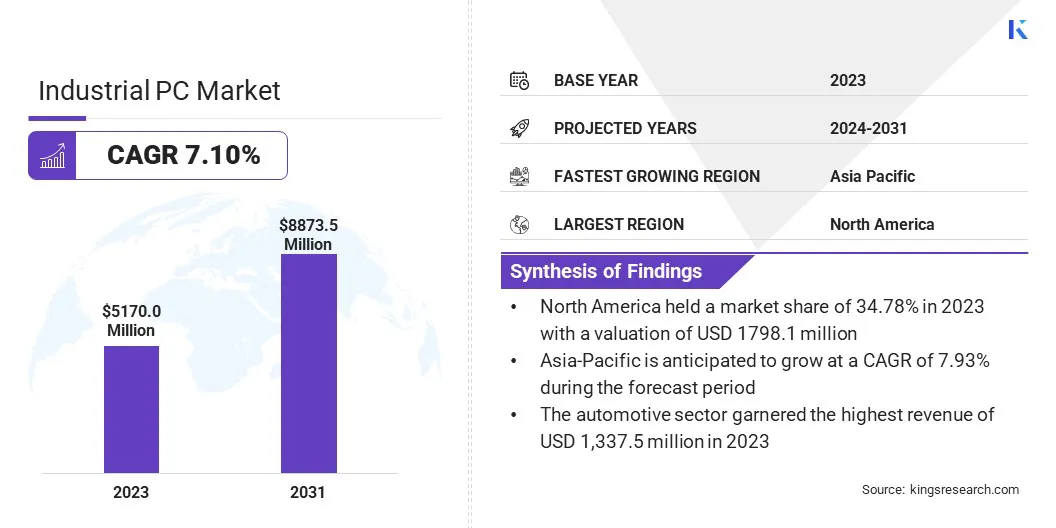

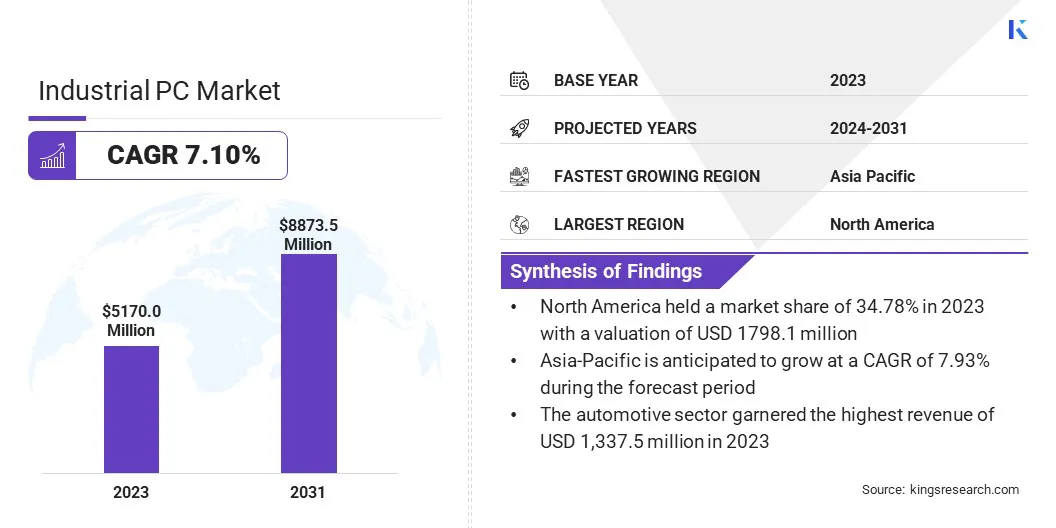

Global Industrial PC Market size was recorded at USD 5,170.0 million in 2023, which is estimated to be at USD 5,489.9 million in 2024 and projected to reach USD 8,873.5 million by 2031, growing at a CAGR of 7.10% from 2024 to 2031. The rising adoption of Industry 4.0 principles is driving the demand for advanced industrial PCs to facilitate smart manufacturing processes.

In the scope of work, the report includes solutions offered by companies such as AAEON Technology Inc., ABB, OMRON Corporation, Siemens, Rockwell Automation, Schneider Electric, Emerson Electric Co, General Electric, Advantech Co., Ltd., Mitsubishi Electric Europe B. V., and others.

The growing adoption of Industry 4.0 principles is a significant factor leading to the increasing demand for advanced industrial PCs, as these principles emphasize the integration of digital technologies into manufacturing. This requires a robust computing infrastructure capable of handling vast amounts of data in real-time, a function ideally served by advanced industrial PCs.

These PCs are essential for facilitating key Industry 4.0 technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning. They enable seamless communication between machines, enhance data analytics capabilities, and support automated decision-making processes.

Additionally, industrial PCs are designed to operate in harsh industrial environments, ensuring reliability and longevity. As manufacturers aim to improve efficiency, productivity, and flexibility in their operations, the demand for sophisticated industrial PCs that support the complex and interconnected systems of smart manufacturing processes continues to rise.

This trend is further amplified by the rising need for real-time data processing and the ability to quickly adapt to changing market demands, establishing advanced industrial PCs as a fundamental element of modern manufacturing strategies.

An industrial PC is a computing platform specifically designed for industrial environments. It offers higher durability, reliability, and longevity compared to consumer-grade PCs. Industrial PCs are built to withstand harsh conditions such as extreme temperatures, dust, vibration, and humidity, making them suitable for deployment in manufacturing plants, automation systems, and other demanding settings.

There are several types of industrial PCs, including panel PCs, box PCs, embedded PCs, and rack-mount PCs. Panel PCs integrate a display and computing unit into a single device, resulting in surging demand for human-machine interface (HMI) applications. Box PCs are compact, rugged systems used in various control and monitoring tasks.

Embedded PCs are small, low-power devices embedded within machinery and equipment for dedicated control functions. Rack-mount PCs, designed for installation in server racks, are commonly used in data centers and large-scale industrial applications. Industrial PCs are utilized across diverse industries such as automotive, aerospace, oil and gas, food and beverage, pharmaceuticals, and energy.

In these sectors, they support critical operations such as process control, data acquisition, automation, and real-time monitoring, ensuring efficient and uninterrupted production processes.

Analyst’s Review

The global industrial PC market is experiencing robust growth, mainly driven by advancements in automation, the widespread adoption of Industry 4.0, and increasing investments in digital transformation. Key players in this market are strategically positioning themselves to capitalize on these trends through various imperatives and strategies.

One critical strategy is innovation in product development, with a major focus on enhancing the performance, reliability, and connectivity of industrial PCs. This includes integrating advanced features such as IoT capabilities, AI and machine learning support, and edge computing functionalities to meet the evolving needs of industrial applications.

Emphasizing customization and offering tailored solutions is another vital strategy, allowing companies to cater to the unique needs of different sectors such as automotive, healthcare, and energy.

In addition, investing in cybersecurity measures is imperative due to the increasing connectivity and data exchange in industrial environments. Companies must ensure that their industrial PCs are equipped with robust security features to protect against cyber threats and ensure data integrity.

Moreover, expanding presence in emerging markets, particularly in developing regions where industrialization is accelerating, presents significant growth opportunities. By implementing these strategies, key players strengthen their market position and propel sustainable growth in the competitive industrial PC landscape.

Industrial PC Market Growth Factors

The growing adoption of artificial intelligence (AI) and machine learning (ML) in industrial applications is fostering the demand for advanced industrial PCs. AI and ML enable automated systems to analyze large volumes of data, identify patterns, and make predictive decisions, which enhances operational efficiency and reduces downtime.

Industrial PCs play a significant role in supporting these intelligent systems, providing the necessary computational power and connectivity to process data in real-time.

Industries such as manufacturing, logistics, and energy are increasingly utilizing AI and ML for predictive maintenance, quality control, and process optimization. These technologies allow for the automation of complex tasks, leading to improved accuracy and productivity. Moreover, the integration of AI and ML in industrial PCs facilitates the development of smart factories, where interconnected systems operate autonomously to optimize production.

As businesses continue to recognize the importance of AI and ML in gaining competitive advantages and operational excellence, the reliance on high-performance industrial PCs is expected to grow, augmenting further advancements and innovation in the market.

The increasing connectivity of industrial PCs, while beneficial for automation and data integration, poses a significant challenge in maintaining the security of industrial operations. As industrial PCs become integral to interconnected networks within smart factories, they become potential targets for cyber-attacks.

These attacks lead to data breaches, operational disruptions, and even physical damage to industrial equipment. The complexity of industrial networks, combined with the convergence of IT and operational technology (OT), creates multiple entry points for cyber threats.

Ensuring the security of industrial PCs requires implementing robust cybersecurity measures, such as firewalls, intrusion detection systems, and regular security updates. However, numerous industrial environments encounter challenges posed by outdated legacy systems and limited cybersecurity expertise, rendering them vulnerable to sophisticated attacks.

Addressing this restraint involves investing in advanced security solutions and fostering a culture of cybersecurity awareness and continuous improvement among industrial personnel.

Industrial PC Market Trends

The rising demand for edge computing solutions is a significant trend in the industrial PC market, fueled by the pressing need for real-time data processing and reduced latency in industrial applications. Edge computing involves the processing of data at the edge of the network, closer to the source, rather than relying on centralized cloud computing.

This approach enhances the responsiveness and efficiency of industrial operations by facilitating immediate analysis and action upon immediately, thereby mitigating the delays associated with transmitting data to and from a distant data center.

Industrial PCs play a crucial role in enabling edge computing by providing the necessary computational power and durability to operate in rugged environments. Industries such as manufacturing, utilities, and transportation are increasingly adopting edge computing to support applications such as predictive maintenance, automated quality control, and smart grid management.

The ability to process data in real-time at the edge helps improve operational efficiency, reduce downtime, and enhance decision-making processes.

Segmentation Analysis

The global industrial PC market is segmented based on type, industry, sales channel, and geography.

By Type

Based on type, the market is categorized into panel PC, embedded, box, rackmount, and others. The embedded segment is anticipated to witness the highest growth, depicting a CAGR of 8.72% over the forecast period, largely attributed to the increasing demand for compact, energy-efficient, and application-specific computing solutions in various industries.

Embedded PCs, known for their small form factor and low power consumption, are integral to the operation of numerous industrial systems and devices. They are widely used in applications such as process control, automation, and monitoring within sectors such as manufacturing, healthcare, transportation, and energy.

The rise of IoT and smart devices has further fueled the need for embedded PCs, as they provide the computational capabilities required for edge computing, real-time data processing, and connectivity in distributed systems. Additionally, advancements in embedded computing technologies, such as improved processing power and enhanced connectivity options, have expanded their applicability and performance.

The flexibility to customize embedded PCs to meet specific industrial requirements makes them an attractive choice for companies seeking tailored solutions, thereby contributing to the growth of the segment.

By Industry

Based on industry, the market is divided into automotive, electronics, medical devices, chemicals, oil & gas, food & beverage, pharmaceuticals, and others. The automotive sector garnered the highest revenue of USD 1,337.5 million in 2023, propelled by the increasing integration of advanced technologies in vehicle manufacturing and production processes.

The automotive industry is leading the adoption of Industry 4.0 principles, which emphasize the use of smart manufacturing technologies such as IoT, AI, and machine learning. Industrial PCs are crucial in enabling these technologies, facilitating automation, real-time data processing, and advanced robotics in automotive plants.

Additionally, the growing demand for electric vehicles has led to significant investments in modernizing manufacturing facilities, thereby boosting the need for sophisticated industrial PCs. These PCs are used for various applications, including assembly line control, quality assurance, and predictive maintenance, thus ensuring higher efficiency and reduced production downtime.

By Sales Channel

Based on sales channel, the market is bifurcated into direct and indirect. The direct segment captured the largest market share of 62.45% in 2023, propelled by the growing preference for direct purchasing channels among large industrial enterprises seeking customized and integrated solutions.

Direct sales channels allow manufacturers to offer tailored solutions that meet the specific needs of their customers, providing a significant advantage in sectors where precision and customization are crucial. By engaging directly with manufacturers, companies aim to communicate their specific requirements, thereby ensuring that the industrial PCs they procure are optimized for their particular applications and operating environments.

This direct interaction often leads to more efficient installation, better integration with existing systems, and enhanced technical support, which is critical for maintaining seamless operations.

Moreover, direct sales channels facilitate stronger relationships between industrial PC providers and end-users, enabling continuous feedback and iterative improvements to both products and services. This customer-centric approach enhances experience, fostering loyalty and encouraging repeat business.

In industries such as automotive, aerospace, and energy, where the reliability and performance of industrial PCs are paramount, the ability to procure customized and fully supported solutions directly from manufacturers is highly valued.

Industrial PC Market Regional Analysis

Based on region, the global industrial PC market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Industrial PC Market share stood around 34.78% in 2023 in the global market, with a valuation of USD 1798.1 million., fueled by the region's strong industrial base and rapid adoption of advanced manufacturing technologies. The presence of major industrial players and extensive investment in automation and digital transformation initiatives have led to the rising demand for industrial PCs.

These companies are placing emphasis on increased implementation of IoT, AI, and machine learning across various sectors, including automotive, aerospace, and healthcare.

Additionally, robust R&D activities and the development of innovative industrial solutions support regional market growth. Government initiatives and favorable policies promoting smart manufacturing and technological advancements are further contributing to this robust growth.

The region's well-established infrastructure, coupled with a high level of technological readiness, enables quick adoption and integration of sophisticated industrial PCs, thereby ensuring operational efficiency and competitive advantage for businesses. This combination of factors positions North America as a leading market for industrial PCs, maintaining its dominant share through continued innovation and increased investment.

Asia-Pacific is anticipated to experience staggering growth at a 7.93% CAGR in the foreseeable future owing to the region's rapid industrialization and the notable expansion of manufacturing sectors. The rise of Industry 4.0, coupled with the increasing adoption of IoT, AI, and machine learning, results in the surge in demand for advanced industrial PCs.

Additionally, government initiatives and supportive policies aimed at enhancing industrial capabilities and infrastructure are playing a significant role in fostering this growth.

The region's large, skilled workforce and cost-effective manufacturing capabilities attract significant foreign investments, further fueling regional market expansion. Moreover, the growing need for efficient production processes and quality control in sectors such as electronics, automotive, and pharmaceuticals underscores the importance of industrial PCs in achieving these goals.

As Asia-Pacific continues to adopt digital transformation, the demand for industrial PCs is expected to rise substantially, thereby stimulating Asia-Pacific industrial PC market growth in the forthcoming years.

Competitive Landscape

The global industrial PC market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Industrial PC Market

- AAEON Technology Inc.

- ABB

- OMRON Corporation

- Siemens

- Rockwell Automation

- Schneider Electric

- Emerson Electric Co

- General Electric

- Advantech Co., Ltd.

- Mitsubishi Electric Europe B. V.

Key Industry Developments

- February 2024 (Partnership): RS, a trading brand of RS Group plc partnered with Siemens to become a distributor of their newly launched industrial tablet, Siemens SIMATIC IPC MD-34A.

- October 2023 (Launch): Rockwell Automation introduced the new Allen‑Bradley ASEM 6300PA, which enhances operational efficiency and flexibility. Featuring a fanless design and wide temperature specifications, these PCs ensure years of reliable performance.

The Global Industrial PC Market is Segmented as:

By Type

- Panel PC

- Embedded

- Box

- Rackmount

- Others

By Industry

- Automotive

- Electronics

- Medical Devices

- Chemicals

- Oil & Gas

- Food & Beverage

- Pharmaceuticals

- Others

By Sales Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America